Updated July 26, 2023

Difference Between Accounting vs CPA

Accounting and CPA are essential elements of business functions, and both terms have an important distinction. If your business has reached a place where you need someone to handle the financial aspects of your company, but you are not sure if you need to hire an accountant or CPA, in that case, it is important to know the key differences between Accounting vs CPA so that you can make the right decision.

So below, the description of the difference between the two terms will help you figure out who you need now.

Accounting

Accounting is a system of preparing accounting records by collecting data, summarizing it properly, analyzing collated data, and finally, reporting in the financial statement. In short, accounting is the language of business.

The person who does the accounting function is the accountant. The accountant is the one who does the day-to-day work within a business. In general, knowing how your business is performing, you need an accountant.

Most accountants hold a bachelor’s degree and can perform a wide range of services by undertaking some training and experience. Accountants work on the past (Financial Reporting, Auditing, Tax Computation), present (Internal control, Risk Management, Regulatory compliance), and future (Costing, Budgeting, Performance Management).

CPA

CPA is a Certified Public Accountant is an account too, but they have obtained a license from a State Board of Accountancy. CPAs are trusted financial advisors who help individuals, businesses, and other organizations plan and reach their financial goals. All CPAs are accountants, but all accountants are not CPAs. In short, CPAs can do all tasks which an accountant does.

The main requirements for CPA Licensure are three E’s that is a) Education {Four years of accounting education}, b) Examination {Uniform CPA Examination}, and C) Experience {Depends on the state to state}. State Boards of accountancy determine the laws and rules for each state or jurisdiction. In most US states, only proper CPAs can provide opinions on financial statements. A certain expectation level comes along when CPA is attached to the end of your name.

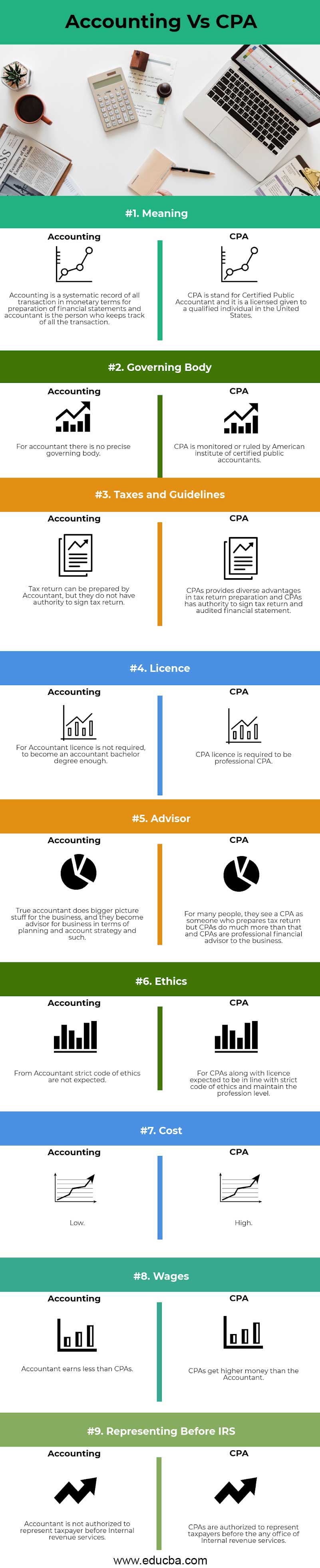

Head To Head Comparison Between Accounting vs CPA (Infographics)

Below are the top 9 differences between Accounting vs CPA:

Key Differences Between Accounting vs CPA

Let us discuss some of the major differences between Accounting vs CPA:

License

- One of the major differences between an accountant vs CPA is that to become an accountant Licence is not required. However, a Professional CPA license is necessary.

- Certified Public Accountant takes an effort of 150 Credits hours in academic courses, either one an undergraduate level or a master level, and they also sit for four parts uniform CPA exam.

- Accountants may have certain specializations. They might be certified management accountants or auditing. However, this certification is much different than the license CPAs hold.

- CPAs are trusted advisors who pass a rigorous exam, meet important experience requirements, and continually take courses to maintain their licenses.

Function

- The primary function that CPAs carry out is assurance services or public accounting. In the assurance service category, CPAs attest financial statements. However, the accountant does have the authority to attest financial statements.

- The main role of the accountant is the planning of the future, auditing of accounts, and maintenance of books of accounts but CPAs who work as consultants do not work as auditors.

- CPAs are business advisors and tax and personal financial planning consultants, which accountants can plan in a systematic way.

Income Tax Preparation and Representing Client

- CPAs also have a niche within the income tax preparation industry. They offer defined services to the client, which accountants cannot provide.

- CPAs may represent taxpayers (Clients) in matters before the Internal Revenue Service; however, the authority to represent taxpayers before the Internal Revenue Service.

Ethics

- It is important for CPAs to follow ethics which means making decisions about accounts and finance in line with the code of ethics, which are integrity, objectivity, confidentiality, etc.

- It is the responsibility of CPAs to exercise sensitive and moral judgments in all their activities.

- So, CPAs have to rise to high education and ethical level and are subject to continuous learning requirements, which is not the case with accountants.

Accounting vs CPA Comparison of Table

Let us discuss the topmost differences between Accounting vs CPA:

| Difference | Accounting | CPA |

| Meaning | Accounting is a systematic record of all transactions in monetary terms for the preparation of financial statements, and an accountant is a person who keeps track of all the transactions. | CPA stands for Certified Public Accountant, and it is a license given to a qualified individual in the United States. |

| Governing Body | For an accountant, there is no precise governing body. | CPA is monitored or ruled by the American Institute of certified public accountants. |

| Taxes and Guidelines | An Accountant can prepare the tax return, but they do not have the authority to sign it. | CPAs provide diverse advantages in tax return preparation, and CPAs have the authority to sign the tax return and audited financial statements. |

| License | An Accountant license is not necessary. To become an accountant bachelor’s degree is enough. | A CPA license is required to be a professional CPA. |

| Advisor | A true accountant does bigger picture stuff for the business, and they become an advisor for the business in terms of planning and account strategy. | For many people, they see a CPA as someone who prepares tax returns, but CPAs do much more than that, and CPAs are professional financial advisors to the business. |

| Ethics | From an Accountant, a strict code of ethics is not expected. | CPAs, along with licenses expected to be in line with a strict code of ethics and maintain a professional level. |

| Cost | Low | High |

| Wages | Accountant earns less than CPAs. | CPAs get higher money than accountants. |

| Representing Before IRS | An accountant is not authorized to represent the taxpayer before the Internal Revenue Service. | CPAs are authorized to represent taxpayers before any office of the Internal Revenue Service. |

Conclusion

So if you are in the early stage of your business or just starting out, a really good accountant will justify your need. You need to bring in CPAs. If you are operating a non-profit, let’s say your revenues exceed in higher amounts than you need a CPAs, or your business grows that you are ready to take publicly, then you will need CPAs. Otherwise, a really good accountant can support your business growth.

CPAs should possess full business knowledge than the accountant. CPA is much more costly than an accountant, and it takes time to get a CPA license. But CPAs get paid much higher than accountants when it comes to salary. Not all accountants are certified public accountants, but all CPAs are accountants.

Recommended Articles

This has been a guide to Accounting vs CPA. Here, we have to discuss the Accounting vs CPA key differences with infographics and a comparison table. You can also go through our other suggested articles to learn more –