Introduction to Confirmation Bias Example

Confirmation bias is a phenomenon that characterizes the tendency or behavior to favor, interpret or recall information in a way that supports your pre-existing beliefs and notions without any reasoning or logical evidence.

Not only do people confirm their notions, but they also tend to research or gather information to support their beliefs selectively. Many psychological experiments conducted across the planet in the 1960s confirmed this behavior. Since then, it has become the darling of marketers in strategizing their campaigns to cross-sell or increase wallet share from customers classified as cash cows. Experts attribute this illogical behavior to selective listening, biased research, emotionally charged ideas, and deep-rooted or long-standing beliefs.

Examples of Confirmation Bias

A few examples of confirmation bias are as follows:

#1 – Stock Markets and Participant’s Behavior

Stock markets have been the biggest example of confirmation bias over a long period of time. People often consider the place as a platform where intellectuals make money. At the same time, speculators consistently lose time and again, proving that reactions are often knee-jerk and in the heat of the moment. A simple rule of finance states that when the economy is booming, equity should give you better returns, while when the economy is going through a rough phase, safe assets like sovereign bonds and gold should be preferred. But what happens when a large firm in a booming market posts unexpected results?

The unexpected result may differ from the expectations regarding top-line numbers, but still, it requires analysis to understand what lies beneath. To understand the firm’s performance in the last quarter, it is necessary to decode these implicit details separately. But what do market participants actually do? They only look at the initial set of numbers; if these numbers are unexpected, they start selling the firm’s stock. The simplest reason being they have been conditioned to react in such a way over the years. Just because everyone is doing it, one should do the same.

This leads to a knee-jerk reaction, often an overreaction by the market and its participants. That is why we sometimes face situations where stocks of even blue-chip firms are down by 5 -10 % even when they have posted decent results. An investor with basic knowledge of finance but who can calm his anxiety and avoid blind sheep behavior can weather these storms and use these situations to generate better market returns. This is a classic case of confirmed biasedness in behavioral finance and its effect on investors.

#2 – Option Traders and their Biasedness Towards Puts

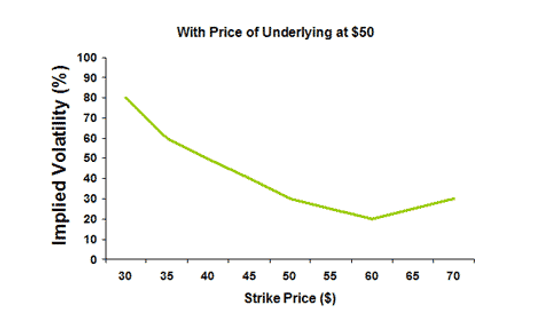

Confirmation bias can best understand by how options traders take their positions. Both option buyers and writers have a general view of the underlying instrument (say, Index), and based on this view; they take positions. The option premiums are calculated based on the probability of hitting the strike price before a pre-decided contract expiry date. Mathematically the probability of the underlying instrument moving by a particular percentage point in either direction is the same, assuming there is no negative or positive news already reflected in the prices and the volatility is not at unprecedented high levels because of any major event shaping up. Even though the probability is equal, there can be variations in the premium amounts charged for calls and puts.

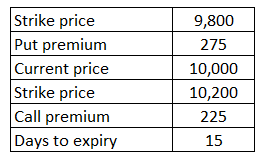

Let’s consider an example where the index is trading at 10,000. For our analysis, we consider two strike prices – one 200 points above the current spot price and one 200 points below the current spot price. The following table summarizes our scenario.

Mathematically, the probability of a 200-point movement in the index is the same either way. However, the put’s premium is still greater than the premium charged for the call price. The simple reason is that the market participants are biased towards a sale rather than buying; hence, they are ready to pay a higher premium. This scenario often refers to volatility smile in Market risk.

#3 – New Investments (Catching a Falling Knife)

Retail investors exhibit confirmation bias when making new investments. Let’s say one wants to invest in a company on the brink of Bankruptcy. The firm’s management will now strive to maximize asset value and promptly settle outstanding debts. You will find two types of news related to the firm in the newspapers. One related to how management is trying to reduce its debts and how successful it has been, and the other related to how these tasks are fruitless and are pushing the firm further into bankruptcy. Again, there will be opinions on both sides.

Depending on the opinion one has framed with the initial encounter with the news, one would interpret those opinions accordingly, leading to confirmation bias. The thought of making quick money further acts as a catalyst and forces people to take positions on this new investment even though the common ratio is to stay away from these investments as it is often termed “Never catch a falling knife”. However, this is seldom the case, as new and experienced investors often become victims and suffer financial losses.

Conclusion

Confirmation bias tendencies play a major role in shaping our opinions from our interactions with the outside world and, eventually, our decision. It’s not that opinions or logical reasoning questioning our opinion are not encountered. They are very much present in front of our eyes, but we choose to either ignore them or interpret them in a way that suits our reasoning and confirmed biases. The most effective way to deal with this behavioral finance concept is to be the devil’s advocate and weigh each opinion objectively.

Recommended Articles

This has been a guide to Confirmation Bias Example. Here we discuss the introduction and example of confirmation bias concerning stock markets and participant’s behavior. You can also go through our other suggested articles to learn more –