Updated November 17, 2023

Difference Between Accrual Accounting vs Cash Accounting

Timing is Important from cricket to accounting; timing plays an important role in all facets of life. Like a well-timed shot, timely recording of revenue and expenses plays a major role in your financial statements. There are two types of accounting: cash-based and accrual-based. Let’s dive in further to understand these concepts.

Definition

Cash accounting or Cash Basis is an accounting method that recognizes the expenses or revenues as and when payments are made for them. Recording transactions this way involves making a journal entry only when cash is received, or bills are paid. For instance, although a company may generate sales in a given year, the revenue from these sales might not be documented until the subsequent year when the payments are actually received. Small-scale enterprises or individuals often employ this method for managing their personal finances. The method is in sync with the old saying – Don’t count your eggs before they are hatched.

In contrast to accrual accounting, which accrues or accumulates payments, accruals are recorded when incurred, realizing revenues and liabilities. In simple terms, one logs the journal entry even before an actual money exchange occurs—recording income before receiving cash and expenses before paying bills. You deliver a service or product to the client and record the transactions, anticipating that the other party will eventually receive the payment.

Accrual Accounting vs Cash Accounting methods are like two sides of a coin. In the long term, they don’t affect much, but in the short term can provide huge differences to the statement of cash flows.

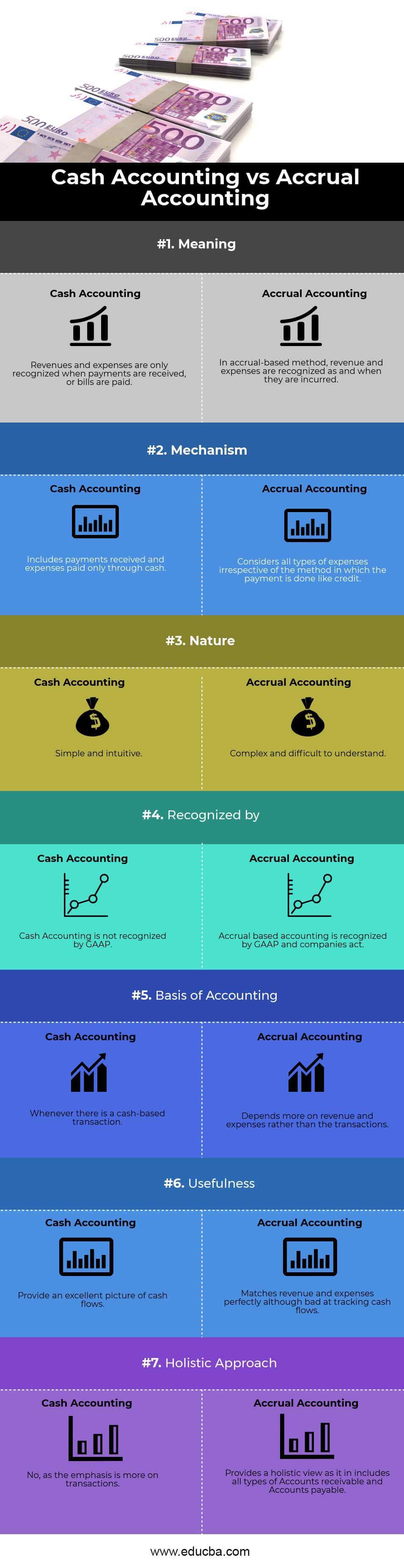

Accrual Accounting vs Cash Accounting Infographics

Below is the top 7 difference between Accrual Accounting vs Cash Accounting.

Key Differences Between Accrual Accounting vs Cash Accounting

Both Accrual Accounting vs Cash Accounting are popular choices in the market; let us discuss some of the major Differences Between Accrual Accounting vs Cash Accounting:

The significant difference between Accrual Accounting and Cash Accounting is where we started our discussion – Timing. The timing of recording or recognizing a transaction, whether Revenue or expenses. On the one hand, the cash-based mechanism believes in instantaneous acknowledgment of expenses and revenues; the accrual-based method, on the other hand, emphasizes anticipated transactions. Another vital difference is in the way cash is tracked. Cash-based accounting provides an exceptional view of cash flows, recording inflows and outflows as and when they occur but losing out on matching revenues and expenses in the journal entry. On the other hand, accrual accounting is bad at tracking cash flows but great at matching revenue and expenses.

Nature

Cash accounting is simple and intuitive to understand. Income and expenditure are realized based on their occurrence. Therefore, it did not matter when the invoice was issued. Hence, when a firm relies on cash-based accounting, it does not need to prepare adjustment entries like accruals, deferrals, or prior period items.

Meeting GAAP

The cash accounting method relies more on the timing of payments than when they were incurred. Consequently, a firm may not record revenue in the year when the corresponding work was performed, as it received the revenue a year later. As a result, it is not an acceptable form of accounting, and hence, it is not recognized by GAAP (Generally Accepted Accounting Principles). On the other hand, Accrual accounting is widely accepted because it recognizes the revenues when earned rather than when received.

A Better Picture of Financial Performance

Relying on cash would be a crude and disorganized way of reporting transactions. The financial status thus reported will not be an accurate way of gauging a company’s financial performance, considering there might be projects that run for a longer time horizon. It can be difficult and frustrating for investors to come up with a future projection of revenues and cash flows, leading to second thoughts over their decision to invest in the company. Accrual is a much more systematic, clean, and acceptable way of accounting. The reliance is more on a holistic view, and a single transaction (whether small or huge) cannot alter the financial status and performance of the firm. Thus providing a true and fair view of financial statements.

Access to Credit

As the business grows, reliance on cash decreases, and transactions rely more on credit. In a competitive market, surviving solely on cash-based transactions is no longer sufficient, as business expansion becomes necessary.

As a result, there will be times when payments will be delayed. Recording and measuring credit can be easily done in accrual accounting, a phenomenon unknown in cash accounting.

Tax Implications

Whether you use the accrual or cash mechanism of accounting, it can substantially impact your tax statements. For example, say you receive a payment in January (start of the fiscal year) for the services provided in Q4 (end of the previous fiscal year) of $ 5000. Cash accounting would include this amount as revenue in the current fiscal year, inflating your tax for the current year. However, accrual accounting would consider this amount in the previous fiscal year itself even though the payment was not received.

Accrual Accounting vs Cash Accounting Comparison Table

Below Is The Topmost Comparison Between Accrual Accounting vs Cash Accounting

| Basis of comparison | Cash Accounting | Accrual Accounting |

| Meaning | The recognition of revenues and expenses only happens when the company receives payments or pays bills | In the accrual method, the company recognizes revenue and expenses as and when they incur them. |

| Mechanism | includes payments received and expenses paid only through cash | Consider all expenses regardless of the payment method, such as credit. |

| Nature | Simple and intuitive | Complex and difficult to understand |

| Recognized by | GAAP does not recognize Cash Accounting | GAAP and the company’s act recognize accrual accounting. |

| Basis of accounting | Whenever there is a cash-based transaction | Depends more on revenue and expenses rather than the transactions. |

| Usefulness | Provide an excellent picture of cash flows | It matches revenue and expenses perfectly, although bad at tracking cash flows. |

| Holistic approach | No, as the emphasis is more on transactions. | It provides a holistic view of all Accounts receivable and Accounts payable types. |

Conclusion

For its simplicity, easy implementation, less time-consuming, and easier interpretation, Cash accounting is acceptable for small enterprises (having less than $ 5 million in sales). This method allows one to easily account for the payments and avoid complex accounting mechanisms like deferrals and accruals. However, since there is too much dependence on the transactions, a single payment from the client can result in unusually high or low profits in a particular quarter because of its sheer size or random timing. This very nature makes cash accounting difficult for publicly traded companies. However, as the firm’s size becomes large and transactions based on credit increase, accrual accounting is no longer an option but a necessity. Hence, it would be in the interest of SMEs and managers anticipating future growth to understand it to smooth the transition.

Recommended Articles

This has guided the top differences between Accrual Accounting and Cash Accounting. Here, we discuss the key differences between Accrual Accounting vs Cash Accounting with infographics and a comparison table. You may also have a look at the following articles –