Return on Average Assets Formula

The Formula of Return on Average Assets can be calculated by dividing Company’s Annual Net Income to its Average Total Assets.

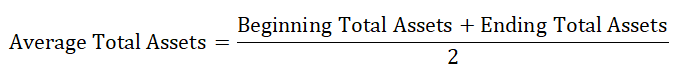

Average Total Assets is calculated using the below formula

In every case, it is not mandatory to have average total assets. In most cases, return on assets is also used. It is given below.

Generally, banks and other financial institutions utilize a return on average assets to evaluate their performance. Periodic calculations, such as quarters and years, are performed at period ends. The return on average assets does not show all the lows and highs. It is, rather, just an average of the period under consideration.

Explanation of Return on Average Assets

The return on average assets ratio is expressed as a percentage of all average assets. The return on Average assets ratio, often called the return on total assets, is a profitability ratio that calculates the net income produced by total assets during a given period by comparing the net income to the average total assets of the company. In simple words, the ROA or return on assets ratio calculates how efficiently a firm or management of a company can manage its assets to produce profits during a given period. In short, the return on Average assets ratio measures how profitable a firm’s assets are.

The return on average assets assumes that the beginning and ending asset statistics reflect the real asset levels retained daily, which is not necessarily the case. If the Return on Average Assets is lower, it can easily be concluded that the firm is more asset-intensive. On the other hand, if the Return on Average Assets is higher, the firm is lower asset-intensive.

Examples of Return on Average Assets Formula

Suppose ABC Company earns $ 4,000 as annual net income while average assets are $40,000.

Return on Average Asset can be calculated as:

- Return on Average Asset = (Net income)/(Total Average Asset)

- Return on Average Asset = ($ 4,000)/($ 40,000)

- Return on Average Asset = 10 %

This indicates that the ABC Company has $0.1 of net income for every dollar of invested assets. Compare return on assets with peers in the same industry, as return on assets exhibits stark differences across various industries. So, it is wise to compare the return on assets with its peers for a good comparison.

Assume that XYZ company earns a total annual Net Income of $ 100,000 while beginning total assets are $600,000 and ending total assets are $500,000 to calculate Return on Average Assets,

Firstly, we will add the beginning and ending total assets and then take the average total assets.

- Average Total Assets=(Beginning Total Assets+ Ending Total Assets)/2

- The average total assets = ($ 600,000 + $ 500,000) / 2

- The average total assets = $ 550,000

According to the Return on Average Assets formula, we get

- Return on Average Assets = Net Income / Average Total Assets

- Return on Average Assets = $ 100,000 / $ 550,000

- Return on Average Assets = 18.18 %

Company XYZ earns 18.18 % of its total assets.

Suppose company ABC & XYZ operates in the same industry. If we compare company ABC & company XYZ, company XYZ utilizes its assets more efficiently than company ABC. Company XYZ has more earnings on assets than Company ABC. As an investment analyst, investing in a company that utilizes its assets efficiently makes more sense.

Significance and Use of Return on Average Assets Formula

The return on Average Assets formula is an indicator that helps to assess how profitable a company is relative to its total annual assets. Return on Average Assets is a type of Return on investments, so it helps to indicate a company’s performance. Return on Average Assets gives an idea to an analyst, investors, and managers of how efficiently management uses its assets to improve earnings. It generates the profitability of a business in relation to its total annual assets.

Return on Average Assets shows how efficiently management or a company can convert the money used to purchase total assets into profits or net income. It makes sense that a higher ratio is more favorable to the management and investors because it shows that the firm is more effectively operating its assets to produce greater amounts of net profit. For the management, the return on Average Assets ratio is also important because the ratio can tell a lot about the firm’s performance, and by comparing the ratio with similar companies under one industry, management should be able to understand how well the firm is doing.

Return on Average Assets Calculator

You can use the following Return on Average Assets Calculator

| Annual Total Income | |

| Average Total Assets | |

| Return on Average Assets Formula | |

| Return on Average Assets Formula | = |

|

|

Return on Average Assets Formula in Excel (With Excel Template)

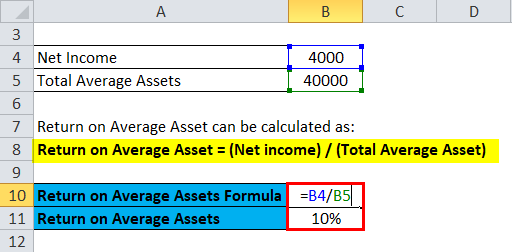

Here, we will do the same example of the Return on Average Assets formula in Excel. It is very easy and simple. You need to provide the three inputs i.e. Net Income and Total Average Asset.

You can easily calculate the Return on Average Assets using the Formula in the template provided.

In the First Example, We calculate the Return on Average Assets using Formula

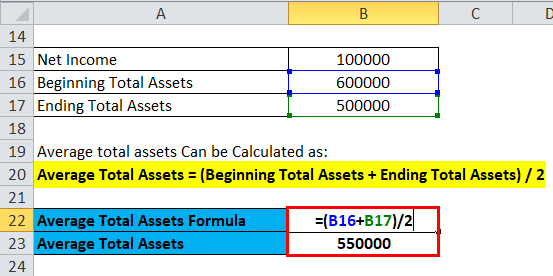

In the Second Example,

first, we calculate the Average total assets.

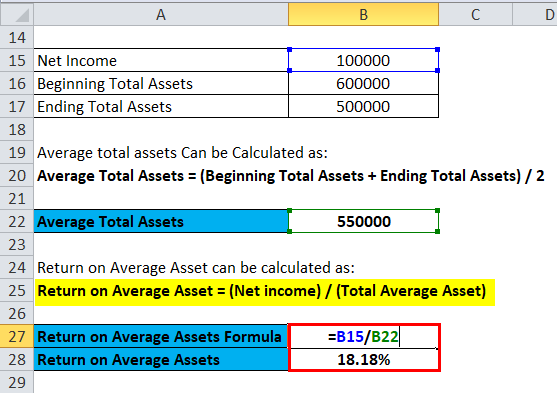

Then, we calculate the Return on Average Assets using Formula

Recommended Articles

This has been a guide to a Return on Average Assets formula. Here, we discuss its uses along with practical examples. We also provide a Return on Average Assets Calculator with a downloadable Excel template. You may also look at the following articles to learn more –