Updated July 21, 2023

Capital Expenditure Formula (Table of Contents)

What is the Capital Expenditure Formula?

The term “capital expenditure” refers to the expense that has been incurred for the purchase or acquisition of some physical assets (e.g.: property, building, land, and equipment) during the course of a year.

In other words, capital expenditure is the increase in property, plant, and equipment (popularly known as PP&E) intended for supporting an increase in revenue. PP&E is an essential line item of the balance sheet, while the change in PP&E is captured in the cash flow statement.

Formula

Under the indirect method, the formula for capital expenditure can be expressed as the difference of PP&E in the current year and the previous year plus the depreciation expense incurred during the year. Mathematically, it is represented as,

Example of Capital Expenditure Formula (With Excel Template)

Let’s take an example to understand the calculation of the Capital Expenditure in a better manner.

Capital Expenditure Formula – Example #1

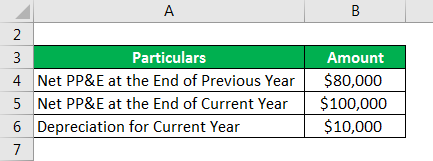

Let us take the example of BNM Inc. to the calculation of the capital expenditure. The following financial information is available:

Solution:

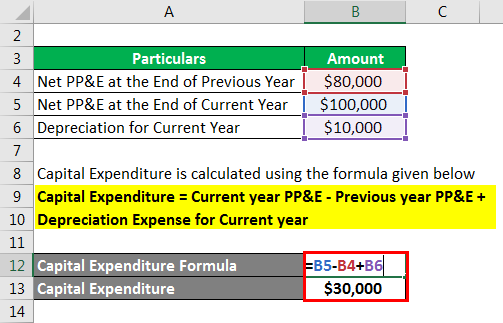

Capital Expenditure is calculated using the formula given below

Capital Expenditure = Current year PP&E – Previous year PP&E + Depreciation Expense for Current year

- Capital Expenditure = $100,000 – $80,000 + $10,000

- Capital Expenditure = $30,000

Therefore, the capital expenditure incurred by BNM Inc. during the year 2019 was $30,000.

Capital Expenditure Formula – Example #2

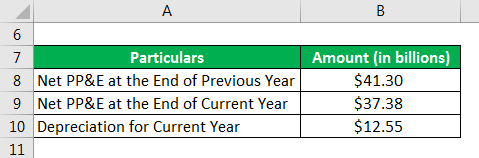

Let us take the example of Apple Inc. to calculate the computation of capital expenditure for a real-life company. As per Apple Inc.’s annual report for the year, the company’s net PP&E stood at $37.38 billion and $41.30 billion as of September 28, 2019, and September 29, 2018, respectively. On the other hand, the depreciation and amortization expense incurred during 2019 was $12.55 billion. Based on the given information, Calculate the capital expenditure incurred by Apple Inc. during the year 2019.

Solution:

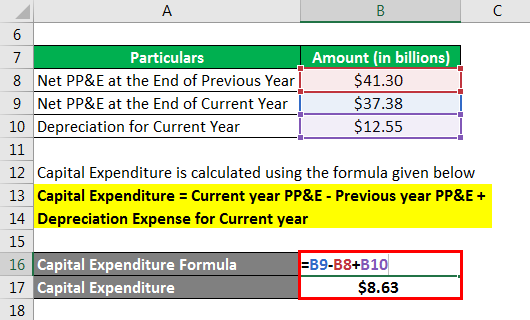

Capital Expenditure is calculated using the formula given below

Capital Expenditure = Current year PP&E – Previous year PP&E + Depreciation Expense for Current year

- Capital Expenditure = $37.38 billion – $41.30 billion + $12.55 billion

- Capital Expenditure = $8.63 billion

Therefore, Apple Inc. incurred a capital expenditure of $8.63 billion during the year 2019.

Source Link: Apple Finance pdf

Explanation

The formula for Capital Expenditure can be calculated by using the following steps:

The concept of capital expenditure arises out of the fact that companies need to decide whether to expense or capitalize an expenditure on the basis of the tenure of the perceived benefit from the expenditure. If the perceived benefit is expected to last for less than a year, then it should be expensed directly on the income statement. On the other hand, if the perceived benefit is expected to last for more than one year, then it gives way to capitalization of the expenditure resulting in the creation of PP&E on the asset side of the balance sheet.

Step 1: Firstly, determine the value of PP&E at the end of the current year from the current year’s balance sheet.

Step 2: Next, determine the value of PP&E at the end of the previous year from last year’s balance sheet.

Step 3: Next, compute the net increase in PP&E by subtracting the PP&E of the previous year (step 2) from that of the current year (step 1).

Step 4: Next, collect the value of depreciation incurred during the course of the year from the current year’s income statement.

Step 5: Finally, the formula for capital expenditure incurred during the year can be derived by adding the difference (step 3) of PP&E in the current year and the previous year to the depreciation expense incurred during the year (step 4) as shown below.

Relevance and Use of Capital Expenditure Formula

The concept of capital expenditure is very essential from the point of view of financial budgeting. As the name indicates, capital expenditure is very expensive in nature, and as such companies need to plan well in advance to ensure that the purchased or acquired asset is utilized efficiently. In the manufacturing sector, companies incur capital expenditure in order to expand its production capacity or to set-up a new production facility with the intention of generating long term benefits out of it. As such, capital expenditure is seen as an important part of a company’s long term business strategy.

Typically, regular capital expenditure and growing netblock or net PP&E is seen as an indication that the company is on a growing stint, which enhances investor confidence. On the other hand, a lack of capital expenditure indicates that the company is not expecting any significant growth opportunity in the future, which can be cases for companies operating in a mature market.

However, one of the major challenges associated with capital expenditure is that it can result in significant losses in case the anticipated benefits are not realized as the production plans are not handled efficiently, given the huge capital investment. So, the wrong capital expenditure can be detrimental to a company’s financial position.

Capital Expenditure Formula Calculator

You can use the following Capital Expenditure Formula Calculator

| Current Year PP&E | |

| Previous Year PP&E | |

| Depreciation Expense for Current Year | |

| Capital Expenditure | |

| Capital Expenditure = | Current Year PP&E - Previous Year PP&E+Depreciation Expense for Current Year |

| = | 0-0+0= 0 |

Conclusion

So, by now you know what is capital expenditure, why it is recognized in the financial statements, and how to compute it based on the information provided in the financial statements.

Recommended Articles

This is a guide to Capital Expenditure Formula. Here we discuss how to calculate Capital Expenditure along with practical examples. We also provide a Capital Expenditure Formula calculator with a downloadable Excel template. You may also look at the following articles to learn more –