Updated July 26, 2023

Definition of Operating Expense Example

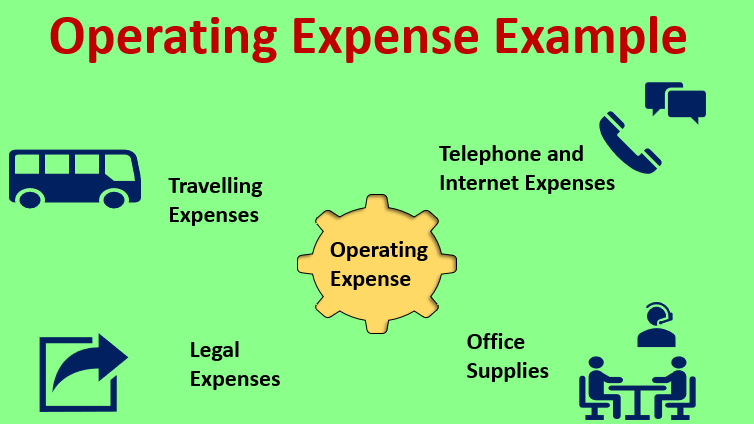

Expenses incurred in the normal course of operations of a business are known as operating expenses. The definition of operating expense example is a loose one. Some consider only selling, general and administrative expenses (SG&A) as operating expenses. Thus, they do not include the Cost of Goods Sold (COGS) as operating expenses. However, some people also consider COGS as operating expenses.

Example of Operating Expense

Examples of Operating expenses are as follows:

#1 – Travelling Expenses

Whenever company employees go on official visits, they incur traveling expenses, which the company later reimburses. Employees can use various modes of transport, such as buses, cars, and trains, for their travel. They incur these expenses while meeting clients or prospective clients to pitch goods and services, sourcing raw materials and supplies, and engaging with outside parties like bankers, government officials, and regulatory agencies. Additionally, travel expenses are incurred for attending meetings, training, and conferences.

It is essential to have a proper travel policy in place within the organization. The department travel coordinator, direct supervisor, finance department, or approving official generally approves travel expenses by the organization’s travel policy. These officials ensure compliance with the policy and timely submission of reimbursement requests. Implementing an electronic system for travel expense reimbursements is a recommended practice as it increases efficiency in the approval process.

#2 – Legal Expenses

The Profit and Loss Account records only legal fees incurred in connection with business, excluding personal legal fees of employees and owners. The company incurs advocate and consultant fees for legal services related to its operations. It also pays for postage, photocopying, court filing, and telephone charges. The company recovers the traveling expenses of lawyers. Legal expenses are recorded in the year they are incurred, even if billed in a different year, and are recognized as liabilities in the Balance Sheet. Advance payments for legal services are treated as current assets until the service is rendered.

#3 – Telephone and Internet Expenses

The costs for internet, including Wi-Fi/broadband connection, as well as landline and mobile phones, incur monthly charges that individuals generally pay. The company often reimburses employees for their telephone expenses. The bill for these services must be paid to telephone service providers such as Verizon Communications, AT&T, CenturyLink, Vodafone, etc. These service providers offer a variety of plans, including Unlimited Calling and Data for heavy users. Some plans include a certain number of free calls and data, and additional charges apply if the usage exceeds the limit.

Some expenses are prepaid through a mobile phone plan, while others are post-paid, where the expenses are paid the following month. In both cases, the expenses are adjusted for the current period, following the accrual accounting system. For example, if $100 is paid in December 2018 for a pre-paid plan covering January 2019, the expenses should be charged to the Profit and Loss Account for January 2019. Similarly, if expenses are related to December 2018 and paid in January 2019 through a postpaid plan, they should be charged to the P & L in December.

#4 – Office Supplies

Operating expenses include the expenses incurred on purchasing office supplies. Office supplies include paper, printing cartridges, stamp pads, pens, pencils, staplers, pins, envelopes, etc. The organization incurs these administrative expenses. One method of accounting involves treating all office supplies as expenses. Another method entails recording the unused supplies in an asset account and charging them to an expense account as and when they are used. Generally, when the amount of office supplies used is small, it is debited to expense without treating it as an asset. Prepaid expenses should be adjusted for office supplies as well.

Conclusion

The Profit and Loss Account debits operating expenses, but one must adjust these expenses for prepaid and outstanding expenses. Calculating operating expenses accurately is essential to ensure the reliability of the resulting profit figure. Typically, organizations create a budget for operating expenses at the beginning of a period and compare it with the actual operating expenses.

Implementing a control system is necessary to prevent wastage in operating expenses. The adequacy of these control systems gets assessed during regular internal audits conducted by the enterprise. When auditing operating expenses, verifying the maintenance of proper invoices and ensuring a suitable approval process for expenses is crucial. Occasionally conducting surprise audits of operating expenses is considered good practice. Moreover, it is essential to be cautious and avoid paying fictitious vendors.

Recommended Articles

This is a guide to the Operating Expense Example. Here we discuss the overview and example of Operating Expense with a detailed explanation. You can also go through our other suggested articles to learn more –