Updated July 29, 2023

Difference Between Standard Cost vs Actual Cost

Standard costs are the estimation of costs for predetermined products and arise from the units of material, labor and other production costs for a specific time period. Actual costs refer to the costs that are incurred. It’s the realized value and is not an estimate. The most common methods of Actual Costing in manufacturing units are – First In, First Out (FIFO), Average Costing, and Last In First Out(LIFO).

Every company and segment within a business prepares a cost budget and an estimate for revenue streams at the beginning of the financial year. The company records actual numbers throughout the year. At the end of the financial year, the actual and standard costs are compared in the budget, and the variance is derived. The same approach is for revenue as well. Standard cost vs actual costs are useful in management costing and in related fields.

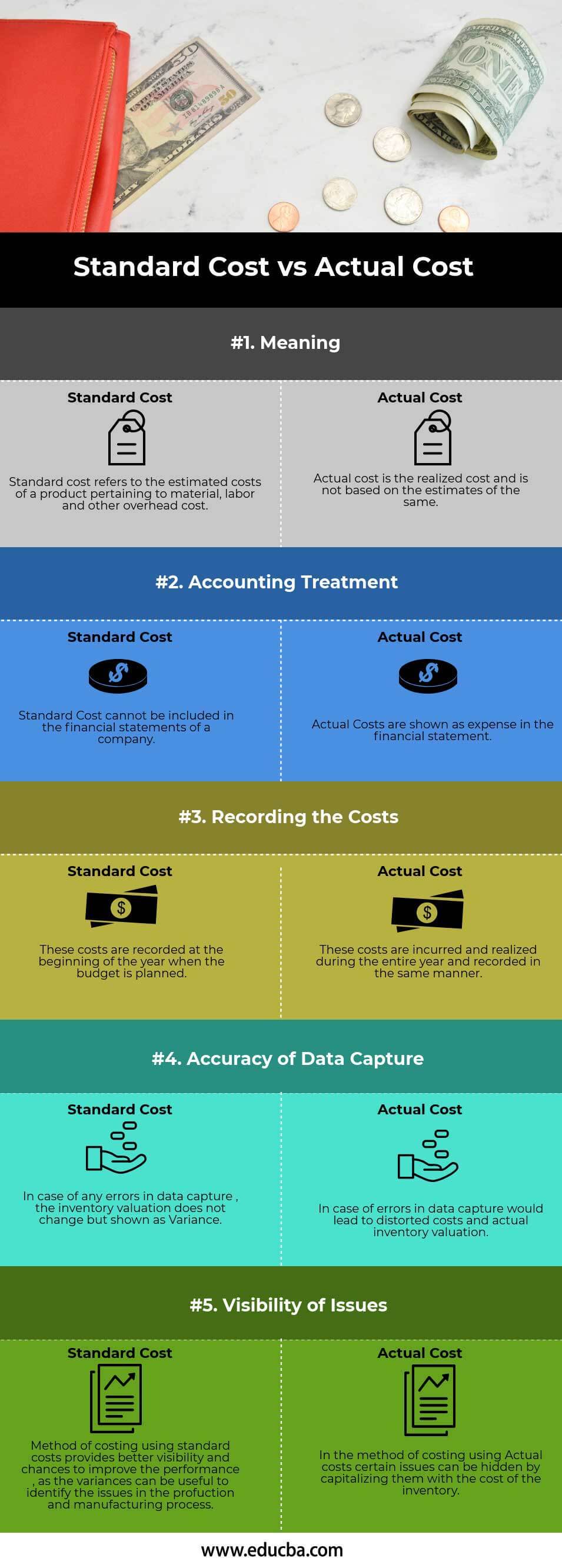

Head To Head Comparison Between Standard Cost vs Actual Cost (Infographics)

The top 5 differences between Standard Cost vs Actual Cost is as follows.

Key Differences Between Standard Cost vs Actual Cost

Let us discuss some of the major differences between Standard Cost vs Actual Cost:

1. Standard costs are the estimated labor, material, and other production costs. On the other hand, actual costs are those during the period and compared at the end.

This difference between the standard cost vs actual cost is termed Variance. If the Actual cost is higher than the standard, it creates an unfavorable variance.

2. The standard costs include the net sales amount and are not part of the financial statements. On the other hand, actual costs are costs during the same period. Hence, there should be a separate entry in the book of accounts- financial statements.

3. The stock or inventory is the value at any predetermined or pre-established cost under standard costing. In addition, any variances are manufacturing variances. These costs add to the costs of products going into production. Hence, it displays the price of the finished good. These costs are the actual manufacturing costs under actual costing and show the final production cost. But this does not drive the total inventory value, unlike the standard costs.

Standard Cost vs Actual Cost Comparison Table

Let’s look at the top 5 Comparison between Standard Cost vs Actual Cost

| Basis of Comparison |

Standard Cost |

Actual Cost |

| Meaning | Standard cost refers to the estimated costs of a product, including the material, labor, and other overhead costs. | The actual cost is the realized cost. |

| Accounting Treatment | Standard Cost is not present in the financial statements of a company. | Actual Costs are expenses in the financial statement. |

| Recording the Costs | These costs are recorded at the beginning of the year when the budget is planned. | These costs are incurred and realized during the entire year and recorded similarly. |

| Accuracy of Data Capture | In case of any errors in data capture, the inventory valuation does not change. | In case of errors in data capture, it would lead to distorted costs and actual inventory valuation. |

| Visibility of Issues | Method of cost using standard costs provides better visibility and chances to improve the performance, as the variances can be useful to identify the issues in the production and manufacturing process. | In the method of costing using Actual costs, certain issues can be hidden by capitalizing them with the inventory cost. |

Conclusion

The Standard Costing method requires work on them yearly or for every period the management decides. Also, monitor and check for the accuracy of the standard after the actual costs. On the other hand, the actual costs vary annually or periodically. The changes in the costs are on an ongoing basis. The costing method to apply for the inventory entirely depends on the management and its style. While actual costing is better in liberating, it offers more options, readily available information, and ultimately more flexibility. Still, there also be some thoughts about standard costing practices being more usable and better. Based on the standard costs, it becomes easier to attract bank loans and plan the unit well in advance based on the estimated costs.

Recommended Articles

This has been a guide to Standard Cost vs Actual Cost. Here we also discuss the Key Differences with Infographics and Comparison Table. You may also have a look at the following articles to learn more –