Updated July 28, 2023

NOPAT Formula (Table of Contents)

NOPAT Formula

NOPAT (Net operating profit after Tax) is a company’s possible cash earnings if the company hasn’t raised any debt, i.e., if the company has an unlevered capital structure.

The formula for calculating NOPAT (Net Operating Profit After Tax):

Examples of NOPAT Formula (With Excel Template)

Let’s take an example to understand the calculation of NOPAT in a better manner.

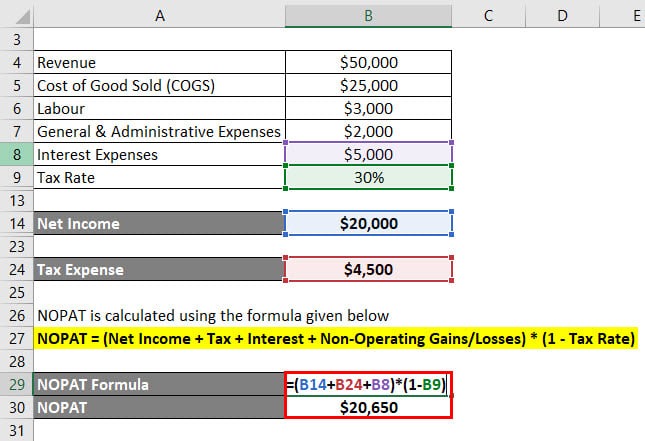

NOPAT Formula – Example #1

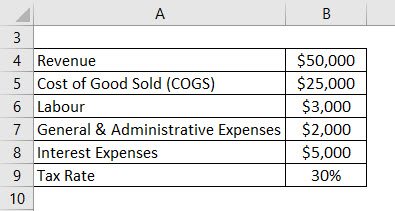

The following details have been taken from the Income Statement of the Anand Group of Companies. We need to calculate the NOPAT for the Anand Group of companies. (Note: All Amounts are in USD).

Solution:

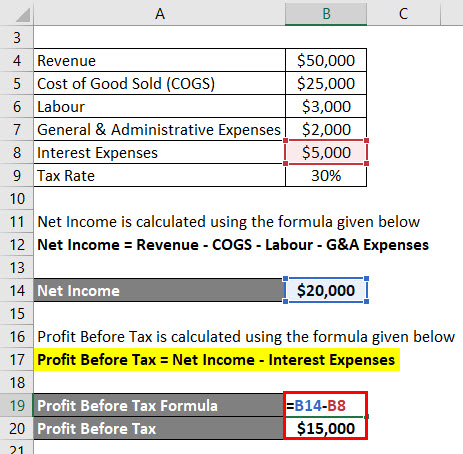

Net income is calculated using the formula given below

Net Income = Revenue – COGS – Labour – G&A Expenses

- Net Income = $50,000 – $25,000 – $3,000 – $2,000

- Net Income = $20,000

Further, We need to Calculate Tax Expenses, which are calculated on the Profit Before Tax.

Profit Before Tax is calculated using the formula given below

Profit Before Tax = Net Income – Interest Expenses

- Profit Before Tax = $20,000- $5000

- Profit Before Tax = $15,000

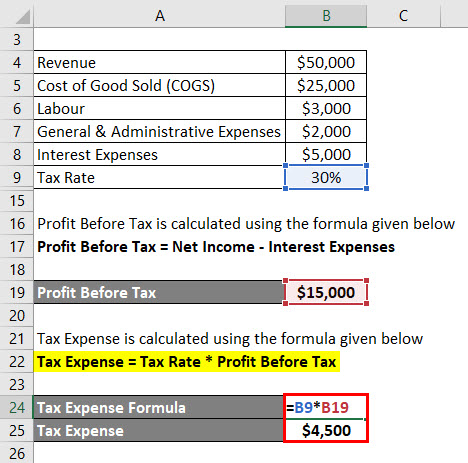

Tax Expense is calculated using the formula given below

Tax Expense = Tax Rate * Profit Before Tax

- Tax Expense= 30% * $15,000

- Tax Expense = $4,500

NOPAT is calculated using the formula given below

NOPAT = (Net Income + Tax + Interest + Non-Operating Gains/Losses) * (1 – Tax Rate)

- NOPAT = ($20,000 + $4,500 + $5,000 + 0) * (1 – 30%)

- NOPAT = $20,650

NOPAT for the Anand Group of companies is $20,650.

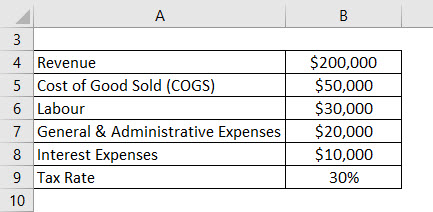

NOPAT Formula – Example #2

The following details have been taken from Jagriti & Son’s Income Statement. Now we need to calculate the NOPAT for Jagriti & Son. (Note: All Amounts are in USD)

Solution:

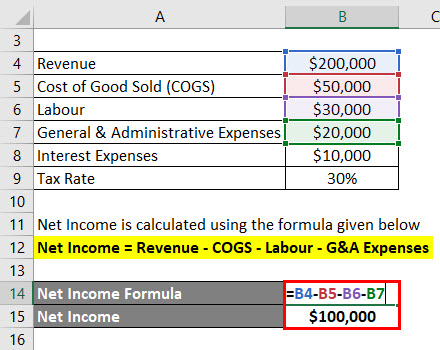

Net income is calculated using the formula given below

Net Income = Revenue – COGS – Labour – G&A Expenses

- Net Income = ($200,000 – $50,000 – $30,000 – $20,000)

- Net Income = $1,00,000

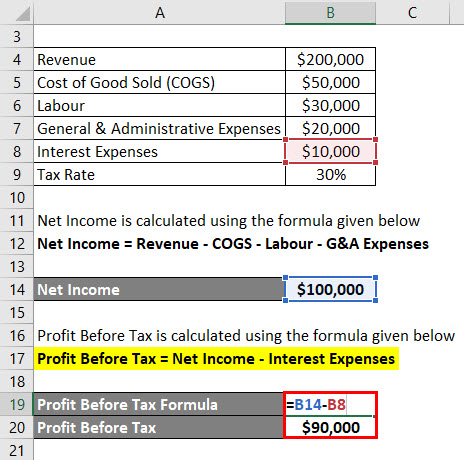

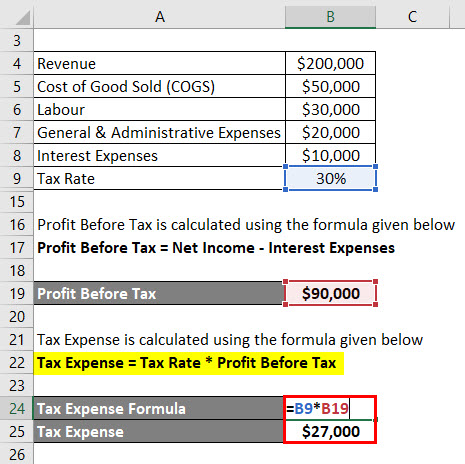

Further, We need to Calculate Tax Expenses, which are calculated on the Profit Before Tax.

Profit Before Tax is calculated using the formula given below

Profit Before Tax = Net Income – Interest Expenses

- Profit Before Tax = $100,000 – $10,000

- Profit Before Tax = $90,000

Tax Expense is calculated using the formula given below

Tax Expense = Tax Rate * Profit Before Tax

- Tax Expense= 30% * $90,000

- Tax Expense = $27,000

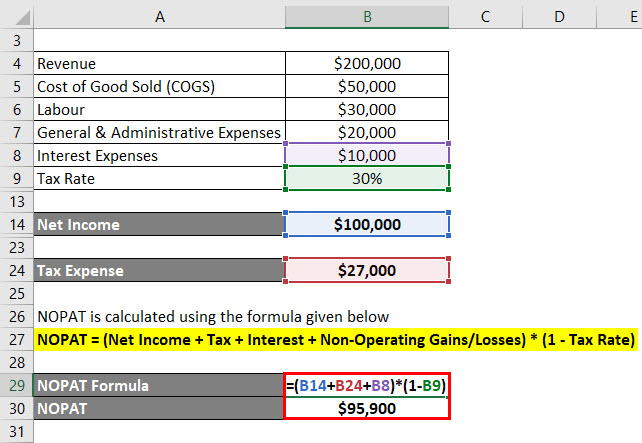

NOPAT is calculated using the formula given below

NOPAT = (Net Income + Tax + Interest + Non-Operating Gains/Losses) * (1 – Tax Rate)

- NOPAT = ($100,000 + $27,000+ $10,000 + 0) * ( 1 – 30%)

- NOPAT = $95,900

NOPAT for Jagriti & Sons is $95,900.

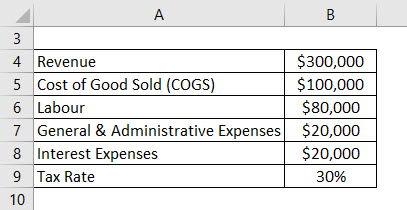

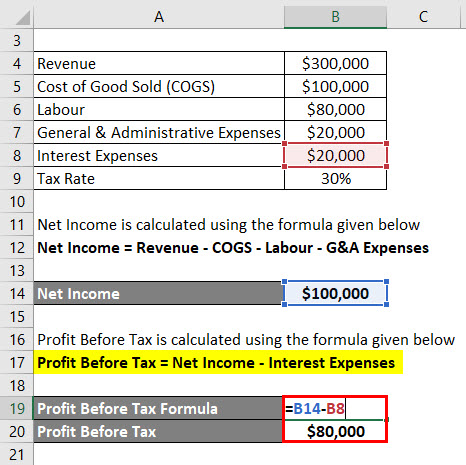

NOPAT Formula – Example #3

The following details have been taken from the Income Statement of Anand & Son’s Pvt Ltd. Now we need to calculate the NOPAT for Anand & Son. (Note: All Amounts are in USD)

Solution:

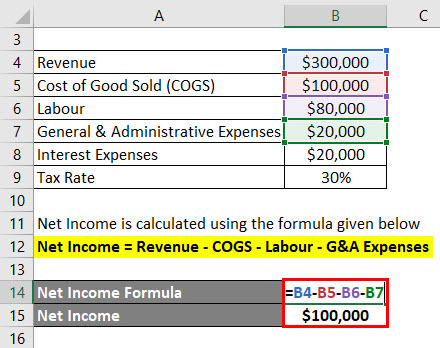

Net income is calculated using the formula given below

Net Income = Revenue – COGS – Labour – G&A Expenses

- Net Income = ($300,000 – $100,000 – $80,000 – $20,000)

- Net Income = $100,000

Further, We need to Calculate Tax Expenses, which are calculated on the Profit Before Tax.

Profit Before Tax is calculated using the formula given below

Profit Before Tax= Net Income – Interest Expenses

- Profit Before Tax = $100,000- $20000

- Profit Before Tax = $80,000

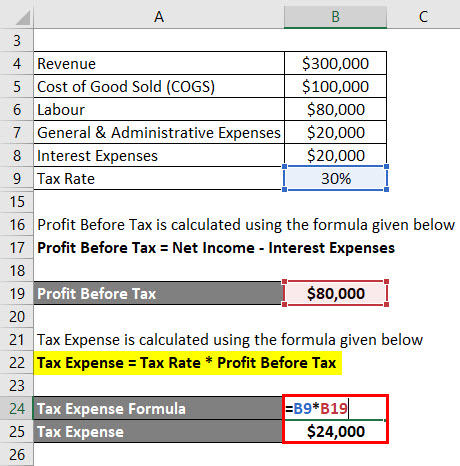

Tax Expense is calculated using the formula given below

Tax Expense = Tax Rate * Profit Before Tax

- Tax Expense= 30% * $80,000

- Tax Expense = $24,000

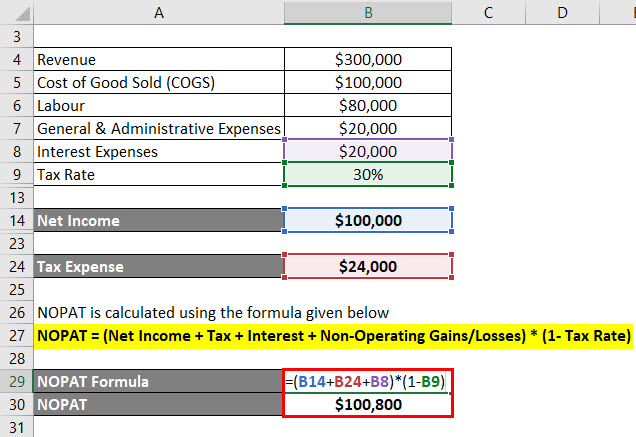

NOPAT is calculated using the formula given below

NOPAT = (Net Income + Tax + Interest + Non-Operating Gains/Losses) * (1 – Tax Rate)

- NOPAT = ($100,000 + $24,000+ $20,000 + 0) * (1 – 30%)

- NOPAT = $100,800

NOPAT for Anand & Sons is $100,800.

Explanation of Net Operating Profit After Tax Formula

NOPAT represents Net Operating Profit After Tax and speaks to an organization’s supposed to pay for tasks if it had no obligation. NOPAT is utilized to make organizations increasingly similar by expelling the effect of their capital structure. Along these lines, it’s simpler to look at two organizations in a similar industry (for example, one with no influence and the other with significant impact).

Networking benefit after duty demonstrates how well an organization performed through its center tasks, net of charges. The figure does exclude one-time charges; these don’t give a genuine description of an organization’s actual productivity. A portion of these charges may incorporate charges identifying with a merger or acquisition, which, whenever considered, don’t demonstrate a precise image of the organization’s tasks, even though they may influence the organization’s primary concern that year.

Relevance and Uses of NOPAT Formula

In financial demonstrating, Net Operating Profit After Tax is used as the starting point for calculating unlevered free income (i.e., free income to the firm FCFF).

The most widely recognized way to deal with valuation is to figure out a company’s venture esteem (rather than its value esteem), so the business’s capital structure is overlooked, and just the association’s advantages are utilized for deciding its esteem.

As you will find in the precedent underneath a DCF display, the “Limited Cash Flow” area begins with EBT, includes back premium cost, and lands at EBIT, which could be compared to Operating Profit. From that point, “money charges” are found, which depend on duplicating Operating Profit (EBIT) by the expense rate.

All the same, providing auditors with a proportion of center working proficiency without the impact of obligation, mergers and acquisitions experts utilize networking benefits after duty. They utilize this to ascertain free income to the firm (FCFF), which approaches networking benefits after responsibility and short changes in working capital. They additionally use it to estimate financial free income to the firm (FCFF), which breaks even with networking benefits after expense less capital. Both are utilized by experts searching for procurement focuses since the acquirer’s financing will supplant the ebb and flow financing course of action. Another approach to computing networking benefits after an assessment is a net gain in addition to net after-charge intrigue cost, or overall improvement in addition to net intrigue cost, duplicated by 1, less the duty rate.

NOPAT Formula Calculator

You can use the following NOPAT Calculator

| Net Income | |

| Tax | |

| Interest | |

| Non-Operating Gains/Losses | |

| Tax Rate | |

| NOPAT Formula | |

| NOPAT Formula = | (Net Income + Tax + Interest + Non-Operating Gains/Losses) * (1 - Tax Rate) | |

| (0 + 0 + 0 + 0) * (1 - 0) = | 0 |

Recommended Articles

This has been a guide to the NOPAT formula. Here we discuss how to calculate NOPAT along with practical examples. We also provide a NOPAT calculator with a downloadable excel template. You may also look at the following articles to learn more –