Updated July 31, 2023

Sales Revenue Formula (Table of Contents)

- Sales Revenue Formula

- Examples of Sales Revenue Formula (With Excel Template)

- Sales Revenue Formula Calculator

Sales Revenue Formula

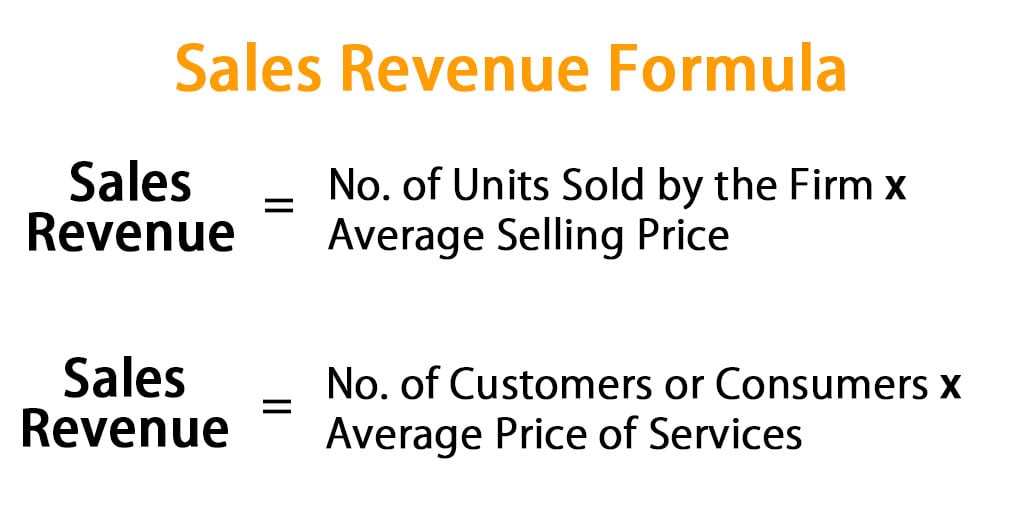

Sales revenue is the income of the company or the firm that it will realize by selling its services or products to the public. The calculation of revenue or sales revenue can be simple or complex, depending on the business. To determine product sales revenue, you multiply the average price at which the firm sells its goods by the total number of products sold.

Or

The last formula can be used in the service industry to calculate the firm’s sales revenue. The above formula is used when direct inputs like units and sell value per unit are available. However, when a product or service cannot be calculated in that direct way, then another way to calculate sales revenue is to add up the cost and find the revenue through the method called absorption costing

Further, one can also use the margin ratio to calculate sales revenue figures. There can be cases where one knows about profit figures, and their margin can be used to calculate the revenue figure.

Examples of Sales Revenue Formula (With Excel Template)

Let’s take an example to understand the calculation of the Sales Revenue formula in a better manner.

Sales Revenue Formula – Example #1

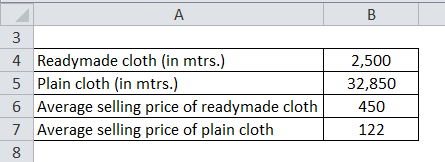

Let’s take an example to calculate the sales revenue figure for XYZ Ltd, which manufactures cloth. Below are the quantity and average selling price available from its production sheet.

Calculate the sales revenue figure for the company.

Solution:

The formula to calculate Sales Revenue is as below:

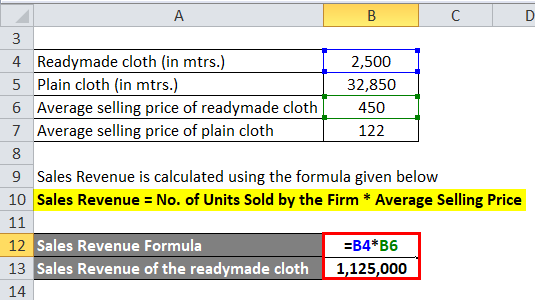

Sales Revenue = No. of Units Sold by the Firm * Average Selling Price

For readymade cloth:

- Sales Revenue of the readymade cloth = 2,500 * 450

- Sales Revenue of the readymade cloth = 1,125,000

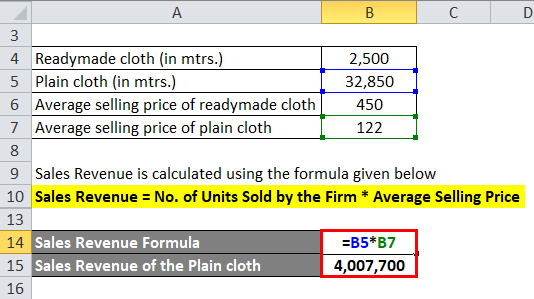

For plain cloth:

- Sales Revenue of the plain cloth = 32,850 * 122

- Sales Revenue of the plain cloth = 4,007,700

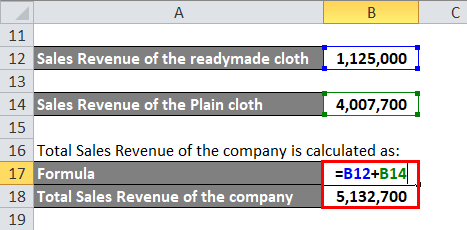

The calculation of Total Sales Revenue is as below:

- Total Sales Revenue = 1,125,000 + 4,007,700

- Total Sales Revenue = 5,132,700

Sales Revenue Formula – Example #2

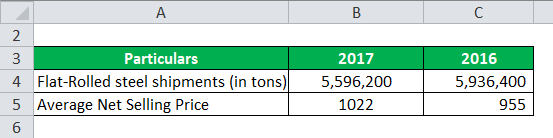

Below are the extracts from the 10-k SEC filing of Ak Steels Holding Corporation:

“Flat-rolled steel shipments in 2017 were 5,596,200 tons, a 6% decrease compared to 2016 shipments of 5,936,400 tons. The decrease in shipments was principally driven by a 10% decline in shipments to the automotive market compared to 2016, primarily due to reduced North American light vehicle production.

Our average net selling price was $1,022 per flat-rolled steel ton in 2017, a 7% increase from the 2016 average net selling price of $955. The increases reflect our strategy of producing and selling higher-value carbon, stainless and electrical steels, higher prices on both automotive and spot market sales, and higher surcharges on specialty steel products.”

Calculate the sales revenue figure for the company.

Solution:

The calculation for Sales Revenue is as below:

Sales Revenue = No. of Units Sold by the Firm * Average Selling Price

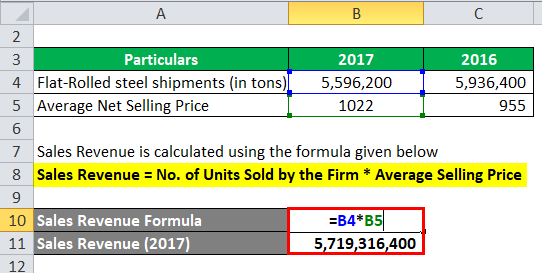

For 2017:

- Sales Revenue = 5,596,200 * 1022

- Sales Revenue = 5,719,316,400

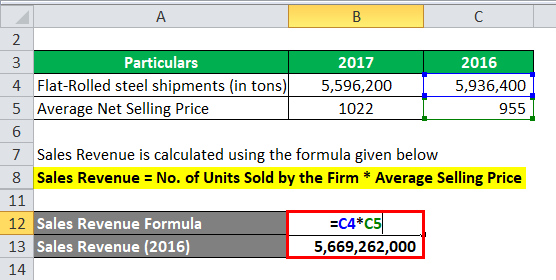

For 2016:

- Sales Revenue = 5,936,400 * 955

- Sales Revenue = 5,669,262,000

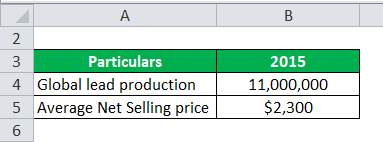

Sales Revenue Formula – Example #3

Below are the extracts from the 10-k SEC filing of AQMS Inc:

“Originally, most of the lead used in batteries was sourced from primary smelters, but in recent decades, secondary lead has become the dominant product used. Industry data shows that six million metric tons of lead were produced in 1995, of which approximately 45% was primary and 55% was from secondary sources. Twenty years later, by 2015, global lead production had increased to approximately 11 million metric tons, of which more than 65% was secondary. Importantly, primary lead production had increased only marginally during this period. This marginal increase is because lead-zinc mine deposits are being depleted globally in existing mines. Increasing primary lead is now the predominant byproduct of zinc mining.

In 2005, secondary lead traded on the LME in a range of $1,000 to $1,200 per metric ton. During 2017, secondary lead traded approximately $2,000 to $2,600 per metric ton.

Calculate the global sales figure 2015, assuming the average selling price of $2,300.

Solution:

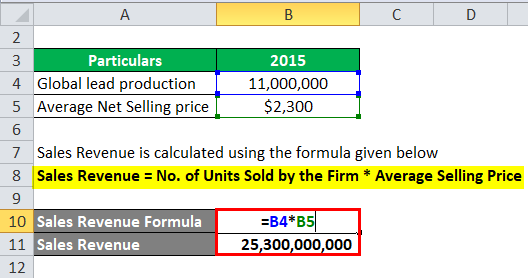

The calculation for Sales Revenue is as below:

Sales Revenue = No. of Units Sold by the Firm * Average Selling Price

- Sales Revenue = 11,000,000 * $2,300

- Sales Revenue = 25,300,000,000

Explanation of the Sales Revenue Formula

The sales revenue formula has two important components in it. The first is quantity which is how much the firm has sold in units, and the second is the selling price which is nothing but the product sale price. However, the company sells multiple products at various prices, so one must take an average selling price. But it is not feasible to arrive at these two figures just by prime face looking at the company’s financial statements as one needs to arrive at a judgment, which becomes subjective in nature. Hence the other way to calculate sales revenue figures is to add up to cost and profit.

Relevance and Uses

Revenue is key when analyzing financial ratios like gross margin (i.e., revenue-cost of goods sold), operating margin, or gross margin percentage (i.e., gross margin/revenue). Then these ratios are used to analyze how much the firm or the company has left over after allocating and accounting for the cost of the merchandise.

The revenue forms a single line and top line of the income statement, which must be recorded properly after accounting for sales revenue return, taxes, etc.

The sales revenue formula will also help examine the trend in sales revenue over time, enabling the company or the business owners to understand their own business much better. Some of the advantages of tracking the sales revenue are like analysis of daily sales revenue trends, which aids in understanding if there is any particular pattern in the consumer or customer behavior.

Sales Revenue Formula Calculator

You can use the following Sales Revenue Calculator.

| No. of Units Sold by the Firm | |

| Average Selling Price | |

| Sales Revenue Formula | |

| Sales Revenue Formula = | No. of Units Sold by the Firm x Average Selling Price |

| = | 0 x 0 = 0 |

Recommended Articles

This has been a guide to the Sales Revenue formula. Here we discuss How to Calculate Sales Revenue along with practical examples. We also provide Sales Revenue Calculator with a downloadable Excel template. You may also look at the following articles to learn more –