Updated July 25, 2023

Times Interest Earned Ratio Formula (Table of Contents)

What is the Times Interest Earned Ratio Formula?

The term “times interest earned ratio” refers to the financial metric that is used to assess the ability of a company to pay an interesting part of the debt obligations.

In other words, this financial metric indicates how many times the pre-tax earnings of a company can cover its interest expense. Times interest earned ratio is also known as the interest coverage ratio. The formula for times interest earned ratio can be derived by dividing the EBIT (earnings before interest and taxes) or operating income of the company by its interest expense. Mathematically, it is represented as,

Examples of Times Interest Earned Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of Times Interest Earned Ratio in a better manner.

Times Interest Earned Ratio Formula – Example #1

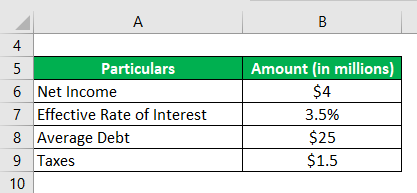

Let us take the example of a company that is engaged in the business of food store retail. During the year 2018, the company registered a net income of $4 million on revenue of $50 million. Further, the company paid interest at an effective rate of 3.5% on an average debt of $25 million along with taxes of $1.5 million. Calculate the Times interest earned ratio of the company for the year 2018.

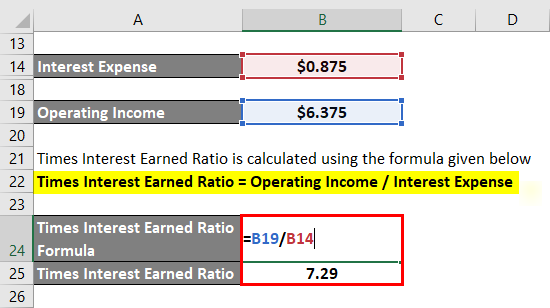

Solution:

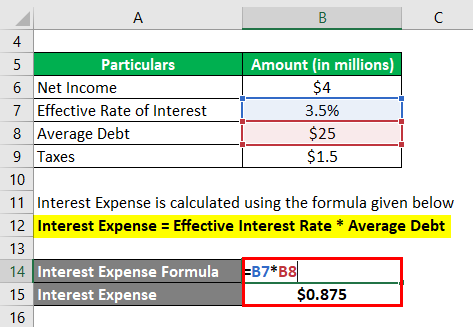

Interest Expense is calculated using the formula given below

Interest Expense = Effective Interest Rate * Average Debt

- Interest Expense = 3.5% * $25 million

- Interest Expense = $0.875 million

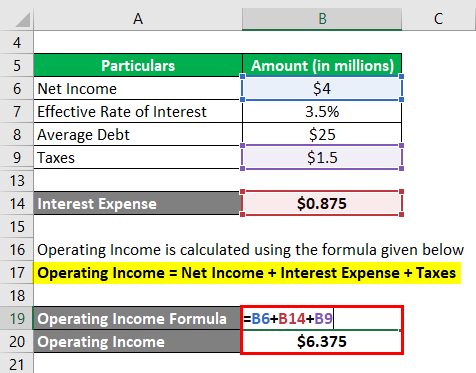

Operating Income is calculated using the formula given below

Operating Income = Net Income + Interest Expense + Taxes

- Operating Income = $4 million + $0.875 million + $1.5 million

- Operating Income = $6.375 million

Times Interest Earned Ratio is calculated using the formula given below

Times Interest Earned Ratio = Operating Income / Interest Expense

- Times Interest Earned Ratio = $6.375 million / $0.875 million

- Times Interest Earned Ratio = 7.29x

Therefore, the Times interest earned ratio of the company for the year 2018 stood at 7.29x.

Times Interest Earned Ratio Formula – Example #2

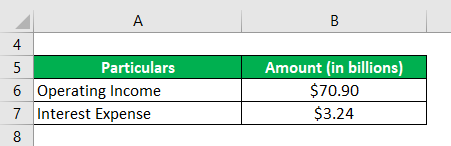

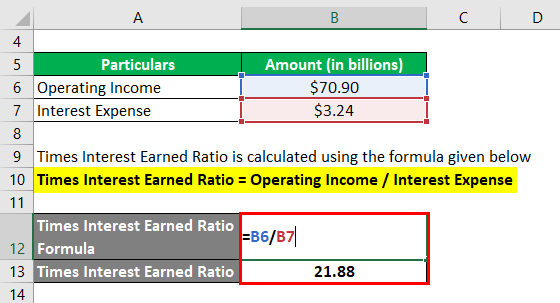

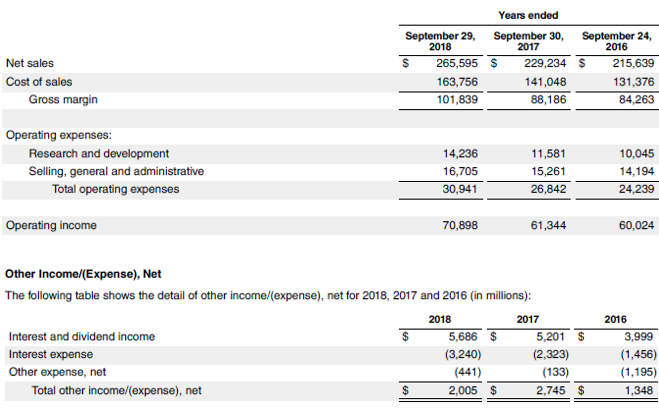

Let us take the example of Apple Inc. to illustrate the computation of Times interest earned ratio. As per the annual report of 2018, the company registered an operating income of $70.90 billion while incurring an interest expense of $3.24 billion during the period. Calculate the Times interest earned ratio of Apple Inc. for the year 2018.

Solution:

Times Interest Earned Ratio is calculated using the formula given below

Times Interest Earned Ratio = Operating Income / Interest Expense

- Times Interest Earned Ratio = $70.90 billion / $3.24 billion

- Times Interest Earned Ratio = 21.88x

Therefore, Apple Inc.’s Times interest earned ratio for the year 2018 stood at 21.88x.

Source Link: Apple Inc. Balance Sheet

Times Interest Earned Ratio Formula – Example #3

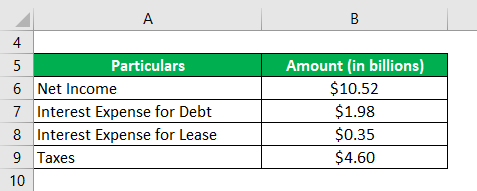

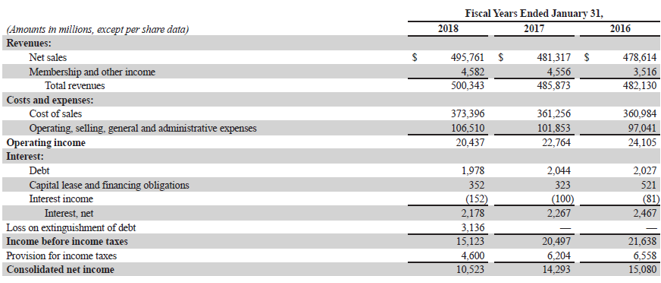

Let us take the example of Walmart Inc.’s annual report for the year 2018 to compute its Times interest earned ratio. According to the annual report, the company’s net income during the period was $10.52 billion. The interest expense towards debt and lease was $1.98 billion and $0.35 billion respectively. Calculate the Times interest earned ratio of Walmart Inc. for the year 2018 if the taxes paid during the period was $4.60 billion.

Solution:

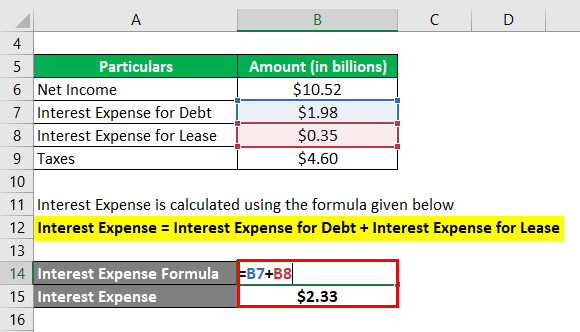

Interest Expense is calculated using the formula given below

Interest Expense = Interest Expense for Debt + Interest Expense for Lease

- Interest Expense = $1.98 billion + $0.35 billion

- Interest Expense = $2.33 billion

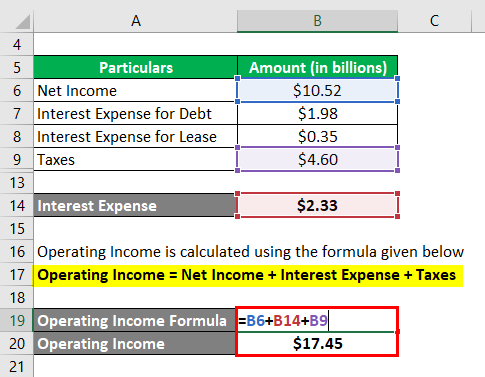

Operating Income is calculated using the formula given below

Operating Income = Net Income + Interest Expense + Taxes

- Operating Income = $10.52 billion + $2.33 billion + $4.60 billion

- Operating Income = $17.45 billion

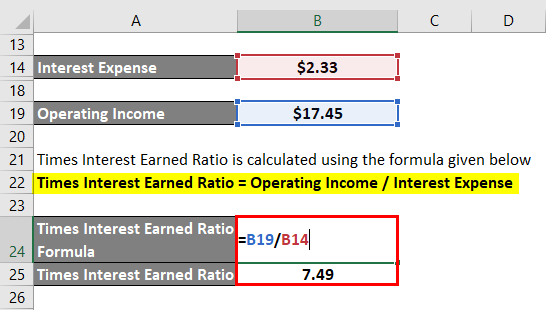

Times Interest Earned Ratio is calculated using the formula given below

Times Interest Earned Ratio = Operating Income / Interest Expense

- Times Interest Earned Ratio = $17.45 billion / $2.33 billion

- Times Interest Earned Ratio = 7.49x

Therefore, the ratio of Times interest earned of Walmart Inc. for the year 2018 stood at 7.49x.

Source: Walmart Annual Reports (Investor Relations)

Explanation

The formula for times interest earned ratio can be derived by using the following steps:

Step 1: Firstly, determine the interest expense incurred by the company. It is easily available from the income statement of the company.

Step 2: Next, determine the operating income of the subject company. In the most income statements, operating income or EBIT is mentioned as a separate line item. In case not provided in the income statement, it can be derived adding back the interest charge and taxes paid to the net income of the company.

Operating Income = Net Income + Interest Expense + Taxes

Step 3: Finally, the formula for times interest earned ratio can be derived by dividing the operating income (step 2) of the company by its interest expense (step 1) as shown below.

Times Interest Earned Ratio = Operating Income / Interest Expense

Relevance and Use of Times Interest Earned Ratio Formula

It is important to understand the concept of “Times interest earned ratio” as it is one of the predominantly financial metrics used to assess the financial health of a company. In case a company fails to meet its interest obligations, it is reported as an act of default and this could manifest into bankruptcy in some cases. So, it is very important that a company generating adequate cash flow to make timely principal and interest payments in order to avoid any kind of financial shortcomings.

Times Interest Earned Ratio Formula Calculator

You can use the following Calculator

| Operating Income | |

| Interest Expense | |

| Times Interest Earned Ratio | |

| Times Interest Earned Ratio | = |

|

|

Recommended Articles

This is a guide to Times Interest Earned Ratio Formula. Here we discuss how to calculate Times Interest Earned Ratio along with practical examples. We also provide a Times Interest Earned Ratio calculator with a downloadable excel template. You may also look at the following articles to learn more –

- Formula for Labor Force Participation Rate Formula

- How to calculate Net Cash Flow Formula

- Example of Accounting Rate of Return Formula

- Calculation of Coverage Ratio Formula

- Interest vs Dividend | Top 8 Key Differences You Should Know

- How to Calculate Cash Flow Formula?

- Coverage Ratio | Advantages and Disadvantages