Updated October 30, 2023

Difference Between FCFF vs FCFE

FCFF is the cash flow available for discretionary distribution to all company investors, both equity and debt, after paying for cash operating expenses and capital expenditure. FCFE is the discretionary cash flow available only to equity holders of a company. After meeting all financial obligations and capital requirements, it remains as residual cash flow. When computing FCFE, they take into consideration interest payments or debt repayments. They call this measure an unleveled cash flow because it does not consider the leverage effects of FCFF in computing interest payments.

Let us study much more about FCFF vs FCFE in detail:

Traditionally, investors have focused on metrics like EBITDA and net income while analyzing stocks. The discounted cash flow method (DCF) uses free cash flow (FCF) as a more accurate measure of company performance, which is significant for trading comps. FCF varies from metrics like operating EBITDA, EBIT, or net income since the former leaves out non-cash expenses and subtracts the capital expenditure required for sustenance. FCF has also gained prominence against the dividend discount valuation model, especially in non-dividend-paying firms.

What is FCFF?

Free cash flow refers to the cash available to investors after paying for operating and investing expenditures. The two types of free cash flow measures used in valuation are Free cash flow to the firm (FCFF) and Free cash flow to equity (FCFE).

Usually, when discussing free cash flow, we refer to FCFF. FCFF is usually computed by adjusting operating EBIT for non-cash expenses and fixed and working capital investments.

FCFF= Operating EBIT- Taxes + Depreciation/Amortization (non-cash expenses)- fixed capital expenditure-Increase in net working capital

Alternate methods of computation are:

FCFF= Cash flow from operations (from cash flow statement) + interest expense adjusted for tax – fixed capital expenditure

What is FCFE?

FCFF= Net Income + Interest expense adjusted for tax + Non-cash expense – fixed capital expenditure-Increase in net working capital

When we do DCF using FCFF, we arrive at enterprise value by discounting the cash flows with the weighted average cost of capital (WACC). In FCFF, they capture the costs of all sources of capital in the discount rate because it considers the company’s entire capital structure.

They refer to this cash flow as levered cash flow because it includes the impact of leverage. Thus if the firm has common equity as the only source of capital, its FCFF and FCFE are equal.

To compute FCFE, they usually adjust post-tax operating EBIT for non-cash expenses, interest expenses, capital investments, and net debt repayments.

FCFE=Operating EBIT- Interest- Taxes+ Depreciation/Amortization (non-cash cost)– fixed capital expenditure-Increase in networking capital-net debt repayment

Where net debt repayment= principal debt repayment –new debt issue

Alternate methods of computation are

FCFE= Cash flow from operations – fixed capital expenditure – Net debt repayments

When we do DCF using FCFF, we arrive at equity value by discounting the cash flows with the cost of equity. FCFE only considers the equity cost as the discount rate because it is the amount left over for only equity shareholders.

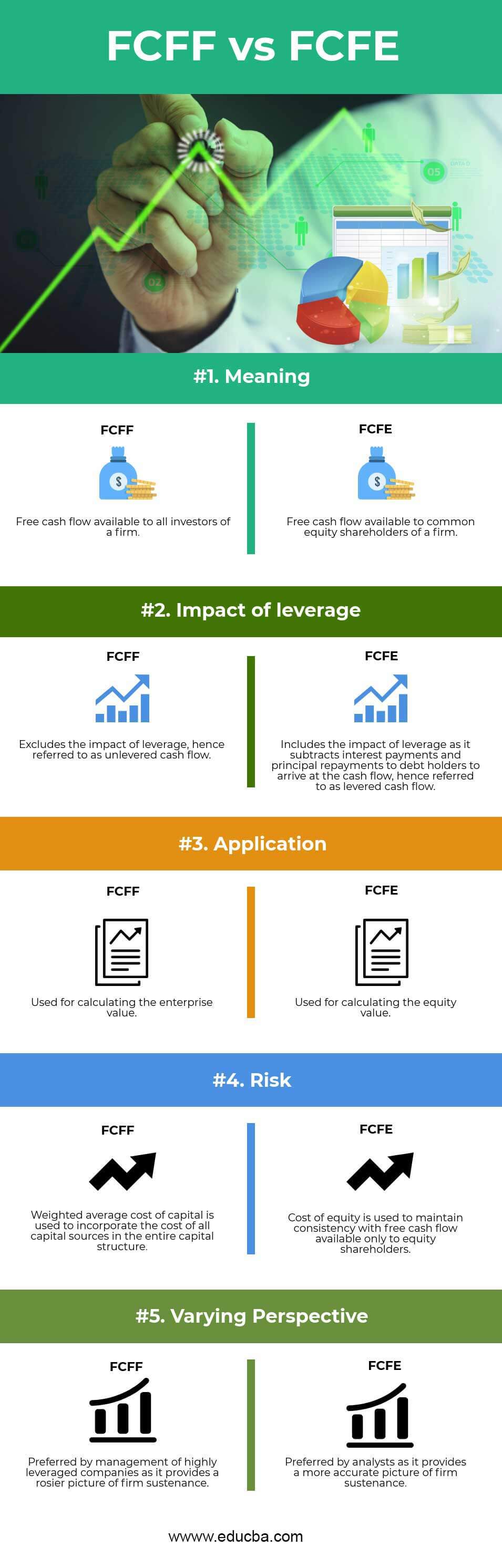

Head To Head Comparison FCFF vs FCFE (Infographics)

Below is the top 5 difference between FCFF and FCFE

Key Differences Between FCFF vs FCFE

Both FCFF vs FCFE are popular choices in the market; let us discuss some of the major differences:

- In the firm, FCFF is the amount that remains for all investors, including bondholders and stockholders, while FCFE is the residual amount that remains for common equity holders.

- FCFF excludes the impact of leverage since it does not consider the financial obligations while arriving at the residual cash flow, known as unleveled cash flow. FCFE includes the impact of leverage by subtracting net financial obligations. Hence it is referred to as levered cash flow

- In DCF valuation, they use FCFF to calculate the enterprise value or the total intrinsic value of the firm. FCFE is used in DCF valuation to compute equity value or the intrinsic value of a firm available to common equity shareholders

- When performing DCF valuation, they pair FCFF with a weighted average cost of capital to consistently incorporate all the capital suppliers for enterprise valuation. They consistently pair FCFE with the cost of equity to incorporate the claim of only the common equity shareholders.

FCFF vs FCFE Comparison Table

Below is the topmost comparisons between FCFF vs FCFE are as follows –

|

The Basic Comparison |

FCFF |

FCFE |

| Meaning | Free cash flow available to all investors of a firm | Free cash flow available to common equity shareholders of a firm |

| Impact of leverage | Excludes the impact of leverage, hence referred to as unleveled cash flow | Includes the impact of leverage as it subtracts interest payments and principal repayments to debt holders to arrive at the cash flow, hence referred to as levered cash flow |

| Application | Used for calculating the enterprise value | Used for calculating the equity value |

| The discount rate used while doing DCF valuation | The weighted average cost of capital is used to incorporate the cost of all capital sources in the entire capital structure | They use the cost of equity to maintain consistency with free cash flow available only to equity shareholders. |

| Varying perspective | Preferred by the management of highly leveraged companies as it provides a rosier picture of firm sustenance | Preferred by analysts as it provides a more accurate picture of firm sustenance |

Conclusion

In this FCFF vs. FCFE article, we have seen that the FCFF is the free cash flow generated by the firm from its operations after taking care of all capital expenditure required for the firm’s sustenance, with the cash flow being available to all providers of capital, both debt and equity. This metric implicitly excludes any impact on the firm’s financial leverage since it does not consider financial obligations of interest and principal repayments for cash flow computation. Hence, it is also known as unleveled cash flow.

FCFE is the free cash flow available to only the common equity shareholders of a firm. It includes the impact of financial leverage by subtracting financial obligations from the cash flow. So, to calculate FCFE, subtract tax-adjusted interest expense and net debt repayments from FCFF. Hence, it is also known as levered cash flow.

Management of highly leveraged companies prefers to use FCFF when presenting their operations. To ensure the company’s long-term sustainability, verifying that it is not experiencing negative levered free cash flow due to high financial obligations is essential.

Recommended Articles

This has been a guide to the top difference between FCFF vs FCFE. Here we also discuss the FCFF vs FCFE key differences with infographics, and a comparison table. You may also have a look at the following articles to learn more