Updated November 21, 2023

Difference Between Costs and Expenses

Costs can be defined as money paid or spent to acquire an asset. It is mainly a one-time payment capitalized and reflected on a balance sheet. The amount spent on purchasing such assets is required for the business to earn future benefits. Expenses sound similar to those costs. Regular payments must be made to cover the cost of something. An expense is an ongoing payment, like rent, depreciation, salaries, and marketing. It is spent monthly/quarterly/annually and is reflected in the income statement, impacting the profitability and margins.

Costs

Cost is an amount that has to be paid or spent to buy products or services. The cost can be specific, like, “What’s the cost of that motorbike?” or it can be a penalty, like “Consider the cost of missing an event.” Consider an example. Tata Motors Ltd. manufactures cars and needs to buy new metal fabrication machines to form the car’s outer body. When the company buys the machines, the price Tata Motors pays or promises to pay a cost.

Expenses

The matching principle guides the recognition of expenses in the income statement, accounting for the cost on the balance sheet as an expense. According to this principle, expenses are recognized proportionately during the same period in which they are utilized for generating revenue. For instance, if you purchase a car for $20,000, it will eventually be expensed through depreciation over several years. So here, the initial amount you spend to buy the car is a cost, and depreciation, which will occur for the next several years, are expenses for handling that car.

Another example of a cost is an insurance prepayment of $1200 for the next 12 months. This will be recorded in the balance sheet as a prepaid expense, which is a current asset. You will divide the insurance payment, paid in advance, evenly over 12 months as an insurance expense of $100 per month. This represents an example of a cost.

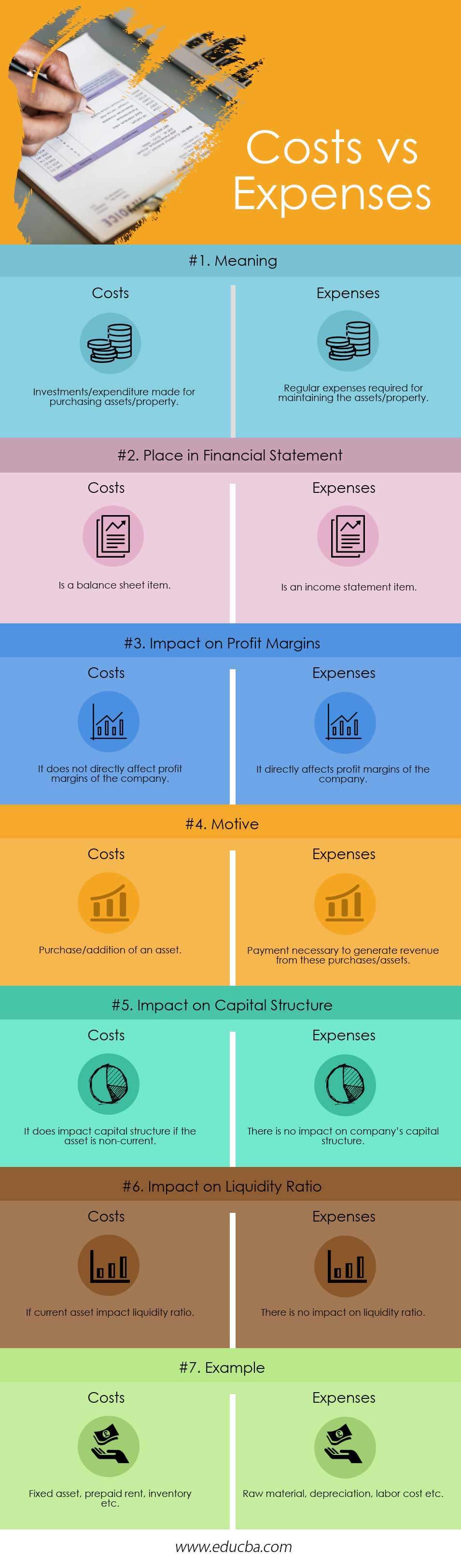

Costs vs. Expenses Infographics

Below is the top 7 difference between Costs vs. Expenses:

Key Differences Between Costs vs Expenses

Both are popular choices in the market; let us discuss some of the significant differences between Costs and Expenses:

- Cost represents a one-time payment, while an expense is incurred regularly.

- According to the matching principle, the company’s income statement should recognize expenses as costs. However, costs cannot be classified as regular expenses or payments.

- For future benefits, the company makes investments for purchasing assets/property and incurs costs; however, maintaining assets or property requires expenses.

- Cost is a balance sheet item, and expenses are an income statement item.

Comparison Table

Let’s have a look at the Comparison between Costs and Expenses:

| The Basis of Comparison | Costs | Expenses |

| Meaning | Investments/expenditures made for purchasing assets/property. | Maintaining assets or property requires regular expenses. |

| Place in financial statement | It is a balance sheet item. | It is an income statement item. |

| Impact on profit margins | It does not directly affect the profit margins of the company. | It directly affects the profit margins of the company. |

| Motive | Purchase/addition of an asset. | Payment is necessary to generate revenue from these purchases/assets. |

| Impact on capital structure | It does impact capital structure if the asset is non-current. | There is no impact on a company’s capital structure. |

| Impact on liquidity ratio | If current assets impact liquidity ratio. | There is no impact on the liquidity ratio. |

| Example | Fixed asset, prepaid rent, inventory, etc. | Raw material, depreciation, labor cost, etc. |

Conclusion

For operating any business, understanding costs vs expenses is very important. While running the company, you purchase/acquire assets and spend an amount on maintaining those assets for revenue generation. Suppose you are not generating significant revenue from purchased assets, and expenses for maintaining those assets are high. In that case, it will directly impact on bottom-line growth of the company.

The accountant uses the term cost to refer specifically to a tangible asset and even more specifically to depreciated assets. The cost of an asset includes purchasing, acquiring, and setting up the support and training of the employee in its use. For example, if the manufacturing company purchased a machine, the cost includes shipping, set-up, and training.

On the other hand, in the business sense, an expense is an item of business outlay chargeable against revenue for a specific period. They are subtracted from revenue/Guide to gross income in calculating profit/losses. Companies use expenses to generate revenue, which is tax-deductible, reducing the company’s income tax bill. Cost doesn’t directly affect taxes, but the price of an asset is used to determine the depreciation expenses for each year, which is a deductible business expense.

Recommended Articles

This has been a guide to the top difference between Costs vs Expenses. Here we also discuss the critical differences between costs and expenses with infographics and comparison tables. You may also have a look at the following articles to learn more-