Updated November 6, 2023

IFRS vs US GAAP Differences

While investing in evolving markets, you must know about the world’s two chief accounting systems: Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

While IFRS vs. US GAAP both give accounting rules for recording transactions, US GAAP is only applicable in the US, while most counties in the world use IFRS.

The two crucial accounting systems have a few dissimilarities that may distress the results. All accounting schemes follow double-entry practices that classify transactions as revenue or expenses, assets or liabilities. If you understand a bit about both IFRS vs US GAAP, you can make a superior evaluation of numbers from companies that follow neither system.

International Financial Reporting Standards (IFRS) is a common global language for business matters, so company accounts are comprehensible and comparable against international boundaries. They result from rising international shareholding and trade and are predominantly vital for companies that have transactions in numerous countries. They are gradually switching to the many diverse national accounting standards. Thus, the guidelines are to be followed by accountants to keep books of accounts that are similar, understandable, dependable, and pertinent to the users’ internal or external.

Companies use mutual accounting principles, standards, and procedures to assemble their financial statements.

Objectives of GAAP

Financial reporting must provide information that is:

- It is beneficial to present to potential investors, creditors, and other users in making a lucid investment, credit, and other financial decisions.

- It is helpful to present to probable investors, creditors, and other users in evaluating the amounts, timing, and uncertainty of future cash receipts about economic resources, their claims, and their variations.

- Useful for carrying out financial decisions.

- Supportive in making long-term decisions

- Useful in refining the performance of the business

- Useful in keeping records

- Basic concepts

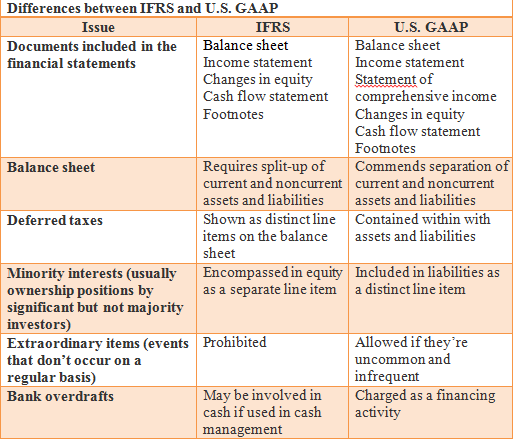

IFRS vs US GAAP Differences

Few of these variances are likely to cause major fluctuations in any company’s reported results; a company with prodigious results under GAAP won’t look awful under IFRS unless it got those results with an extraordinary item, which is an event that doesn’t occur regularly such as a merger or a corporate restructuring. And due to the disclosure of extraordinary items, someone looking at the financial statements could adjust easily.

The Impact of IFRS vs US GAAP Convergence

The Sarbanes-Oxley Act, the SEC’s acceptance of international standards, and the economic and financial collapse in recent years have been applying pressure on several countries, together with the United States, to eliminate the gap between the International Financial Reporting Standards (IFRS) and the U.S. Generally Accepted Accounting Principles (GAAP). Such initiatives have consequences on the world of accounting diversity, and the standards convergence of the U.S. GAAP and the IFRS largely impacts corporate management, investors, stock markets, accounting professionals, and accounting standards setters.

The Consequences of Initiatives on Worldwide Accounting Diversity

1. Impact on Financial Reporting

Financial reporting standards and requirements differ by country, which makes variations in financial reporting. This problem is more widespread for investors trying to categorize accounting reporting differences when they are making an allowance for providing funding to capital-seeking companies that trail the accounting standards and financial reporting of the country in which they are undertaking business with the help of IFRS vs US GAAP.

2. Impact on Corporate Management

Corporate management will profit from modest, efficient standards, rules, and practices that are smeared to all countries and followed worldwide. The change will allow corporate management to raise capital via lower interest rates while sinking risk and business costs.

3. Impact on Investors

Investors will have to re-educate themselves. The procedure will offer more reliable information and will be abridged without changing the country’s standards. Moreover, the new standards will intensify the international flow of capital.

4. Impact on Stock Markets

Stock markets will see a decrease in the prices that go with entering foreign exchanges, and all markets obeying the same rules and standards will further permit markets to contest internationally for global investment prospects.

5. Impact on Accounting Professionals

Modifying and merging the recent standards with internationally accepted ones will force accounting professionals to learn the new standard, leading to steadiness in accounting practices.

6. Impact on Accounting Standards Setters

Once standards have come together, the actual method of developing and applying new international standards will be unpretentious. It will remove the dependence on agencies to improve and sanction a decision on any definite standard.

Arguments for and Against the Convergence of International Accounting Standards

Arguments for the convergence are (a) renewed clarity, (b) possible simplification, (c) transparency, and (d) comparability between different countries on accounting and financial reporting. This will increase capital flow and international investments, further reducing interest rates and leading to economic growth for a specific nation and the firms with which the country conducts business. Timeliness and the availability of uniform information to all concerned stakeholders will also conceptually make for a smoother and more time-efficient process. Additionally, new safeguards will be in place to prevent another national or international economic and financial meltdown.

Arguments against accounting standards convergence are (a) the unwillingness of the different nations in the process to collaborate based on different cultures, ethics, standards, beliefs, types of economies, political systems, and preconceived notions for specific countries, systems, and religions; and (b) the time it will take to implement a new system of accounting rules and standards across the board.

The Quality of International Accounting Standards

The Securities and Exchange Commission’s (SEC) goals and efforts, both domestically and internationally, have been consistently pursuing the achievement of fair, liquid, and efficient capital markets, thus providing investors with accurate, timely, comparable, and reliable information. One of the ways the SEC has pursued these goals is by upholding the domestic quality of financial reporting and encouraging the convergence of the U.S. and IFRS standards.

Research indicates that firms that apply the international standards show the following: a higher variance of net income changes, a higher change in cash flows, a significantly lower negative correlation between accruals and cash flows, a lower frequency of small positive income, a higher frequency of large negative income and higher value relevance in accounting amounts. Additionally, these firms have fewer earnings management, more timely loss recognition, and more value relevance in accounting amounts than domestic (U.S.) firms following the GAAP. Therefore, IFRS vs US GAAP firms adhering to the IFRS generally exhibit higher accounting quality than when they previously followed the GAAP.

The Bottom Line

Regardless of documented research signifying higher accounting excellence experienced by firms that either follow the IFRS or swapped to the IFRS from the GAAP, there is a qualm and concern from the FASB (Financial Accounting Standards Board) regarding the application and carrying out of principle-based standards in the U.S. A key may be that the IFRS should agree to take some FASB standards to accommodate the needs of the U.S. constituents and stakeholders.

Although the merging efforts were on financial performance reporting, the main problem is the difference in the U.S. GAAP and IFRS methods. The IFRS is more vibrant and constantly revised in response to an ever-changing financial environment.

From a legal viewpoint, anyone can estimate how this convergence will grow and influence the accounting profession in the U.S.. Companies will be required to reveal qualitative and quantitative information about contracts with customers, as well as a maturity analysis for contracts spread out beyond a year, as well as the addition of any noteworthy judgments and changes in judgments made in applying the proposed standard to those contracts. Maybe the solution is to think through a more in-depth study and analyze the factors persuading the molding or development of a country’s accounting system. So these are the IFRS vs US GAAP differences.

Related Articles

We have some articles based on the IFRS vs US GAAP differences to help you get more details about the IFRS vs US GAAP differences.