Updated July 4, 2023

What is Financial Leverage?

Financial leverage is the act of borrowing money to purchase assets with a vision of gaining more profit than the money borrowed.

Herein, the purchased assets are treated as collateral until it is fully repaid with interest. Financial leverage ratios tell us about the ability of any business whether it can meet its long-term debt obligations or not. These obligations can be anything like interest payments on the debt amount, the principal cost on the debt amount, or any other kind of fixed obligations like lease payments of the business.

Assume Starstruck, a shoe manufacturing company, borrows $10 million in debt to expand its business globally. If its financial leverage ratio is less than 1, it means that the company has made practical investments and can pay off its debt. However, if the ratio is above 1, we can conclude that the company has a poor investment strategy and may be unable to pay back its debt.

Key Highlights

- Financial leverage, also known as leverage or trading on equity, is a strategy companies use to finance projects or buy more assets.

- It is calculated by dividing a company’s total debt by the shareholder’s equity.

- A high leverage ratio indicates that the company uses its debt to expand its resources more than the available equity.

- Investors utilize the financial leverage ratios to find whether a company is worth investing in or not.

- The most common ratios used to measure financial leverages are the Debt-to-Equity Ratio, Debt to Capital Ratio, Debt to EBITDA Ratio, and Interest Coverage Ratio.

How Does Financial Leverage Work?

When borrowing any asset or capital, a company has two options available, i.e., equity and debt. Indeed, companies can also utilize equity to purchase assets, but they prefer debts as the cost of equity is always higher than the cost of borrowing. However, this option is profitable only when the company has the vision to easily generate more profit from the investment to pay off the debt.

We can say that a company with a high debt ratio indicates that it utilizes its debt to finance its assets and resources profitably. However, a low financial leverage ratio means the business uses its finances responsibly while generating a steady revenue stream.

Let’s say, Fun & Blitz Pvt. Ltd. company is looking for ways to expand its business. They go for a loan to increase their production and generate more profit in return. This way, the company uses the financial leverage strategy to outperform its debt. However, the company has to ensure that the return is more than what they have invested; otherwise, it will run into financial risks.

Formula to Calculate Financial Leverage

The financial leverage formula is as follows:

Financial leverage = Total Debt/ Shareholder’s Equity

(Total Debt = Short term + Long Term Debt)

Here,

- Total Debt is the funds borrowed to expand the business to generate more revenue.

- Shareholder’s Equity is the total money all the investors have together invested in a company.

How to Calculate Financial Leverage? Excel Examples

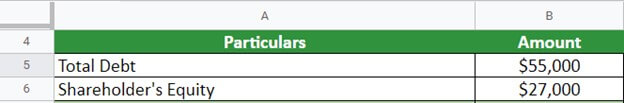

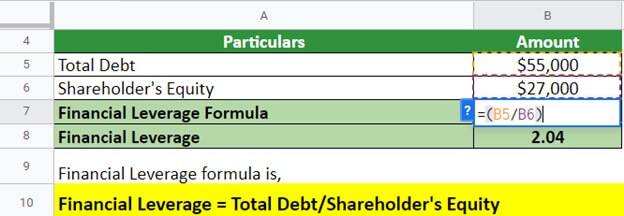

Example #1

Moonlight Pvt. Ltd. is a UK-based company that manufactures decorative lights & lamps. For FY22, the company mentions a total debt of $55,000 and shareholder’s equity of $27,000 in its balance sheet. Calculate the financial leverages for the company for FY22.

Given,

Solution:

Implementing the formula, let’s find the financial leverages for the company by evaluating the data provided.

Thus, Moonlight Pvt. Ltd. has a financial leverages of 2.04 for FY22. Here, the ratio is higher than 2, which is quite concerning as it can be risky for potential company investors to invest in the company. Ideally, a ratio of less than 1 is considered beneficial for the company.

Example #2

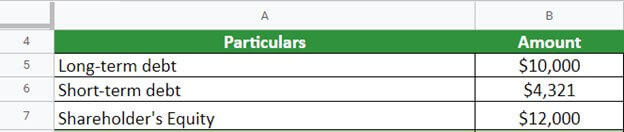

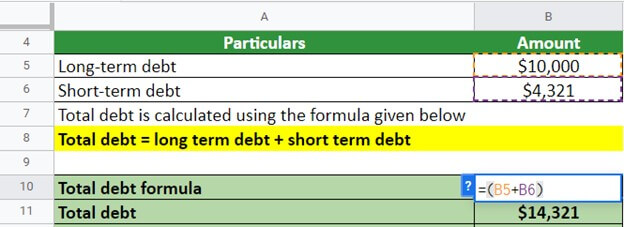

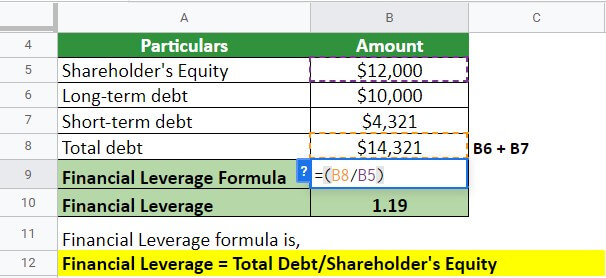

After analyzing the balance sheet of a company named John & Co., we can make the following inputs;

- Long-term debt = $10,000

- Short-term debt = $4,321

- Shareholder’s equity = $12,000

Calculate the financial leverages for the company.

Given,

Solution:

First, we have to find the total debt for the company. For the calculation of the same, we will implement the below formula:

So, the total debt for the company is $14,321. Now we have both the required values, let’s evaluate the financial leverages for the company.

Thus, John & Co. has a financial leverages of 1.19. Here, the ratio is lower than 2 but higher than 1, which is not much concerning for the company. They are in a good position where investors can consider investing in the company. Ideally, a ratio of less than 1 is considered beneficial for the company.

Example #3

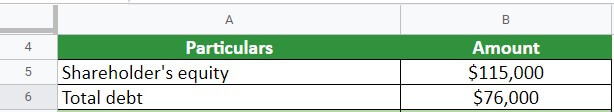

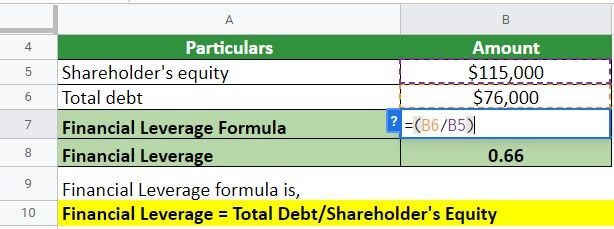

Marcs & Sons. is a shoe manufacturing company based in Brisbane that is planning to get a loan to expand its business. But, before getting a loan, they must know their financial leverage, given that the total debt accounts for $76,000 and the shareholder’s equity is $1,15,000. Calculate the financial leverages for the company.

Given,

Solution:

Implementing the formula, let’s find the financial leverages for the company by evaluating the data provided.

Thus, Marcs & Sons have financial leverages of 0.66. Here, the ratio is lower than 1, meaning the company is in a good position and they are eligible to take a loan. Also, investors can consider investing in the company.

Real-World Examples of Financial Leverage

#1 Pepsico

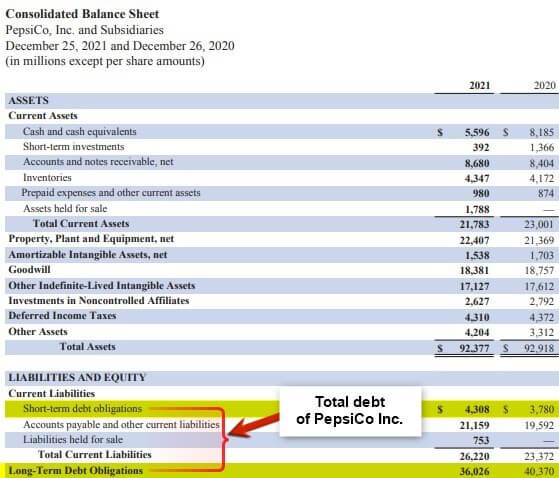

Let us take the example of Pepsico to illustrate the concept of financial leverage for a real-world company.

(Image Source: Pepsico’s Annual Report, 2021)

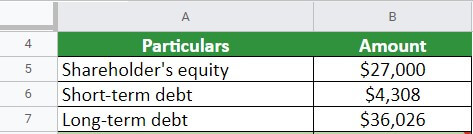

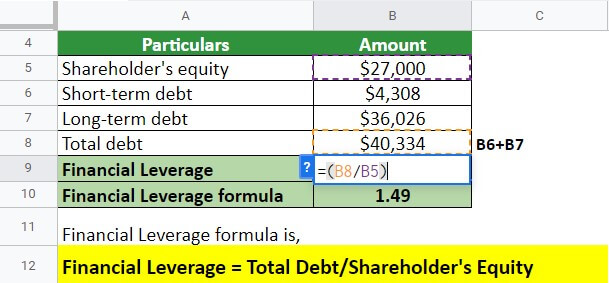

As per the latest annual report, Pepsico reported the following:

- Short-term debt = $4,308

- Long-term debt = $36,026

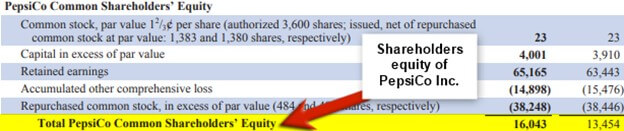

- Shareholder’s equity = $16,043

Calculate the financial leverages for Pepsico for FY21.

Given,

Solution:

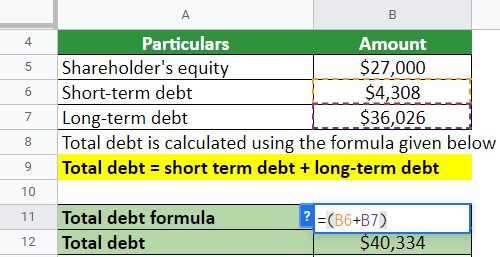

First, we have to find the total debt for the company. For the calculation, we will implement the below formula:

So, the total debt for the company is $40,334. Now we have both the required values, let’s evaluate the financial leverage for the company.

Thus, Pepsico has a financial leverage of 1.49. Here, the ratio is lower than 2 but higher than 1, which is not much concerning for the company. They are in a good position where investors can consider investing in the company. Ideally, a ratio of less than 1 is considered beneficial for the company.

#2 Domino’s Pizza Inc.

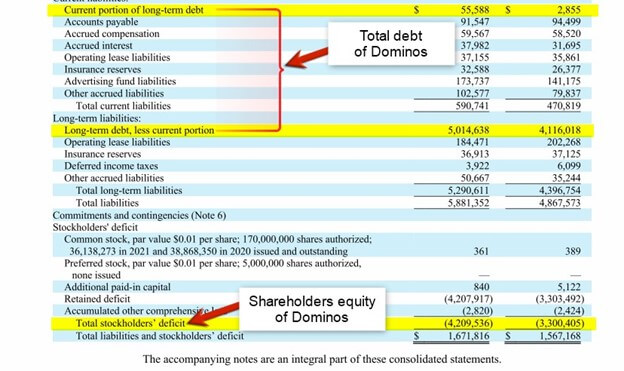

Let us take the example of Domino’s Pizza Inc. to illustrate the concept of financial leverages for a real-world company.

(Image Source: Domino’s Pizza Inc. Annual Report, 2021)

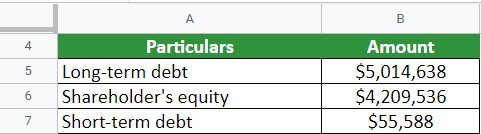

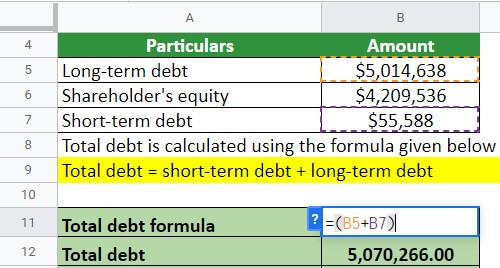

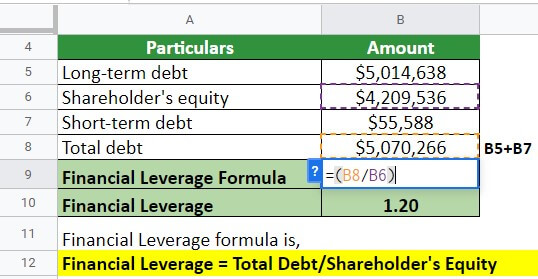

As per the latest annual report, Domino’s reported the following:

- Long-term debt = $5,014,638

- Current portion of long-term debt = $55,588

- Shareholder’s equity = $4,209,536

Calculate the financial leverage for Domino’s for FY21.

Given,

Solution:

First, we have to find the total debt for the company. For the calculation, we will implement the below formula:

So, the total debt for the company is $5,070,266. Now we have both the required values, let’s evaluate the financial leverages for the company.

Thus, Domino’s has a financial leverage of 1.20. Here, the ratio is lower than 2 but higher than 1, which is not much concerning for the company. They are in a good position where investors can consider investing in the company. Ideally, a ratio of less than 1 is considered beneficial for the company.

#3 Paypal Holdings Inc.

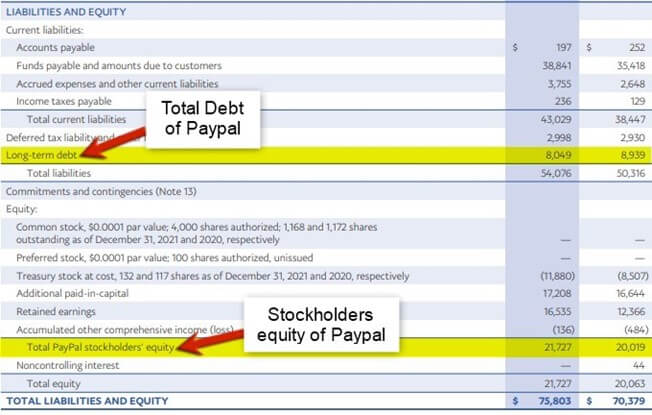

Let us take the example of Paypal Holdings Inc. to illustrate the concept of financial leverage for a real-world company.

(Image Souce: Paypal’s Annual Report 2021)

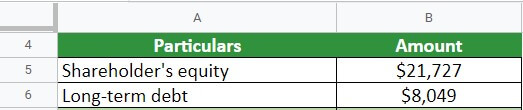

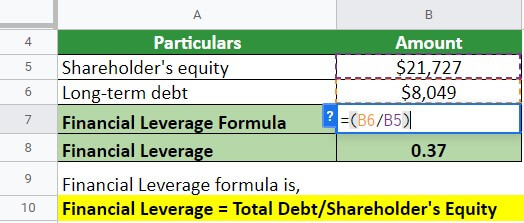

As per the latest annual report, Paypal Holdings Inc. reported the following:

- Long-term debt = $8,049

- Shareholder’s equity = $21,727

Calculate the financial leverage for Paypal for FY21.

Given,

Solution:

Implementing the formula, let’s find the financial leverages for the company by evaluating the data provided.

Thus, Paypal has a financial leverage of 0.37. Here, the ratio is lower than 1, meaning the company is in a good position and can easily take they are eligible to take a loan. Also, investors can consider investing in the company.

What is the Degree of Financial Leverage?

- The degree of financial leverage is called the leverage ratio, which helps measure the sensitivity of the earnings per share (EPS) to the fluctuations in the company’s income.

- The degree calculates the promotional change in the business’s net income due to any change in the company’s capital structure.

- However, this calculation helps evaluate the debt which a company is still obligated to repay.

- If the degree becomes higher, the business has higher volatile earnings.

- This is typically analyzed to understand the company’s financial health for long-term success.

The Formula for the Degree of Financial Leverage (DFL)

The finance professionals use below two formulas to calculate this:

EBIT means the percentage change in the company’s earnings before paying interest and taxes.

Here, EBT means the earnings of the company before paying the taxes

Difference between Financial Leverage and Operating Leverage

|

Basis of Difference |

Financial leverage |

Operating Leverage |

| Meaning | It can be defined as the company’s ability to use the capital of the company to earn more and better returns and therefore reduce the payable taxes. | It can be defined as the company’s ability to use fixed costs to generate higher returns later. |

| What is it all about? | It is all about the capital structure of the company.

|

It is all about the fixed costs of the company.

|

| Calculations | It is calculated with the help of the EBIT and EPS of the company.

|

It is calculated with the help of the Sales and EBIT of the company.

|

| Formula | DFL = EBIT / EBT | DOL = Contribution / EBIT

|

| Based On | It is based on the capital structure of the business.

|

It is based on the business’s cost structure.

|

| Preference | This is highly preferred. | This is preferred very rarely. |

| Relation | It directly connects with the liability side of the company’s balance sheet. | The degree of Operating Leverage is expected to be higher than the break-even point.

|

| Measurement | It measures the financial risks of running the business.

|

It measures the operational risks in the running business.

|

Features of Financial Leverage

- Borrowings that lead to fixed annual liabilities, such as interest or even fixed dividends in the case of preference shares, fall under this category.

- Its need arises when a company expects that the returns generated from the purchased asset will be greater than the cost of borrowing, commonly known as the interest expense.

- Interest expense is mandatory even if the company doesn’t earn profits. However, interest expense is tax-deductible, providing a tax shield, a lucrative feature of leverage financing.

- As the borrowings are used to purchase fixed assets, these are generally for a long-term period.

Limitations of Financial Leverage

- Financial leverage is typically beneficial for businesses with stable earnings.

- It also increases the interest rate and risks because every taken debt increases the interest rate on the subsequent loans.

- As the returns are not guaranteed in financial leverages, there are chances of losing a more incredible amount than the initial capital investment in the business.

- In the worst-case scenarios, the investors must be prepared for a negative result in their investment.

- Due to the risk factor, some financial institutions restrict themselves from financial leverage.

Advantages & Disadvantages of Financial Leverage

|

Advantages |

Disadvantages |

| Borrowing money allows you to make investments sooner rather than waiting. | The returns on the investments made are not guaranteed. |

| Making an investment in any property helps you grow your wealth in the long run. | If you borrow money from friends or family, it can strain your relationship with them soon. |

| Using financial leverage enhances your earnings. | Using financial leverage has the possibility of getting disproportionate losses. |

| The interest expense of the borrowed money is tax deductible. | If you borrow money against your home, you can lose your home in case of no great returns. |

| Your investment is mainly to improve your quality of life, like buying a house. | If the returns are not that good and you miss paying off your credit cards or loans, that will damage your credit score. |

Calculator

Use the following calculator for financial leverage calculations.

| Total Debt | |

| Shareholder’s Equity | |

| Financial Leverage = | |

| Financial Leverage = | (Total Debt / Shareholder’s Equity) |

| = | (0 / 0 ) = 0 |

Final Thoughts

We can conclude that financial leverage is justified only for companies with high growth prospects. It is unsuitable for small start-ups because interest expenses must be paid even if the company is incurring losses, which might not be feasible for such companies. They should enter into venture financing or angel investment.

Frequently Asked Questions (FAQs)

Q.1. Financial leverage is also known as?

Answer: Financial leverage is also known as Trading on equity. As the definition states, it is a balance between the cost of the financial operations of any business with its debt or equity and the income they are earning from those operations.

Q.2. What does financial leverage measure? Why is it important?

Answer: Financial leverages measure the business’s total debt ratio to its total assets. If the proportion of the debt to assets increases, the financial leverage amount also increases. The primary importance is that it helps enhance the business’s earnings. Secondly, as many jurisdictions consider interest expenses tax deductible, it helps reduce the borrower’s net debt.

Q.3. What are financial leverage and its types?

Answer: Financial leverage is the money you borrow to invest to get greater returns. The idea behind this is to spend money to make more money. The three different types of leverage are financial, operating, and combined.

Q.4. What is the financial leverage formula?

Answer: The formula is; financial leverage = total debt of the business/equity of the shareholder. The total debt of the business includes both short-term and long-term obligations.

Q.5. What is an excellent financial leverage ratio?

Answer: As per the industry standards, if the financial leverage ratio comes out to be less than 1, it is considered suitable for that business. If the balance comes out to be higher than 1, that can be proven a risky investment.

Q.6. How to increase financial leverage?

Answer: The business should borrow capital from fixed-income companies or lenders to increase financial leverage. As soon as the proportion of debt to assets increases, there’s an increase in the amount of financial leverage too.

Recommended Articles

This is a guide to financial leverage. Here we discuss how to calculate the along with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more –