Updated July 12, 2023

What is Leverage Ratio?

Leverage Ratio is a ratio that focuses on the solvency of a company keeping the capital raised from Debt structuring or from the company itself to meet the company’s financial obligations.

It can also be said that the Leverages measure the firm’s long-term stability & capital structure. The leverage ratio helps the management identify how much they can borrow to increase the company’s profitability. Leverages help find the company’s debt-raising capacity according to its capital structure.

Types & Formula to Leverage Ratio

There are many ratios to be calculated under Leverage Ratios. Following are the types and their respective formulas to calculate different leverage ratios:

1. Debt-Equity Ratio

This ratio represents the ratio of Debt over the Equity of the Company

Where,

Total Equity = Equity Share Capital + Reserves & Surplus

2. Debt to Asset Ratio

This ratio represents the ratio of Debt of the company compared with the assets of the company.

3. Debt to Capital

This ratio represents the debt ratio to the company’s total Capital.

Where,

Total Capital = Total Equity + Total Debt

4. Debt to EBITDA

This ratio explains the ratio of Debt to the Earnings of the company.

Where,

EBITDA = Earnings before Interest Tax Depreciation & Amortization.

5. Asset to Equity Ratio

This ratio helps to understand the value of the assets compared with the shareholder’s capital.

Examples of Leverage Ratio (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

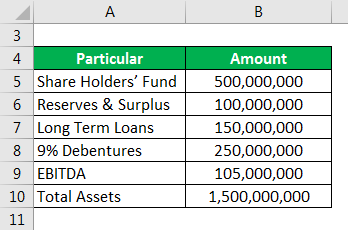

Following is the balance sheet of XYZ Inc. for the year ended 31 Dec. 20XX. You are required to calculate the leverage.

Solution:

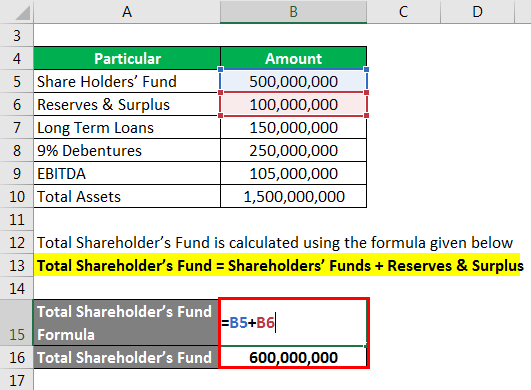

Total Shareholder’s Fund calculate using the formula

Total Shareholder’s Fund = Shareholders’ Funds + Reserves & Surplus

- Total Shareholder’s Fund = 500,000,000 + 100,000,000

- Total Shareholder’s Fund = 600,000,000

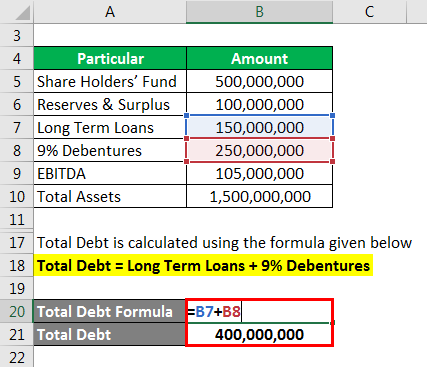

Total Debt calculate using the formula given below

Total Debt = Long Term Loans + 9% Debentures

- Total Debt = 150,000,000 + 250,000,000

- Total Debt = 400,000,000

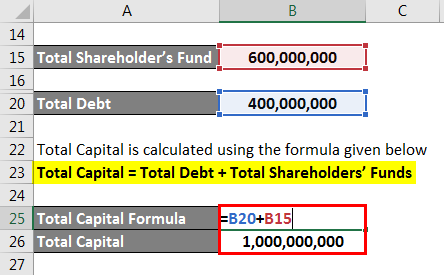

Total Capital calculate using the formula given below

Total Capital = Total Debt + Total Shareholders’ Funds

- Total Capital = 600,000,000 + 400,000,000

- Total Capital = 1,000,000,000

Leverage Ratios

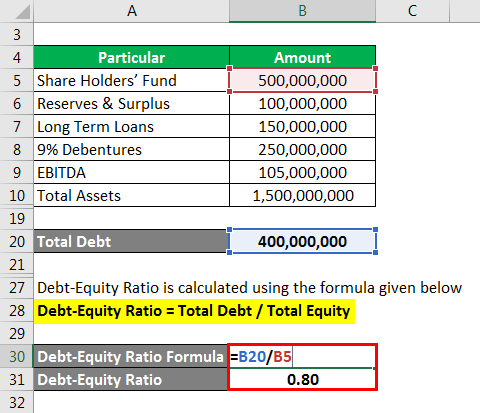

Debt-Equity Ratio calculate using the formula given below

Debt-Equity Ratio = Total Debt / Total Equity

- Debt-Equity Ratio = 400,000,000 / 500,000,000

- Debt-Equity Ratio = 0.80

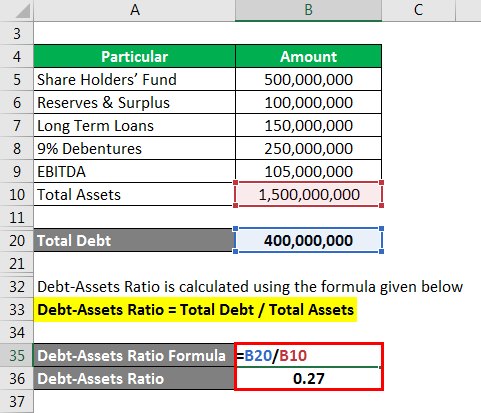

Debt-Assets Ratio calculate using the formula given below

Debt-Assets Ratio = Total Debt / Total Assets

- Debt-Assets Ratio = 400,000,000 / 1,500,000,000

- Debt-Assets Ratio = 0.27

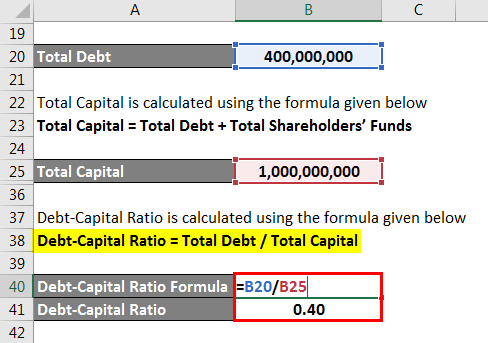

The debt-Capital Ratio calculate using the formula given below

Debt-Capital Ratio = Total Debt / Total Capital

- Debt-Capital Ratio = 400,000,000 / 1,000,000,000

- Debt-Capital Ratio = 0.40

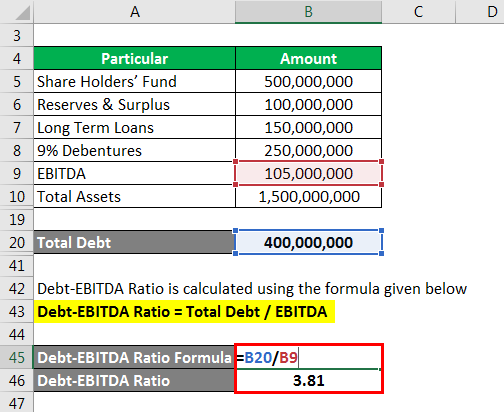

Debt-EBITDA Ratio calculate using the formula given below

Debt-EBITDA Ratio = Total Debt / EBITDA

- Debt-EBITDA Ratio = 400,000,000/105,000,000

- Debt-EBITDA Ratio = 3.81

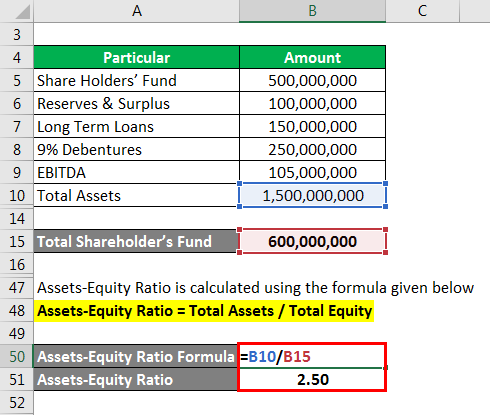

Assets-Equity Ratio calculate using the formula given below

Assets-Equity Ratio = Total Assets / Total Equity

- Assets-Equity Ratio = 1,500,000,000 / 600,000,000

- Assets-Equity Ratio = 2.50

Uses & Importance of Leverage Ratio

Leverage ratios are important as they provide a view to the management about the company’s leverage position, how it is leveraged, and how much debt it is in. The debt is often termed as the load on the company’s balance sheet, and the management sometimes wants to keep a check on the company’s rising debt. Let us say that a company has a higher debt ratio, which means the company would have a bigger burden of clearing the debt in principal and interest payments, adversely affecting the company’s cash flow. Compared to a low debt ratio, both the principal and interest ratio would not have that much impact on the company’s cash flow. Also, with the low impact on the cash flow, the low debt ratio indicates that the company has unutilized leverages, which can be used to make the company more profitable and grow its business.

High leverage shows that the company should repay its debts to release its cashflows from the burden of interest & principal payment. Analysis of Leverage Ratios is important for both internal & external parties involved in the business, be it investors, creditors, or management. These ratios are important as they provide a detailed view of the financial health of the company and its capability to meet its financial liabilities. The creditors can rely on these ratios up to the extent of credit provided to the company even if the company is highly under debt but have good and healthy earnings and good return on their Investments which can easily meet their interest liability.

Advantages and Disadvantages

Below are the advantages and disadvantages:

Advantages

Let us first discuss the benefits of the Leverage Ratios:

- A leverage ratio can operate fully independently of any complex modeling assumptions;

- Leverage Ratios are complementary to risk-weighted requirements when assessing banks’ capital adequacy.

- Leverage Ratios ensure a minimum buffer to absorb the negative consequences of imprudent behavior.

- Leverage Ratios help Banks a lot in identifying the financial health of the companies before providing them the financial aid.

- It provides a clear picture of the company’s finances and earnings for shareholders’ capacity, which is very helpful for all the relevant insiders and outsiders of the company.

Disadvantages

- Off-Balance Sheet Exposures: To get the leverage ratios, the capital must be divided by the company’s total assets. Therefore it fails to take into account the items which are not included in the balance sheet. To include these items not in the balance sheet, the banks will need to built-up large off-balance sheet exposures to consider these items.

- Pro-cyclicality: The concern regarding the leverage ratios will amplify the financial cycle are valid. This is because, firstly, the imposition of the leverage ratio in the present crises will also put deleveraging pressure on the banks. Secondly, these crises will make the availability of credit facilities more volatile in the longer run.

Conclusion

Leverage ratios are important indicators of the financial health of the company. They are used to measure the solvency of the company and its financial structure and help make important decisions relating to fundraising for their future plans and the company’s growth.

Recommended Articles

This is a guide to the Leverage Ratio. Here we discuss how to calculate, along with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more –