Updated November 10, 2023

Difference Between Budget vs Forecast

A budget is a detailed statement of expected revenues and expenditures that quantifies the tactical plans of the management to reach a desired goal for the company during a specified period. Through a budget, you can convert your action plan for your company into estimates of revenue and expenses, cash flows, debt requirements, etc., gauge the feasibility of your vision, and prepare a baseline for comparing your actual performance. Forecasting estimates future outcomes that quantify the company’s direction during the forecasted period. Forecasts, being strategic, help companies to realize their growth plans. Financial forecasting will help you model various scenarios and evaluate whether your company will meet your strategic growth plan.

Budget

Budget not only quantifies your execution plan but also examines your plan’s viability, your company’s expected financial position, debt requirements, and a control technique to evaluate the actual performance. Usually, organizations conduct budgets for a maximum duration of an accounting period, typically short-term. You may find short-duration budgets for a month based on the company’s expense management. Companies prepare the budget before implementing the plan and may adjust it to manage their operations better.

Forecast

Financial forecasting depends on historical data, business drivers, and assumptions of the situational factors expected to affect the company during the forecasted period. As a company manager, you want to know where your company is going. Financial forecasting serves as an input for making budget allocations and helps management to develop its strategic plan. Forecasts can be short-term as well as long-term. There could be quarterly revenue forecasts based on business drivers and past data. There could also be forecasts of cash flows for several years, helping management in several aspects, like determining the optimal capital structure.

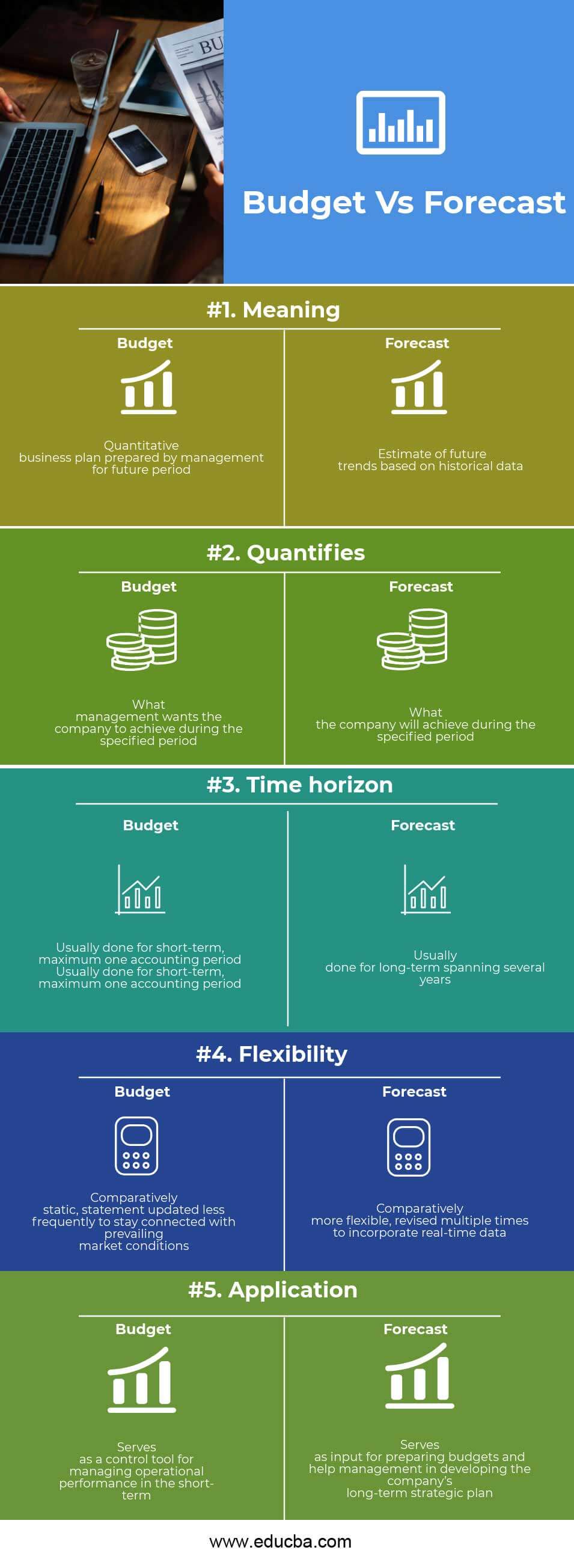

Head To Head Comparison Between Budget vs Forecast (Infographics)

Below is the top 5 difference between Budget and Forecast

Key Differences Between Budget vs Forecast

Both Budget vs Forecast are popular choices in the market; let us discuss some of the major Differences:

- A budget is a financial statement of expected revenues and expenses during the budgeted period prepared by management before the budgeted period starts. The forecast is the projection of financial trends and outcomes prepared based on historical data.

- The budget is the quantified outline of the tactical plan that expresses what the management wants the company to achieve during the budgeted period. A financial forecast is the quantified outline of the upcoming business activities demonstrating the company’s direction for the anticipated period.

- Budgets are usually prepared for one accounting period. Forecasts include short-term projections spanning one quarter and long-term estimates spanning several years.

- Budgets are more static. Once prepared, budgets are adjusted less frequently, only when there are changes in assumptions used to make the budget. In contrast, forecasts are more frequently adjusted to vary the premises and environmental changes and thus include the most recent and relevant data at any time.

- Budgets are tactical tools that help companies to manage their operations during an accounting period. Forecasts are strategic tools that help companies to plan for their growth over several years.

- Budgets establish targets for future performance and serve as the basis for analyzing variances between actual and expected results.

Forecasts are only projections; they do not provide any performance yardsticks for comparing actual results with forecasted results.

Budget vs Forecast Comparison Table

Below is the topmost comparison between Budget vs forecast

|

Basis Of Comparison |

Budget |

Forecast |

| Meaning | Quantitative business plan prepared by management for a future period | Estimate of future trends based on historical data |

| Quantifies | What management wants the company to achieve during the specified period | What will the company achieve during the specified period |

| Time horizon | Usually done for a short-term, maximum of one accounting period | Usually done for a long time spanning several years |

| Flexibility | Comparatively static statements are updated less frequently to stay connected with prevailing market conditions. | Comparatively more flexible, revised multiple times to incorporate real-time data |

| Application | Serves as a control tool for managing operational performance in the short-term | Serves as input for preparing budgets and helps management in developing the company’s long-term strategic plan |

Conclusion

A budget is a management tool used to forecast revenues and expenses during a specified period to identify avenues for cost-cutting and be more efficient and productive in operations. Budgets also ensure a planned approach toward managing cash flows and debt requirements in the business. Typically, budgets have a maximum time horizon of one accounting period and are short-term. Budgets usually represent action plans that management uses to achieve their strategic goals.

In contrast, financial forecasting is a strategic tool that projects a company’s growth trajectory over several years in the future. Thus, Forecasting provides a direction to the company’s strategic growth plan and helps make strategic decisions like new product introduction or acquisitions or addressing the cyclical pattern of demand, etc. Forecasts are developed based on past sales and expense trends, future sales contracts, trends in growth drivers, and changes in internal and external environmental factors affecting the company, for example, changes in competition and market share. In the case of a new company, forecasts would be prepared by tracking the past sales of competitors.

Hence, while the budget provides management insight into what they want the company to attain, the forecast shows whether it can achieve its budget. Forecasting sales and expenses from past performance or peer performance guides developing an effective budget. Moreover, comparing a budgeted summary with the most recent forecast helps management make necessary amendments to address changing business conditions and formulate more reasonable budgets in subsequent years.

However, Budget vs forecast is not mutually exclusive since they serve different purposes. While forecasts help achieve strategic goals, that is only possible by attaining tactical goals or managing action plans through sound budgets.

Recommended Articles

This has been a guide to the top difference between Budget vs forecast. Here, we also discuss the Budget vs prediction key differences with infographics and comparison tables. You may also have a look at the following articles –