Updated July 25, 2023

Cost-Benefit Analysis Formula (Table of Contents)

What is the Cost-Benefit Analysis Formula?

The term “cost-benefit analysis” refers to the analytical technique that compares the benefits of a project with its associated costs. In other words, all the expected benefits out a project are placed on one side of the balance and the costs that have to be incurred are placed on the other side.

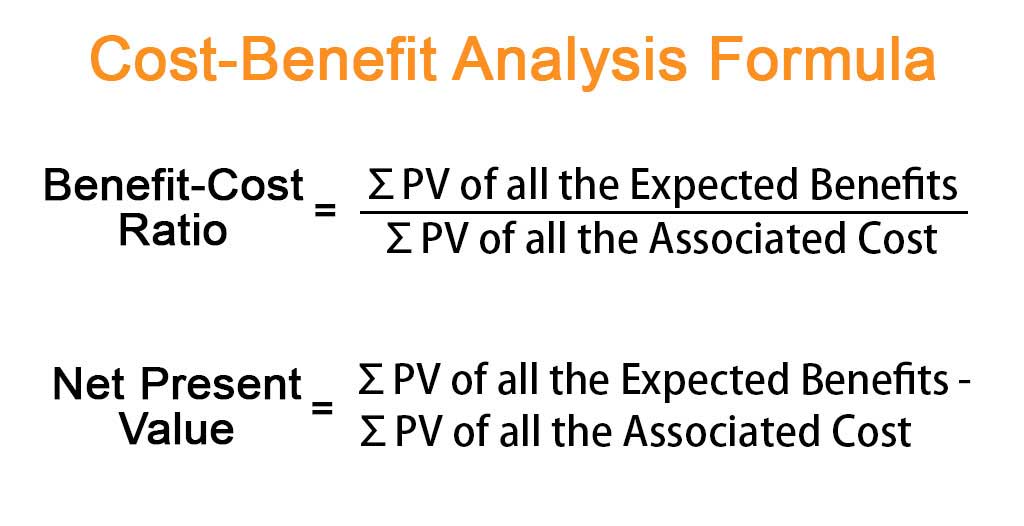

The cost-benefit analysis can be executed either using “benefit-cost ratio” or “net present value”. The formula for a benefit-cost ratio can be derived by dividing the aggregate of the present value of all the expected benefits by an aggregate of the present value of all the associated costs, which is represented as,

Cost-Benefit Analysis Formula,

The formula for net present value can be derived by deducting the sum of the present value of all the associated costs from the sum of the present value of all the expected benefits, which is represented as,

Example of Cost-Benefit Analysis Formula (With Excel Template)

Let’s take an example to understand the calculation of Cost-Benefit Analysis in a better manner.

Cost-Benefit Analysis Formula – Example #1

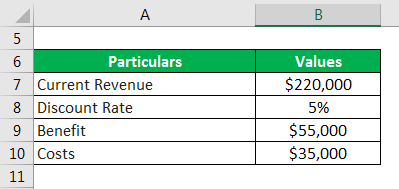

Let us take the example of a financial technology start-up which is contemplating on hiring two new programmers. The promoter expects the programmers to increase the revenue by 25% while incurring an additional cost of $45,000 in the next one year. The help promoter decides whether to go ahead with the recruitment based on cost-benefit analysis if the revenue of the company in the current year is $220,000 and the relevant discount rate is 5%.

Solution:

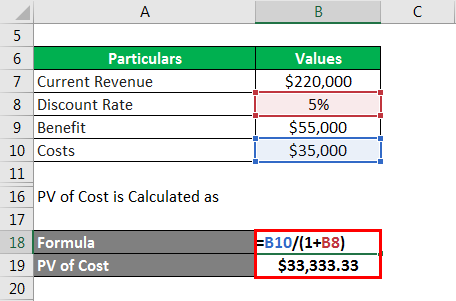

PV of Benefit is Calculated as:

- PV of Benefit= $55,000 / (1 + 5%)

- PV of Benefit = $52,380.95

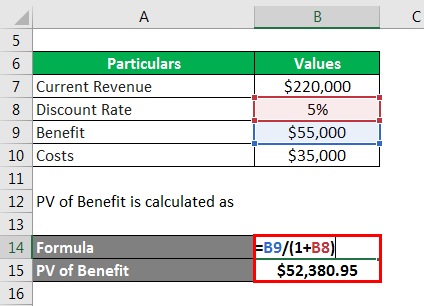

PV of Cost is Calculated as:

- PV of Cost = $35,000 / (1 + 5%)

- PV of Cost = $33,333.33

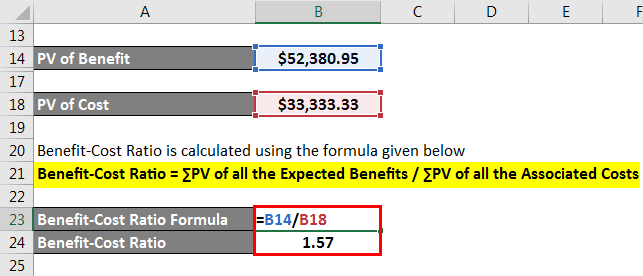

Benefit-Cost Ratio is calculated using the formula given below

Benefit-Cost Ratio = ∑PV of all the Expected Benefits / ∑PV of all the Associated Costs

- Benefit-Cost Ratio = $52,380.95 / $33,333.33

- Benefit-Cost Ratio = 1.57x

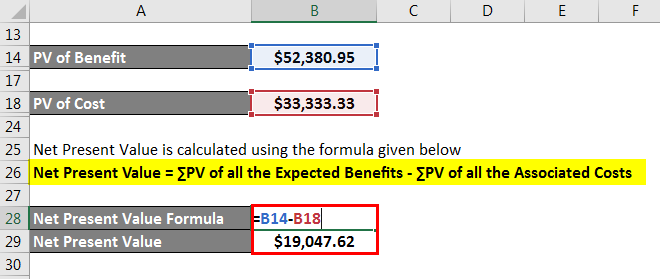

Net Present Value is calculated using the formula given below

Net Present Value = ∑PV of all the Expected Benefits – ∑PV of all the Associated Costs

- Net Present Value = $52,380.95 – $33,333.33

- Net Present Value = $19,047.62

Therefore, both the method of cost-benefit analysis suggests that the promoter should go ahead with the recruitment.

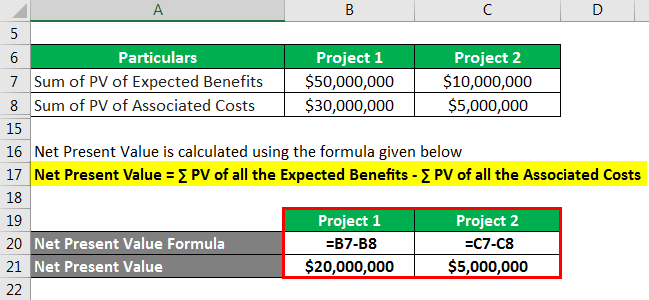

Cost-Benefit Analysis Formula – Example #2

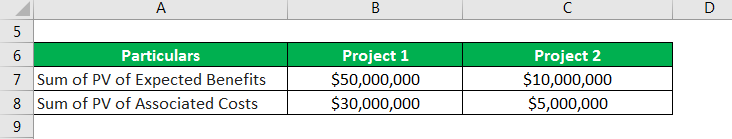

Let us take the example of two projects to illustrate the use of cost-benefit analysis. The sum of the present value of expected benefits from Project 1 is $50 million with the sum of the present value of associated costs of $30 million. On the other hand, the sum of the present value of expected benefits from Project 2 is $10 million with the sum of the present value of associated costs of $5 million. Discuss which project is better based on cost-benefit analysis.

Solution:

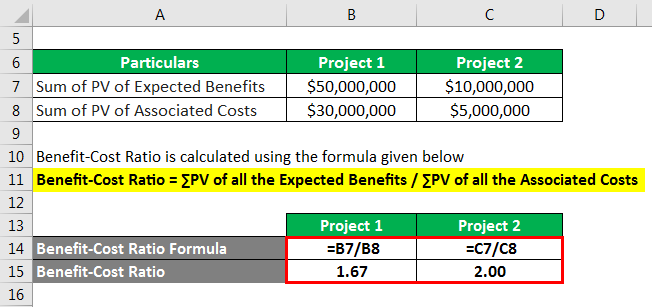

Benefit-Cost Ratio is calculated using the formula given below

Benefit-Cost Ratio = ∑PV of all the Expected Benefits / ∑PV of all the Associated Costs

For Project 1

- Benefit-Cost Ratio = $50,000,000 / $30,000,000

- Benefit-Cost Ratio = 1.67x

For Project 2

- Benefit-Cost Ratio = $10,000,000 / $5,000,000

- Benefit-Cost Ratio = 2.00x

Net Present Value is calculated using the formula given below

Net Present Value = ∑PV of all the Expected Benefits – ∑PV of all the Associated Costs

For Project 1

- Net Present Value = $50,000,000 – $30,000,000

- Net Present Value = $20,000,000

For Project 2

- Net Present Value = $10,000,000 – $5,000,000

- Net Present Value = $5,000,000

Therefore, as per the benefit-cost ratio, project 2 is better, while the net present value suggests project 1 is better. Although this is a stalemate mind of the situation, the inherently net present value gets the preference. Therefore, project 1 will be considered better.

Explanation

The formula for cost-benefit analysis can be calculated by using the following steps:

Step 1: Firstly, Calculate all the cash inflow from the subject project, which is either revenue generation or savings due to operational efficiency.

Step 2: Next, Calculate all the cash outflow into the project, which are the costs incurred in order to maintain and keep the project up and running.

Step 3: Next, Calculate the discounting factor based on the current pricing of assets with a similar risk profile.

Step 4: Next, based on the discounting factor, calculate the present value of all the cash inflow and outflow. Then, add up the present value of all the cash inflow as ∑PV of all the expected benefits and outflow as ∑PV of all the associated costs.

Step 5: Now, the formula for a benefit-cost ratio can be derived by dividing aggregate of the present value of all the expected benefits (step 4) by aggregate of the present value of all the associated costs (step 4) as shown below.

Benefit-Cost Ratio = ∑PV of all the Expected Benefits / ∑PV of all the Associated Costs

Step 6: Now, the formula for net present value can be derived by deducting the sum of the present value of all the associated costs (step 4) from the sum of the present value of all the expected benefits (step 4) as shown below.

Net Present Value = ∑PV of all the Expected Benefits – ∑PV of all the Associated Costs

Relevance and Use of Cost-Benefit Analysis Formula

The importance of cost-benefit analysis lies in the fact that it is used for assessing the feasibility of an opportunity, comparing projects, appraising opportunity cost and building real-life scenario-based sensitivity testing. In this way, this technique helps in ascertaining the accuracy of an investment decision and provides a platform for its comparison with similar proposals.

Cost-Benefit Analysis Formula Calculator

You can use the following Cost-Benefit Analysis Formula Calculator

| ∑PV of all the Expected Benefits | |

| ∑PV of all the Associated Costs | |

| Benefit-Cost Ratio | |

| Benefit-Cost Ratio | = |

|

|

Recommended Articles

This is a guide to Cost-Benefit Analysis Formula. Here we discuss how to calculate the Cost-Benefit Analysis Formula along with practical examples. We also provide a Cost-Benefit Analysis calculator with a downloadable excel template. You may also look at the following articles to learn more –