Updated July 26, 2023

Return on Capital Employed Formula (Table of Contents)

What is Return on Capital Employed Formula?

The term “return on capital employed” refers to the profitability ratio that is used by analysts to check how effectively an entity is able to use the capital employed in the business to generate profits during a certain period of time.

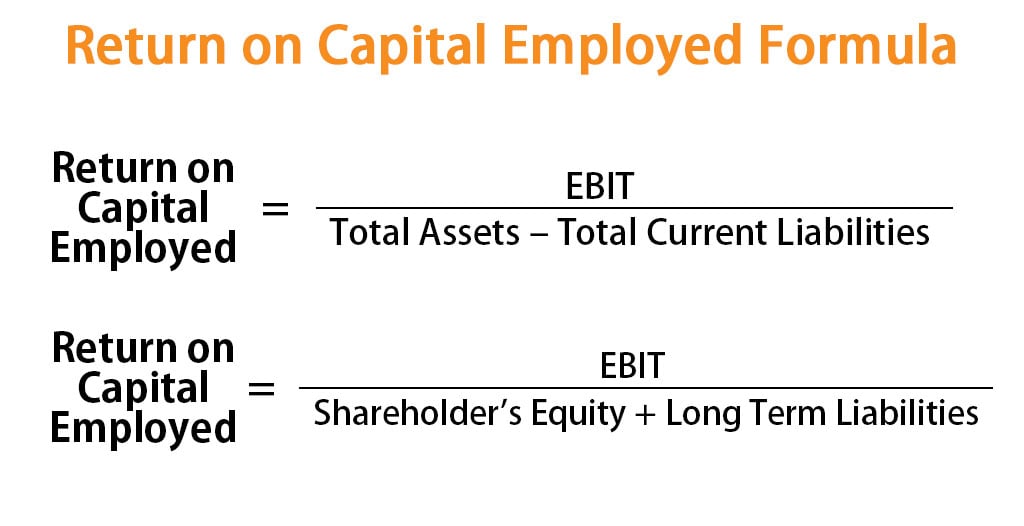

In other words, the return on capital employed is a measure of how many dollars can be generated from each dollar of the capital employed. The capital employed includes both shareholders equity and debt liabilities. The formula for return on capital employed can be derived by dividing the company’s operating profit or earnings before interest and taxes (EBIT) by the difference between total assets and total current liabilities. Mathematically, ROCE Formula is represented as,

The formula for return on capital employed can also be expressed by dividing the operating profit by the summation of shareholder’s equity and long term liabilities. Mathematically, ROCE Formula is represented as,

Examples of Return on Capital Employed Formula (With Excel Template)

Let’s take an example to understand the calculation of Return on Capital Employed in a better manner.

Return on Capital Employed Formula – Example #1

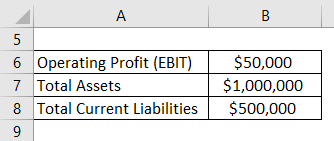

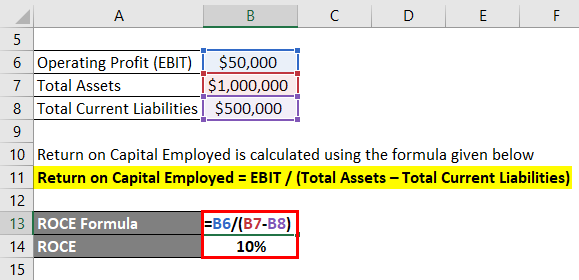

Let us take the example of a hypothetical company. As per the recent annual report, the reported operating profit is $50,000, while the total assets and the total current liabilities stood at $1,000,000 and $500,000 respectively as on the balance sheet date. Calculate the return on capital employed for the company during the year.

Solution:

Return on Capital Employed is calculated using the formula given below

Return on Capital Employed = EBIT / (Total Assets – Total Current Liabilities)

- Return on Capital Employed = $50,000 / ($1,000,000 – $500,000)

- Return on Capital Employed = 10%

Therefore, the company generated a return on capital employed by 10% during the year.

Return on Capital Employed Formula – Example #2

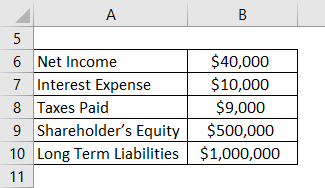

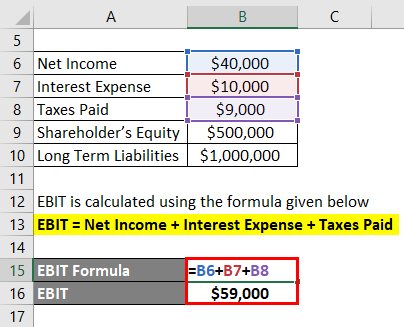

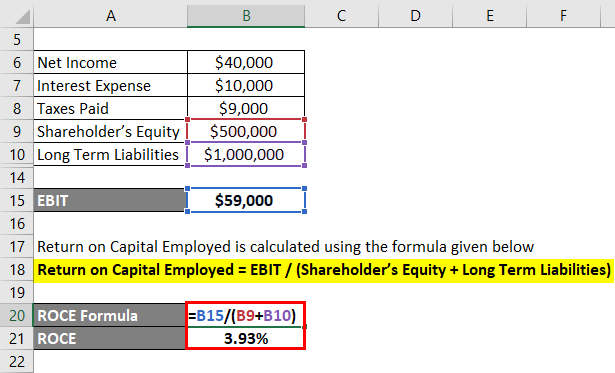

Let us take the example of another company that reported net income of $40,000 in its income statement. Further, it recorded interest expense and tax payment of $10,000 and $9,000 respectively. On the other hand, the shareholder’s equity and long term liabilities stood at $500,000 and $1,000,000 respectively as on balance sheet date. Calculate the return on capital employed for the company during the year.

Solution:

EBIT is calculated using the formula given below

EBIT = Net Income + Interest Expense + Taxes Paid

- EBIT = $40,000 + $10,000 + $9,000

- EBIT = $59,000

Return on Capital Employed is calculated using the formula given below

Return on Capital Employed = EBIT / (Shareholder’s Equity + Long Term Liabilities)

- Return on Capital Employed = $59,000 / ($500,000 + $1,000,000)

- Return on Capital Employed = 3.93%

Therefore, the company generated return on capital employed of 3.93% during the year.

Return on Capital Employed Formula – Example #3

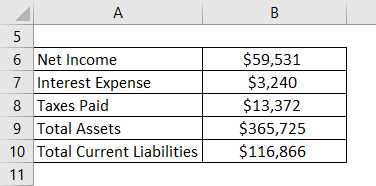

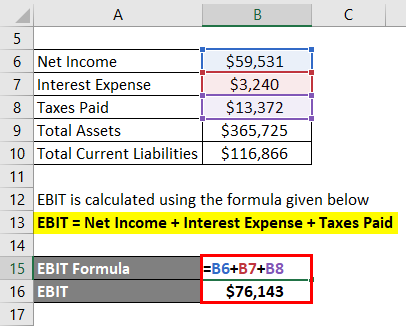

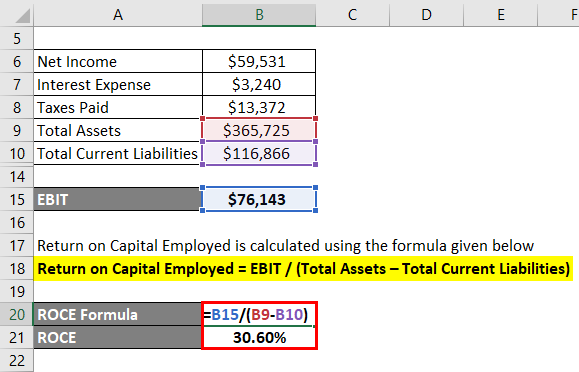

Let us take the example of Apple Inc. As per the latest annual report, Apple reported net income of $59,531 Mn, interest expense of $3,240 Mn and provision for income taxes of $13,372 Mn. On the other hand, the total asset and total current liabilities stood at $365,725 Mn and $116,866 Mn respectively as on balance sheet. Calculate the return on capital employed for Apple Inc.

Solution:

EBIT is calculated using the formula given below

EBIT = Net Income + Interest Expense + Taxes Paid

- EBIT = $59,531 Mn + $3,240 Mn + $13,372 Mn

- EBIT = $76,143 Mn

Return on Capital Employed is calculated using the formula given below

Return on Capital Employed = EBIT / (Total Assets – Total Current Liabilities)

- Return on Capital Employed = $76,143 Mn / ($365,725 Mn – $116,866 Mn)

- Return on Capital Employed = 30.60%

Therefore, Apple Inc. booked to return on capital employed of 30.60% during last year.

Explanation of ROCE Formula

The formula for return on capital employed can be derived by using the following steps:

Step 1: Firstly, determine operating profit or EBIT which is usually provided directly in the income statement. However, if it is not mentioned directly, then it can be computed by adding back interest expense and taxes paid to the net income of the company from its income statement.

Step 2: Next, figure out the total assets from the balance sheet of the company, which includes both long-term and short term assets like plant & equipment, advances paid, trade receivables, etc.

Step 3: Next, figure out the total current liabilities from the balance sheet of the company, which includes liabilities that are to be paid within one year, such as trade payable, accrued expenses, interest payable, etc.

Step 4: Finally, the formula for return on capital employed can be derived by diving the operating profit (step 1) by the difference between total assets (step 2) and total current liabilities (step 3) as shown below.

Relevance and Uses

It is important to understand the concept of return on capital employed because this profitability ratio is usually used by investors and analysts to assess how effectively a company is able to utilize the capital employed in the business. Typically, return on capital employed is considered to be a better indicator than the return on equity because of the former analyses the profitability relative to both equity and debt. It is usually used to compare companies from the same industry and of a similar scale. In some cases, companies with large cash reserves tend to include the cash in the employed capital computation which is not the usual practice.

Return on Capital Employed Formula Calculator

You can use the following Return on Capital Employed Calculator

| EBIT | |

| Total Assets | |

| Total Current Liabilities | |

| Return on Capital Employed | |

| Return on Capital Employed= |

| |||||||||

|

Recommended Articles

This is a guide to Return on Capital Employed Formula. Here we discuss How to Calculate Return on Capital Employed along with practical examples. We also provide a Return on Capital Employed Calculator with a downloadable excel template. You may also look at the following articles to learn more –