Updated August 1, 2023

Sharpe Ratio Formula (Table of Contents)

- Sharpe Ratio Formula

- Sharpe Ratio Formula Calculator

- Sharpe Ratio Formula in Excel (With Excel Template)

Sharpe Ratio Formula

The Sharpe ratio calculates the excess rate of return of the portfolio by dividing it by the standard deviation of the portfolio return. The excess rate of return of the portfolio is calculated by deducting the risk-free rate of return from the actual rate of return of the portfolio.

The formula is as below:

where,

- Rp = Expected rate of return of the portfolio

- Rf = Risk-free rate of return

- ơp = Standard deviation of the portfolio return

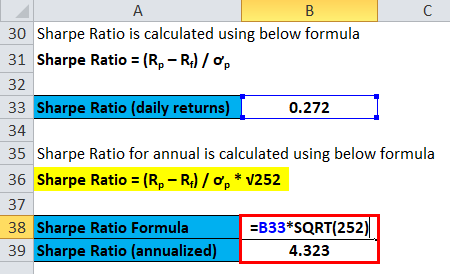

To annualize the Sharpe ratio based on daily returns, multiply the ratio by the square root of 252, representing the number of trading days in a year.

Explanation of the Sharpe Ratio Formula

To compute the Sharpe ratio, follow these steps:

Step 1: Firstly, collect the daily rate of return of the concerned portfolio over a substantial period of time, such as monthly or annually. The rate of return is calculated based on net asset value at the beginning of the period and at the end of the period. Then the average of all the daily returns is determined, denoted as Rp.

Step 2: Now, the daily yield of a 10-year government security bond is collected to compute the risk-free rate of return, which Rf denotes.

Step 3: To compute the excess rate of return of the portfolio, you deduct the risk-free rate of return (step 2) from the portfolio’s rate of return (step 1).

Excess rate of return = Rp – Rf

Step 4: Now, the standard deviation of the daily return of the portfolio is calculated, denoted by ơp.

Step 5: The Sharpe ratio calculates the excess rate of return of the portfolio (step 3) by dividing it by the standard deviation of the portfolio return (step 4).

Sharpe Ratio = (Rp – Rf) / ơp

Step 6: Finally, the Sharpe ratio can be annualized by multiplying the above ratio by the square root of 252, as shown below.

Sharpe Ratio = (Rp – Rf) / ơp * √252

Examples of Sharpe Ratio Formula

Let’s take an example to understand the calculation of the Sharpe Ratio formula in a better manner.

Sharpe Ratio Formula – Example #1

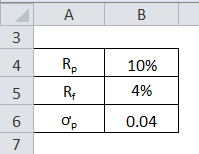

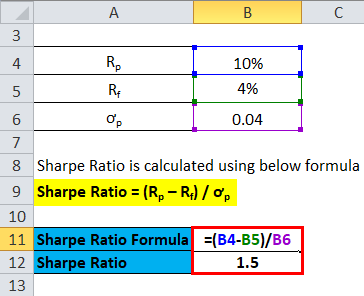

Let us take an example of a financial asset with an expected rate of return of 10% while the risk-free rate of return is 4%. The standard deviation of the asset’s return is 0.04.

Sharpe Ratio is calculated using the below formula

Sharpe Ratio = (Rp – Rf) / ơp

- Sharpe Ratio = (10% – 4%) / 0.04

- Sharpe Ratio = 1.50

This means that the financial asset gives a risk-adjusted return of 1.50 for every unit of additional risk.

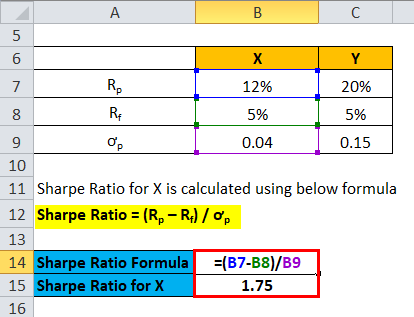

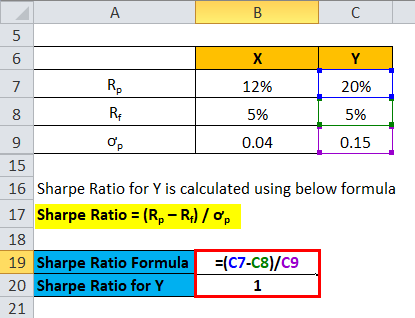

Sharpe Ratio Formula – Example #2

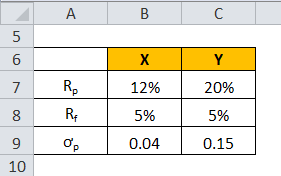

Let us take an example of two financial assets X and Y, with the expected rate of return being 12% and 20% for both while the risk-free rate of return is 5%. However, the standard deviation of assets X and Y are 0.04 and 0.15. Figure out which is the better investment given the risk associated.

Sharpe Ratio = (Rp – Rf) / ơp

- Sharpe ratio for X = (12% – 5%) / 0.04

- Sharpe ratio for X = 1.75

Sharpe Ratio = (Rp – Rf) / ơp

- Sharpe ratio for Y = (20% – 5%) / 0.15

- Sharpe ratio for Y = 1

This means that even though asset Y offers a higher return than asset X (asset Y-20% asset X-12%), asset X is a better investment as it has a higher risk-adjusted return indicated by the Sharpe ratio of 1.75 compared to 1 of asset Y.

Relevance and Uses

It is quintessential to understand the concept of the Sharpe ratio as it is a comprehensive tool to assess the performance of a portfolio against a certain level of risk. Investors typically use the ratio to capture the change in the overall risk-return characteristics of a portfolio after adding a new asset or asset class. The ratio can also evaluate the past performance of a portfolio by incorporating actual returns into the formula. The estimated Sharpe ratio can utilize the ratio to assess the expected performance of the portfolio. As per the Sharpe ratio, a higher value indicates the better risk-adjusted performance of the portfolio.

Sharpe Ratio Formula Calculator

You can use the following Sharpe Ratio Calculator.

| Rp | |

| Rf | |

| Op | |

| Sharpe Ratio Formula = | |

| Sharpe Ratio Formula = |

|

|

Sharpe Ratio Formula in Excel (With Excel Template)

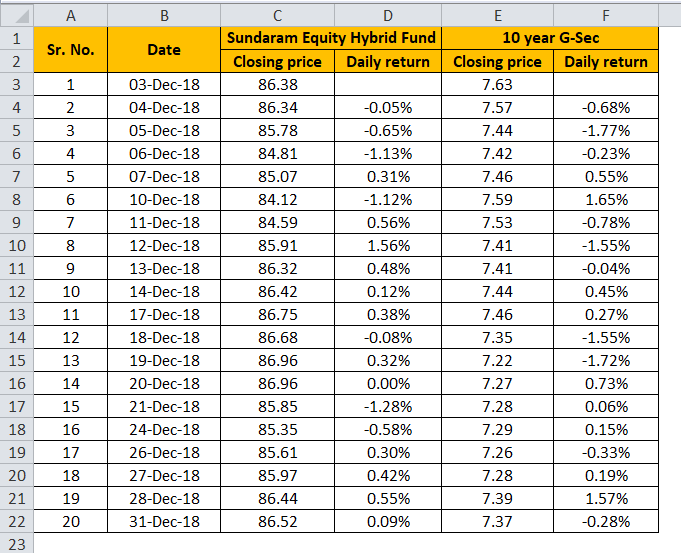

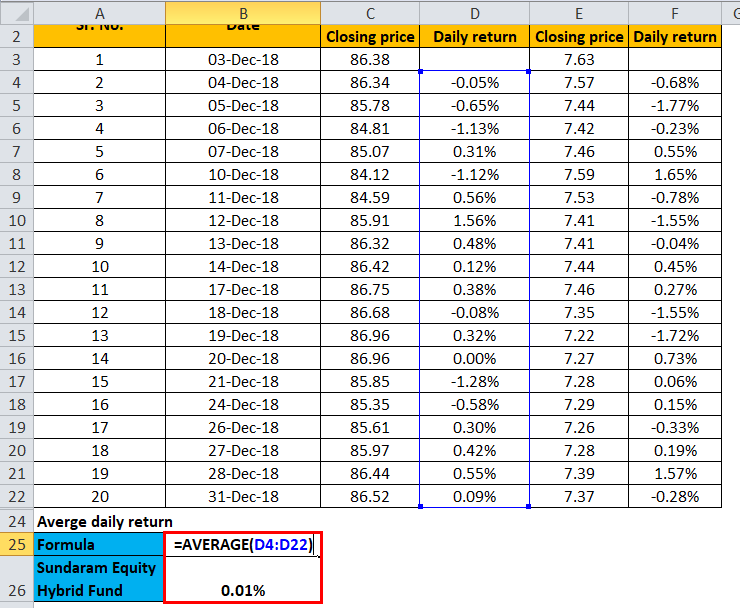

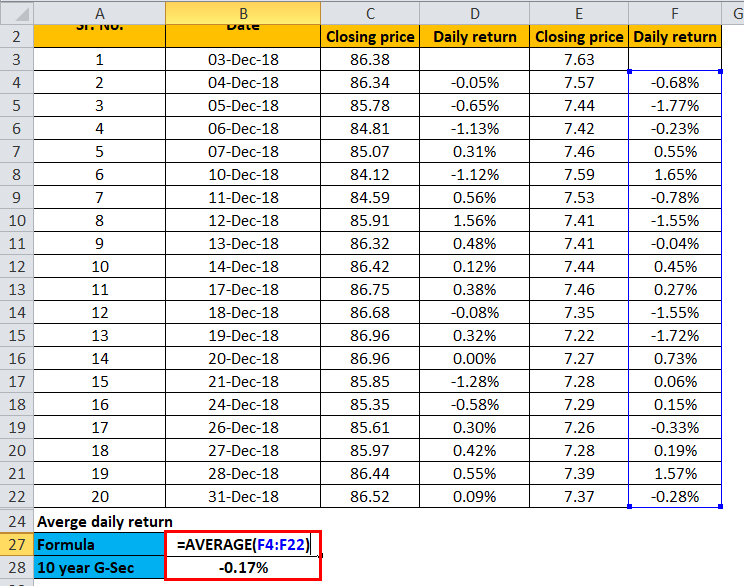

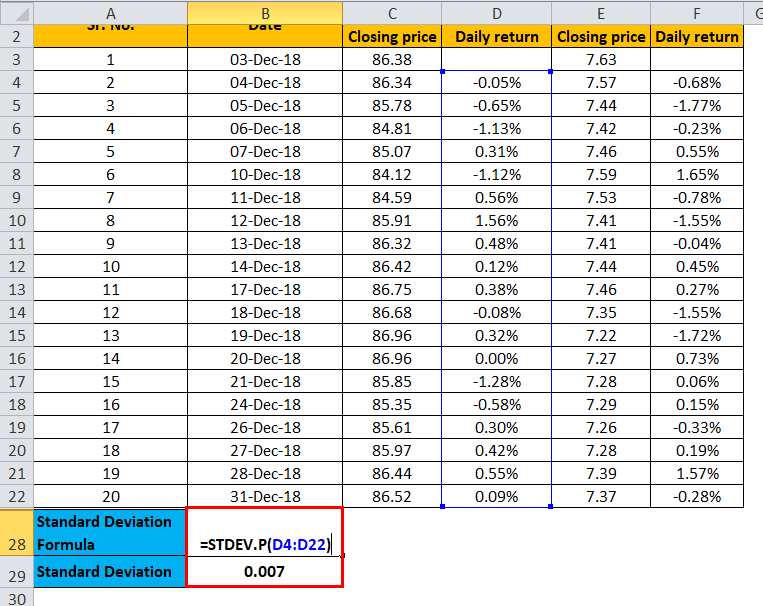

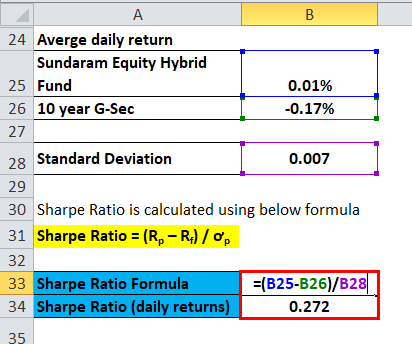

Now let us take the monthly return information of Sundaram Equity Hybrid Fund to illustrate in the Excel template below. The table provides the detailed Sharpe ratio calculation for Sundaram Equity Hybrid Fund.

The Sharpe ratio calculates the difference between the daily return of the Sundaram equity hybrid fund and the daily return of 10-year G Sec bonds, divided by the standard deviation of the return of the hybrid fund. Consequently, analysts calculate the Sharpe ratio based on the daily return as 0.272. Furthermore, analysts multiply the previous result by the square root 252 to analyze the Sharpe ratio.

Average of the daily return of Sundaram Equity Hybrid Fund

Average of the daily return of 10-year G-Sec

Standard Deviation

Calculation of Sharpe Ratio:

Calculation of Sharpe Ratio:

Recommended Articles

This has been a guide to the Sharpe Ratio formula. Here we discuss How to Calculate Sharpe Ratio along with practical examples. We also provide a Sharpe Ratio Calculator with a downloadable Excel template. You may also look at the following articles to learn more –