Updated July 28, 2023

Difference Between Average Cost vs Marginal Cost

In accounting, costing is an important concept: a cash amount assigned to an asset. Cost is the amount paid to get assets ready for use. So, in short, the cost is the expenses incurred to produce one product unit. Average cost vs Marginal cost is the different type of cost technique used to calculate the production cost of output or product. Breaking down costs into an average and marginal cost is important because each method offers insight into the firm. Now we learn the concept of Average Cost vs Marginal Cost.

Average Cost

Definition: It is the total cost of making a single product calculated by dividing the Total cost by the number of products manufactured. The most important components of average cost are fixed cost and Variable cost. It is also called Unit cost.

Formula

The above formula shows that the average cost is directly related to the number of units manufactured; If it is increased, the average cost per unit will decline; If it is decreased, the average cost per unit will increase.

Marginal Cost

Definition: It is a cost incurred due to the change in total cost due to an increase in the unit of product. So it is an additional or extra cost due to an increase in the production of one more product unit. The most important component of marginal cost is the variable cost of production. Marginal cost plays an important role in the business decision-making process. When the company performs a financial analysis that evaluates the pricing of each product offered to consumers, that time management console marginal costing analysis.

Formula

The total cost can be increased or decreased while producing one extra product unit.

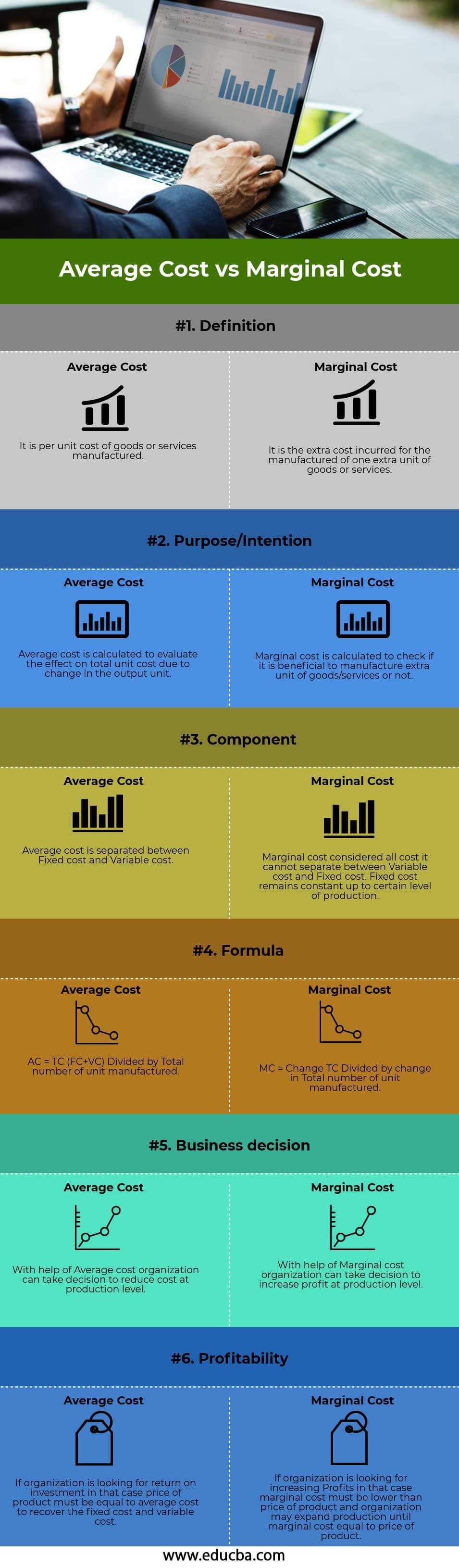

Head to Head Comparison Between Average Cost vs Marginal Cost (Infographics)

Below is the top 6 difference between Average Cost vs Marginal Cost

Key Differences Between Average Cost vs Marginal Cost

Let us discuss some of the major differences between Average Cost vs Marginal Cost:

- The average cost is the total cost divided by the number of units manufactured, which shows the result per unit cost of the product. In contrast, Marginal cost is the extra cost generated while producing one or some extra units of products, and it is calculated by dividing the change in total cost by Chang in the total manufactured unit.

- Marginal cost considers all cost that fluctuates during the level of production, and fixed cost remain constant up to a certain level of production, whereas Average cost considers Fixed cost and Variable cost. In Average cost, both Fixed and Variable cost is product cost, whereas, in margin cost, Fixed cost is considered period cost, and Variable cost is product cost.

- Average cost calculates the effect on the total unit due to a change in output level. In contrast, marginal cost is calculated to determine if producing one extra unit of product is profitable.

- The average cost method is also called a weighted average method, and the Marginal cost method is also called variable costing.

- Both average and marginal costs are measured under the same units and obtain the result from Total cost.

- The marginal cost technique is useful if an objective is to increase profit during the production level. When an objective is to reduce cost during production level, in that case, the Average cost technique is used.

Average Cost vs Marginal Cost Comparison Table

Let’s look at the top 6 Comparison between Average Cost vs Marginal Cost

|

Description |

Average Cost |

Marginal Cost |

| Definition | It is per unit cost of goods or services manufactured. | Manufacturing one extra unit of goods or services is the extra cost incurred. |

| Purpose/Intention | The average cost is calculated to evaluate the effect on total unit cost due to the change in the output unit. | Marginal cost is calculated to check if it is beneficial to manufacture an extra unit of goods/services or not. |

| Component | The average cost is separated between Fixed cost and Variable cost. | Marginal cost considers all costs. It cannot separate between Variable cost and Fixed cost. Fixed cost remains constant up to a certain level of production. |

| Formula | AC = TC (FC+VC) Divided by the Total number of units manufactured. | MC = Change TC Divided by change in the Total number of units manufactured. |

| Business decision | With the help of Average cost, an organization can reduce cost at a production level. | With the help of Marginal cost, an organization can decide to increase profit at the production level. |

| Profitability | If an organization is looking for a return on investment, in that case, the price of the product must be equal to the average cost to recover the fixed cost and variable cost. | If an organization is looking to increase Profits, in that case, the marginal cost must be lower than the product’s price, and the organization may expand production until the marginal cost is equal to the price. |

Conclusion

Marginal cost vs Average cost are both costing techniques used to calculate the product cost incurred while manufacturing. It helps an organization set the product’s final price and cover all its expenses through it. The marginal cost method helps an organization to increase profitability at the production level, and the Average cost method helps an organization to reduce cost at the production level. The average cost helps to understand how much expenses are incurred while producing a single product, and the Marginal cost helps to understand how much extra cost will incur while producing one extra product unit.

Marginal cost does not depend on fixed cost because it does not change with output or remains constant up to a certain production level, whereas variable cost changes with the output; in short, marginal cost is due to the change in variable cost. The average cost considers the product’s fixed and variable costs, called Total cost.

The average cost and Marginal cost affect each other as the production varies. When the average cost decreases in that case, the marginal cost is less than the average cost and vice versa, and when the average cost is the same or constant in that case, both are equal to each other. Marginal cost plays an important role in economics as it shows the costs at a definite point. Even though the average and marginal cost is an important concepts for an organization, the time pricing of products with this method leads to a significantly different result.

Recommended Articles

This has been a guide to the Top difference between Average Cost vs Marginal Cost. Here we also discuss the key differences between the Average Cost vs Marginal Cost with Infographics and a Comparison table. You may also have a look at the following articles to learn more –