Updated July 27, 2023

Return on Total Assets Formula (Table of Contents)

What is Return on Total Assets Formula?

The term “Return on Total Assets” refers to the financial ratio used as an indicator to check how well a company can use its assets to generate earnings during a specific period.

In other words, it measures the profitability of the company’s available assets. The Return on Total Assets can be derived by dividing the company’s earnings before interest and taxes (EBIT) by its average total assets. Mathematically, it is represented as,

Examples of Return on Total Assets Formula (With Excel Template)

Let’s take an example to understand the calculation of the Return on Total Assets in a better manner.

Return on Total Assets Formula – Example #1

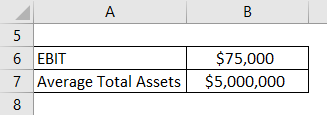

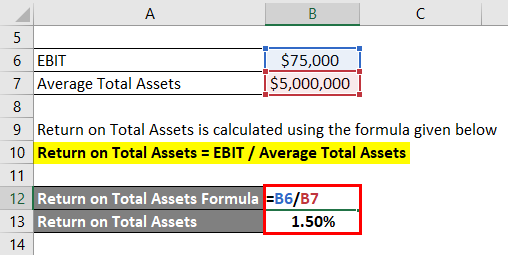

Let us take the example of a company with reported earnings before interest and taxes (EBIT) of $75,000 as per the income statement. As per the balance sheet for the year ending on December 31, 2018, the average total assets of the company stood at $5,000,000. Calculate the Return on Total Assets for the company during the period.

Solution:

The formula to calculate Return on Total Assets is as below:

Return on Total Assets = EBIT / Average Total Assets

- Return on Total Assets = $75,000 / $5,000,000

- Return on Total Assets = 1.50%

Therefore, the company reported a Return on Total Assets of 1.50% during the period.

Return on Total Assets Formula – Example #2

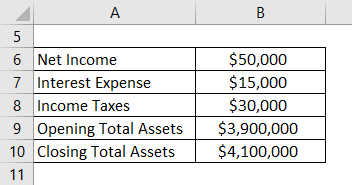

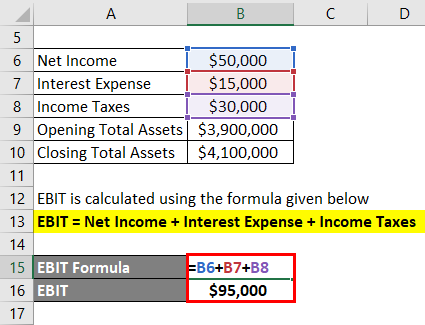

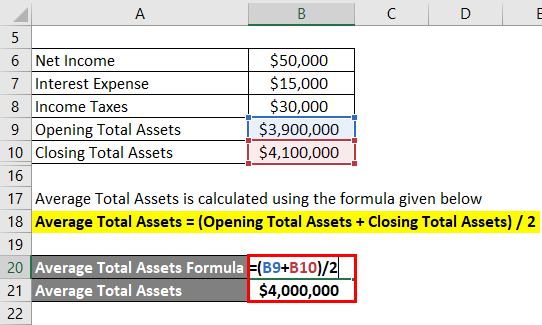

Let us take the example of ABC Ltd, which reported a net profit of $50,000 on a turnover of $500,000. Per its income statement, the interest expense and income taxes stood at $15,000 and $30,000, respectively. Further, as per the balance sheet, the opening and closing value of the total assets is $3,900,000 and $4,100,000, respectively. Calculate the Return on Total Assets for ABC Ltd based on the latest reported financials.

Solution:

The formula to calculate EBIT is as below:

EBIT = Net Income + Interest Expense + Income Taxes

- EBIT = $50,000 + $15,000 + $30,000

- EBIT = $95,000

The formula to calculate Average Total Assets is as below:

Average Total Assets = (Opening Total Assets + Closing Total Assets) / 2

- Average Total Assets = ($3,900,000 + $4,100,000) / 2

- Average Total Assets = $4,000,000

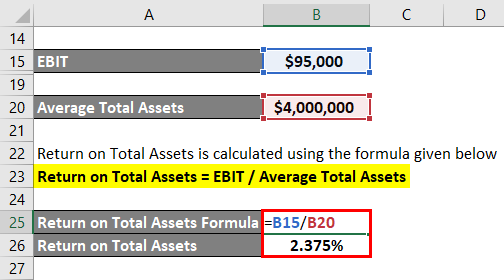

The formula to calculate Return on Total Assets is as below:

Return on Total Assets = EBIT / Average Total Assets

- Return on Total Assets = $95,000 / $4,000,000

- Return on Total Assets = 2.375%

Therefore, ABC Ltd managed a Return on Total Assets of 2.375% during the last reported year.

Return on Total Assets Formula – Example #3

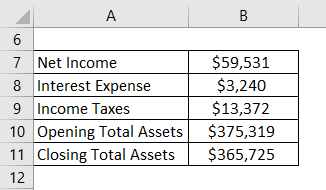

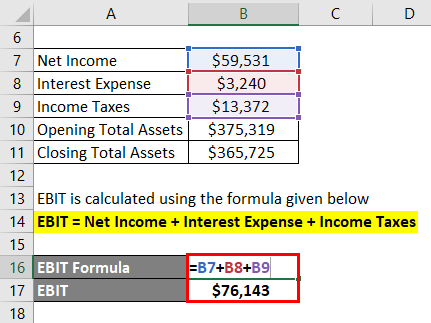

Take the real-life example of Apple Inc., which reported a net income of $59,531 Mn during the last reported financial year. As per the annual report for the year ending September 29, 2018, the interest expense and provision for income taxes for the year stood at $3,240 Mn and $13,372 Mn, respectively. Further, the total asset at the beginning and end of the year stood at $375,319 Mn and $365,725 Mn, respectively. Calculate the Return on Total Assets for Apple Inc. based on the information.

Solution:

The formula to calculate EBIT is as below:

EBIT = Net Income + Interest Expense + Income Taxes

- EBIT = $59,531 Mn + $3,240 Mn + $13,372 Mn

- EBIT = $76,143 Mn

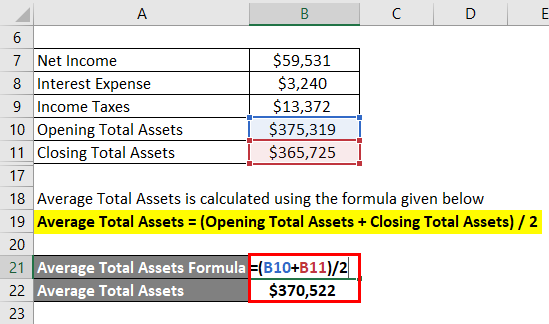

The formula to calculate Average Total Assets is as below:

Average Total Assets = (Opening Total Assets + Closing Total Assets) / 2

- Average Total Assets = ($375,319 Mn + $365,725 Mn) / 2

- Average Total Assets = $370,522 Mn

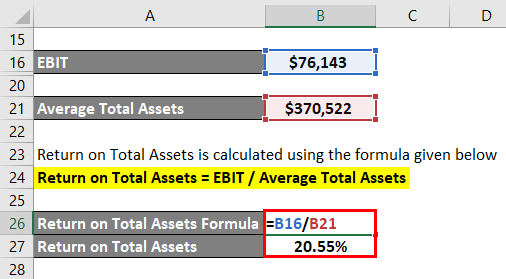

The formula to calculate Return on Total Assets is as below:

Return on Total Assets = EBIT / Average Total Assets

- Return on Total Assets = $76,143 Mn / $370,522 Mn

- Return on Total Assets = 20.55%

Therefore, Return on Total Assets for Apple Inc. stood at 20.55% for the year ending on September 29, 2018.

Explanation

The formula for Return on Total Assets can be derived by using the following steps:

Step 1: First, calculate the company’s net income from its income statement. Next, determine the interest expense incurred and corporate taxes paid during the year. Add the interest expense and tax to the net income to compute the company’s EBIT.

EBIT = Net Income + Interest Expense + Tax

Step 2: Next, determine the company’s total assets at the beginning and the end of the current year. The total assets include short-term and long-term assets for the period under consideration. Now, add the values for total assets and divide by 2 to arrive at the average total assets.

Average Total Assets = (Opening Total Assets + Closing Total Assets) / 2

Step 3: Finally, the formula for Return on Total Assets can be derived by dividing the company’s EBIT (step 1) by its average total assets (step 2), as shown below.

Return on Total Assets = EBIT / Average Total Assets

Relevance and Uses of Return on Total Assets Formula

It is one of the important profitability metrics that allows an analyst to assess the effectiveness of a company in its asset utilization. A higher Return on Total Assets value indicates favorable healthy asset utilization to produce greater earnings, eventually attracting investors. Inherently, a positive ratio signifies an upward trend for profit.

The ratio can be used to compare companies of the same scale and in a similar industry. However, comparing companies from different industries is meaningless as asset utilization varies significantly.

Return on Total Assets Formula Calculator

You can use the following Return on Total Assets Calculator

| EBIT | |

| Average Total Assets | |

| Return on Total Assets Formula | |

| Return on Total Assets Formula | = |

|

|

Recommended Articles

This is a guide to the Return on Total Assets Formula. Here we discuss calculating the Return on Total Assets and practical examples. We also provide a Return on Total Assets calculator with a downloadable Excel template. You may also look at the following articles to learn more –