Updated July 26, 2023

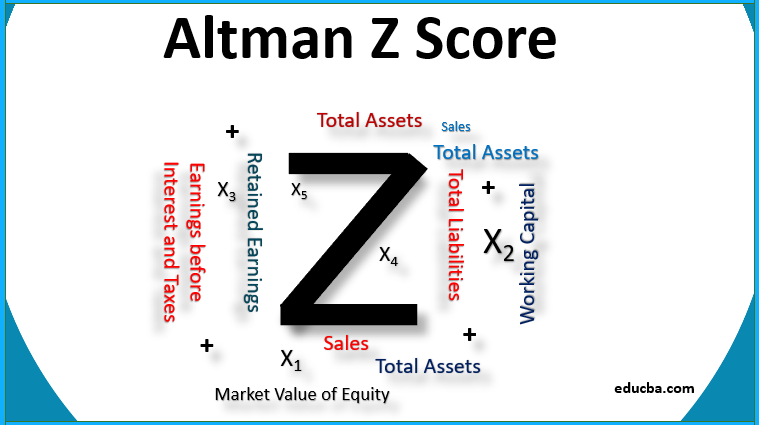

Overview of Altman Z Score

The term “Altman Z score” refers to the statistical tool used to assess how likely a company is to go bankrupt in the near future based on its financial position.

The assessment is done on the basis of five financial ratios using seven pieces of financial information which is easily available in the annual report of a company. The objective of the Altman Z score model is to gauge the financial health of a company in order to forecast the likelihood of it failing in the next 2 years.

Typically, a lower Z score value indicates a higher risk of bankruptcy and vice visa. In fact, a Z score of more than 3.0 indicates that the company is fairly stable and not expected to go bankrupt in the next 2 years, while a score between 1.8 and 3.0 falls in the grey area where it is difficult to predict whether or not the company will go bankrupt. On the other hand, a Z score of less than 1.8 means that the company is likely to file for bankruptcy in the near future.

Formula

The formula for the Altman Z score is the weighted average of five financial ratios pertaining to liquidity, productivity, leverage, and efficiency. Mathematically, it is represented as,

where,

- X1 = Working Capital / Total Assets, which is a Measure of Liquidity

- X2 = Retained Earnings / Total Assets, which Indicates Leverage

- X3 = Earnings before Interest and Taxes / Total Assets, which Measures Productivity

- X4 = Market Value of Equity / Total Liabilities, which Captures the Effect of Decline in Market Value

- X5 = Sales / Total Assets, which is a Measure of Asset Efficiency

The original Altman Z Scores scoring system was intended for manufacturing firms with an asset size of more than $1 million. However, due to its predictability prowess, the model has been modified over a period of time to be applicable to other types of organizations. Nevertheless, in this article, we will focus on the original Altman Z score.

Examples of Altman Z Score (With Excel Template)

Let’s take an example to better understand the Altman Z Score formula calculation in a better manner.

Example – #1

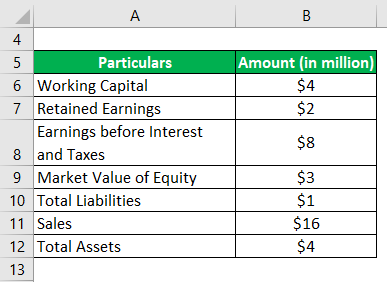

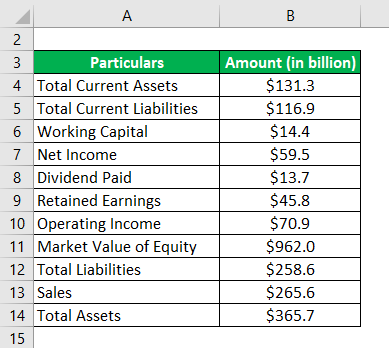

Let us take the example of a company named AJX Ltd. An investor is interested to invest his money in the company and so wants to check the financial health of the company based on Altman Z score. Help the investor with the following information about the target company:

Solution:

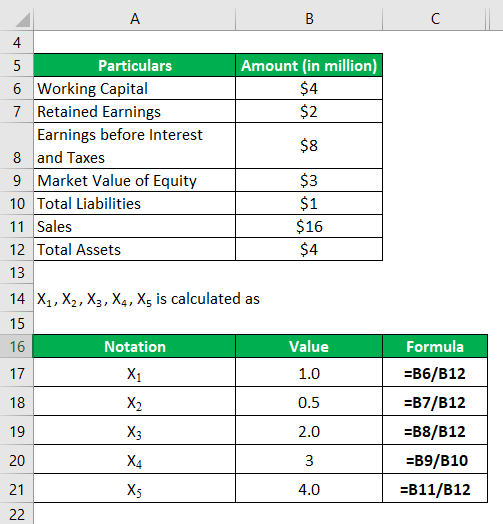

X1 , X2 , X3 , X4 , X5 is calculated as

X1 is Calculated as

X1 = Working Capital / Total Assets

- X1 = $4.00 Mn / $4.00 Mn

- X1 = 1.0

X2 is Calculated as

X2 = Retained Earnings / Total Assets

- X2 = $2.00 Mn / $4.00 Mn

- X2 = 0.5

X3 is Calculated as

X3 = Earnings before interest and taxes / Total Assets

- X3 = $8.00 Mn / $4.00 Mn

- X3 = 2.0

X4 is Calculated as

X4= Market Value of Equity / Total Liabilities

- X4 = $3.00 Mn / $1.00 Mn

- X4 = 3.0

X5 is Calculated as

X5 = Sales / Total Assets

- X5 = $16.00 Mn / $4.00 Mn

- X5 = 4.0

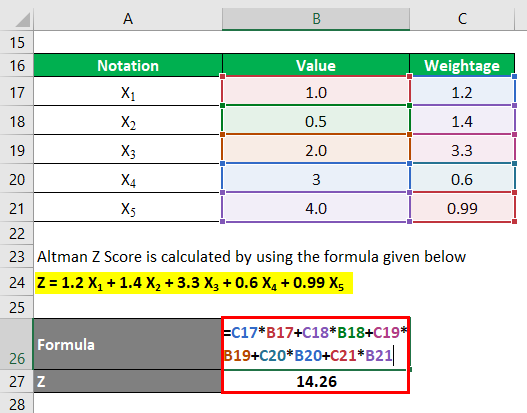

Altman Z Score is calculated by using the formula given below

Z = 1.2 X1 + 1.4 X2 + 3.3 X3 + 0.6 X4 + 0.99 X5

- Z = 1.2 * 1.0 + 1.4 * 0.5 + 3.3 * 2.0 + 0.6 * 3.0 + 0.99 * 4.0

- Z = 14.26

Therefore, the Altman Z score for AJX Ltd is well above the score of 3.0 which indicates that the company is highly unlikely to go bankrupt in the near future.

Example – #2

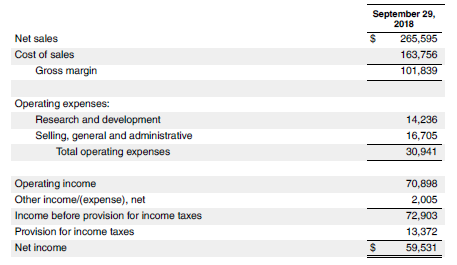

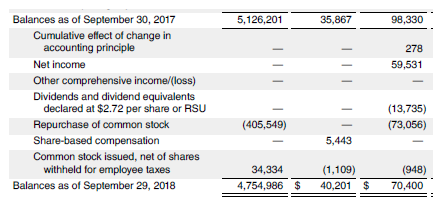

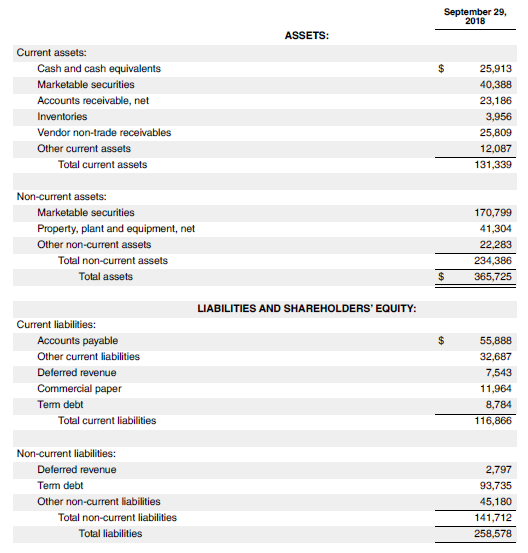

Let us take the example of Apple Inc. to calculate the Altman Z score. The following information is available for 2018:

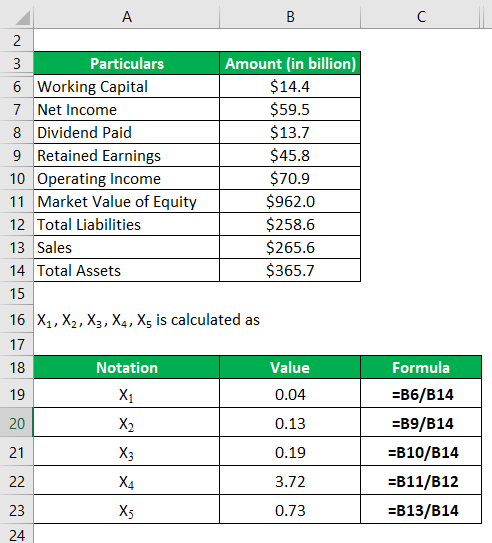

Solution:

X1 is Calculated as

X1 = Working Capital / Total Assets

- X1 = $14.4 Bn / $365.7 Bn

- X1 = 0.04

X2 is Calculated as

X2 = Retained Earnings / Total Assets

- X2 = $45.8 Bn / $365.7 Bn

- X2 = 0.13

X3 is Calculated as

X3 = Operating Income / Total Assets

- X3 = $70.9 Bn / $365.7 Bn

- X3 = 0.19

X4 is Calculated as

X4 = Market Value of Equity / Total Liabilities

- X4 = $962.0 Bn / $258.6 Bn

- X4 = 3.72

X5 is Calculated as

X5 = Sales / Total Assets

- X5 = $265.6 Bn / $365.7 Bn

- X5 = 0.73

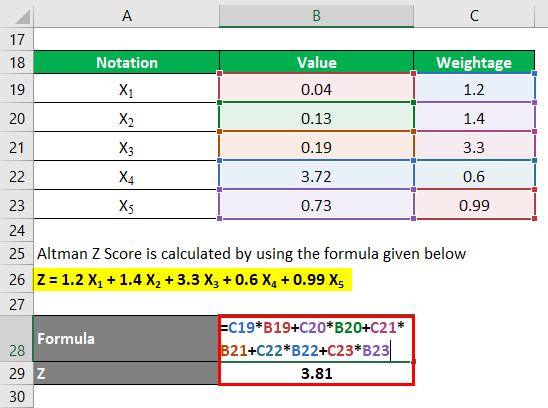

Altman Z Score is calculated by using the formula given below

Z = 1.2 X1 + 1.4 X2 + 3.3 X3 + 0.6 X4 + 0.99 X5

- Z = 1.2 * 0.04 + 1.4 * 0.13 + 3.3 * 0.19 + 0.6 * 3.72 + 0.99 * 0.73

- Z = 3.81

Therefore, the Altman Z score for Apple Inc. indicates that the company is highly unlikely to go bankrupt.

Source: d18rn0p25nwr6d.cloudfront.net

Advantages and Disadvantages of Altman Z Score

Some of the advantages and disadvantages of the Altman Z Score are as follows:

Advantages

- The scoring system uses fives financial ratios that are calculated on the basis of seven financial data which is easily available from the balance sheet and income statement of any company.

- It is a quantitative model that can be mapped with the credit scoring model which is more of a mix of quantitative and qualitative measures.

- Being a quantitative model, it is very easy to draw insights from the outcome.

- Investors usually use it to measure the solvency of a company in order to decide whether to invest or not in that company.

Disadvantages

- One of the major disadvantages of the model is that it can only be forecast the likelihood of failure only if the company is comparable to its database. For instance, a restaurant typically exhibits a negative working capital cycle and as such the model may end up indicating high bankruptcy risk which is not true.

- The scoring system does not work well for new or emerging companies as their earnings are too low and will end up indicating a high risk.

- The model fails to incorporate the benefits of good cash flow management.

- The model works on garbage in garbage out method and so a misleading company financial will result in a misleading Z score.

Conclusion

So, the Altman Z score is a very important metric that is used to assess the financial strength of a company. A lower Z score means that the entity is on its way towards insolvency or bankruptcy and vice versa. As such, beware of companies with lower Z scores.

Recommended Articles

This has been a guide to the Altman Z score Formula. Here we discuss the introduction, examples, advantages, and disadvantages along with a downloadable excel template. You can also go through our other suggested articles to learn more –