Updated July 26, 2023

FCFF Formula (Table of Contents)

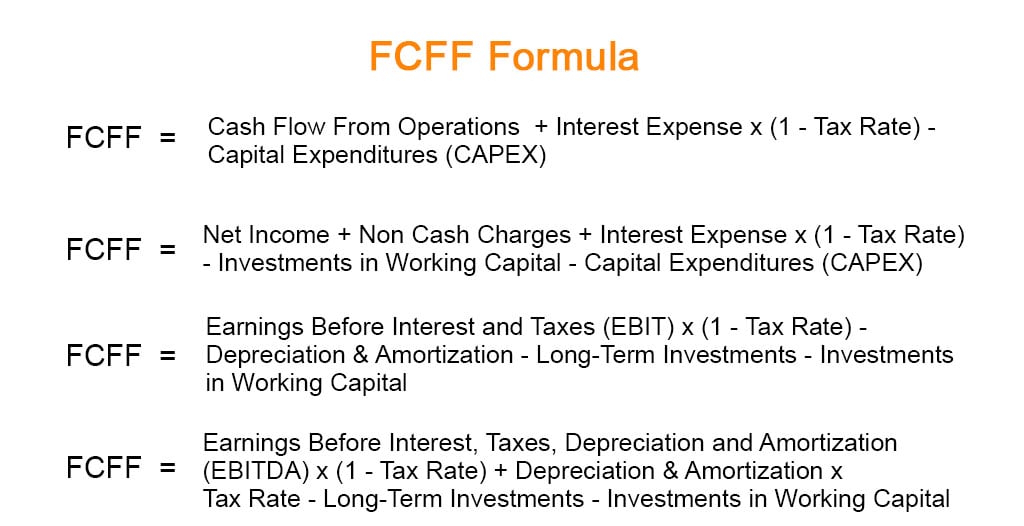

What is the FCFF Formula?

FCFF (Free Cash Flow to the Firm) represents the available cash for the investors, both equity and debt holders, after the company pays off all its expenses, including taxes, interest, net capital expenditures, and working capital.

In other words, free cash flow to the company is the cash left over after a company has paid its operating expenses and capital expenditures.

Examples of FCFF Formula (With Excel Template)

Let’s take an example to understand the calculation of the FCFF Formula in a better manner.

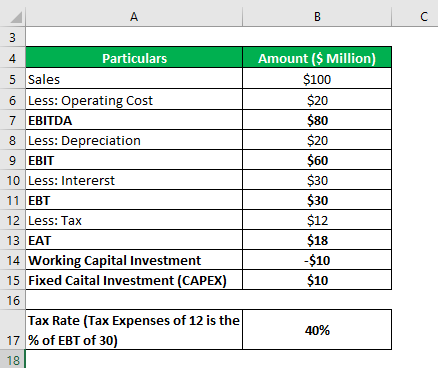

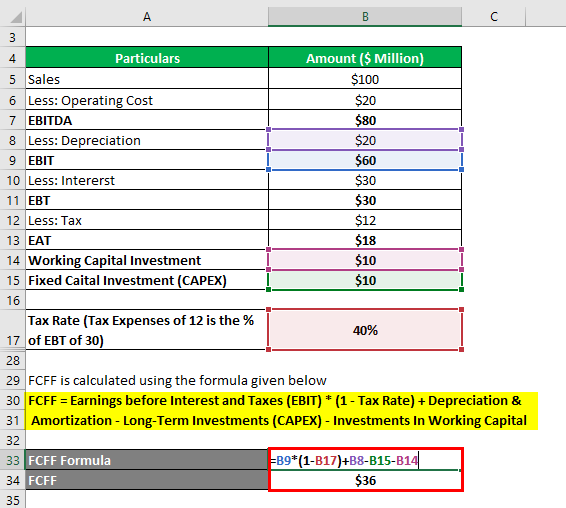

FCFF Formula – Example #1

Let’s understand the calculation of the Free Cash Flow to the Firm (FCFF) by a simple example.

We have assumed the following information about ABC Company:

Solution:

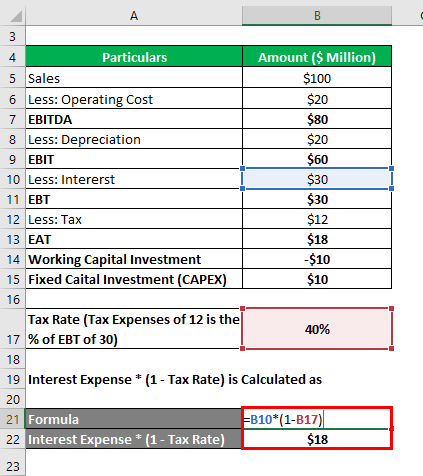

Interest Expense * (1 – Tax Rate)

- = $30 * (1- 40%)

- = $18

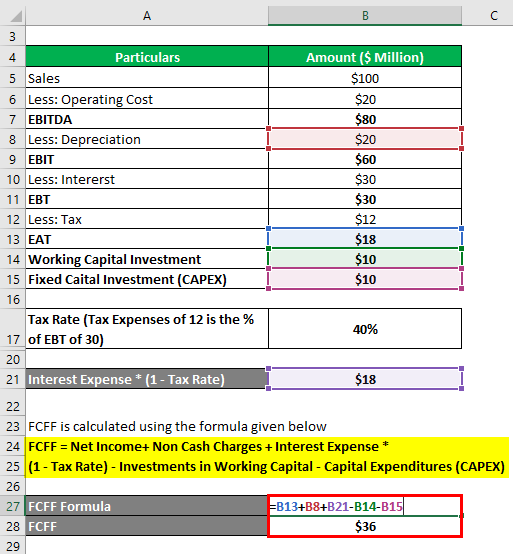

By using Formula (Net Profit)

FCFF is calculated using the formula given below

FCFF = Net Income+ Non Cash Charges + Interest Expense * (1 – Tax Rate) – Investments in Working Capital – Capital Expenditures (CAPEX)

- FCFF = $18 + $20 + $18 – $10 – $10

- FCFF = $18 + $20 + $18 + $10 – $10

- FCFF = $36.

By using Formula (Operating Profit):

FCFF is calculated using the formula given below

FCFF = Earnings before Interest and Taxes (EBIT) X (1 – Tax Rate) + Depreciation & Amortization – Long-Term Investments (Capex) – Investments In Working Capital

- FCFF = $60 * (1- 40%) + $20 – $10 – $10

- FCFF = $36.

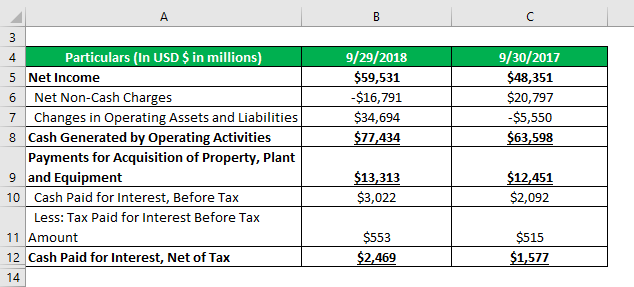

FCFF Formula – Example #2

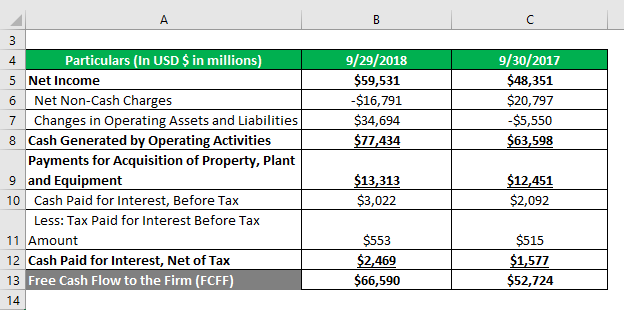

Let us take the example of Apple Inc. We have key financial figures of Apple Inc. for the year ended 2018 & 2017. Now, we will calculate the Free Cash Flow to the Firm by using the formula:

Solution:

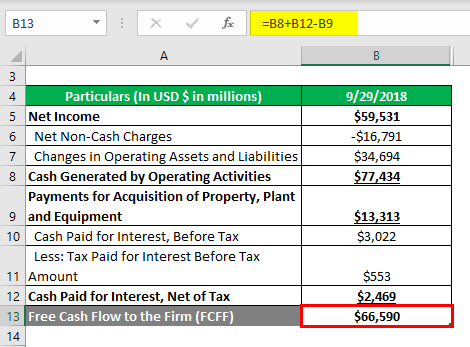

For the year 2018

- FCFF = $77,434 + $2,469 – $13,313

- FCFF = $66590

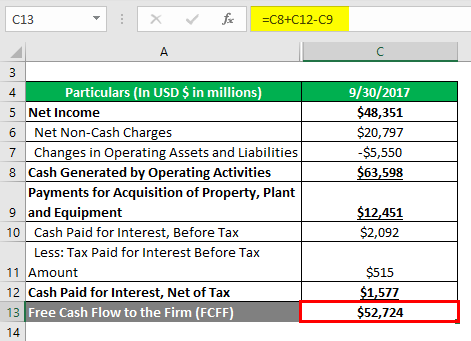

For the year 2017

- FCFF = $63,598 + $1,577 – $12,451

- FCFF = $52,724

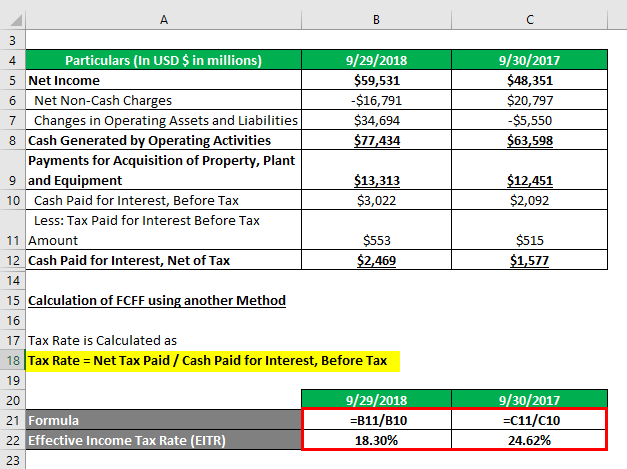

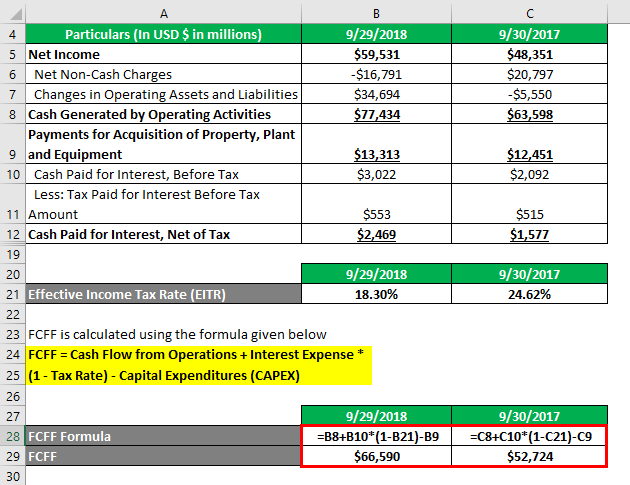

Calculation of FCFF using another Method

Tax Rate is calculated as

Tax Rate = Net Tax Paid / Cash Paid for Interest, Before Tax

For 9/29/2018

- Tax Rate = $553 / $3,022

- Tax Rate = 18.30%

For 9/30/2017

- Tax Rate = $515 / $2,092

- Tax Rate = 24.62%

FCFF is calculated using the formula given below

Free Cash Flow to the Firm (FCFF) = Cash Flow from Operations + Interest Expense * (1 – Tax Rate) – Capital Expenditures (CAPEX)

Apple Inc.’s FCFF has increased from 2017 to 2018. It means that the cash flow available with Apple Inc.’s suppliers of capital after all operating expenses made and meeting investments in working and fixed capital expenses.

FCFF Formula – Example #3

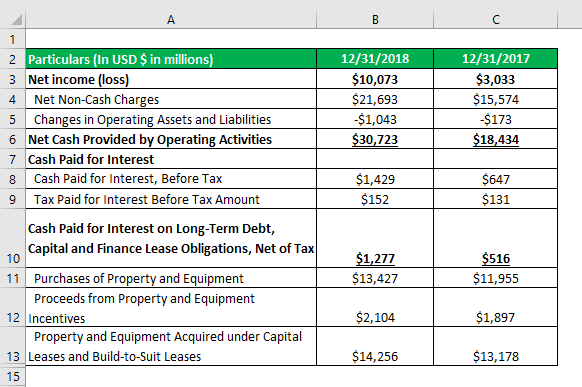

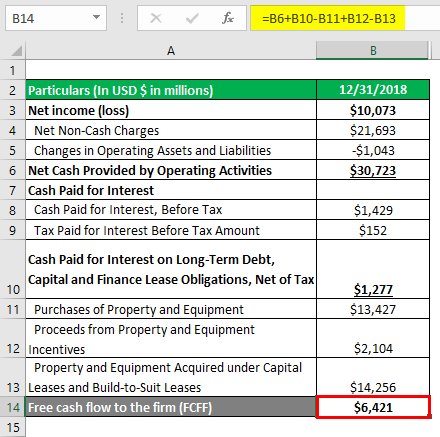

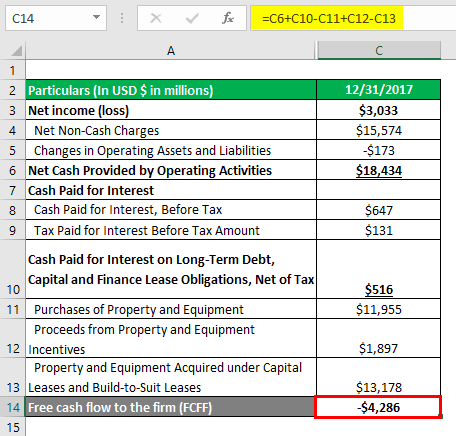

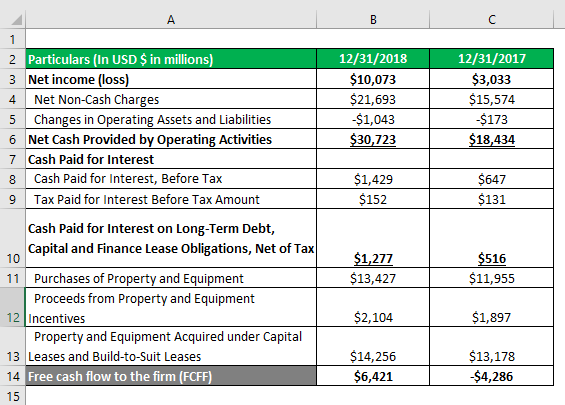

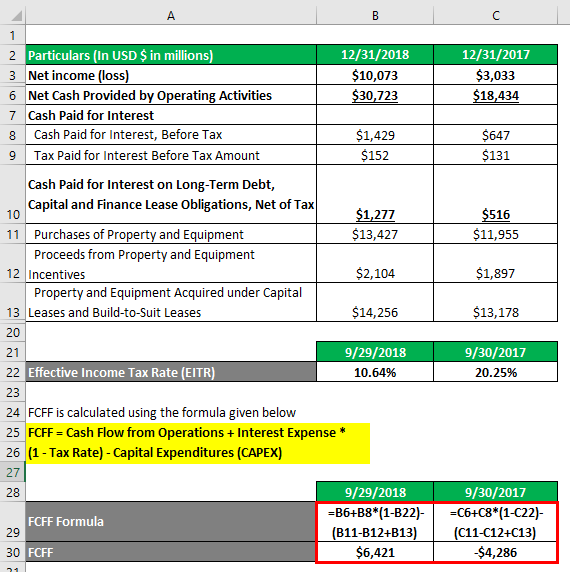

Let us take the example of Amazon.com Inc. We have key financial figures of Amazon.com Inc. for the year ended 2018 & 2017. Now, we will calculate the Free Cash Flow to the Firm by using the formula:

Solution:

For the year 2018

- FCFF = $30,723 + $1,277 – $13,427 + $2,104 – 14,256

- FCFF = $6,421

For the year 2017

- FCFF = $18,434 + $516 – $11,955 + $1,897 -$13,178

- FCFF = -$4,286

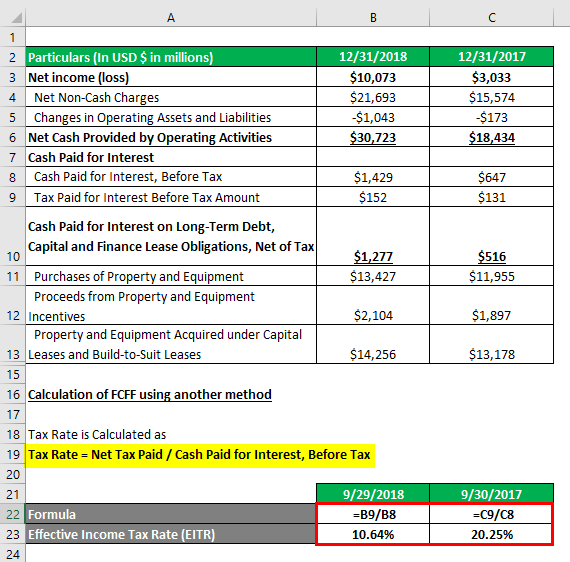

Calculation of FCFF using another Method

Tax Rate is calculated as

Tax Rate = Net Tax Paid / Cash Paid for Interest, Before Tax

For 9/29/2018

- Tax Rate = $152 / $1,429

- Tax Rate = 10.64%

For 9/30/2017

- Tax Rate = $131 / $647

- Tax Rate = 20.25%

FCFF is calculated using the formula given below

Free Cash Flow to the Firm (FCFF) = Cash Flow from Operations + Interest Expense * (1 – Tax Rate) – Capital Expenditures (CAPEX)

Amazon.com Inc.’s FCFF has increased from 2017 to 2018. It means that the cash flow available with Amazon.com Inc’s suppliers of capital after all operating expenses made and meeting investments in working and fixed capital expenses.

Explanation

The formula for free cash flow to the firm is:

FCFF = Net Income+ Non Cash Charges + Interest Expense * (1 – Tax Rate) – Investments in Working Capital – Capital Expenditures (CAPEX)

Here’s where we can find the financial items to calculate the Free Cash Flow to the Firm:

Net Income: Income Statement

Net income includes the amount of funds that remains, after all, operating expenses, taxes, interest, and preferred stock dividends being deducted from the company’s total revenue.

EBIT (1 – Tax Rate): Income Statement

Net tax paid on the Earnings before tax (EBT) amount and escapes the capitalization impact.

Less: Non-Operating Expenses: Income Statement

Non-operating expenses incurred during a certain period of time that is unrelated to the core business. Examples include interest income, interest expense, gain/loss on disposal of fixed assets, and other one-time charges.

Add: Depreciation & Amortization – Cash Flow Statement (Operating)

Any reduction in the value of the intangible assets is called amortization. Depreciation is the gradual reduction in the value of an asset over its estimated useful life span. Amortization is the process of writing off deferred revenue expenditure over more than one accounting period.

Less: Capital Expenditure (Capex) – Cash Flow Statement (Investing)

CAPEX or Capital expenditures are the funds that a business uses to obtain a long-term advantage (purchase goods or services) to expand the company’s abilities to generate profits.

Add: Change in Working Capital – Cash Flow Statement (Operating)

It represents the cash inflow or outflow in the firm and excludes cash and cash equivalents and short-term debt (notes payable and CPLTD).

Relevance and Uses of Free Cash Flow to the Firm (FCFF Formula)

- Free cash flow to the firm is important because it reflects the amount of cash flow available to all the investors, including bondholders and shareholders of the firm.

- It allows the firms to pursue opportunities for the shareholders to enhance the value of their investments. Without cash, developing new products, making acquisitions/up-gradating machinery, paying dividends, and discharging the debt is impossible.

- Investors prefer free cash flow as net income measures a firm’s financial performance because it is more difficult to manipulate than net income.

- It is one of the most important tools in the valuation of a Company since this helps to know how much cash the company can generate in a given set of parameters.

Recommended Articles

This is a guide to FCFF Formula. Here we discuss calculating the FCFF Formula, practical examples, and a downloadable Excel template. You may also look at the following articles to learn more –