Updated October 23, 2023

Overview of Wealth Management in India

Wealth Management in India is becoming increasingly popular as many Indians join the millionaires club. The economic boom and the resultant income level increase are favoring the increase in the number of millionaires.

Wondering what this has to do with wealth management? The huge chunks of money these millionaires possess must be managed well, which many can’t do. This is when wealth management comes into the picture. For those who don’t know what wealth management is, it is investment advice or assistance to manage a person’s financial life. These wealth management services offered to clients in packages provide benefits with two main goals: growth and safety of their existing investment.

According to Investopedia, Wealth Management is

“A professional service which is the combination of financial/investment advice, accounting/tax services, and legal/estate planning for one fee.”

Types of Wealth Management Service Providers

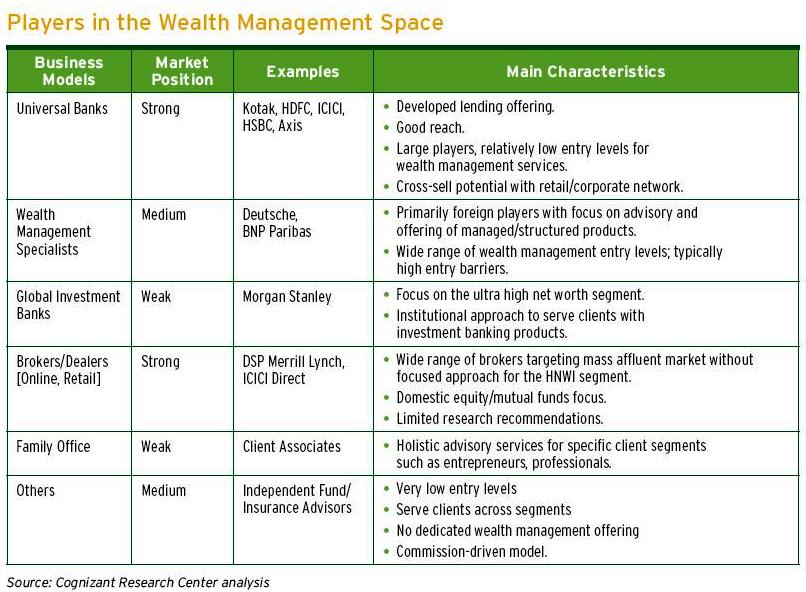

Currently, there are three types of wealth management service providers in India, viz. Banks, Brokerage firms, and Boutique advisory firms.

- Banks – Banks are known to have a larger investment distribution model, meaning they do not concentrate on only one investment option but on a large investment portfolio. Further, they cater to mid-level segment clients apart from the HNWIs.

- Brokerage Firms – Brokerage firms focus on investing the customer’s money in shares and IPO, which are equity market products.

- Boutique advisory firms – Boutique advisory firms provide customized financial solutions to clients, which are majorly the ultra-HNWIs (greater than USD 30 million) and HNWIs (USD 1 million to 30 million)

Recommended courses

Overview of Wealth Management in India

Before the advent of liberalization in India, wealth was in the concentration of a few hands. After 1991, when the Narasimha Rao Government introduced liberalization, it created wealth from private enterprises.

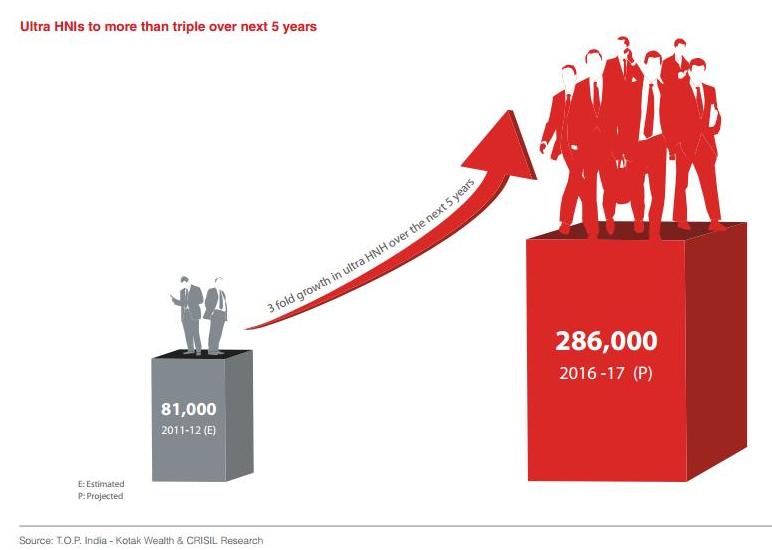

The 21st century in India saw a spell of entrepreneurial ventures, which has created an ever-growing High net-worth Individuals or HNWIs. According to a report, India – The Future of HNWIs to 2015: Bourgeoning Wealth and Wealth Management Opportunities.

- India has the fourth-highest HNWIs in the Asia-Pacific region after Japan, China, and Australia. In 2011, there were 251,000 HNWIs in India who, together, hold a total of US$1,083 billion.

- The number of Indian HNWIs will grow by 85%, reaching 465,000 individuals in 2015. HNWI’s wealth will grow by 97% to US$2,134 billion in 2015.

The HNWI segment is the fastest-growing segment, leading to the growth of the wealth management industry, which could be the most sought-after career choice. Wealth management in India is growing rapidly mainly because of the changing regulatory environment and increasing competition. The growth rate has attracted big names wanting to set up their wealth management division in India in the last few years. Also, the existing business houses in financial services are looking to expand their business lines into wealth management.

In the early period, wealth management in India began with banks providing individuals insurance and mutual funds products. During that time, advisory services did not exist, and institutions did not charge for them. However, with gradual regulatory changes, the sector has found new sources of income.

Various financial institutions and wealth management banks are gradually eyeing ways to entice customers towards their wealth management services. Because of this, today, different wealth managers are available from which customers can seek the best wealth management services.

Wealth management in India is in its nascent stage and is largely fragmented. The majority of the organized players have focused majorly on the urban segment. It has left one-fifth of the HNWI population of India untapped. The regulatory environment and tax structure changes will present many opportunities for wealth managers to multiply their product offerings. This tendency will probably continue, with India projected to become the third-largest global economy by 2030.

Competitive Players of Wealth Management in India

The competitive rivalry is increasing in the wealth management sector in India as the existing players are expanding and diversifying their operations. This industry is fragmented, with many brokers, sub-brokers, financial advisers, and insurance and tax consultants. In contrast, there are new local and global players wanting to make a stand here. Financial institutions like Reliance Money and Aditya Birla Group provide these services. Private banking divisions of popular lenders such as Barclays, Deutsche Bank, ICICI Bank, HSBC, and Kotak Mahindra are already well established in this segment. Customers can also opt for public sector banks such as Indian Bank, Canara Bank, and State Bank of India for wealth management services.

The entry of public sector banks in the wealth management domain cannot be neglected. They possess prodigious brand equity, influence, and corporate affiliations, which can prove as a tough competitor for the existing players.

Size and Growth of Wealth Management in India

These statistics show that India is one of the fastest-growing wealth management markets. If we look at the total size of the HNWI population of India, it could be a small number compared to the other established markets. However, the HNWI wealth was to grow by 97% to US$2,134 billion in 2015. Likewise, the liquid assets of the HNWI compared to the liquid assets are increasing at a good pace, which shows the growth of investable wealth in the country.

According to research reports, wealthy households include 8% off, but they account for 45% of the total wealth. There are a lot of scopes for the wealth management sector to grow, as only 20-25% of the HNWI population takes advice from wealth managers. Considering the demographics, the HNWI population is between the age group of 30-55 years. They are looking for wealth management services that lead to wealth accumulation, risk mitigation, and product portfolio, which gives them high returns.

India is an attractive economy for prospective new participants in the wealth management area, as it has been under the prediction that it will be the largest economy by 2030.

Another fact that favors the growth of wealth management in India is the decrease in the share of unorganized players in the market. By unorganized players, we mean the small brokers, agents, and advisers. This happened because the organized players have an increased presence, and income and profitability burdens have resulted in consolidation. As a resultant effect of this, the liquid assets accessible to the organized players have increased, which added to their growth in assets under management.

Also, wealth management firms in India have been inclined to offer custom-made services to non-resident Indian clients. This could be a rewarding segment for wealth management in India since NRI people are around 29 million worldwide.

Challenges to Wealth Management in India

1. Regulatory environment

The regulatory environment of the Indian economy is still evolving. Because of this, there still is substantial vagueness in the jurisdiction of numerous regulators. Also, looking at the various products and commodities, the derivative and bond market is not as mature as the equity market in India. And one of the reasons wealth managers do not experiment with innovative products is because of the vigilant measures of the Indian regulators.

2. Entry Blockades

Another important challenge for potential wealth managers is setting up locations for which they have to pay a heavy property price. The increase in real estate prices in the last decade has acted as a deterrent. Moreover, having physical locations cannot be avoided, as wealth management as a service requires a physical presence to build client relationships.

3. Finance Literacy

The awareness about the available financial products is low among the target population. Also, there is a sense of insecurity among the investors due to scams, harmful practices of some advisers, and the absence of an investor protection environment. All this has led to a very narrow-minded view among investors regarding certain long-term investments.

4. Sector Reach

Foreign banks and other large brokers attend the HNWI, but its reach is limited only to metropolitan areas. According to the statistics, 20% of the HNWI population lives outside the metros served by unorganized players. Therefore, for this sector to expand, its reach will play an important part in arresting the untapped wealth and transforming it into assets under management.

5. Product and Service Offerings

Though there has been a great improvement in the product portfolio for investors, the standards do not match that of other mature market players. Wealth management service providers must innovate to meet diverse customer needs to succeed. Even innovating could pose a challenge in the obstructive regulatory environment coupled with preserving the product structure and pricing transparency.

Wealth Management in India Infographics

Learn the juice of this article in just a single minute, Wealth Management in India Infographics.

Conclusion

Wealth management services are attracting more and more attention as the economy moves towards higher income levels and saving patterns. Looking at the trends, it indicates that opportunities lay ahead for the wealth management sector to boom. But this could happen when they invest significantly in brand building to build trust, quality advisory, translucent and compliant wealth management system for the investors. Wealth management has great opportunities to expand with increasing market players. To avail the benefits of this market’s potential, considering the specific features of the Indian market will be helpful for financial service organizations.

Wealth management in India is still blossoming and is a promising profession for the new age of India. This could be just the beginning of the best, which this industry has not yet seen.

Recommended Articles

This has been a guide to Wealth Management in India. Here are some articles to help you get more details about Wealth Management. So, just go through the link.