Updated November 23, 2023

Beta Formula (Table of Contents)

- Beta Formula

- Calculate Beta by Correlation Formula

- Calculate Beta Manually

- Calculation of Beta for the stock profile

- Beta Calculator

- Beta Formula in Excel (With Excel Template)

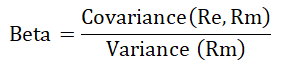

Beta Formula

Beta is an essential element in stock analysis; it measures stock or portfolio risk. Beta is very volatile as it depends on the stock market, and we know it very well. Beta helps determine the risk and expected rate of returns for a specific stock, as well as aids in Discounted Cash Flow evaluation.

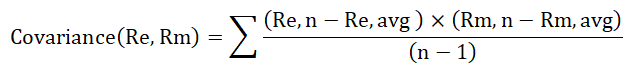

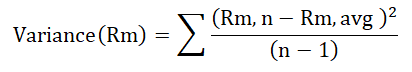

Beta is the covariance of the return of an asset divided by the variance of the return of the benchmark over a specific time period, and the formula for this can be written as:-

Where,

- Re = Stock Return

- Rm = Market Return

Calculation of Beta by the above Beta Formula-

Beta can be calculated using the above beta formula by the below steps:-

- Get past the security price for an asset of the company.

- Get past security price for comparison benchmark.

- Calculate the percentage change periodically for both asset and benchmark.

- Calculate variance by VAR.S(Sum of all the percentage changes of the asset).

- Calculate covariance by COVARIANCE.S(Sum of all the percentage changes of the asset, the Sum of all the percentage changes of the benchmark).

- Divide covariance by variance to get the Beta.

Examples

Let’s see an example to calculate Beta.

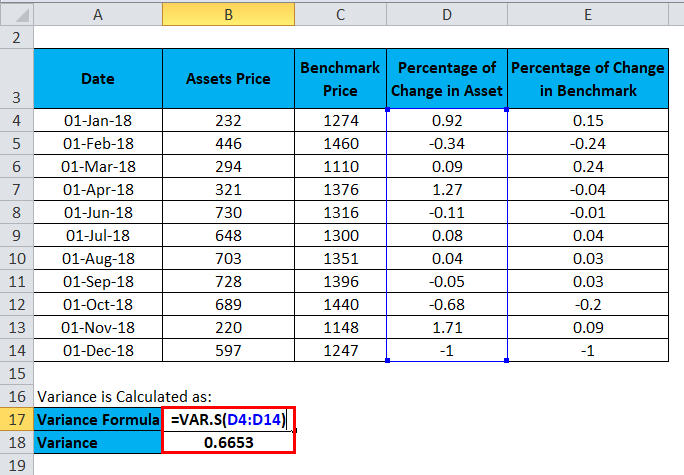

A company has below asset and benchmark price from Jan-2018 to Dec-2018.

| Date | Assets Price | Benchmark Price | Percentage of Change in Asset | Percentage of Change in Benchmark |

| 1-Jan-18 | 232 | 1274 | 0.92 | 0.15 |

| 1-Feb-18 | 446 | 1460 | -0.34 | -0.24 |

| 1-Mar-18 | 294 | 1110 | 0.09 | 0.24 |

| 1-Apr-18 | 321 | 1376 | 1.27 | -0.04 |

| 1-Jun-18 | 730 | 1316 | -0.11 | -0.01 |

| 1-Jul-18 | 648 | 1300 | 0.08 | 0.04 |

| 1-Aug-18 | 703 | 1351 | 0.04 | 0.03 |

| 1-Sep-18 | 728 | 1396 | -0.05 | 0.03 |

| 1-Oct-18 | 689 | 1440 | -0.68 | -0.2 |

| 1-Nov-18 | 220 | 1148 | 1.71 | 0.09 |

| 1-Dec-18 | 597 | 1247 | -1 | -1 |

Then, calculate the percentage of change in asset and percentage of change in the benchmark.

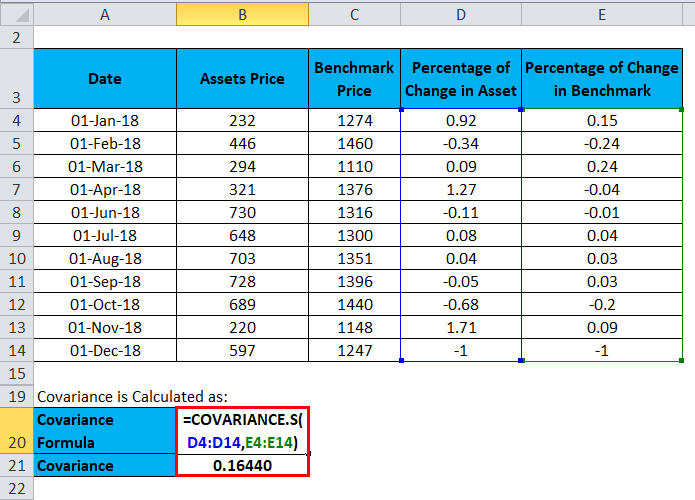

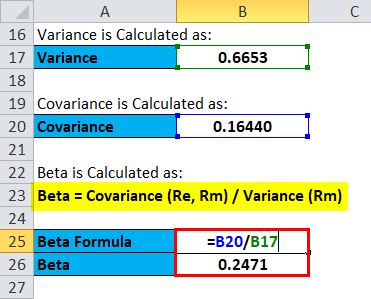

Variance is calculated as follows:

Covariance is calculated as follows:

Beta is calculated as:

So, the value of Beta is 0.24, which means the company is less volatile than the Market.

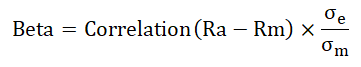

Calculate Beta By Correlation Formula

The beta formula in terms of correlation can be written as:-

Where,

- σe= Standard deviation of returns of the benchmark

- σm = Standard deviation of returns of asset

To calculate Beta, you can use the above formula, dividing the standard deviation of asset returns by the standard deviation of benchmark returns. After that, multiply the result by the correlation between asset and benchmark returns.

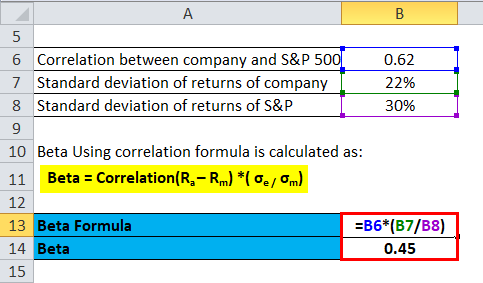

Now, let us calculate Beta using the correlation formula.

Suppose an investor wants to invest in a company; he wants to calculate the Beta of the company and compare it with the S&P 500 EFT Trust correlation between the two is 0.62, the standard deviation of returns of the company is 22%, and the standard deviation of returns of S&P is 30%.

- Beta = Correlation(Ra – Rm) *( σe / σm)

- Beta = 0.62 * (0.22 / 0.30)

- Beta= 0.45

So, the value of Beta is 0.45, which means the company is less volatile than the Market.

Calculate Beta Manually

Beta can be calculated manually by the below steps:-

- Find the risk-free rate-

It is the rate of return on the investment done.

- Find the rate of return of stocks and rate of return on the Market-

If any of the values are negative, that will lead to a value of Beta as negative, which means loss.

- Find return on risk is taken on stock-

It is the stock’s rate of return minus the risk-free rate.

- Find return on risk is taken on the Market-

It is the Market’s rate of return minus the risk-free rate.

- Divide the return on the risk taken on the stock by the return on the risk taken on the Market-

This will provide you with value for Beta.

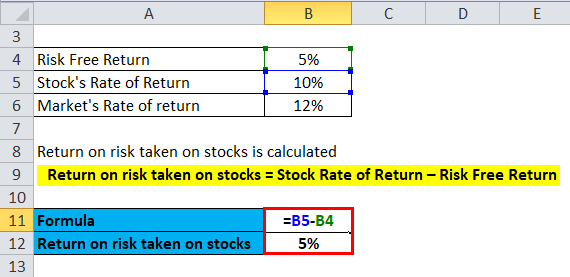

Let us use an example to calculate Beta manually,

A company gave a risk-free return of 5%, the stock rate of return is 10%, and the market rate of return is 12% now; we will calculate Beta for the same.

Return on the risk taken on stocks is calculated using the below formula

- Return on the risk taken on stocks = Stock Rate of Return – Risk-Free Return

- Return on risk taken on stocks = 10% – 5%

- Return on the risk taken on stocks = 5%

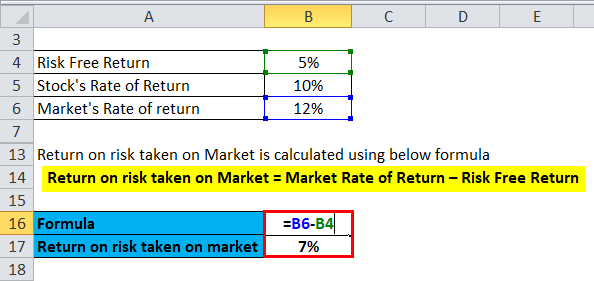

The return on the risk taken on the market is calculated using the formula below.

- Return on the risk taken on Market = Market Rate of Return – Risk-Free Return.

- Return on risk taken on Market = 12% – 5%

- Return on the risk taken on the Market = 7%

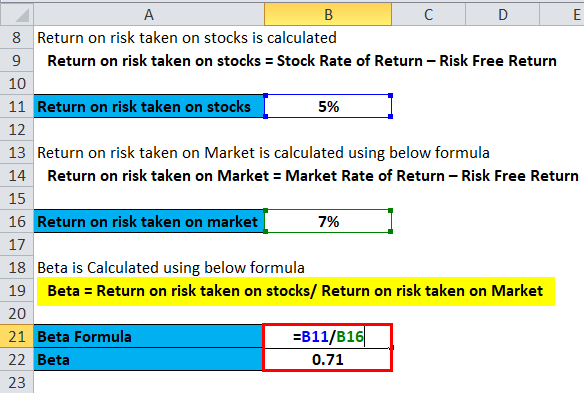

Beta is calculated using the formula below

- Beta = return on the risk taken on stocks/return on the risk taken on the Market.

- Beta = 5 /7

- Beta = 0.71

So, the value for Beta is 0.71, which means the company is less volatile than the Market.

Calculation of Beta for the Stock Profile

Now, let us see a calculation of Beta for the stock profile.

Beta is calculated for stock, and for a stock portfolio value of each stock, Beta is added up according to their weights to create the portfolio beta. The formula for the same is as follows:-

The Beta of the Portfolio = Weight of Stock * Beta of Stock + Weight of Stock * Beta of Stock…so on

Let us see an example to calculate the same.

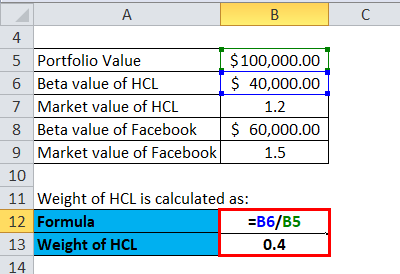

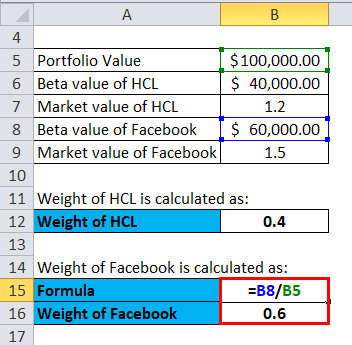

An investor has a portfolio of $100,000, the market value of HCL is $40,000 with a Beta value of HCL is 1.20, and the market value of Facebook is $60,000 with a Beta value is 1.50. The Beta of the Portfolio will be:-

The weight of HCL is calculated as follows:

- Weight of HCL = 40,000 / 100,000

- Weight of HCL = 0.40

The weight of Facebook is calculated as follows:

- Weight of Facebook = 60,000 / 100,000

- Weight of Facebook = 0.60

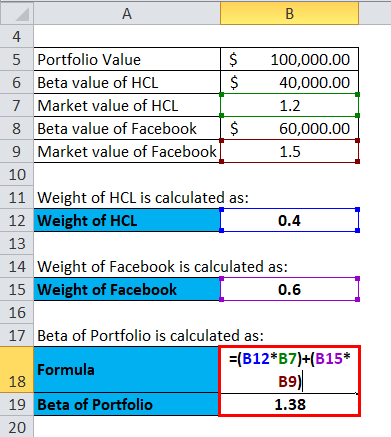

The Beta of the Portfolio is calculated as follows:

The Beta of the Portfolio = Weight of Stock * Beta of Stock + Weight of Stock * Beta of Stock…so on

- Beta of Portfolio = (0.40*1.20) + (0.60*1.50)

- Beta of Portfolio = 0.48 + 0.9

- Beta of Portfolio = 1.38

The Beta of the Portfolio is 1.38, which means the stock is highly risky and volatile.

Beta Measurement and its Relation with the Market

The value of Beta defines the risk associated with the company; Beta tells whether an investment in the company is risky or not and how much it depends on the Market. Beta measures the stock rise in relation to the stock market. Beta value and its interpretation are as follows:-

- If Beta = 1, then the risk in stock will be the same as in the stock market. It means the stock is volatile, like the stock market.

- If Beta>1, then the level of risk is high and highly volatile compared to the stock market.

- If Beta > 0 and Beta < 1, the stock price will move with the Market. However, the stock price will be less risky and less volatile.

Uses of Beta Formula

There are many uses of Beta and its Formula, and they are as follows:-

- It helps in the risk analysis of the stock.

- Beta helps to calculate the rate of returns.

- It also helps in the evaluation of discounted cash flow.

- Beta provides a real picture of the investment portfolio.

Beta has some disadvantages as it depends on past performance, but in reality, past performance cannot guarantee the future and cannot give an accurate value. Despite being in Beta, investment bankers and investors extensively use it to calculate risk.

Beta Calculator

You can use the following Beta Calculator

| Covariance | |

| Variance | |

| Beta Formula | |

| Beta Formula | = |

|

|

Beta Formula in Excel (With Excel Template)

Here, we will do the same example of the Beta formula in Excel. It is very easy and simple.

You can easily calculate the Beta using the formula in the template provided.

Beta using the correlation formula is calculated as:

Return on the risk taken on stocks is calculated as:

Return on the risk taken on the Market is calculated as:

To calculate Beta, use the following formula:

Use the following formula to calculate the weight of HCL:

The following method determines Facebook’s significance:

Use the following formula to calculate the Portfolio Beta:

Recommended Articles

This has been a guide to a Beta formula. Here, we discuss its uses along with practical examples. We also provide you Beta Calculator with a downloadable Excel template. You may also look at the following articles to learn more –