Updated July 3, 2023

What is the Cash Ratio Formula?

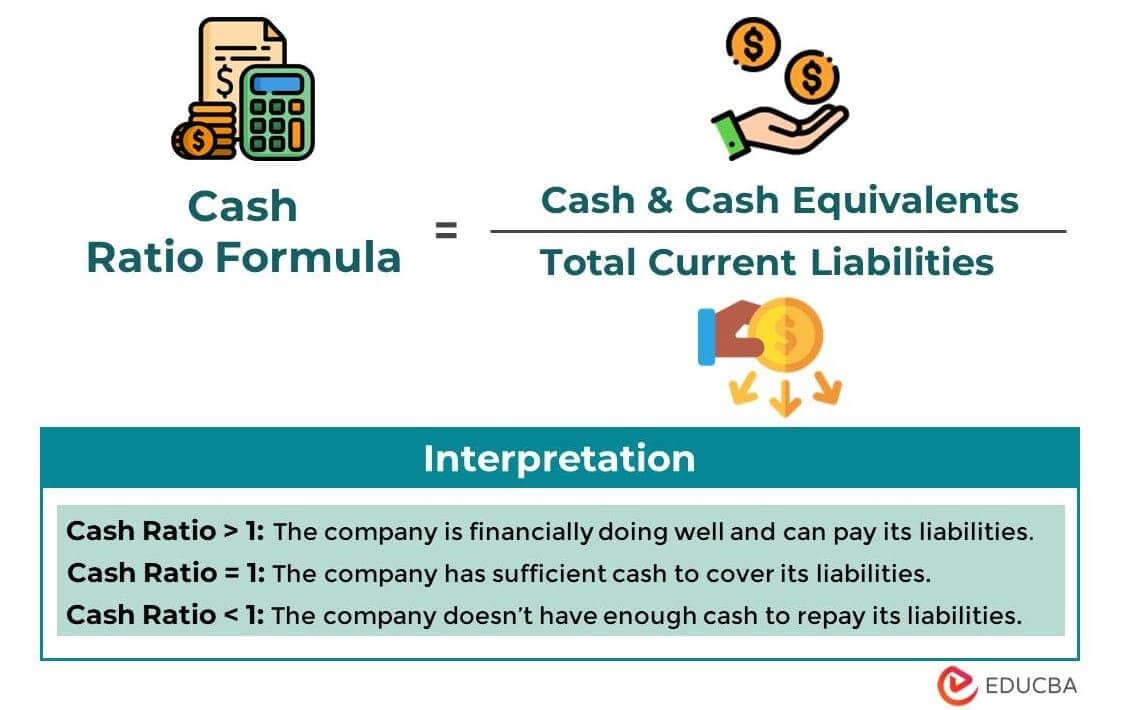

The cash ratio formula helps determine if a company can use only its cash and cash equivalents and pay all of its immediate bills and short-term debts. It compares the amount of cash a company has with the amount of money it owes right now.

Imagine you have $200 (cash & cash equivalent) in your wallet and owe a friend $100 (current liabilities). Your cash ratio would be 2 (cash & cash equivalent/current liability) as you have twice as much cash as you owe. It means you can quickly pay back your friend.

Similarly, if a company has $10,000 (cash & cash equivalent) in cash and owes $5,000 (current liability) to suppliers, its cash ratio would be 2 (cash & cash equivalent/current liability). It means the company has enough cash to cover its immediate debts twice, which is a good sign of financial stability. Simply, the cash ratio reflects if a company has enough cash to meet its short-term obligations, just like you have enough cash to pay back your friend when you owe them money.

Cash Ratio Formula

The cash ratio formula is:

Where,

- Cash & cash equivalent includes all investments that we can convert into cash within 90 days.

- Total current liabilities are loans/debts that a company must repay within a short time or one year.

Instead of using the total current liabilities, we can also consider the sum of accruals, accounts payable, and notes payable for calculating the cash ratio. The formula is,

Where,

- Accruals represent expenses incurred by the company but not yet paid.

- Accounts Payable reflect the amount the company owes to its suppliers or vendors.

- Notes Payable is the total money the company owes to its investors and financiers.

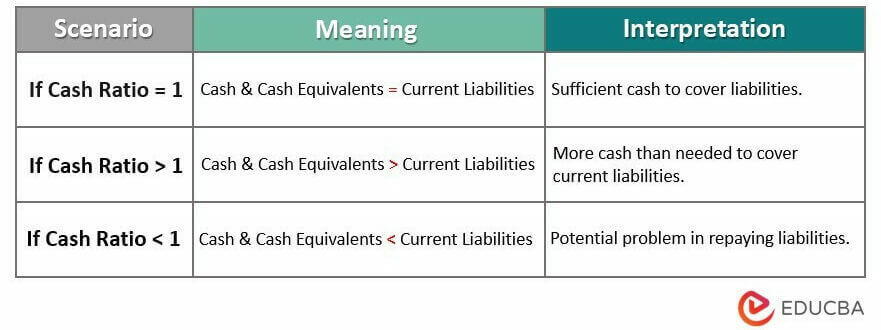

Cash Ratio Interpretation

The higher the cash ratio number, the better the company’s position. Now, there can be three situations while calculating the cash ratio. Let’s understand it:

Situation #1: When Cash and Cash Equivalents > Current Liability

It’s always a good sign for a company when they have more cash and cash equivalents than the current liabilities. It means the company is financially doing well and can pay its liabilities. Typically a ratio of 1 or higher is most appropriate.

Situation #2: When Cash and Cash Equivalents = Current Liability

It is a very stable condition where a company has an exact amount of cash as much as liabilities. They are neither too profitable nor in a loss.

Situation #3: When Cash and Cash Equivalents < Current Liability

It’s a very unfavorable condition where a company doesn’t have enough cash and cash equivalents to pay back its liabilities. It means the company is not utilizing its assets properly and is not financially stable. Typically, a ratio below 1 is bad for a company.

Examples of Cash Ratio Formula (With Excel Template)

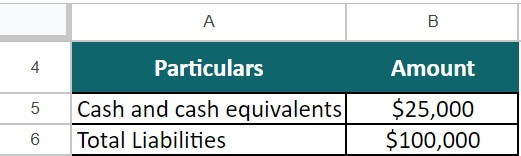

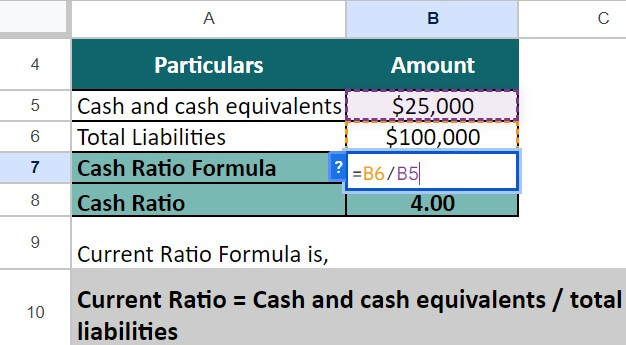

Example #1

K&G Pvt. Ltd, with cash and cash equivalent of $25,000 and total liabilities of $100,000, wants to know the cash ratio. Calculate its cash ratio.

Given,

Solution:

We have all the values. Let’s calculate the cash ratio using the below formula.

Cash Ratio = $25,000 / $100,000

Cash Ratio = 4

Cash Ratio Result Analysis of K&G Pvt. Ltd

So, the cash ratio is 4. It means the company’s cash and cash equivalents are four times greater than its current liabilities. This means the company can use only 25% of its cash to pay 100% of its liabilities.

Example #2

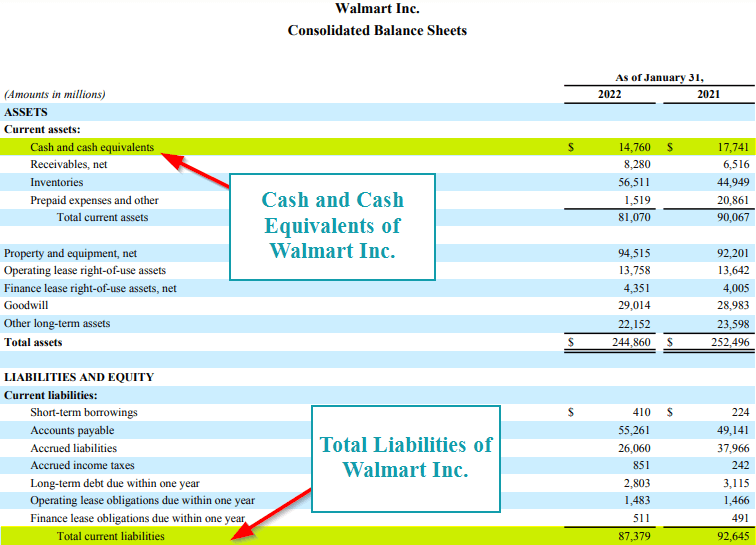

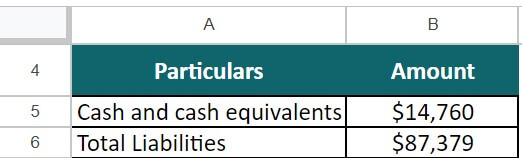

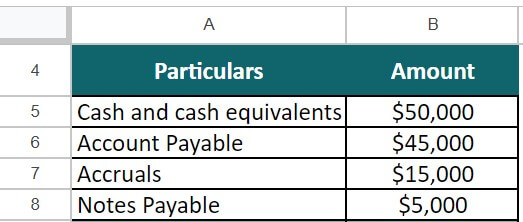

Let’s analyze the balance sheet of Walmart Inc. for FY22 and calculate its cash ratio.

(Source: Annual Report of Walmart for FY22)

Given,

Solution:

We have all the values. Let’s calculate the cash ratio using the below formula.

Cash Ratio = $14,760 / $87,379

Cash Ratio = 5.92

Cash Ratio Analysis of Walmart

Here, Walmart Inc. is in a very good financial position as its cash ratio is relatively high at 5.92. They efficiently use their assets and can repay their debt in a given timeframe.

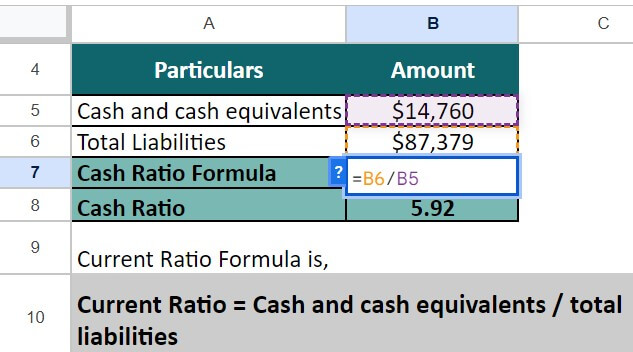

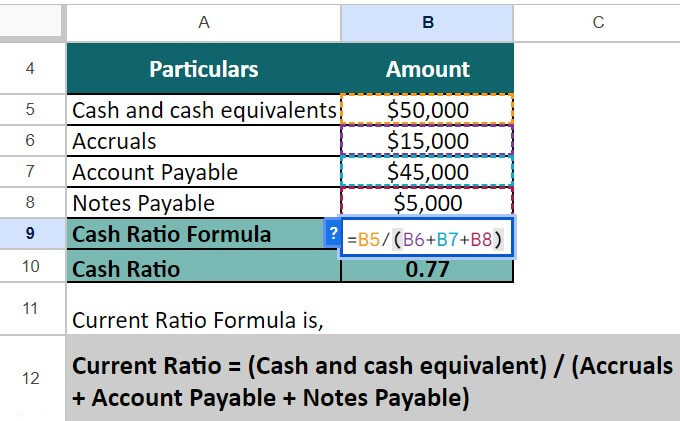

Example #3

Martin & Co. reflects a cash and cash equivalent of $50,000, accruals of $15,000, account payable of $45,000, and notes payable of $5,000 in its balance sheet. Let’s calculate its cash ratio.

Given,

Solution:

Let us use the below formula to find out the cash ratio for Martin & Co.

Cash Ratio = $50,000 / ($15,000 + $45,000 + $5,000)

= $50,000 /$65,000 = 0.77

Cash Ratio Result Analysis of Martin & Co

So, the cash ratio is 0.77. That means a company has enough cash and cash equivalent to pay 77% of current liabilities.

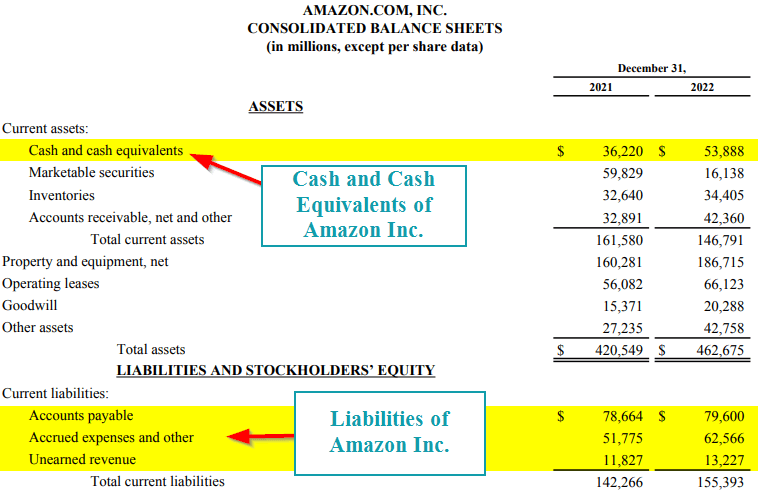

Example #4

Amazon Inc. is a very reputed company with a turnover of millions of dollars. Let’s calculate their cash ratio to have a more accurate view of the cash ratio.

(Source: Annual Report of Walmart for FY22)

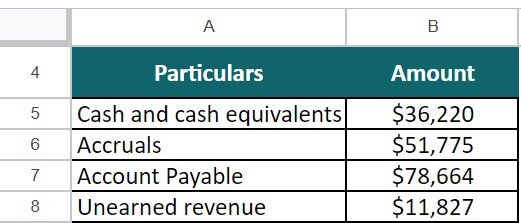

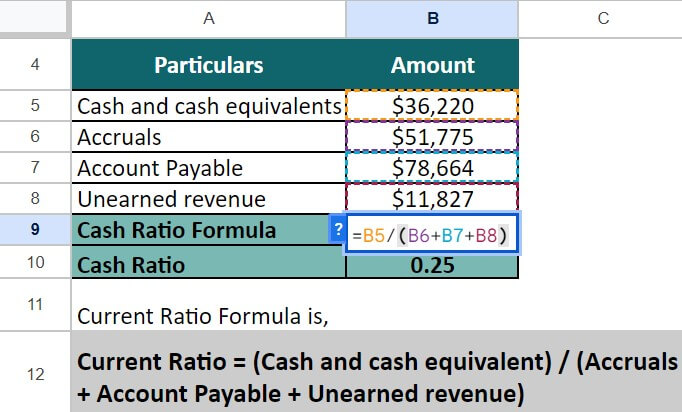

Given,

Solution:

We will implement the below formula to calculate the cash ratio.

Cash Ratio = $36,220 / ($51,775 + $78,664 + $11,827)

= $36,220 /$142,266 = 0.25

Cash Ratio Result Analysis of Amazon

We can see that the cash ratio for Amazon Inc. is 0.25, which is lower than the ideal ratio, i.e., 0.5 or above. In general terms, the company may face issues repaying its debts. However, large companies usually depend on various sources to clear their liabilities rather than just cash and cash equivalents.

Cash Ratio Calculator

You can use the following Cash Ratio Calculator.

| Cash and cash equivalents | |

| Total Current Liabilities | |

| Cash Ratio = | |

| Cash Ratio = | (Cash and cash equivalents / Total Current Liabilities) |

| = | (0 / 0 ) = 0 |

Relevance and Uses

1. Financial Health Indicator: A high cash ratio indicates the company’s strong cash position, indicating financial stability. The company can easily pay off unexpected expenses, manage day-to-day operations efficiently, etc.

2. Risk Evaluation: A low cash ratio may indicate a higher risk of liquidity issues. It measures a company’s inability to pay off its debt and may need external financing.

3. Comparison Across Time: One can track a company’s liquidity changes over time by calculating the cash ratio over multiple periods. It shows a company’s ability to generate and maintain cash reserves and identify trends or patterns in its financial health.

4. Benchmarking Ratio: The cash ratio can compare a company’s liquidity position against its competitors. It helps assess the company’s liquidity strength and identify areas for improvement if needed.

5. Better Decision Making: Investors, lenders, and creditors consider cash ratio while making decisions regarding investment, lending, or creditworthiness.

Limitations

While the cash ratio is a useful liquidity ratio, it also has certain limitations that we should consider. Here are some of the limitations of the cash ratio formula:

1. Incomplete assessment: It only considers the cash a company has on hand and doesn’t look at other assets that we can easily turn into cash, like money owed to the company or investments that the company can sell. It means it doesn’t give a complete picture of how much money a company can access quickly.

2. Ignoring the timing of cash flows: It doesn’t think about when money will actually come in or go out. It assumes all the cash is available immediately to pay off debts without considering future money coming in or near future bill payments.

3. Industry-specific considerations: Different industries have different cash needs. So comparing the cash ratios of companies in different sectors may not be fair because some industries naturally require more cash to operate smoothly.

4. Potential manipulation: Companies can easily manipulate the cash ratio. They can temporarily increase their cash or reduce their debts to show a higher cash ratio, even if it doesn’t reflect their true financial situation.

Frequently Asked Questions (FAQs)

Q1. What is the ideal cash ratio?

Answer: A ratio of 1 or above is ideal for a company. A high cash ratio indicates the company is in an excellent position to repay its debt. A ratio of 0.5 is comparatively risky as an entity has twice much debt to pay as its cash.

Q2. How to calculate the cash ratio from the balance sheet?

Answer: To calculate the cash ratio from the balance sheet, you need two key figures; the cash and cash equivalents and total current liabilities. After this, you can apply the formula:

Q3. How to improve the cash ratio?

Answer: A company can improve its cash ratio by cutting unnecessary expenses and costs. Also, monitoring capital management and increasing cash inflows can be of great help.

Q4. What does the cash ratio measure?

Answer: The cash ratio helps to measure a company’s liquidity position. Here, liquidity is a measure of judging if a company will be able to repay the money it owes to lenders and creditors.

Q5. Discuss cash ratio vs. quick ratio

Answer: Cash and quick ratios are two financial metrics helpful in assessing a company’s liquidity. The primary difference between both ratios is that the cash ratio uses only the cash and cash equivalents to measure liquidity. In contrast, in the quick ratio, we use all the liquid assets like accounts receivables, marketable securities, cash & cash equivalents, etc. The quick ratio uses many varieties of liquid assets than the cash ratio.

Recommended Articles

This EDUCBA guide on the cash ratio formula uses Excel examples to explain the use, importance, and limitations of the formula. Below are similar references for you: