Updated June 16, 2023

Best Books to Learn Risk Management

Risk management identifies, prioritizes, and eliminates any business risk. It has tremendous significance in IT, finance, law, and strategy. A thorough knowledge of risk management can help businesses understand their risks and how to minimize them.

This list helps its readers take calculated risks in their business. Professionals and beginners alike can read these books to understand risk management better.

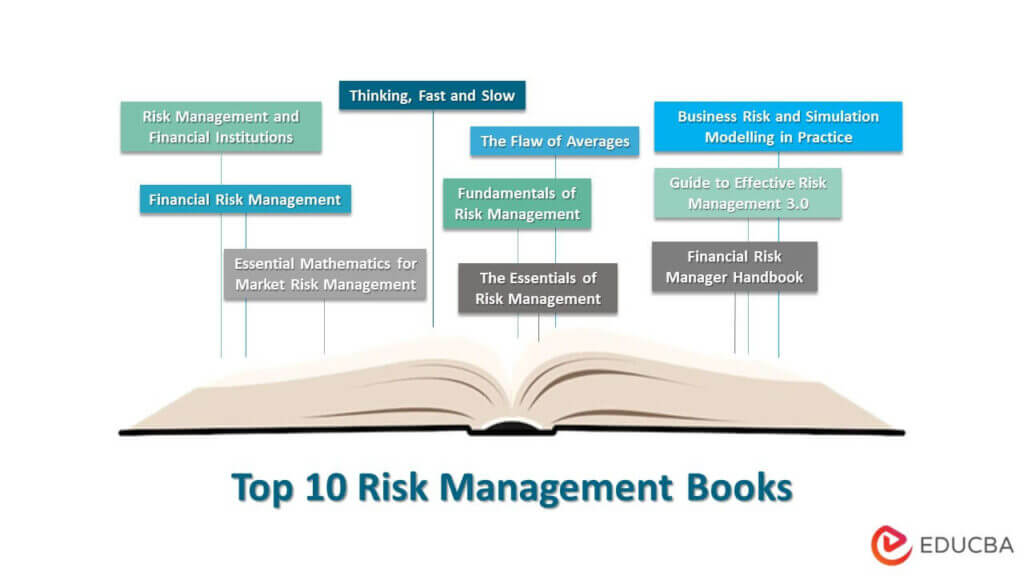

Here are the top 10 books on risk management that every entrepreneur must read(not in order of rating).

| # | Risk Management Books | Author | Published | Rating |

| 1 | The Essentials of Risk Management | Michel Crouhy, Dan Galai and Robert Mark | 2014 | Amazon: 4.5

Goodreads: 3.66 |

| 2 | Financial Risk Management | JImmy Skoglund and Wei Chen | 2015 | Amazon: 4.2

Goodreads: 4.00 |

| 3 | Business Risk and Simulation Modelling in Practise | Micheal Rees | 2015 | Amazon: 4.7

Goodreads: 3.5 |

| 4 | Guide to Effective Risk Management 3.0 | Alex Sidorenko and Elena Demidenko | 2017 | Amazon: 2.8

Goodreads: 4.20 |

| 5 | The Flaw of Averages | Sam L. Savage | 2012 | Amazon: 4.4

Goodreads: 3.85 |

| 6 | Financial Risk Manager Handbook | Philippe Jorion | 2011 | Amazon: 4.1

Goodreads: 4.19 |

| 7 | Fundamentals of Risk Management | Paul Hopkin | 2018 | Amazon: 4.5

Goodreads: 3.68 |

| 8 | Risk Management and Financial Institutions | John C. Hull | 2015 | Amazon: 4.5

Goodreads: 4.05 |

| 9 | Essential Mathematics for Market Risk Management | Simon Hubbert | 2011 | Amazon: 5.0

Goodreads: 4.00 |

| 10 | Thinking, Fast and Slow | Daniel Kahneman | 2012 | Amazon: 4.5

Goodreads: 4.18 |

Let us discuss each risk management book in detail, reviewing their reviews and key points.

Book #1: The Essentials of Risk Management

Authors: Michel Crouhy, Dan Galai, and Robert Mark

Buy this book here.

Review:

Written by leading figures in the global risk management sphere, this book is accessible to professionals and beginners alike. It’s a helpful handbook for measuring risk vs. return in a post-recession era. It provides you with a simple yet practical approach to risk assessment. Though written in 2005, it holds relevance in a post-pandemic world suffering from a global recession.

Key Points:

- The authors highlight the latest practices for measuring credit risk and increasing transparency.

- It engages you with corporate governance, risk compliance, and integrated risk management.

- They provide a detailed Enterprise Risk Management (ERM) system analysis.

Book #2: Financial Risk Management

Authors: Jimmy Skoglund and Wei Chen

Buy this book here.

Review:

Published in 2015, it caused a stir in financial risk management. It is a practical guide to anticipating and preventing banking risk. It created a unique approach to viewing the problem of risk. Looking at risk from a brand perspective brought new insights into compliance and assessment.

Key Points:

- It provides an insightful analysis of banking risk on a global scale.

- The book is for industry leaders looking for a deeper understanding of the field and beginners taking their first steps.

- Financial Risk Management is a simple and practical guide to identifying, mitigating, and minimizing risk in the global banking sector.

Book #3: Business Risk and Simulation Modelling in Practice

Author: Michael Rees

Buy this book here.

Review:

Part of the Wiley Finance Series, the book was written by a leading authority in the world of business risk. This game-changer, written by Michael Rees, describes risk assessment processes, models, and simulations. It demonstrates its models by using multiple practical examples. It provided a clear and crisp picture for novice and experienced readers alike.

Key Points:

- It is an analytical take on the theory and practice of risk quantification for business management.

- The book expertly teaches the reader to implement risk models using Excel macros, VBA, and Risk.

Book #4: Guide to Effective Risk Management 3.0

Authors: Alex Sidorenko and Elena Demidenko

Buy this book here.

Review:

This diplomatic work leaves behind the clichés of management books. It bravely explores the idea of creating a culture that encourages risk discussions. It looks at the broader business landscape and integrates it with modern risk research and methodologies.

Key Points:

- A thorough guide in the implementation of modern risk research in business management.

- This book’s core discusses integrating risk analysis and compliance with business processes and decision-making.

- It’s not just about processes and instructions. It’s about changing the mindset of business leaders.

Book #5: The Flaw of Averages

Author: Sam L. Savage

Buy this book here.

Review:

The Flaw of Averages analyzes statistical errors explained in plain and simple language. It further explores the new and upcoming field of probability management and equips the reader with the skill to understand it. Sam L. Savage crafts a thoughtful peek into statistical risk and how leaders can understand it.

Key Points:

- It is an enjoyable but authentic read on some misunderstandings of statistics.

- This book delves deep into the influence of statistical uncertainties in business.

- The author talks about why making plans based on average assumptions are incorrect.

- This book is for anyone whose decisions make substantial financial impacts.

Book #6: Financial Risk Manager Handbook

Author: Philippe Jorion

Buy this book here.

Review:

Philippe Jorian crafts a clear and crisp manual for risk management students. It delivers valuable insights on managing credit, market, and financial risk for future FRM managers. It is one of the most detailed guides, with all the latest industry best practices.

Key Points:

- The ideal handbook for candidates studying for the GARP Financial Risk Management exam.

- It provides all the knowledge a young mind will need to take on the world of risk.

Book #7: Fundamentals of Risk Management

Author: Paul Hopkin

Buy this book here.

Review:

Fundamentals of Risk Management introduces the basic framework of risk management. It makes the reader familiar with the principles, scope, and types of risk while equipping them with the skill required to mitigate it. Overall, it is a good guide for people starting a career in risk management.

Key Points:

- A great starting point for people wanting a peek inside the world of risk management.

- This book will give readers a strong and reliable foundation for a successful risk management career.

Book #8: Risk Management and Financial Institutions

Author: John C. Hull

Buy this book here.

Review:

Our financial institutions have an array of potential dangers against which they need protection. A must-read for risk professionals, the book comprehensively solves the most significant problems finance houses face. It helps readers understand the financial market regulations practices.

Key Points:

- An engaging, layered insight into the world of financial risk.

- This book provides a different perspective on financial risks and how they affect financial institutions.

- The new edition sheds light on the significant changes that have occurred in the industry.

- Enterprise risk management and scenario analysis are also in the latest edition.

Book #9: Essential Mathematics for Market Risk Management

Author: Simon Hubbert

Buy this book here.

Review:

Essential Mathematics for Market Risk Management captures the reader’s interest through simulations and practical problems. Simon Hubbert capitalizes on his experience as a professor to break down sophisticated ideas into simpler ones. A one-stop-shop for learning the mathematical story behind risk management

Key Points:

- It is a presentation on statistical tools and their integration into risk assessment.

- This book explores the foundations of quantitative risk and the complex models of modern business risk.

Book #10: Thinking, Fast and Slow

Author: Daniel Kahneman

Buy this book here.

Review:

A slight deviation from hardcore risk management textbooks, Thinking, Fast and Slow boldly questions the human mind and thought process—a revolutionary take on human rationality and thinking. In an enthralling read, the Nobel Laureate author explores the effect of cognitive biases on risk, economics, and strategy.

Key Points:

- This book enables better decision-making through the analysis of human error and prejudice.

- The book talks about the two ways we make decisions: slowly, after rational thinking, and quickly, based on intuitive thinking.

- This book explains how our decisions are often affected by prejudice.