Updated July 31, 2023

Financial Leverage Formula (Table of Contents)

- Financial Leverage Formula

- Examples of Financial Leverage Formula (With Excel Template)

- Financial Leverage Formula Calculator

Financial Leverage Formula

The firm employs an asset or source of funds for which it must pay a fixed cost or fixed return. This fixed cost or fixed return remains constant regardless of changes in the volume of output or sales. It can be stated that higher leverage leads to increased risk and return to the owner.

Leverage is basically of two types, Operating Leverage and Financial Leverage. A combination of these two leverages is called Combined Leverage.

The use of Long Term Fixed Interest-bearing Debt and Preference Share Capital and Equity Share Capital is called financial leverage.

In simple terms, the Use of Debt with Equity is termed Financial Leverage. In an organization, Debt plays the role of Leverage so as to increase the Earning Per Share available to the investors.

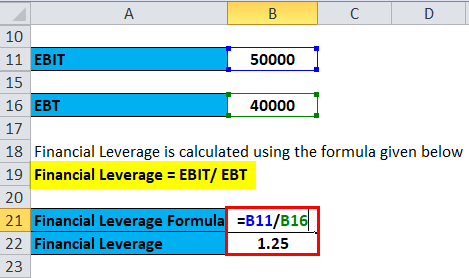

The formula to calculate Financial Leverage is as follows:

Where,

- EBIT: Earnings Before Interest and Tax

- EBT: Earnings Before Tax

The formula to calculate the degree of Financial Leverage is:

Where,

- EPS: Earnings Per Share

The degree of Financial Leverage Formula is used when Data from more than one Financial Year of a company is given.

Examples of Financial Leverage Formula (With Excel Template)

Let’s take an example to understand the calculation of the Financial Leverage formula in a better manner.

Example #1

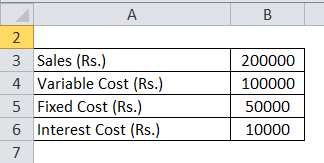

The following details are available of XYZ Ltd for the year ended 31/03/2018. Calculate the Financial Leverage of XYZ Ltd.

Solution:

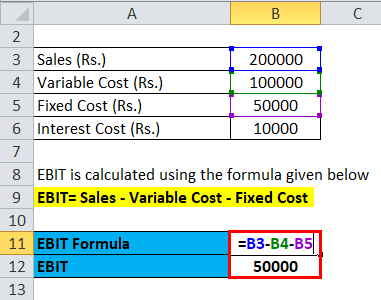

The formula to calculate EBIT is as follows:

EBIT= Sales – Variable Cost – Fixed Cost

- EBIT = 200000 – 100000 – 50000

- EBIT = Rs.50000

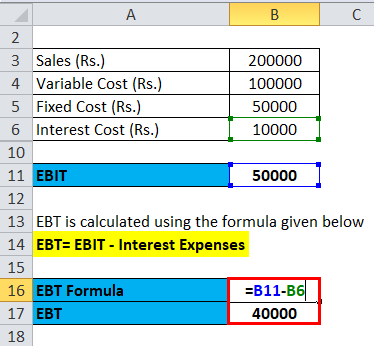

The formula to calculate EBT is as below:

EBT= EBIT – Interest Expenses

- EBT= 50000 – 10000

- EBT = Rs.40000

The formula to calculate Financial Leverage is as below:

Financial Leverage = EBIT / EBT

- Financial Leverage= 50000/40000

- Financial Leverage = 1.25 times

The degree of Financial Leverage can be understood with the help of the following example:

Example #2

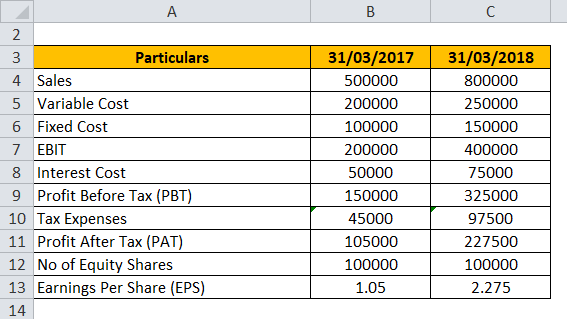

Following are the data related to XYZ Ltd. Extract of Statement of Profit and Loss for the Year ended:

Calculate the Degree of Financial Leverage for XYZ Ltd from the above data.

Solution:

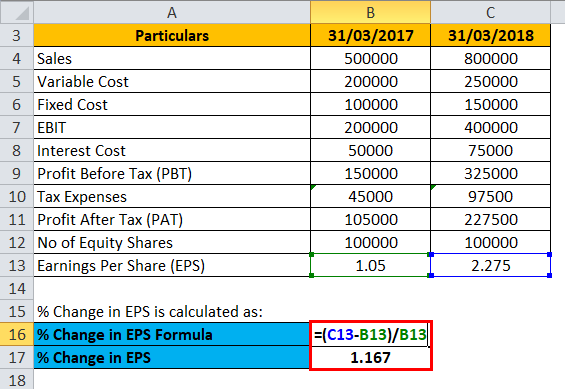

The calculation of the % Change in EPS is as below:

- % Change in EPS = (2.275 – 1.05) / 1.05

- % Change in EPS = 1.167

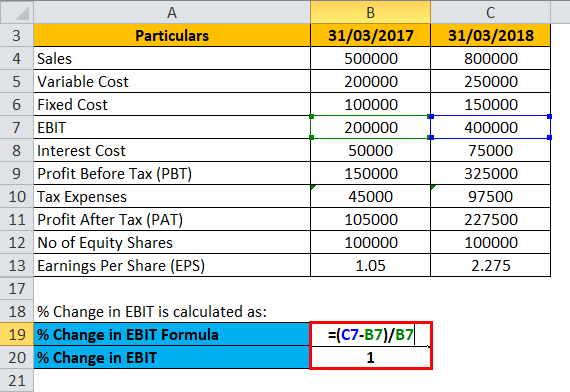

The % Change in EBIT is as below:

- % Change in EBIT = (400000 – 200000) / 200000

- % Change in EBIT = 1

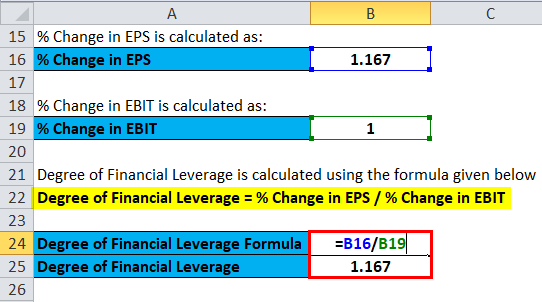

The formula to calculate the Degree of Financial Leverage is as below:

Degree of Financial Leverage = % Change in EPS / % Change in EBIT

- Degree of Financial Leverage = 1.167 / 1

- Degree of Financial Leverage = 1.167 times

Example #3

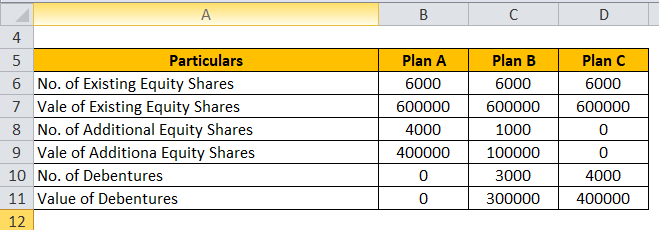

A firm has Equity Share Capital of Rs.600000 consisting of 6000 shares of Rs.100 each. The firm now wishes to raise a fund of Rs.400000 for the expansion of its projects. The fund can be raised through any of the following three sources:

Plan A: By issuing 4000 Equity Shares of Rs.100 each.

Plan B: By issuing 1000 Equity Shares of Rs.100 each and a balance of Rs.300000 by issuing 10% Debentures.

Plan C: By issuing Rs.400000, 10% Debentures.

Further additional information is available:

Calculate Financial Leverage under each of the three plans.

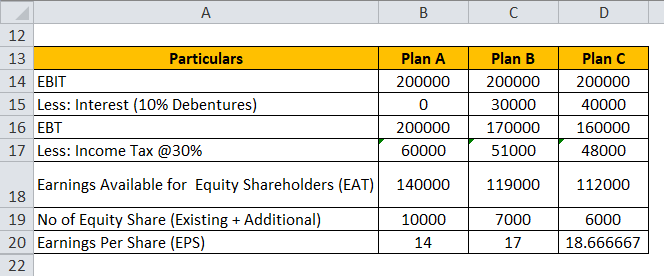

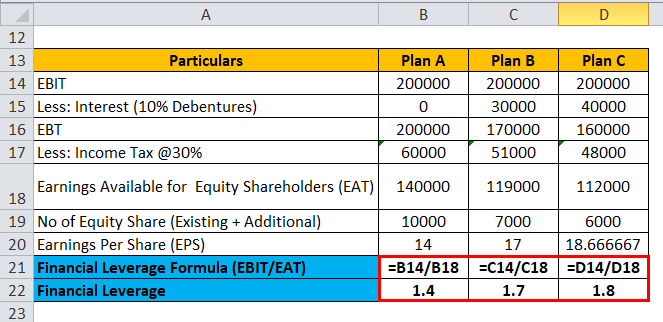

Solution:

The calculation of Financial Leverage is as below:

Explanation of Financial Leverage Formula

Financial Leverage Formula works on the saying that the higher the ratio of debt to equity, the greater the return for the equity shareholders because with the higher proportion of debt in the capital structure of the company, more financing decisions are taken through debt financing and lesser weighted is given to equity funding, which results in lower no of issued share capital and correspondingly results in higher return for the shareholders.

Thus Financial Leverage indicates the dependency of a business on debt financing over equity finance for its financial decision-making. The use of Long Term Fixed Interest Bearing Debt and Preference Share Capital and Equity Share Capital is called Financial Leverage.

Financial Leverage is a ratio that measures the sensitivity of a company’s earnings per share (EPS) to the fluctuations in its operating income because of the changes in its capital structure. The ratio shows that the more the value of the degree of financial leverage, the more volatile the EPS is.

Relevance and Uses

Capital Structure cannot affect the total earnings of a firm, but it can affect the share of earnings of equity shareholders. From example 3 above, it can be seen that whenever we have a higher degree of financial leverage, i.e. when we have a high amount of Debt in our capital structure, then this is going to give a leverage effect on the Earnings Per Share because in the example we can see that a company is taking the highest level of leverage in Plan C and by doing so the earnings per share is maximum in this case.

The analysis of this Financial Leverage formula shows that Financial Leverage has helped in improving the Earnings Per Share of Equity Shareholders. It helps to conclude that the higher the ratio of Debt to Equity, the greater the return for the equity shareholders.

Financial Leverage Formula Calculator

You can use the following Financial Leverage Calculator.

| EBIT | |

| EBT | |

| Financial Leverage Formula | |

| Financial Leverage Formula | = |

|

|

Recommended Articles

This has been a guide to the Financial Leverage formula. Here we discuss How to Calculate Financial Leverage along with practical examples. We also provide Financial Leverage Calculator with a downloadable Excel template. You may also look at the following articles to learn more –