Updated July 25, 2023

Capital Gain Formula (Table of Contents)

What is the Capital Gain Formula?

The term “capital gain” refers to the increase in the value of an asset or a portfolio over a period of time solely due to growing price, while not taking into account the dividend paid during the same period.

In other words, it measures how much higher is the selling price of the asset than its purchase price. The formula for capital gain can be derived by deducting the purchase value of the asset or portfolio from the selling value. Mathematically, it is represented as,

Examples of Capital Gain Formula (With Excel Template)

Let’s take an example to understand the calculation of Capital Gain in a better manner.

Capital Gain Formula – Example #1

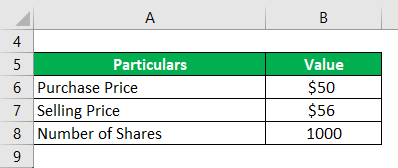

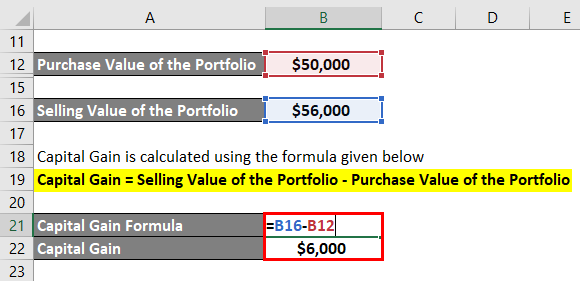

Let us take the example of Jenny who purchased 1,000 equity stocks of a company named BNM Inc. for $50 each a year back. The company paid a dividend of $4 per share during the year and currently she is selling all the stocks for $56 per share. Calculate Jenny’s capital gain for the transaction based on the given information.

Solution:

Purchase Value of the Portfolio is calculated as

- Purchase Value of the Portfolio = $50 * 1,000

- Purchase Value of the Portfolio = $50,000

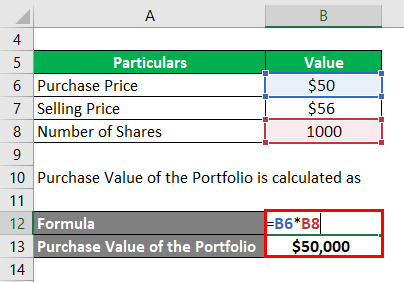

Selling Value of the Portfolio is calculated as

- Selling Value of the Portfolio= $56 * 1,000

- Selling Value of the Portfolio = $56,000

Capital Gain is calculated using the formula given below

Capital Gain = Selling Value of the Portfolio – Purchase Value of the Portfolio

- Capital Gain = $56,000 – $50,000

- Capital Gain = $6,000

Therefore, Jenny’s capital gain for the transaction was $6,000.

Capital Gain Formula – Example #2

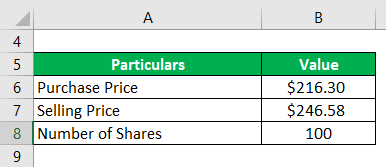

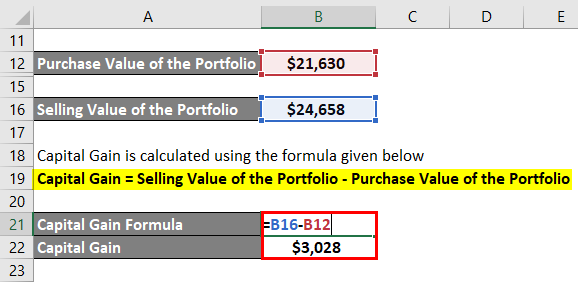

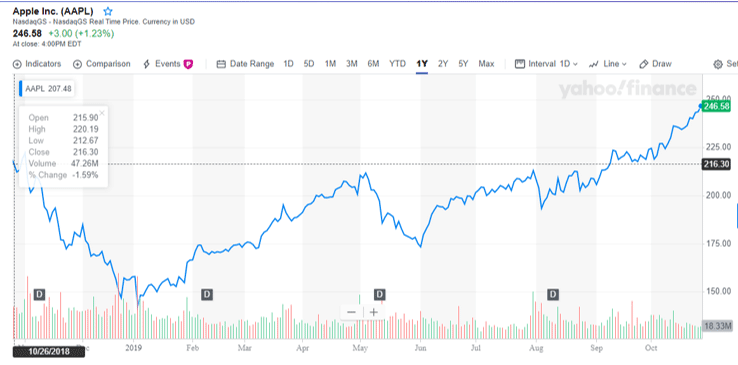

Let us take the example of Apple Inc.’s stock price movement to illustrate the concept of capital gain. Let us assume that John purchased 100 shares of Apple Inc. on 26 October 2018 for $216.30 per share and he sold all the shares on 25 October 2019 for $246.58 per share. Calculate John’s capital gain in this transaction.

Solution:

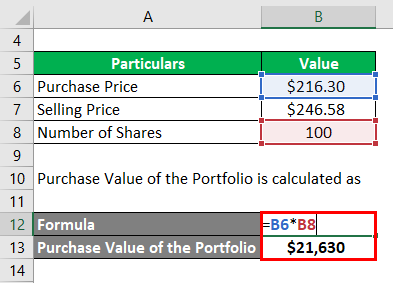

Purchase Value of the Portfolio is calculated as

- Purchase Value of the Portfolio = $216.30 * 100

- Purchase Value of the Portfolio = $21,630

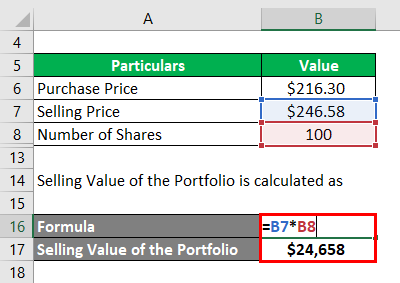

Selling Value of the Portfolio is calculated as

- Selling Value of the Portfolio = $246.58 * 100

- Selling Value of the Portfolio = $24,658

Capital Gain is calculated using the formula given below

Capital Gain = Selling Value of the Portfolio – Purchase Value of the Portfolio

- Capital Gain = $24,658 – $21,630

- Capital Gain = $3,028

Therefore, in this transaction, over a period of one year, John earned a capital gain of $3,028.

Screenshot of stock price used for calculation

Capital Gain Formula – Example #3

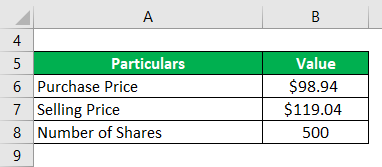

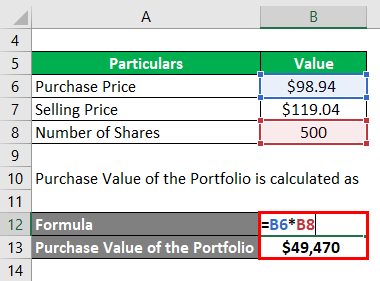

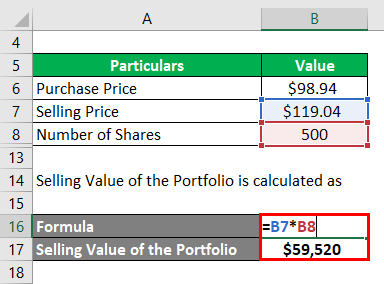

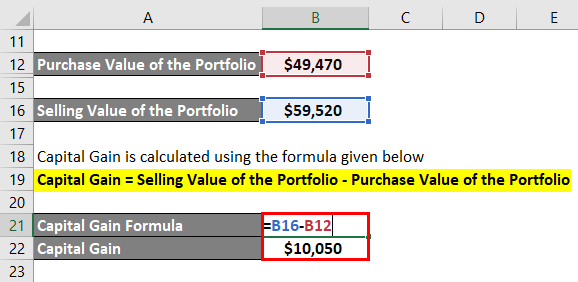

Let us take the example of Walmart Inc.’s stock price movement in the last one year. If Lucy purchased 500 shares of Walmart Inc. on 26 October 2018 for $98.94 per share and then sold all the shares on 25 October 2019 for $119.04 per share, Calculate the capital gain earned by her in selling these 500 shares.

Solution:

Purchase Value of the Portfolio is calculated as

- Purchase Value of the Portfolio = $98.94* 500

- Purchase Value of the Portfolio = $49,470

Selling Value of the Portfolio is calculated as

- Selling Value of the Portfolio = $119.04 * 500

- Selling Value of the Portfolio = $59,520

Capital Gain is calculated using the formula given below

Capital Gain = Selling Value of the Portfolio – Purchase Value of the Portfolio

- Capital Gain = $59,520 – $49,470

- Capital Gain = $10,050

Therefore, Lucy earned a capital gain of 10,050 by holding these 500 shares of Walmart Inc. for a period of one year.

Screenshot of stock price used for calculation

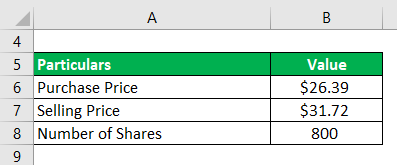

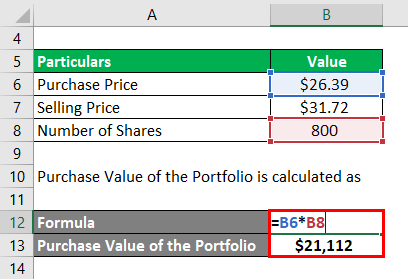

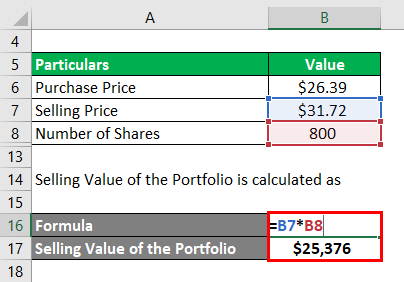

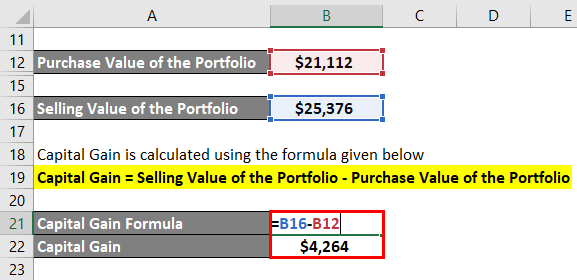

Capital Gain Formula – Example #4

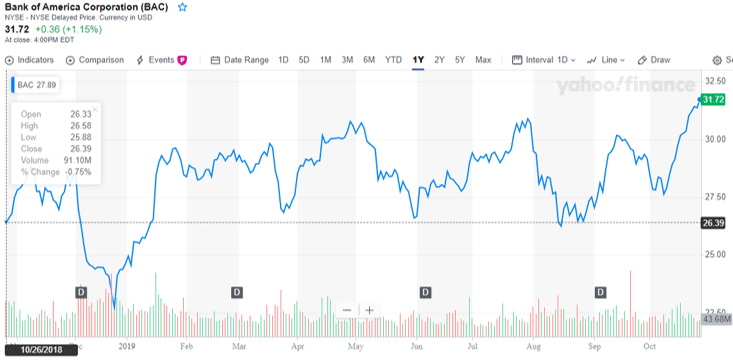

Let us take the example of the stock price movement of Bank of America Corporation during the last one year. Jason purchased 800 shares of the bank on 26 October 2018 and sold all the shares on 25 October 2019. Calculate Jason’s capital gain if the purchase price was $26.39 per share and selling price was $31.72 per share.

Solution:

Purchase Value of the Portfolio is calculated as

- Purchase Value of the Portfolio = $26.39 * 800

- Purchase Value of the Portfolio = $21,112

Selling Value of the Portfolio is calculated as

- Selling Value of the Portfolio = $31.72 * 800

- Selling Value of the Portfolio = $25,376

Capital Gain is calculated using the formula given below

Capital Gain = Selling Value of the Portfolio – Purchase Value of the Portfolio

- Capital Gain = $25,376 – $21,112

- Capital Gain = $4,264

Therefore, Jason’s capital gain in this transaction was $4,264.

Screenshot of stock price used for calculation

Explanation

The formula for capital gain can be derived by using the following steps:

Step 1: Firstly, determine the purchase value of the asset. For instance, the purchase value of a portfolio of stocks can be the product of the purchase price of each stock and the number of stocks purchased.

Step 2: Next, determine the selling value of the asset. Again, it is the product of the selling price of each stock and the number of stocks sold.

Step 3: Finally, the formula for capital gain can be derived by deducting the purchase value (step 1) of the asset from the selling value (step 2) as shown below.

Capital Gain = Selling Value – Purchase Value

Relevance and Use of Capital Gain Formula

It is one of the most important performance metrics for both investors and trading analysts because it helps in determining how much the investors’ investment has appreciated over a period of time. But please bear in mind that capital gain is not realized unless and until the subject asset is sold. A capital gain that is realized within a year is known as short-term capital gain, while capital gain realized over a longer time period (more than one year) is known as long term capital gain. The income tax treatment of long term capital gain is different than that of short term capital gain.

One of the limitations of this metric is that it expressed in dollar terms and as such it doesn’t provide any meaningful insight unless it is compared with the invested amount. However, this limitation can be overcome by the use of capital gain yield.

Capital Gain Formula Calculator

You can use the following Capital Gain Formula Calculator

| Selling Value | |

| Purchase Value | |

| Capital Gain | |

| Capital Gain = | Selling Value – Purchase Value |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This is a guide to Capital Gain Formula. Here we discuss how to calculate capital gain formula along with practical examples. we also provide a capital gain calculator with a downloadable excel template. You may also look at the following articles to learn more –