Updated July 26, 2023

Definition of Quick Ratio

The term “Quick Ratio” refers to the liquidity ratio that assesses the ability of a company to cover its short-term liabilities by utilizing all those assets that can be easily converted into cash. The name “quick ratio” comes from the underlying idea that the ratio considers only those assets that can be quickly liquidated. The ratio is also known as the name acid test ratio.

The primary examples of such quick assets include cash, marketable securities, and accounts receivables. This ratio is relatively more conservative than the current ratio as it restricts the ability to repay short-term liabilities with only assets readily convertible to cash.

If a company’s quick ratio is greater than 1, it means that it has more than enough liquid assets that can be used to repay the current liabilities immediately. On the other hand, if it is less than 1, it indicates that the company’s liquidity is inadequate to pay off its current liabilities in case it is required to pay immediately.

Formula

The formula for Quick Ratio can be derived by dividing the sum of cash, marketable securities, accounts receivables, and other current assets (other than inventories and prepaid expenses) by the total current liabilities. Mathematically, it is represented as,

One can also derive the formula for Quick Ratio by subtracting inventories and prepaid expenses from the total current assets and then dividing the resulting figure by the total current liabilities. Mathematically, this is represented as:

Examples of Quick Ratio (With Excel Template)

Let’s take an example to understand the calculation of the Quick Ratio formula in a better manner.

Example – #1

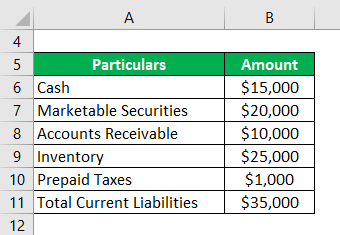

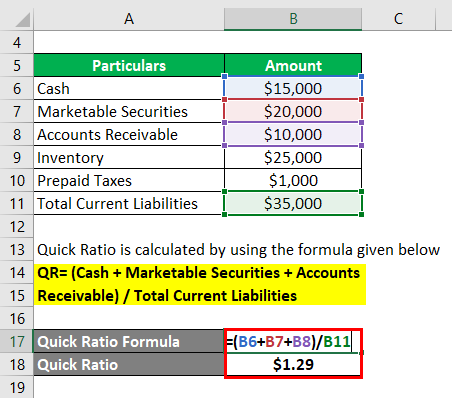

Let us take the example of a company that has applied for a bank loan in order to remodel its storefront. The company has provided the following balance sheet information to the bank:

Based on the given information, Calculate the quick ratio of the company.

Solution:

Of the above-mentioned current assets, only cash, marketable securities, and accounts receivable can be considered quick assets.

Calculate Quick Ratio using the formula given below:

QR= (Cash + Marketable Securities + Accounts Receivable) / Total Current Liabilities

- QR = ($15,000 + $20,000 + $10,000) / $35,000

- QR = 1.29

Therefore, the quick ratio for the company stood at 1.29, which indicates a fairly comfortable liquidity position.

Example – #2

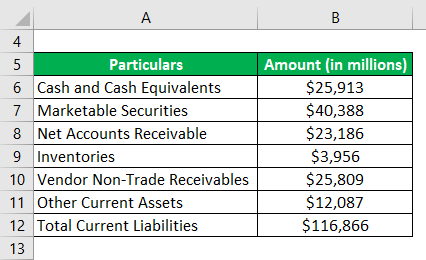

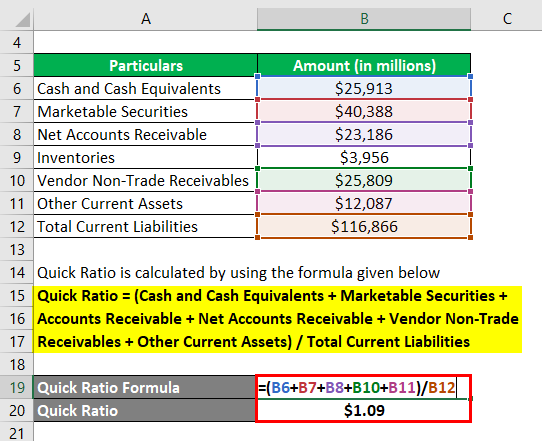

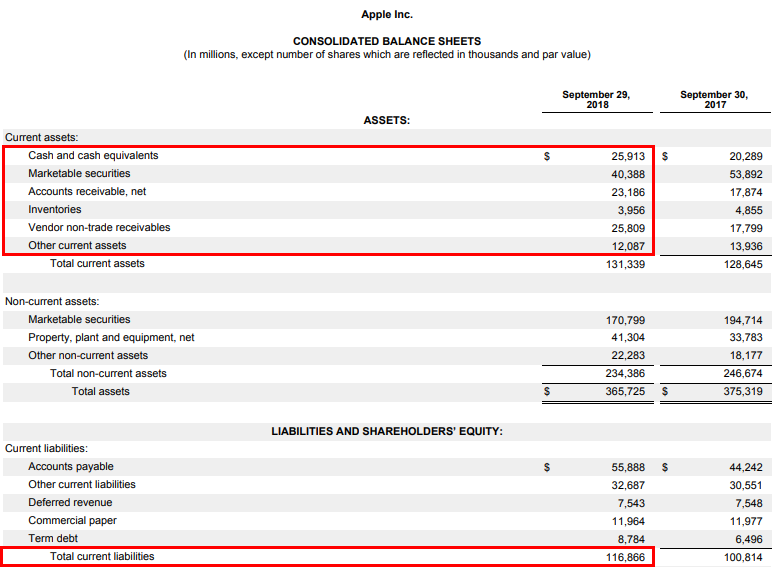

Let us take the latest annual report of Apple Inc. to explain the quick ratio calculation. As per the annual report for the year ended on Sep 29, 2018, the following information is available:

Based on the given information, Calculate the quick ratio for Apple Inc. for the year ending Sep 29, 2018.

Solution:

Out of the above-mentioned current assets, only cash and cash equivalents, marketable securities, net accounts receivable, vendor non-trade receivables, and other current assets can be considered quick assets.

Calculate Quick Ratio using the formula given below:

Quick Ratio = (Cash and Cash Equivalents + Marketable Securities + Accounts Receivable + Net Accounts Receivable + Vendor Non-Trade Receivables + Other Current Assets) / Total Current Liabilities

- QR = ($25,913 Mn + $40,388 Mn + $23,186 Mn + $25,809 Mn + $12,087 Mn) / $116,866 Mn

- QR = 1.09

Therefore, the QR for Apple Inc. for the year ending Sep 29, 2018, stood at 1.09, indicating a moderate liquidity position.

Source:d18rn0p25nwr6d.cloudfront.net

Advantages and Disadvantages of QR or Acid Test Ratio

Some of the advantages and disadvantages are as follows –

Advantages

- It assesses the ability to repay current liabilities based on the assets a company can quickly convert to cash. As such, it is a relatively more conservative liquidity ratio.

- Its calculation omits inventories because converting inventories into cash could take too long. Elimination of inventories from its calculation helps management and other stakeholders to have a precise idea about the liquidity position of the concerned company.

- This ratio is one of the easiest ratios to understand, and as such, it can be very helpful for people who do not have a deep understanding of accounting and finance.

- It is a ratio that can compare companies of different sizes and scales. However, it is not advisable to compare companies that vary too much in terms of their scale of operation.

Disadvantages

- It doesn’t provide any information about the timing of cash flows which can be a defining factor in the assessment of the liquidity position of a company.

- Some of the assumptions of the QR are not realistic. For instance, it assumes that accounts receivable is readily available for collection, which is not always true.

- It does not consider the situation that may arise in times of crisis. During the crisis, even the most easily saleable securities may find it difficult to trade in the market.

Conclusion

So, it can be seen that the quick ratio is a moderate conservative liquidity measure which is more conservative than the current ratio but less conservative than the cash ratio. This ratio helps the creditors in the assessment of the liquidity position of a company more accurately.

Recommended Articles

This has been a guide to the Quick Ratio. We discuss the introduction, examples, advantages, disadvantages, and a downloadable Excel template. You can also go through our other suggested articles to learn more –