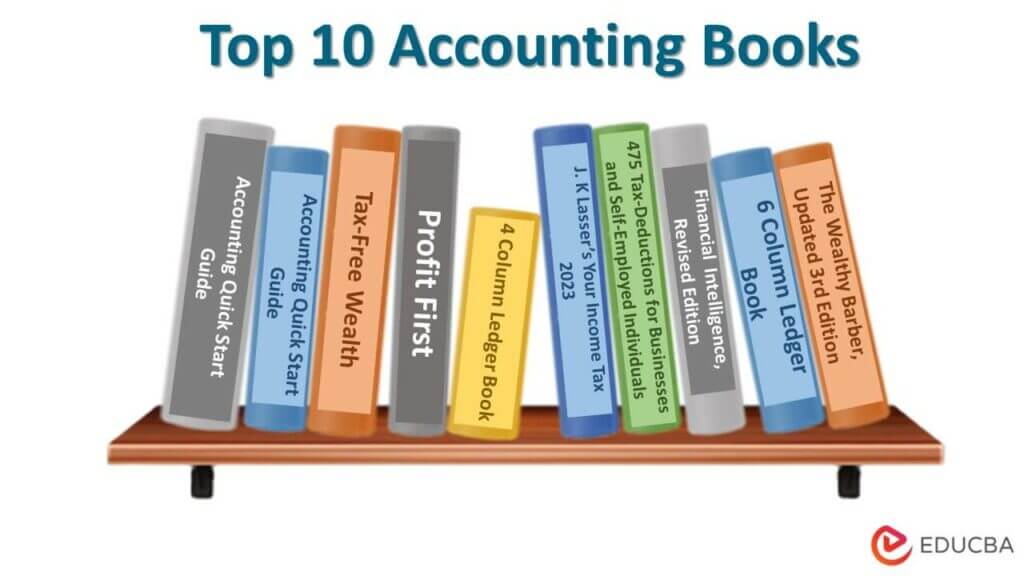

Best Books to Learn Accounting

Accounting is an essential part of financial studies. It teaches society how to properly budget, file taxes, save, and invest their earnings well. Apart from managing personal expenses, it also guides business expenses. Hence, learning more about accounting is helpful for all.

This list of the top 10 accounting books summarizes the most important topics covered in those books, so you can skip all the filler and go straight to the information you need to learn to become an expert.

Below is the top 10 accounting books that will help beginners and professionals.

|

# |

Book | Author | Published |

Rating |

| 1 | Accounting Quick Start Guide | Josh Bauerle CPA | 2018 | Amazon: 4.5

Goodreads: 4.25 |

| 2 | Accounting for Beginners 2023 | Roger Myers | 2022 | Amazon: 4.9

Goodreads: 3.40 |

| 3 | Tax-Free Wealth: How To Build Massive Wealth by Permanently Lowering Your Taxes | Tom Wheelwright | 2018 | Amazon: 4.7

Goodreads: 4.26 |

| 4 | Profit First: Transform Your Business From a Cash-Eating Monster to a Money-Making Machine | Mike Michalowicz | 2017 | Amazon: 4.8

Goodreads: 4.26 |

| 5 | JK Lasser’s Your Income Tax 2023: For Preparing Your 2022 Tax Return | J.K Lasser | 2022 | Amazon: 4.7

Goodreads: 4 |

| 6 | 475 Tax-Deductions for Businesses and Self-Employed Individuals: An A-Z Guide To Hundreds Of Tax-Write-offs | Bernard B. Karnoroff | 2019 | Amazon: 4.7

Goodreads: 4.16 |

| 7 | Financial Intelligence, Revised Edition: A Manager’s Guide To Knowing What The Numbers Really Mean | Karen Berman | 2013 | Amazon: 4.7

Goodreads: 4.13 |

| 8 | 4 Column Ledger Book | Adam Heazterfien Louie | 2021 | Amazon: 4.6

Goodreads: 3.07 |

| 9 | The Wealthy Barber, Updated 3rd Edition | David Chilton | 2017 | Amazon: 4.5

Goodreads: 4.03 |

| 10 | 6 Column Ledger Book | Adam Heazterfien Louie | 2021 | Amazon: 4.6

Goodreads: 3.00 |

Let’s go through each book in the list of these 10 Accounting Books.

Book #1: Accounting Quick Start Guide

Author: Josh Bauerle CPA

Buy this book here.

Book Review:

It is a book by Josh Bauerle, an accounting student who later became a super CPA. This ground-breaking book is essential for accounting students, bookkeepers, business owners, and other finance and record-keeping professionals. It expertly simplifies the fundamentals of accounting. Josh Bauerle breaks down the accounting fundamentals into manageable chunks using amusing stories and examples, clear illustrations, and practice problems. These elements work together to give readers a quick and efficient route to mastering the subject.

Key Points:

- Learn how to manage your cash flow, make your company audit-proof, and boost your profits.

- In an accessible, educational format, the Accounting QuickStart Guide will teach you the essential insights to improve your bottom line.

- You won’t find a more entertaining or instructive way to learn the fundamentals of managerial and financial accounting in a textbook.

- You can better comprehend fundamental accounting ideas through practical, real-world examples like the basic accounting equation, financial statements, managerial accounting, and more.

Book #2: Accounting for Beginners 2023

Author: Roger Myers

Buy this book here.

Book Review:

The author Roger Myers of the book Accounting for Beginners 2023, can assure you that the best way to ensure your accounting is on track is to have at least a basic understanding of the topic. For this reason, even if your math skills aren’t perfect, Roger Myers wrote “Accounting for Beginners 2023,” updated with all the pertinent information for the upcoming fiscal year, specifically to assist you, a young business owner, in navigating this complex topic and prevent you from becoming lost in technical accounting jargon.

Key Points:

- The book has simple explanations of small businesses’ accounting and bookkeeping fundamentals.

- This book has all the advantages of effective accounting to advance your company.

- It gives you 11 key insights to manage your cash flow, protect your company from audits, and boost your profits.

- How to avoid unpleasant tax surprises and never be caught unprepared.

Book #3: Tax-Free Wealth: How To Build Massive Wealth by Permanently Lowering Your Taxes

Author: Tom Wheelwright

Buy this book here.

Book Review:

The tax code is genuinely changed only about once every 30 years. The U.S. tax code has only undergone three significant revisions in the past 75 years: the first in 1954, the second in 1986, and the most recent at the end of 2017. President Reagan enacted the Tax Simplification Act of 1985 with two goals: simplicity and revenue neutrality (no net increase to the deficit). Before the Tax Reform Act of 1986 finally passed, it took another year(everyone prioritized simplicity over other reform objectives.) With significantly lower tax rates, individuals, insurance companies (who largely escaped unharmed), and businesses were the primary beneficiaries of tax reform in 1986.

Key Points:

- Employees can work as independent contractors and deduct 20% of their pay for small businesses. Those in the service industry who were not eligible for the 20% deduction can now convert to C corporations and lower their tax rate to 21%.

- Investors who benefited from tax advantages from the costs of investing in the stock market can either start investing in real estate, which offers significant tax advantages, or invests through a Roth IRA or Roth 401(k) to avoid paying taxes on their investment income and gains.

- The second edition includes some suggestions for utilizing the new incentives.

- This edition should assist anyone outside the United States in finding ways to utilize their government’s incentives, regardless of the nation in which they do so. Considering that the United States is, in some ways, a tax haven, you might even decide that this is the ideal time to conduct business there.

Book #4: Profit First

Author: Mike Michalowicz

Buy this book here.

Book Review:

The logical (though flawed) formula: Sales – Expenses = Profit, is used in conventional accounting. The issue is that people manage businesses and don’t always make logical decisions. Serial entrepreneur Mike Michalowicz has reversed this formula by developing a behavioral approach to accounting. Similar to how the best way to lose weight is to use smaller plates, Michalowicz demonstrates how business owners can turn their organizations into profitable cash cows by prioritizing profit and allocating the leftovers for expenses.

Key Points:

- Accounting can be made simpler by adhering to four straightforward principles, which make it simpler to manage a successful business by glancing at bank account balances.

- Businesses that achieve early and sustained profitability have a better chance of long-term growth.

- The book explains how a profitable but small business has much more worth than a large business surviving on its top line.

- Michalowicz has the game-changing guide for any entrepreneur to make the money they’ve always wanted with dozens of case studies, applicable, step-by-step advice, and his trademark sense of humor.

Book #5: JK Lasser’s Your Income Tax 2023: For Preparing Your 2022 Tax Return

Author: JK Lasser

Buy this book here.

Book Review:

You can use worksheets and forms to file your taxes, information about the most recent updates to the 2022 tax code, and the most recent guidance on maximizing your credits and deductions. You’ll discover how to legally keep the most money possible in your bank account while minimizing the amount Uncle Sam deducts from your earnings.

Key Points:

- The book has special features that walk you through current Tax Court rulings and regulations.

- These regulations control how your deductions and credits apply to Tax preparation.

- It has tips and tricks that are clever (but entirely legal!) and clever tax planning techniques that can help you save money.

- The book also explains the most recent congressional legislation and how it affects taxes.

Book #6: 475 Tax-Deductions for Businesses and Self-Employed Individuals: An A-Z Guide To Hundreds Of Tax-Write-offs

Author: Bernard B. Karnoroff C. P. A

Buy this book here.

Book Review:

It is a great book to start with. This book covers hundreds of deductions to help you save money on taxes. It also includes key strategies to get your deductions approved by the IRS. It is an easy read, but it has all the information you need to be successful with tax deductions. The government won’t likely notify you of a deduction you overlooked, and your accountant is unlikely to ask you about every deduction to which you are entitled. Mark Everson states, “If you don’t claim it, you don’t get it. For millions of Americans, that is money wasted.

Key Points:

- The book is a straightforward guide that will help you to take advantage of every possible tax deduction.

- With this book, you can maximize your deductions to reduce your taxable income.

- This book is a must-have if you are self-employed or an owner or president of a small business.

- The book also has helpful tips for handling the IRS audit process.

Book #7: Financial Intelligence, Revised Edition

Author: Karen Berman

Buy this book here.

Book Review:

The book has easy-to-understand sections, with key takeaways from each chapter summarized in bullet points on every page. It makes it easy to identify what you should focus on as you read, which is essential because some topics can be complex and dry. The book’s revised version has new chapters, such as How Corporate Performance Impacts Shareholders. There are sample quizzes at the end of every chapter and plenty of illustrations.

Key Points:

- It is an excellent resource for any business owner wanting to better understand and analyze financial statements.

- In particular, this book provides a good starting point for those new to accounting by explaining concepts like balance sheet items in simple language without being condescending or overly simplistic.

- The authors also do an excellent job of breaking down complex ideas, such as depreciation, into understandable chunks for those just beginning to learn about these topics.

- Plenty of useful resources are used as references in the book’s back half.

Book #8: 4 Column Ledger Book: Accounting Ledger Book for Bookkeeping, Account Journal, Ledger Book for Small Business and Personal Use

Author: Adam Heazterfien Louie

Buy this book here.

Book Review:

Adam Heazterfien Louie is a certified public accountant who has been in business for over 30 years. The simplicity is easy to understand, making this book an excellent choice for anyone looking for an alternative to more complicated accounting books. For those new to accounting, this book is a great way to get started without paying expensive tuition or hiring someone with experience. Many readers have said that they gained a much better understanding of how finance works after reading this insightful manual.

Key Points:

- This book introduces accounting and explains how to keep records in a simple, four-column ledger book. The author describes different types of transactions and shows you where they would go in the appropriate column on your ledger.

- He also teaches you what each column is for and what kind of information you should record.

- There are ledgers included with this book, so you can start using them immediately! A good example is when he discusses debtors versus creditors and debits versus credits.

- On one page, he has two columns filled with objects illustrating both concepts side by side.

Book #9: The Wealthy Barber, Updated 3rd Edition: Everyone’s Commonsense Guide to Becoming Financially Independent

Author: David Chilton

Buy this book here.

Book Review:

This book is an excellent choice for those new to reading about finance and wants something that can help them make sense of their finances without being too complicated. This updated version of The Wealthy Barber, written in 2001, is as informative, relevant, and entertaining as it was first released. Some topics discussed include retirement planning, investing, tax deductions, estate planning, wills, trusts, and other matters related to wealth building. Some anecdotes keep the text from becoming dry and monotonous while giving information essential to financial success.

Key Points:

- The book is a top-selling personal finance book in Canada and has sold over 1.5 million copies in North America.

- The book’s written as a series of fictional stories that follow Rob and his barber, Roy, over several decades.

- These stories discuss various personal finance topics such as income tax, saving for retirement, insurance, and estate planning.

- Roy offers simple explanations about financial concepts and solutions to common financial problems.

Book #10: 6 Column Ledger Book

Author: Adam Heazterfien Louie

Book Review:

The book’s design is for personal and professional use. For example, accountants, bookkeepers, small business owners, entrepreneurs, or people interested in accounting can use it. It features 12 double-sided pages with six columns on each page for journal entries sorted into three categories: Income (I), Expenditure (E), and Balance Sheet (B). Every entry has a description and an icon denoting if the entry is an expense or income type. You can also see how much your assets and liabilities change during any day, week, month, year, etc.

Key Points:

- If you are looking for one book to summarize everything you need about accounting and financial management, this book is for you.

- First, it is a best-seller and can be yours at an affordable price.

- Secondly, it covers almost everything from simple recording to advanced things like how to set up your accounting system depending on your business needs.

- The 6 Column Ledger Book is only about 1 inch thick when closed and has a hardcover design that makes it feel like a more permanent fixture than most ledger books. Each page is ruled on both sides, with horizontal lines along the top third of the page.

Recommended Books

We hope this EDUCBA guide on the top 10 accounting books was helpful. For further information, EDUCBA recommends these articles,