What is Return On Average Equity?

Return on average equity (ROAE) measures a company’s profitability by comparing its net income with the average amount of equity held by its shareholders. This ratio also tries to assess how effectively a company uses the capital of its owners. Therefore, the return on average equity formula is a subset of the more popular return on equity (ROE) ratio.

Key Takeaways

- Return on average equity (ROAE) gauges a company’s performance based on the average amount of outstanding equity held by its shareholders.

- The formula to calculate it is to divide Net Income by the Average Shareholder’s Equity.

- The higher the ratio, the more money the business makes. Analysts also use this ratio to understand the company’s various aspects like profitability, turnover, etc.

- Investors might use this formula to determine whether the company has ever provided the kind of return it anticipates and base the investment decision accordingly.

Return on Average Equity Formula

ROAE is calculated to determine the performance of an entity. We can calculate it by dividing the Net Income by the Average Shareholder’s Equity.

- Here “Net Income” means Net Profit that is distributed to equity shareholders, i.e., after subtracting all the expenses and payments to loans, debentures, and preference shares.

- “Average Shareholders Equity” means an average of shareholders’ funds or owner’s money invested in doing business in the last two years.

In general industry practice, Return on Equity is used more prominently than this ratio. However, ROAE provides a better understanding of a company’s performance, especially in a scenario of changing equity.

Examples of Return On Average Equity Formula

XYZ Company has provided the following information to calculate ROAE

- Net Income for the year = Rs. 25,000

- Shareholder’s Equity of previous year = Rs. 1,00,000

- Shareholder’s Equity of current year = Rs. 2,00,000

Let’s first calculate the Average Shareholder’s Equity

- Average Shareholder’s Equity = (Shareholder’s Equity of previous year+ Shareholder’s Equity of current year)/2

- = (1,00,000+2,00,000)/2

- = 1,50,000

Now, let’s calculate ROAE for XYZ Company,

- ROAE = Net Income / Average Shareholder’s Equity

- = 25,000/1,50,000

- = 0.1667 or 16.67%

Explanation of Return On Average Equity Formula

The Return on Average Equity Formula helps us to understand how much return an entity generates for its shareholders. Simply put, it allows us to calculate how much profit equity shareholders make by investing in the entity or for every dollar they invest.

Components of the Formula

As illustrated above, one can calculate the ROAE by dividing the previous year’s Net Income by the average shareholder’s equity.

- Net Income is the profit after tax available for distribution to the Equity Shareholder. The company’s income statement contains the net income and is the final line item on the income statement. Therefore, to derive the net income, we subtract the operating costs, extraneous expenses, etc., from the revenue and income.

- Equity represents the investment amount by equity shareholders, which is in the balance sheet. We must consider the shareholders’ equity’s beginning and ending points to calculate the average. We can compute the shareholders’ equity using a simple average using those two numbers.

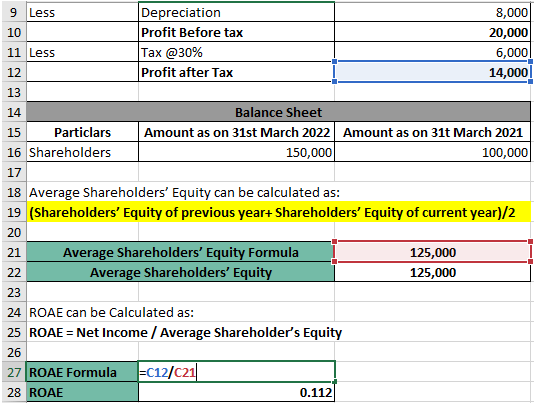

Return On Average Equity Formula in Excel (With Excel Template)

You can easily calculate the ratio using the formula in the template.

You can also download the Excel template here – Return On Average Equity Template.

Here, we use the same example in Excel. It is very easy and simple. You need to provide the inputs of the Average Shareholder’s Equity and Net Income.

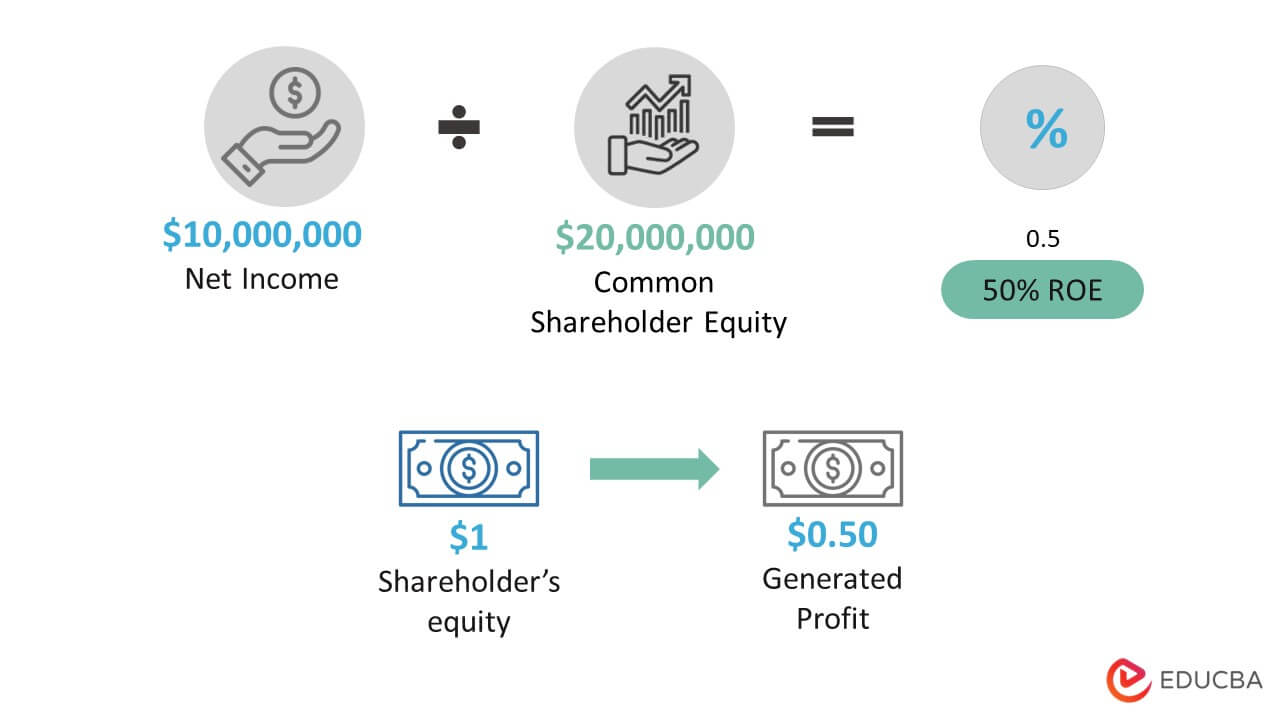

As illustrated in the spreadsheet, there is a company named VU, whose Balance Sheet and Profit and Loss Account extract are given, and we have to calculate the return on average equity.

- So, as per the formula, we first calculated Net Income, which is nothing but Profit after tax. To do so, we subtract all the expenses, including Interest and depreciation, from Net Sales and arrive at a Profit Before tax. We deduct tax and arrive at Profit After Tax.

- Similarly, we have been provided with two years’ shareholder’s equity amount in the Balance Sheet. First, we calculate the Average Shareholder’s Equity.

Then, we calculate ROAE using Formula.

ROAE vs. ROE

Here are some reasons why the ROAE ratio is better than ROE.

- In contrast to Return On Equity, which considers only the final value of shareholders’ equity, ROAE provides analysts with a more accurate picture of how well a company is doing.

- Equity holders are ultimately paid after all the expenses and debt repayments. Since the risk of investment is higher for equity investors than others, they expect higher returns than debt and preference shares.

- The end value of shareholders’ equity can occasionally be a poor predictor. Businesses might buy back shares in the final seconds of the accounting period, an internal transaction known as a share repurchase. It also involves a corporation purchasing its shares in the open market.

- Another more typical instance is dividend payment, where an owner’s equity would be less worth on the balance sheet if stockholders paid dividends before the period ended. The dividend comes from net income; even if one does not pay the dividend, one would still add all net income to the owners’ equity. Therefore, the only other amount considered as equity is the amount left after paying dividends.

In all the above-mentioned scenarios, ROAE will provide an accurate assessment of a company’s profitability compared to ROE.

Significance and Use of Return on Average Equity Formula

This ratio has significant relevance and uses for an investor evaluating investing in a company’s equity shares.

- Using this formula, they understand what kind of returns they can expect from the company if they choose to invest and then compare it with other alternative investments and returns to make the best choice.

- If the investors feel it is risky, they may expect a higher return on their investment. Hence, they could check using this formula whether the company has ever given the kind of return it expects and form their investment decision accordingly.

- The return on Average Equity formula discloses how efficiently a company manages shareholders’ money.

- If the ratio is on the higher side, it means that the entity is efficiently managing shareholders’ money.

- If the ratio is on the lower side, it indicates inefficient management of shareholders’ money by the entity’s management.

Return On Average Equity Formula Calculator

You can use the following Calculator.

| Net Income | |

| Average Shareholder's Equity | |

| Return on Average Equity (ROAE) Formula | |

| Return on Average Equity (ROAE) Formula | = |

|

|

Conclusion

Thus, the ROAE ratio aids in our comprehension of how effectively shareholders’ equity produces net income. By employing this ratio, a potential investor in common shares can gauge the company’s shareholders’ equity effectiveness. Therefore, if the ratio is higher, the shareholders’ equity is being managed and used well; if the ratio is lower, the management is not effectively managing and using the shareholders’ equity.

Frequently Asked Questions(FAQs)

Q1. What is the definition of the Return on Average equity ratio?

Answer: A measure of profitability that assesses the relationship between net income and average shareholders’ equity is the return on average equity ratio.

Q2. What is the formula for Return on Average Equity?

Answer: The return on average equity ratio is calculated by dividing the net income by the average shareholders’ equity.

Q3. What is the significance of the return on average equity ratio?

Answer: The return on average equity ratio is crucial because it gauges how effectively a business turns a profit from its assets. One can use it to evaluate a company’s performance compared to its competitors or previous performance.

Q4. How can the return on average equity ratio be interpreted?

Answer: When a company’s ROAE is high, it means that it generates more profit per dollar of stockholder equity. Additionally, it gives the analyst knowledge about the organization’s levers for generating higher returns, including profitability.

Q5. How does Return on Average Equity (ROAE) differ from Return on Equity?

Answer: Return on Average Equity is a financial metric that gauges a company’s performance using the average amount of outstanding equity held by shareholders. Return on equity (ROE), a performance indicator, is computed by dividing net income by the balance sheet’s final shareholders’ equity value.

Recommended Articles

This has guided the Average Equity Formula; we discussed its uses and practical examples here. We also provide a downloadable Excel template.