Updated July 28, 2023

What is Secure Electronic Transaction

Secure Electronic Transaction is an open-source encryption and security specification designed to protect credit card transactions on the internet. Remember that a secure electronic transaction is not a payment system; it is a set of security protocols and format that ensures that using online payment transaction on the internet is secure. Secure Electronic Transaction is also called SET. SET provides a secure environment for all the parties that are involved in the e-commerce transaction. It also ensures confidentiality. It provides authentication through digital certificates. In this article, we will discuss the basic concept of Secure Electronic Transaction and its working.

Secure Electronic Transaction Participants

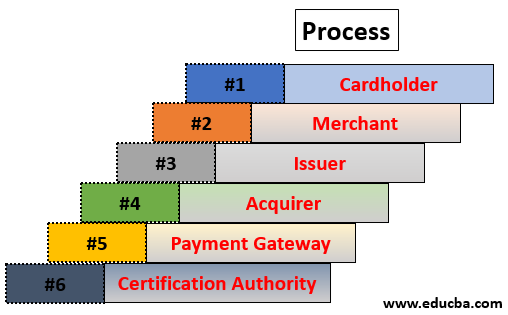

Below is the list of participants who are involved in the SET process:

- Cardholder: A cardholder is an authorized holder of the payment card. The card can be a Master card or a Visa which an issuer has issued.

- Merchant: A merchant is any person or organization who wants to sell its goods and services to cardholders. Note that a merchant must have a relationship with the acquirer to accept the payment through the internet.

- Issuer: An issuer is a financial organization such as a bank that issues payment card – Master card or visa to user or cardholder. The issuer is responsible for the cardholder’s debt payment.

- Acquirer: This is a financial organization with a relationship with the merchant for processing the card payment authorization and all the payments. An acquirer is part of this process because the merchant can accept credit cards of more than one brand. It also provides an electronic fund transfer to the merchant account.

- Payment Gateway: For payment authorization, the payment gateway acts as an interface between secure electronic transactions and existing card payment networks. The merchant exchanges the Secure Electronic Transaction message with the payment gateway through the internet. In response to that, the payment gateway connects to the acquirer’s system by using a dedicated network line.

- Certification Authority: It is a trusted authority that provides public-key certificates to cardholders, payment gateways, and merchants.

How Secure Electronic Transaction Works?

Secure Electronic Transaction works as follows:

Step 1: Customer Open an Account

The customer opens a credit card account like a master card or visa with a bank, i.e. issuer that supports electronic payment transactions and the secure electronic transaction protocol.

Step 2: Customer Receive a Certificate

Once the customer identity is verified (Verification can be done by using a passport, business documents or other documents), it receives a digital certificate which is issued by CA (Certificate Authority). This certificate contains customer details like name, public key, expiry date, certificate number, etc.

Step 3: Merchant Receives a Certificate

The merchant who wants to accept certain credit card brands must process a digital certificate for trustworthiness.

Step 4: Customer Place an Order

It is a shopping cart process where customers borrow an item from the available list, search for the specific item according to requirements, and place the order. Once the customer places the orders, the merchant, in return, sends the details of the order, such as a list of items selected, their quantity and price, total bill, etc., to maintain a record of the order at the customer site.

Step 5: Merchant is Verified

Merchant also sends a digital certificate to the customer to ensure the customers that they are dealing with an authorized or valid merchant.

Step 6: The Order and Payment Details Are Sent

Along with the customer’s digital certificate customer also sends an order and payment details to the merchant. The order part is used to confirm the transaction with the reference of items that are mentioned in the order form. The payment part contains the credit card( master card or visa) details. This payment information is in encrypted form; even the merchant cannot read it. The customer certificate ensures the merchant of a customer’s identity.

Step 7: Merchant Requests Payment Authorization

Once the merchant gets the customer’s payment details, it transfers them to the payment gateway via the acquirer and requests the payment gateway to authorize the payment details. This process ensures start the customer credit card is valid, and the credit limit is not breached.

Step 8: Payment Gateway Authorizes the Payment

Using the credit card information received from the merchant, the payment gateway cross verify the customer’s credit card with the help of the issuer. Based on the verification result, it either authorizes the payment or rejects the payment.

Step 9: Merchant Confirm the Order

Assuming that the payment gateway authorizes the payment, merchants send confirmation of the order to the customer.

Step 10: Merchant Provides a Goods and Services

Now the merchant provides goods and services according to the customer’s order.

Step 11: Merchant Request Payment

The merchant sends a request to the payment gateway for making payment. After that, the payment gateway interacts with various financial organizations such as the issuer, acquirer and the clearinghouse to effect the payment from the customer’s account to the merchant’s account.

Recommended Articles

This is a guide to Secure Electronic Transaction. Here we discuss how secure electronic transaction works with various steps and a list of involved participants in the SET process. You can also go through our other suggested articles to learn more –