Updated August 1, 2023

Cost of Debt Formula (Table of Contents)

- Cost of Debt Formula

- Examples of Cost of Debt Formula (With Excel Template)

- Cost of Debt Formula Calculator

Cost of Debt Formula

The cost of debt is the minimum rate of return that the debt holder will accept for the risk taken. The cost of debt is the effective interest rate the company pays on its current liabilities to the creditor and debt holders.

The after-tax cost of debt generally refers to the difference between the before-tax cost of debt and the after-tax cost of debt, which is dependent on the fact that interest expenses are deductible. It is an integral part of WACC, i.e., average weight cost of capital. The company’s capital cost is the sum of the debt cost plus the equity cost. And the cost of debt is 1 minus tax rate into interest expense.

The cost of debt formula is:-

The effective interest rate is annual interest upon total debt obligation into 100. The formula for the same is below:-

Examples of Cost of Debt Formula (With Excel Template)

Let’s see an example to understand the cost of debt formula in a better manner.

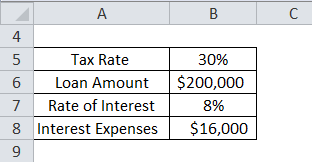

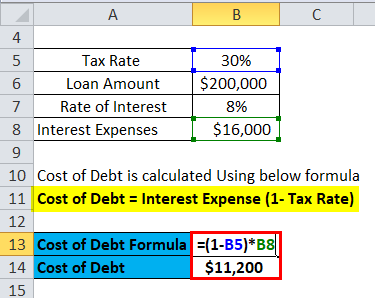

Cost of Debt Formula – Example #1

A company named Viz Pvt. Ltd took a loan of $200,000 from a Bank at the rate of interest of 8% to issue a company bond of $200,000. Based on the loan amount and interest rate, interest expense will be $16,000, and the tax rate is 30%.

The cost of debt is calculated Using the below formula

Cost of Debt = Interest Expense (1- Tax Rate)

- Cost of Debt = $16,000(1-30%)

- Cost of Debt = $16000(0.7)

- Cost of Debt = $11,200

The cost of debt of the company is $11,200.

Now let’s take one more to understand the formula of interest expense and cost of debt.

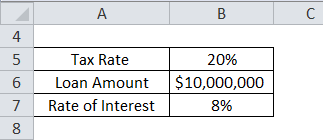

Cost of Debt Formula – Example #2

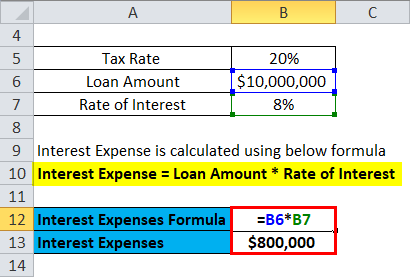

Suppose a company named Arts Pvt. Ltd has taken a loan from a bank of $10 million for business expansion at a rate of interest of 8%, and the tax rate is 20%. Now we will calculate the cost of debt.

Let interest is applied on principle. Assuming the interest calculation method as simple interest.

Interest Expense = Loan Amount * Rate of interest

- Interest Expense = $10,000,000 * 8%

- Interest Expense = $800,000

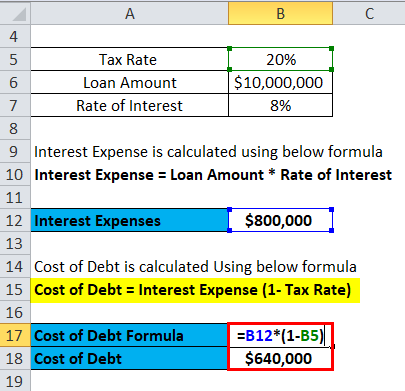

The cost of debt is calculated Using the below formula

Cost of Debt = Interest Expense (1- Tax Rate)

- Cost of Debt = $800,000 (1-20%)

- Cost of Debt = $800,000 (0.80)

- Cost of Debt = $640,000

Here, the cost of debt is $640,000.

The measurement of the cost of debt helps in finding the company’s financial condition and also enables the determination of the company’s risk level. If the company has a high debt level, it indicates a high level of risk associated with the company, based on which investors decide whether to invest in the company. The cost of debt calculation includes a significant element of the tax rate and interest expense. Once calculated, one can evaluate the loan by comparing the business income generated by the loan with the cost of debt. This cost of debt provides an interest expense, which is later utilized for taxation purposes as a tax deduction, thus allowing the company to save on taxes. The company uses this interest expense as a business expense for tax-saving purposes.

The after-tax cost of debt formula will be as follows:-

Now, we can see that the after-tax cost of debt is one minus tax rate into the cost of debt.

Let’s see an example to understand it better.

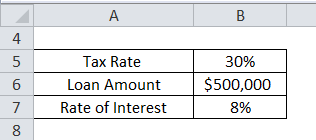

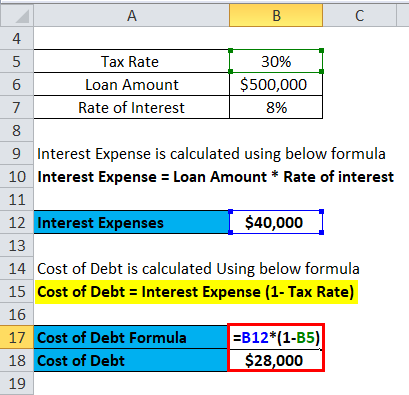

Cost of Debt Formula – Example #3

Suppose a company named AIM Marketing has taken a loan for business expansion of $500,000 at the rate of interest of 8%. The tax rate applicable was 30%; here, we have to calculate the after-tax cost of debt.

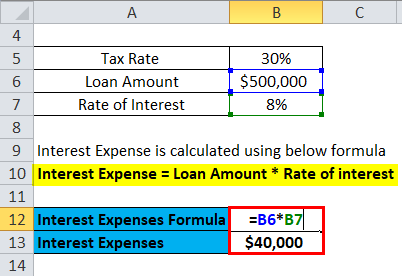

Interest Expense is calculated using the below formula

Interest Expense = Loan Amount * Rate of interest

- Interest Expense= $500,000 * 8%

- Interest Expense = $40,000

The cost of debt is calculated Using the below formula

Cost of Debt = Interest Expense (1- Tax Rate)

- Cost of Debt = $40,000 *(1-30%)

- Cost of Debt = $40,000 *0.70

- Cost of Debt = $28,000

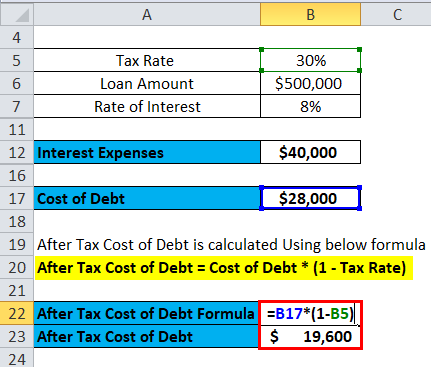

After-Tax Cost of Debt is calculated Using the below formula

After-Tax Cost of Debt = Cost of Debt * (1 – Tax Rate)

- After-tax cost of debt = $28,000 * (1-30%)

- After-Tax Cost of Debt = $28,000* (0.70)

- After-Tax Cost of Debt = $19,600

Now, we got an after-tax cost of debt which is $19,600.

The after-tax cost of debt is high as income tax paid by the company will be low as the company has a loan on it, and the interesting part paid by the company will be deducted from taxable income. Hence, the cost of debt is crucial as it gives a chance to a company to save its tax. The company keeps in mind the rate of interest shown below when borrowing money for the issuance of a bond, as it has to give a fixed rate of interest to an investor who has invested in their company bonds.

Now, let’s see a practical example to calculate the cost of debt formula.

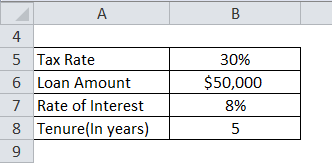

Cost of Debt Formula – Example #4

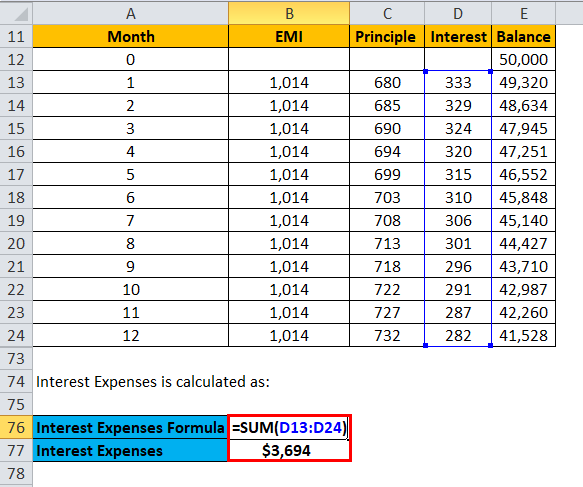

A company named S&M Pvt. Ltd has taken a loan of $50,000 from a financial institution for five years at a rate of interest of 8%; the tax rate applicable is 30%. Now, we will see amortization to calculate the cost of debt.

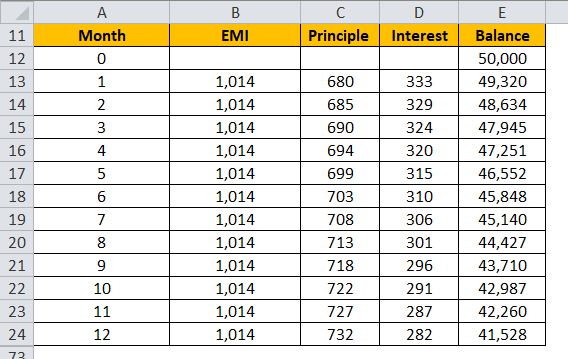

Amortization schedule of one year of the loan.

Here, we can see that interest paid by a company in one year is:-

- Interest Expenses = 333 + 329 + 324 + 320 + 315 + 310 + 306 + 301 + 296 + 291 + 287 + 282

- Interest Expenses = $3,694

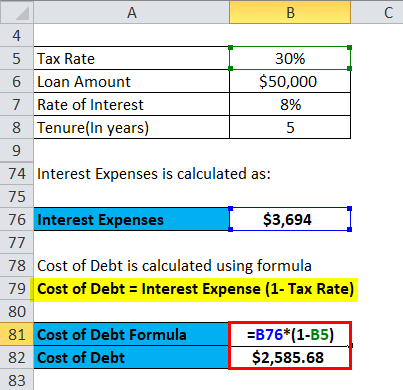

The cost of debt is calculated using the formula

Cost of Debt = Interest Expense (1- Tax Rate)

- Cost of Debt = $3,694 * (1-30%)

- Cost of Debt = $2,586

The cost of debt is lower as a principal component of a loan keeps on decreasing; if the loan amount has been used wisely and can generate a net income of more than $2,586, then taking a loan is beneficial.

Relevance and Uses of Cost of Debt Formula

There are multiple uses of the cost of debt formula; they are as follows:-

- Cost of debt help to save taxes.

- It helps to calculate the risk associated with the company.

- Using loan amounts helps one calculate the net income a company generates.

- The cost of debt formula is a component of WACC, i.e., Weighted average Cost of capital.

- One can also calculate the after-tax debt cost to know a company’s actual financial position.

Ways to Low Cost of Debt

There are many ways to reduce the low cost of debt; they are as follows:-

1. Get a Cheaper Loan

A cheaper loan means to get a loan at a lower rate of interest which can be done by creating a good credit score by repaying loans on time, offering collaterals, negotiating, etc.

2. Refinancing Loan

First, one needs to start a loan with a rate of interest he is eligible for; then, when the business starts growing, he can refinance the loan at a lower rate after some months of the loan.

3. Optimize Business Growth

Increasing business income allows one to avail more debt as they can afford it, thereby reducing the cost of debt by comparing it with the income generated by the loan amount.

Cosdebt Debt Formula Calculator

You can use the following Cost of Debt Calculator

| Interest Expense | |

| Tax Rate | |

| Cost of Debt Formula = | |

| Cost of Debt Formula = | Interest Expense x (1 - Tax Rate) |

| = | 0 x (1 - 0) = 0 |

Conclusion

It is a tool that helps one know whether that loan is profitable for business as we can compare the cost of debt with income generated by loan amount in business. Multiple reasons exist for taking out a loan, ranging from issuing bonds to purchasing prime machinery in order to generate revenue and grow the business. It also helps to know the cost of capital of a company. It helps to know the actual cost of debt, and debt helps to justify the cost of debt in the business.

Recommended Articles

This has been a guide to a Cost of Debt formula. Here we discuss How to Calculate the Cost of Debt along with practical examples. We also provide you with the Cost of Debt Calculator with a downloadable Excel template. You may also look at the following articles to learn more –