Price to Book Value Formula

The price-to-book value formula can be defined as the market value of a firm’s equity divided by the book value of its equity. It is also called market to book ratio.

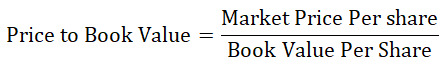

Here’s the price-to-book value Formula –

Example of Price to Book Value Formula

Let’s take an example to find out the price-to-book value ratio for a company X: –

The book value per share can be found by dividing the Book Value of the Equity of the company by the total shares outstanding in the market.

- Book Value of Equity = Total Assets – Total Liabilities

- Book Value of Equity = Total Shareholder’s equity in the company

- Assuming the Book Value of Assets for company X = Rs 30 million

- Total Shares Outstanding in the market = 1 million

- Market Share price = Rs 100

Hence,

Book Value per share is calculated as

- Book Value per share = Book Value of Equity / Total Shares Outstanding

- Book Value per share = 30 / 1

- Book Value per share = Rs 30 per share

Price to Book Value is calculated as

- Price to Book Value = Market price per share / Book Value per share

- Price to Book Value = Rs 100 / Rs 30

- Price to Book Value = 3.33

Taking assumed values for the following: –

|

Company |

P/B Value |

|

X |

3.33 |

|

Y |

5 |

|

Z |

7 |

|

Industry Average |

5 |

A comparison of P/B is generally made between the peer group and the industry average. Company X has a P/B lower than the industry average and lower than its peer group, which highlights that X might be undervalued. Company Y has a P/B equal to industry-valued, and it can be assumed that Y’s stock is correctly valued. Company Z has a P/B greater than its peer group and higher than the industry average. Hence, it can be assumed that the company’s stock is overvalued in the market. But it must be remembered that P/B is one of the indicators for the valuation of a company or stock. Still, it should not be the sole criterion to judge whether a stock is overvalued or undervalued.

Explanation

Price to Book Value alone indicates nothing substantial about the company’s financial health. In relative valuation, analysts compare companies operating in a similar industry. Analysts consider firms as value stocks if they have low price-to-book values compared to their peers, while they classify firms as growth stocks if they exhibit high price-to-book values. The more optimistic the investors are about the firm’s future growth, the greater its price-to-book value ratio.

Price to Book Value is generally the preferred metric for financial companies, banks, etc. This is because, due to regulations, they have to mark to market their assets regularly; their book value accurately reflects the market value of their assets. This is not true for other companies; hence, the price-to-book value becomes an essential metric when comparing financial companies.

Investors make adjustments to the P/B ratio when comparing different stocks. One adjustment involves using tangible book value and subtracting intangible assets from the equity’s book value. Goodwill and patents are intangible assets that need to be removed from the book value of equity for better comparison. Also another example of adjustments is the removal of off-balance sheet assets and liabilities. Comparing the P/B ratios of companies within the same industry requires making inventory adjustments. Companies using First In First Out (FIFO) for inventory valuation cannot be compared with those using Last In First Out (LIFO) for their inventory valuation.

Advantages of Price to Book Value Formula

The advantages of using the Price Book Value ratio Formula are: –

- Book value is an amount that is generally positive even when the company reports a loss in its Profit and Loss statement. Hence, P/B is an effective measure in comparing companies when P/E cannot be used for these firms.

- Book value does not frequently change, which is useful in comparing companies whose EPS is particularly low, high, or volatile.

- Valuing banks, financial companies, etc., effectively relies on the book value as it provides a meaningful comparison, given that these entities frequently mark their assets to market.

- P/B measure is effective in the valuation of companies that are about to go out of business.

- P/B can be useful in valuing companies expected to go out of business.

- Research suggests that P/B explains the dissimilarities in long-run average stock returns.

Disadvantages of Price to Book Value Formula

Some of the disadvantages of using the price-to-book value ratio formula include: –

- One of the disadvantages is that P/B doesn’t accurately reflect intangible economic assets e.g. human capital.

- There are sometimes significant differences in the business models of various firms operating in the same industry. For example, a company might be outsourcing its production. Hence, this firm will have fewer assets and lower book value, which would overstate its P/B value than another company doing its in-house production.

- Also, various accounting conventions used by different companies can conceal the true investment in the company by its shareholders, which decreases the comparability of P/B across firms and countries. For example: – In the United States, the convention followed is that Research and Development costs are expensed, which can understate capital investment.

- External factors such as inflation and technological changes can significantly alter the book and market value of assets, decreasing the importance of book value as a measure of shareholder’s investment. This would decrease the comparability between firms using the P/B ratio.

Price to Book Value Formula Calculator

You can use the following Price to Book Value Calculator

| Market Price per Share | |

| Book Value per Share | |

| Price to Book Value Formula= | |

| Price to Book Value Formula= | = |

|

|

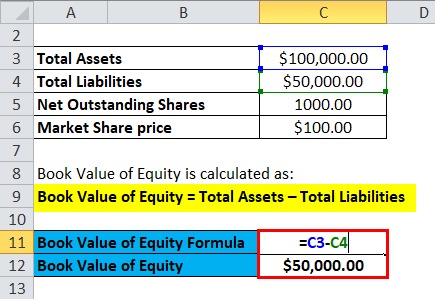

Price to Book Value Formula in Excel (With Excel Template)

Here, we will do the same example of the price-to-book value formula in Excel. It is very easy and simple. You need to provide two inputs, i.e, Market price per share and Book Value per share

You can easily calculate the Price to Book Value using Formula in the template provided.

First, we need to Calculate the Book Value of Equity.

Then, we need to calculate the Book Value per share

Now, we can calculate Price to Book Value using the Formula

Conclusion

Value investors generally use the P/B ratio since the basic foundational belief of value investing is that markets are inefficient. The market price of a share does not incorporate the company’s actual book value. A P/B ratio below the market averages may suggest the firm is undervalued, offering a buying opportunity.

Recommended Articles

This has been a guide to a Price Book Value Formula. Here, we discuss its uses along with practical examples. We also provide a Price to Book Value Calculator with a downloadable Excel template. You may also look at the following articles to learn more –