Updated April 19, 2023

Introduction to Market Failure and The Role of Government

Changing the incentive structure or reallocating resources can correct a bad market outcome. Economists often differ in their opinion about the type of market failure and the corrective measures required to resolve it.

What is a Market Failure?

It’s impossible to correct the market failure concept without understanding what it exactly is and why it stays. The most common interpretation of a market failure—failing to attain the standards of “a perfect competition in the general equilibrium of economics”— is easily identifiable in most, if not all, the markets. While the price equilibrium is a shifting target, consider all sellers and buyers in the market as sprinters in a race, except that the finishing line keeps changing between right, left, up, and down.

Economic participants not being properly incentivized is a better pragmatic interpretation of market failures, as it hinders their ability to push the markets toward more acceptable results. Most academic literature on market failure concentrates here.

A market failure has a negative effect on the economy due to the non-optimal allocation of resources. In other words, the social cost to manufacture the goods or services i.e. all the opportunity costs of input resources used in the creation is not minimized. This also leads to the wastage of resources.

Take, for instance, the common argument regarding the minimum wage laws. The law sets wages above the prevalent market clearing wage to raise the market wages.

Many critics argue that enacting the regulation would lead employers to hire fewer minimum wage employees than before due to the higher wage cost. The higher wage cost led to more minimum wage laborers becoming unemployed, resulting in a social cost that caused the market failure.

Reasons for Market Failure

Market failures happen because of the inefficiency of correctly allocating goods and services. The price mechanism fails to factor in all the costs and benefits involved while providing a particular good or service. In such cases, the market won’t produce socially optimal goods. They will be either under or overproduced.

To fully understand the concept of market failure, it’s pertinent that we recognize the reasons behind it. Because of the structure, it’s impossible for markets to be perfect. Most markets, as a result, are unsuccessful and need some kind of intervention.

Following are some of the key reasons for a market failure.

-

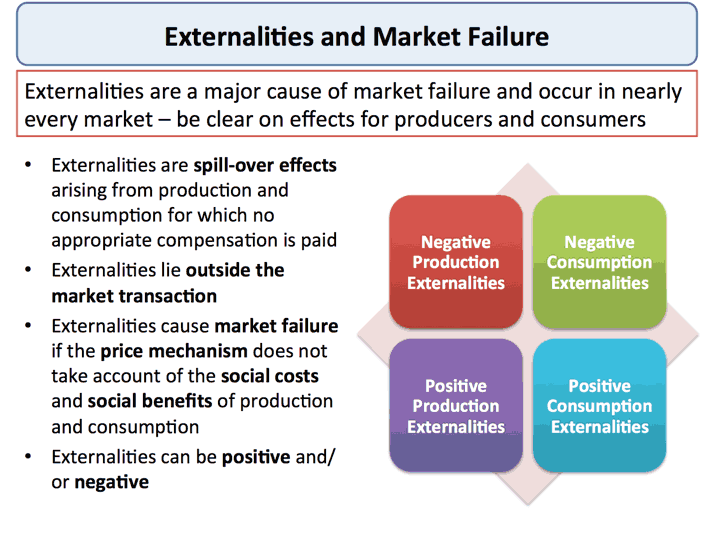

Positive and negative externalities

The availing of a particular good or service usually causes an effect on a third party, known as an externality. Goods or services can generate an optimistic spillover, a positive externality. For instance, while public education may directly affect only the schools and their students, an educated population will positively affect society. A negative externality, on the other hand, is a pessimistic spillover effect on a third party. For instance, passive smoking could adversely affect people’s health, even if they don’t directly indulge in smoking.

-

Environmental concerns

Effects on the environment as an important consideration and sustainable development.

-

Lack of public goods

Public goods are those where the cost of production doesn’t increase with the number of customers. For instance, a lighthouse has a fixed cost of production which remains the same throughout, regardless of whether just one ship or hundreds of ships use it. Public goods and services could be under-produced. There is little benefit from the private sector to erect a lighthouse because one can wait for somebody else to provide it and then use the light sans incurring any cost. The act of deriving benefits from a product or service without paying for it is a free rider problem.

-

The underproduction of merit goods

Society believes there is under-consumption of certain private-sector products, known as merit goods. Society considers healthcare, education, sports centers, and other products merit goods.

-

Over-provision of demerit goods

Society believes that certain goods, known as demerit goods, are over-consumed, often leading to negative externalities. It is the opposite of merit goods. These include alcohol, cigarette, drugs, and similar things.

-

Abuse of monopoly power

An imperfect market restricts the output to maximize profits.

Probable corrective action for Market Failure

Using the definition of a broad perfect competition, a market failure can usually be corrected by allowing consumers and competing sellers to shove the market towards equilibrium over a period of time. Markets often tend to move towards an equilibrium constantly but never attain it because of limitations to human knowledge and changes in global situations.

Many policy experts and economists seek possible regulations and interventions for compensating a perceived market failure. Subsidies, tariffs, punitive or redistributive taxation, trade restrictions, disclosure mandates, price ceilings, and other economic distortions were mooted to correct inefficient outcomes.

Other economic experts argue that a market is recognizably imperfect. However, people often frame market failures improperly. Instead of asking whether market failures are related to perfect competition, they say that the question must revolve around whether a market performs better than other processes which humans may trigger.

Free market economists like Milton Friedman, FA Hayek, and others have argued that a market is the only recognized discovery process capable of adjusting correctly to all inefficiencies. They say that regulation can interfere with the process causing inefficiencies to deteriorate than better.

Here are some actions that can be adopted to resolve a market failure.

Control of monopoly

The government can control a monopoly power in the market by passing restrictive trade practice legislation and anti-monopoly laws. These regulations are targeted to remove unfair competition in the market, prevent iniquitous price discrimination, and fix prices that are equal to competitive prices.

The government may also de-escalate all monopoly prices to a competitive level via taxation and price regulation. The authorities may enforce a price ceiling to bring down monopoly pricing to near or equal to a competitive price. To achieve this, people often set up a commission that fixes the price of monopoly goods or services below the monopoly price.

Taxation is another way of controlling monopoly power during a market failure. Taxes could be levied lumpsum, irrespective of the output of the monopolist. The tax could also be proportional to the output i.e. the taxable amount rising with a rise in output. In both cases, the target is to bring down the monopoly to a competitive level.

Eminent English economist, Arthur Cecil Pigou, favored nationalizing monopoly to end monopoly power.

External factors

Pigou suggested social control measures and using subsidies and taxes to achieve an optimal allocation of resources in the face of various externalities. The government can interfere, in all cases, with an external diseconomy of production to remove any divergence between social and private costs and benefits. The government, in that case, can ask the business owner to move out of the residential area by extending appropriate facilities to a smoke-emitting workshop. He said that in case of any external diseconomy of consumption, the government could end the noise pollution by banning loudspeakers, except during a special occasions at specific hours with prior permission.

Pigou also suggested the government encourage the production of goods and services with positive externalities by granting subsidies on each unit of product or service by the manufacturer. This will also help buyers maximize their satisfaction by tax concession to buy more commodities. Negative externalities often discourage sellers from production and buyers from consumption by levying taxes, Pigou claimed.

The government, for instance, can impose a tax on every family living in an area and thus collect the entire sum to pay the smoke-emitting factory to relocate. This way, subsidies, and taxes can help bridge the gap between social and private costs and benefits.

Another commonly suggested measure is to internalize or unitize the externalities in production. For instance, firms engaged in oil production in the same field could lead to over-pumping and over-drilling. With the merger or unitization of the firms, oil can be extracted more efficiently, sans a diseconomy of production.

Public goods

All public goods are non-rivaled and non-excluded; hence, they are unavailable in the free market. Private companies can’t provide these public goods and services. They can be provided only by the public authority. It is impossible to divide the benefits of public goods and services. The government must make people share the costs of public utilities so that each is better off.

Image source: pixabay.comOne way of paying for public goods and services is to charge each person an equal proportion of the maximum amount he/she is ready to pay instead of forsaking the product while fixing that proportion to cover the entire cost of production. In the case of special public goods like defense materials, the government may produce them or buy from private firms that meet all relevant production guidelines. So far, the “free rider” issue is concerned, whereby utility services like police, firefighting, etc., are free to all users. The government can provide them with tax revenues.

Increasing returns to scale

Opinions largely differ about the government’s role in providing solutions to market failure in case of increasing returns to scale. Many economists and policymakers have opined that a government must nationalize industries with decreasing costs, leading to overproduction. But many others disapprove of this idea. They feel government control could make matters worse. Yet others suggest that the private sector must produce goods and services, and the government must impose a price regulation and tax them to balance private and social costs and benefits.

Indivisibles

The solution to the problem of indivisibility in the case of goods and services jointly used by several persons, like paved roads, street lights, traffic signals, etc, local authorities, like the civic corporation, have to spend on its maintenance and repairs. In this regard, someone has to collect the cost from the residents of a particular area or those who use the service.

Property Rights and the Coase Theorem

Common property rights lead to external situations. “Who owns property, to what uses it can be put, the rights people have over it and how it may be transferred” are the issues related to property rights. Everyone has a right to prevent people from imposing costs on them. Public properties like parks, civic services, libraries, etc can be included in this.

The second solution could be distributing wealth from the rich to the poor. But it’s more a question of changing property rights instead of extending ownership rights. Such a solution, however, won’t be practical.

The third solution could be for the government to charge or compensate for damages. However, it involves the problem of compensating those who acquired a property at a much lesser cost because of the damage.

The fourth option is to move the court for monetary damages by the party harmed by the externality. British economist and author Ronal Coase suggested that a market failure because of property rights could be eliminated via mutual bargaining among the involved parties. He pointed out that property rights must be marketable and clearly defined, with transaction costs at zero. Only then will a perfectly competitive economy allocate optimal resources even under externalities. This is called the Coase Theorem.

Image source: pixabay.comMissing markets

To rectify a market failure concept in the case of incomplete or missing markets, where two products are produced jointly, Nobel laureates Gerard Debreu, and Kenneth Arrow suggested separate markets, where each product and service may be traded to a point where the private and social marginal benefits equal the two’s marginal costs. This will lead to the optimal allocation and utilization of resources.

Final words

Correcting the market when it fails is one of the government’s most important responsibilities. The private sector has to play a part by not resorting to unfair practices. Correcting market failure is a major component of welfare economics. Falling markets have an impact on the overall economy of a country. With globalization being the norm today, a fall in one country’s market has a ripple effect on others. When Dow Jones takes a hit, Nikkei and other indexes can feel the effects.

Recommended Articles

Here are some articles that will help you get more details about the Market Failure, so just go through the link.