Updated July 25, 2023

Bank Efficiency Ratio Formula (Table of Contents)

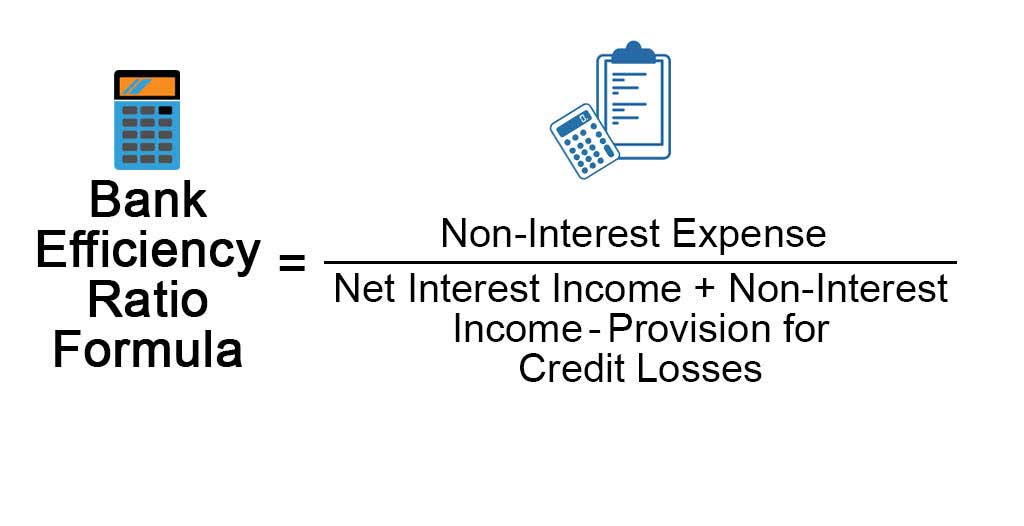

What is the Bank Efficiency Ratio Formula?

There are multiple types of ratios Operating Margin Ratio, Return on Asset, Return on Equity, Debt to Equity Ratio, Asset Turnover Ratio, Account Receivable Turnover Ratio, Working Capital Ratio, and each ratio indicates the various aspect of the business.

The efficiency ratio, the Activity ratio, indicates how effectively the company performs using its internal resources. Banks use the efficiency ratio as it helps analysts examine how well the bank performs its operations overhead to generate revenue. The lower the ratio, the better it is, 50% is considered to be an ideal ratio.

Examples of Bank Efficiency Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Bank Efficiency Ratio in a better manner.

Bank Efficiency Ratio Formula – Example #1

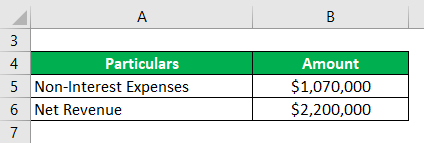

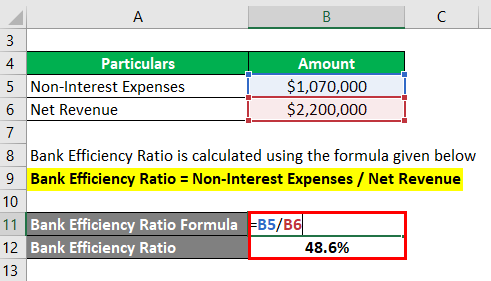

Let us take the example of Local Bank A it’s Non-Interest Expenses is $1,050,000, and its Net Revenue is $2,200,000. Using this data, we need to calculate the Bank Efficiency Ratio for Bank.

Solution:

The formula to calculate Bank Efficiency Ratio is as below:

Bank Efficiency Ratio = Non-Interest Expenses / Net Revenue

- Bank Efficiency Ratio = $1,070,000 / $2,200,000

- Bank Efficiency Ratio = 48.6%

To calculate the Efficiency Ratio, we need to divide Non-Interest Expense of $ 1,070,000 by Revenue of $ 2,200,000. Using the above-explained formula, we have a value of 48.6%, which means the company spent $ 0.486 to generate a dollar.

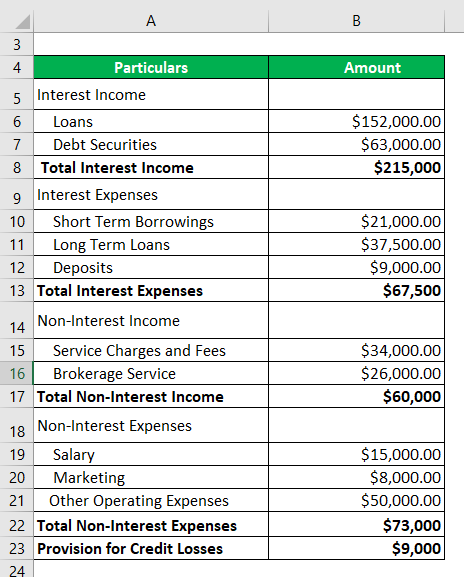

Bank Efficiency Ratio Formula – Example #2

Let us take another example of the same Bank A, which has recently started, and they want to identify the bank’s efficiency ratio to analyze how well the company is using its resources to generate revenue. Bank’s Provision for credit losses is $ 9000.

Solution:

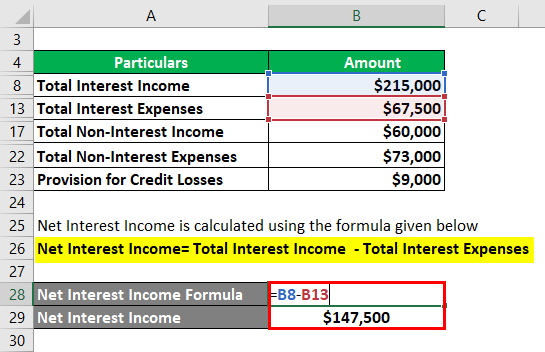

The formula to calculate Net Interest Income is as below:

Net Interest Income= Total Interest Income – Total Interest Expenses

- Net Interest Income = $215000- $67500

- Net Interest Income = $147500

The formula to calculate Bank Efficiency Ratio is as below:

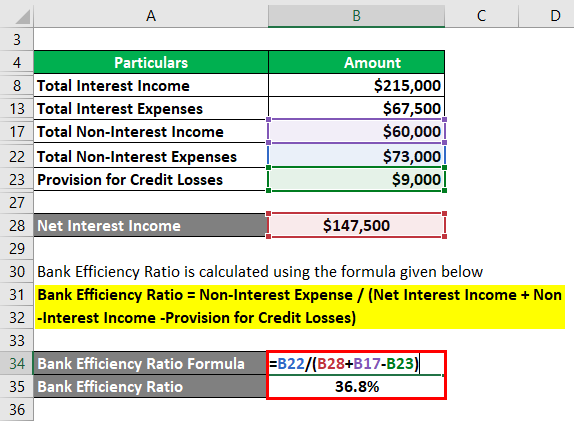

Bank Efficiency Ratio = Non-Interest Expense / (Net Interest Income + Non-Interest Income -Provision for Credit Losses)

- Bank Efficiency Ratio = $ 73000/ $ 198500

- Bank Efficiency Ratio = 36.8%

From the above calculation, it can be concluded that this bank is working very efficiently, with a ratio of 36.8%.

Bank Efficiency Ratio Formula – Example #3

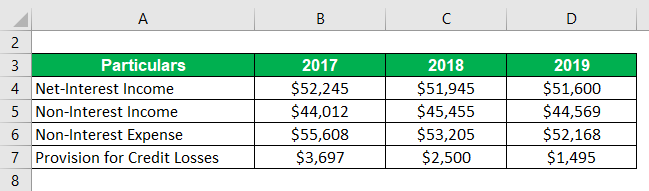

Let’s take one more example of Green Bank Corp. Below is the historical data of the bank

Solution:

The formula to calculate Bank Efficiency Ratio is as below:

Bank Efficiency Ratio = Non-Interest Expense / (Net Interest Income + Non-Interest Income -Provision for Credit Losses)

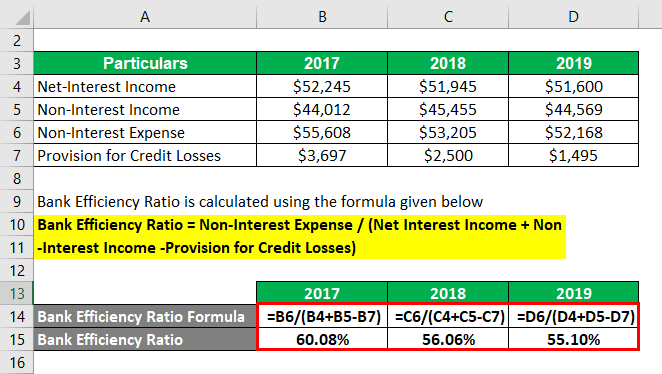

For 2017

- Bank Efficiency Ratio = $55,608 / ($52,245 + $44,012 – $3,697 )

- Bank Efficiency Ratio = 60.08%

For 2018

- Bank Efficiency Ratio = $53,205 / ($51,945 + $45,455 – $2,500)

- Bank Efficiency Ratio = 56.06%

For 2019

- Bank Efficiency Ratio = $52,168 / ($51,600 + $44,569 – $1,495)

- Bank Efficiency Ratio = 55.10%

Following are observations of the above case –

- It is interesting to see that the bank efficiency ratio is significantly reducing over the last three years. From an investor’s or a business manager’s perspective, this is a great thing that the bank is improving its performance over the years.

- The efficiency ratio is reducing because of multiple factors here. As you can see, there is a downward trend in Non-Interest expenses, which means the bank is managing its business very well with low operation costs, which will lead to an increase in profitability in the future.

- On the other hand, the provision for credit losses is also reducing, which can be interpreted in multiple ways. First, this means that the bank has a high loan recovery rate, which is positive. On the other hand, the bank might face big issues related to credit losses in the future. Then it would be a big challenge for the banks to recover the losses.

Explanation

The formula for Banking Efficiency Ratio can be derived by using the following steps:

Step 1: First, figure out the Non-Interest Expense of the Bank. Some examples of Non-interest expenses are Rent, Salary, Administration costs, etc. Non-Interest Expenses are the fixed operating cost of the bank.

Step 2: Next, figure out the Net Interest Income of the bank, which can be calculated as interest earned less interest Paid by the bank).

Step 3: Identify the Non-interest Income of the bank. Examples of Non-interest Income are loan processing fees, deposit charges, Credit card fees, and Income earned from the capital market by selling products like mutual funds, insurance, etc.

Step 4: In the fourth step, subtract “Provision for credit losses” from Net and Non-Interest Income.

Step 5: Finally, Banking Efficiency Ratio can be derived by dividing Non-Interest Expense from Step One by the value we have calculated from Step 4.

Relevance and Use of Bank Efficiency Ratio Formula

An analyst uses the Bank Efficiency ratio to determine insights into the business, and it provides awareness about the efficiency of the different business areas. Analysts also use this ratio to measure banks with peer companies within the same industry. It helps banks identify the businesses that are managed well compared to others.

This Ratio is used by higher Management to know how well they are operating their business and gives a clear picture of whether they have met the set goals or not. Using this, they can change their strategies to operate the business activities and use resources better to reach the predetermined goals.

This ratio is also used by the investors as well as the management. Investors use this ratio to determine whether the business is a good investment because a better efficiency ratio means that management is operating the business efficiently, which could lead to good returns in the future.

Recommended Articles

This is a guide to Bank Efficiency Ratio Formula. Here we discuss how to calculate Bank Efficiency Ratio along with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more –