Updated July 21, 2023

Expense Ratio Formula (Table of Contents)

What is the Expense Ratio Formula?

The term “expense ratio” refers to the efficiency ratio that measures the expenses incurred to manage the fund as a proportion of the total investment made in the fund, such as mutual fund, equity fund, exchange-traded fund, etc.

In other words, the ratio indicates what percentage of the total investment made in the fund goes into compensating for the management fees. The management fees include (not exhaustive) audit costs, transactional costs, legal fees, fund manager fees, transfer fees, marketing fees, and other miscellaneous expenses.

The formula for expense ratio is expressed as the management fees incurred for the fund divided by the overall asset size of the investment fund. Mathematically, it is represented as,

Example of Expense Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Expense Ratio in a better manner.

Expense Ratio Formula – Example #1

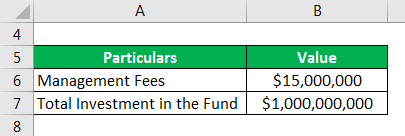

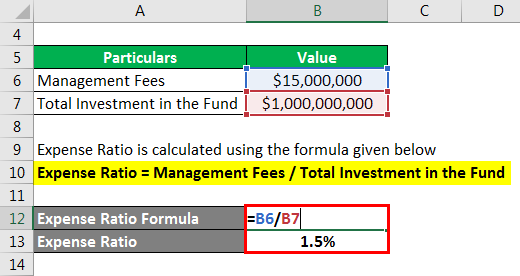

Let us take the example of a mutual fund to illustrate the computation of the expense ratio. During FY2019, the fund incurred total management fees of $15 million, and the asset under management for the fund stood at $1,000 million on December 31, 2019. Determine the expense ratio of the fund for the year 2019.

Solution:

The formula to calculate Expense Ratio is as below:

Expense Ratio = Management Fees / Total Investment in the Fund

- Expense Ratio = $15 million / $1,000 million

- Expense Ratio = 1.5%

Therefore, the mutual fund’s expense ratio was 1.5% for the year 2019.

Expense Ratio Formula – Example #2

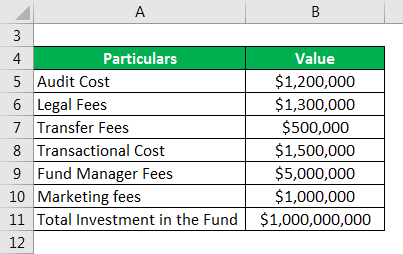

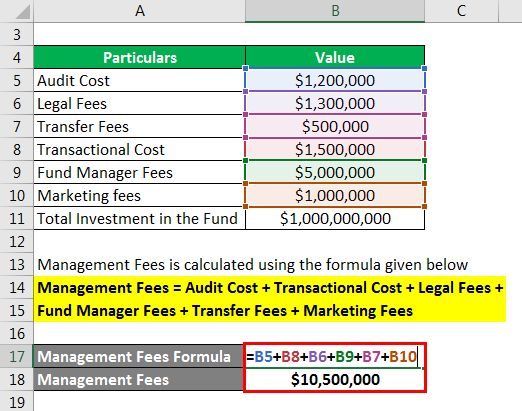

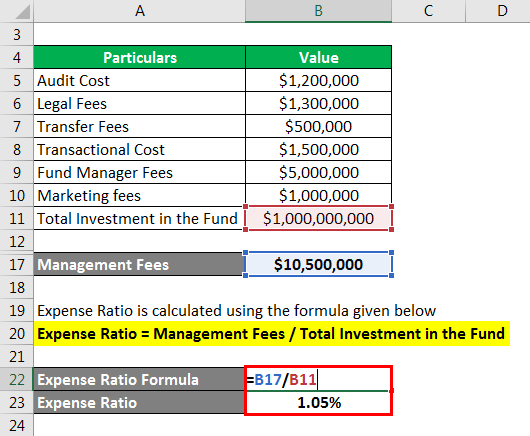

Let us take the example of a mutual fund with a more detailed expense break-up. During FY2019, the fund incurred the following expenses. Calculate the expense ratio of the fund if the asset under management for the fund stood at $1,000 million as on December 31, 2019.

Solution:

The formula to calculate Management Fees is as below:

Management Fees = Audit Cost + Transactional Cost + Legal Fees + Fund Manager Fees + Transfer Fees + Marketing Fees

- Management Fees = $1.2 million + $1.5 million + $1.3 million + $5.0 million + $0.5 million + $1.0 million

- Management Fees = $10.5 million

The formula to calculate Expense Ratio is as below:

Expense Ratio = Management Fees / Total Investment in the Fund

- Expense Ratio = $10.5 million / $1,000 million

- Expense Ratio = 1.05%

Therefore, the mutual fund’s expense ratio was 1.05% for the year 2019.

Explanation

The formula for Expense Ratio can be calculated by using the following steps:

Step 1: First, determine all the costs incurred for operating and managing the investment fund, which primarily includes audit costs, transactional costs, legal fees, fund manager fees, transfer fees, marketing fees, along with other miscellaneous expenses.

Step 2: Next, determine the size of investment made in the fund, also known as an asset under management.

Step 3: Finally, the formula for expense ratio is expressed as the management fees (step 1) incurred for the fund divided by the overall asset size of the investment fund (step 2), as shown below.

Relevance and Use of Expense Ratio Formula

The concept of expense ratio is very important for investors and analysts assessing such investment funds. All investment fund management involves various operating costs for creating, managing, and maintaining it. So, all these costs are clubbed under a single head of management fees or fund costs, and then eventually, the expense ratio is computed. Now, checking whether the fund is generating returns higher than the expense ratio is quintessential. If not, it means the investors are losing money in that fund at the end of the investment period. Further, this metric also helps compare different investment funds with different investment styles and cater to different risk appetites.

One of the most striking expense ratio comparisons between index funds (aka passive funds) and actively managed funds. Both these types of funds charge different expense ratios owing to the difference in their style of managing the investment portfolio. In index funds, the fund manager only tracks whether or not the portfolio is in sync with the benchmark index with which it is mapped. As such, these funds don’t require any active management team resulting in a lower expense ratio. For instance, T. Rowe Price Equity Index 500 Fund is an index fund that mimics S&P 500 Index. Its gross and net expense ratios are 0.23% and 0.21%, respectively.

On the other hand, actively-managed funds require a strong portfolio management team of analysts who identify and analyze potential investment opportunities that can generate high returns. As such, these funds incur a higher cost of operation which is then passed on to the investors and are captured under the expense ratio. For instance, AB Large Cap Growth Fund is an example of an actively-managed fund whose gross and net expense ratios are 1.02% and 1.00%, respectively.

Expense Ratio Formula Calculator

You can use the following Expense Ratio Formula Calculator

| Management Fees | |

| Total Investment in the Fund | |

| Expense Ratio | |

| Expense Ratio = | Management Fees /Total Investment in the Fund |

| = | 0 /0 = 0 |

Recommended Articles

This is a guide to the Expense Ratio Formula. Here we discuss how to calculate the Expense Ratio along with practical examples. We also provide an Expense Ratio calculator with a downloadable Excel template. You may also look at the following articles to learn more –