Updated July 28, 2023

Working Capital Turnover Ratio Formula (Table of Contents)

- Working Capital Turnover Ratio Formula

- Examples of Working Capital Turnover Ratio Formula (With Excel Template)

- Working Capital Turnover Ratio Formula Calculator

Working Capital Turnover Ratio Formula

Working Capital Turnover Ratio Formula contains two terms, i.e., “Working Capital” and “Turnover.” Before understanding Working Capital Turnover Ratio, we must first understand what Working Capital is and what Turnover for Business means.

Working Capital

Working capital is the capital required by the business for day-to-day business operations. Working capital is extremely important for a business to run successfully. Without proper management of Working Capital, a business can be stuck in between. Working capital is a short-term funds requirement. A company must continuously monitor its Working Capital and immediately take corrective actions when required. Positive Working Capital means that a business has sufficient short-term funds to pay off its short-term liabilities and is suitable for business.

Working Capital is the difference between Current Assets and Current Liabilities. In equation form, Working Capital can be written as follows.

Current Assets include Cash & Bank Balance, Sundry Debtors, Short Term Loans and Advances, Short Term deposits, and Inventory.

Current Liabilities include Bank OD, CC, and Sundry Creditors for Purchases, Expenses, Taxes, Payables, and other payables within a year.

Turnover

Turnover of business means net sales of the company. Net sales mean Gross Sales less all discounts, credit notes, and taxes. Turnover is used in calculations of many ratios. In the equation form, Turnover can be written as below:

As we understand the meaning of both the terms, namely Working Capital and Turnover, we are good to understand the Working Capital Turnover Ratio.

Working Capital Turnover Ratio

The working Capital Turnover Ratio is used to analyze the utilization of short-term resources for sales. Working Capital Turnover Ratio is the ratio of net sales to working capital.

Formula For Working Capital Turnover Ratio

Examples of Working Capital Turnover Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Working Capital Turnover Ratio in a better manner.

Working Capital Turnover Ratio – Example #1

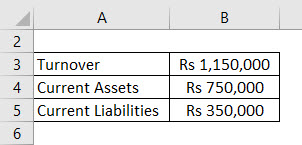

Calculate the Working Capital Turnover Ratio with the below information and Interpret the same:

Solution:

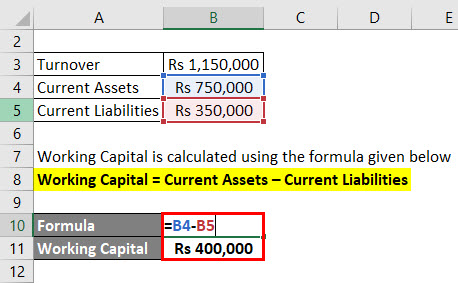

Working Capital is calculated using the formula given below

Working Capital = Current Assets – Current Liabilities

- Working Capital = Rs 750,000 – Rs 350,000

- Working Capital = Rs 400,000

The working Capital Turnover Ratio is calculated using the formula given below.

Working Capital Turnover Ratio = Turnover (Net Sales) / Working Capital

- Working Capital Turnover Ratio = Rs 1,150,000 – Rs 400,000

- Working Capital Turnover Ratio = 2.88

Hence, the Working Capital Turnover ratio is 2.88 times which means that for every unit sale, 2.88 Working Capital is utilized for the period.

Working Capital Turnover Ratio – Example #2

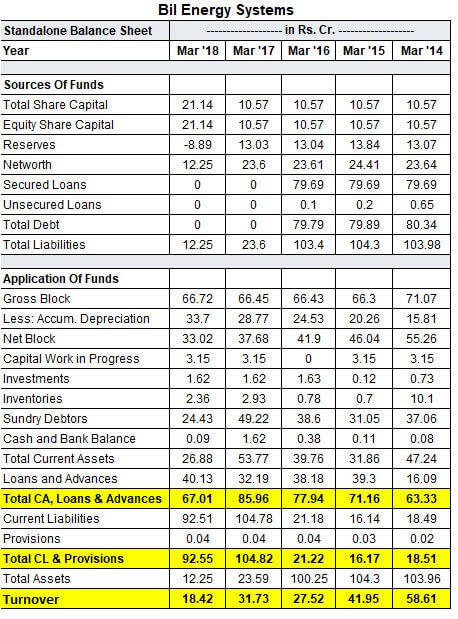

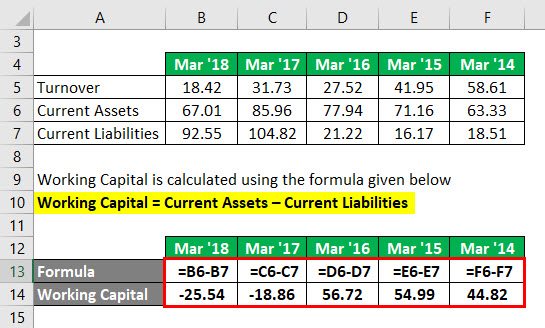

From the Balance Sheet of Bill Energy Limited (Listed Company), Calculate the Working Capital Turnover Ratio for Five Years and Interpret the same.

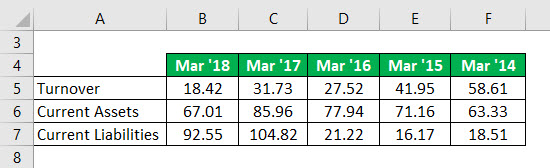

With the help of the Balance Sheet, we have the following information.

Source: Money Control

Solution:

Working Capital is calculated using the formula given below

Working Capital = Current Assets – Current Liabilities

For-Mar’18

- Working Capital = 67.01 -92.55

- Working Capital = -25.54

For-Mar’17

- Working Capital = 85.96 – 104.82

- Working Capital = -18.86

For-Mar’16

- Working Capital = 77.94 – 21.22

- Working Capital = 56.72

For-Mar’15

- Working Capital = 71.16 – 16.17

- Working Capital = 54.99

For-Mar’14

- Working Capital = 63.33 – 18.51

- Working Capital = 44.82

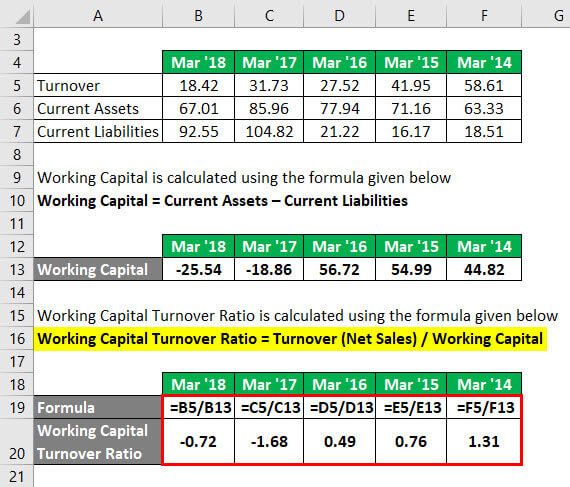

The working Capital Turnover Ratio is calculated using the formula given below.

Working Capital Turnover Ratio = Turnover (Net Sales) / Working Capital

For-Mar’18

- Working Capital Turnover Ratio = 18.42 / (-25.54)

- Working Capital Turnover Ratio = -0.72

For-Mar’17

- Working Capital Turnover Ratio = 31.73 / (-18.86)

- Working Capital Turnover Ratio = -1.68

For-Mar’16

- Working Capital Turnover Ratio = 27.52 / 56.72

- Working Capital Turnover Ratio = 0.49

For-Mar’15

- Working Capital Turnover Ratio = 41.95 / 54.99

- Working Capital Turnover Ratio = 0.76

For-Mar’14

- Working Capital Turnover Ratio = 58.61 / 44.82

- Working Capital Turnover Ratio = 1.31

Interpretation

For the year March 2018 and March 2017 Working Capital Turnover Ratio is negative, which means that the company does not have sufficient short-term funds to fulfill the sales done for that period. This will cause a shortage of funds and can cause a business to run out of money. This is alarming to the company.

For the year March 2016, 2015, and 2014, the company has a positive Working Capital Turnover Ratio, which reflects the company has effective working capital management for sales done in that period.

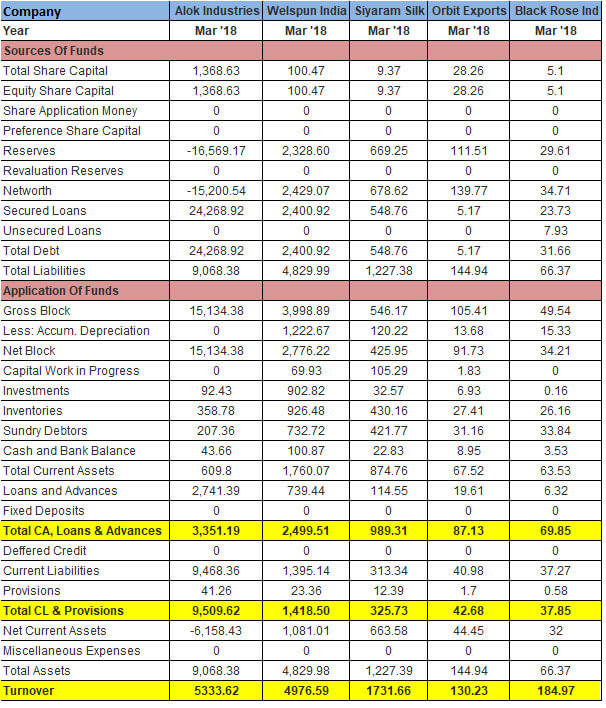

Working Capital Turnover Ratio – Example #3

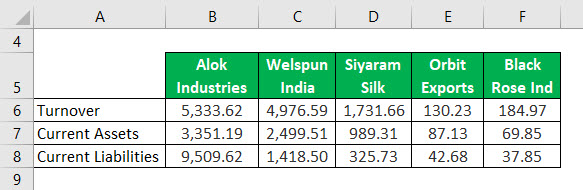

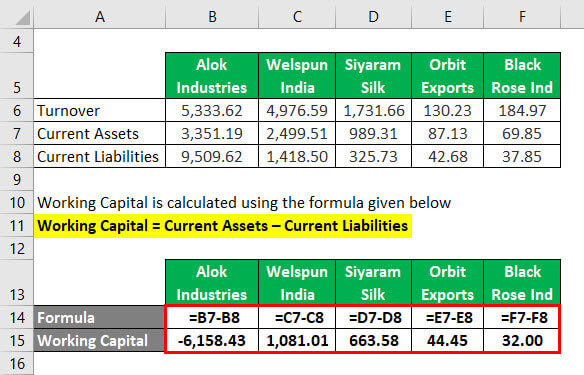

Alok Industries, Welspun India, Siyaram Silk, Orbit Exports, and Black Rose Industries are peer companies. Below are the Balance sheet and Turnover of the companies. Calculate the Working Capital Turnover Ratio and analyze the same.

With the help of the Balance Sheet, we have the following information.

Solution:

Working Capital is calculated using the formula given below

Working Capital = Current Assets – Current Liabilities

For Alok Industries

- Working Capital = 3,351.19 – 9,509.62

- Working Capital = -6,158.43

For Welspun India

- Working Capital = 2,499.51 – 1,418.50

- Working Capital = 1,081.01

For Siyaram Silk

- Working Capital = 989.31 – 325.73

- Working Capital = 663.58

For Orbit Exports

- Working Capital = 87.13 – 42.68

- Working Capital = 44.45

For Black Rose Ind

- Working Capital = 69.85 – 37.85

- Working Capital = 32

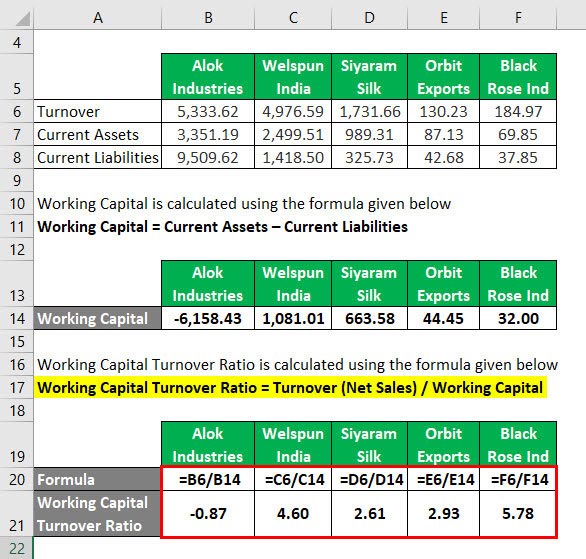

The working Capital Turnover Ratio is calculated using the formula given below.

Working Capital Turnover Ratio = Turnover (Net Sales) / Working Capital

For Alok Industries

- Working Capital Turnover Ratio = 5,333.62 / (-6,158.43)

- Working Capital Turnover Ratio = -0.87

For Welspun India

- Working Capital Turnover Ratio = 4,976.59 / 1,081.01

- Working Capital Turnover Ratio = 4.60

For Siyaram Silk

- Working Capital Turnover Ratio = 1,731.66 / 663.58

- Working Capital Turnover Ratio = 2.61

For Orbit Exports

- Working Capital Turnover Ratio = 130.23 / 44.45

- Working Capital Turnover Ratio = 2.93

For Black Rose Ind

- Working Capital Turnover Ratio = 184.97 / 32

- Working Capital Turnover Ratio = 5.78

Interpretation

Siyaram Silk and Orbit Exports have the best Working Capital Turnover ratio with the sales done, i.e., 2.61 and 2.93.

With regards to Welspun India and Black Rose Ind it has a high Working Capital Turnover ratio, which means that they have a good scope of increasing the sales or, in other words, there is an underutilization of working capital.

Alok Industries have a negative Working capital Turnover ratio, which means the company can go out of funds if working capital is not increased with the given sales.

Explanation

Working Capital Turnover Ratio Formula can be interpreted as how much Working Capital is utilized per sales unit. In other words, this ratio gives per unit of Working Capital for Sales done.

A higher Working Capital Ratio reflects the company has sufficient working capital for sales. It must be noted that high working capital also has a negative impact, which means there is a scope for increasing sales with the given Working Capital. For competitive analysis, you should compare the ratio with other peer companies in the same industry.

Lower the working capital turnover ratio reflects the company has poor management of working capital for sales done or the company’s inability to utilize the working capital efficiently. This impacts the business in survival in the long run.

Relevance and Uses of Working Capital Turnover Ratio

The Working Capital Turnover Ratio Formula determines the per-unit utilization of Working Capital. This analysis helps the company make practical decisions regarding working capital utilization, ensuring business survival in the long run and promoting growth.

Working Capital Turnover Ratio Formula Calculator

You can use the following Working Capital Turnover Ratio Calculator

| Turnover (Net Sales) | |

| Working Capital | |

| Working Capital Turnover Ratio Formula | |

| Working Capital Turnover Ratio Formula | = |

|

|

Recommended Articles

This has been a guide to Working Capital Turnover Ratio Formula. Here we discuss how to calculate Working Capital Turnover Ratio and practical examples. We also provide a Working Capital Turnover Ratio calculator with a downloadable Excel template. You may also look at the following articles to learn more –