Updated November 27, 2023

Revenue Formula

Revenue is the total sales of the company’s goods and services in a period. Revenue is the main element of the income statement in business. The company’s revenue expense done by the company is deducted to result in net income. Revenue can be calculated by multiplying the number of goods or services by their price. The formula for Revenue can be written as:-

Where,

- R = Revenue

- Q = Quantity

- P= Price

Revenue Recognition Principle

According to the revenue recognition principle, revenue is recorded when the benefit of sales is generated, and risks of ownership are transferred from buyer to seller when goods and services are delivered to the seller. When the product is sold, revenue is recorded in the balance sheet, and cash also increases in the balance sheet. When goods and services are sold on credit, revenue is recorded in the balance sheet, and when cash is received by the company, only cash is recorded.

Examples of Revenue Formula

Let us see an example to understand the revenue formula.

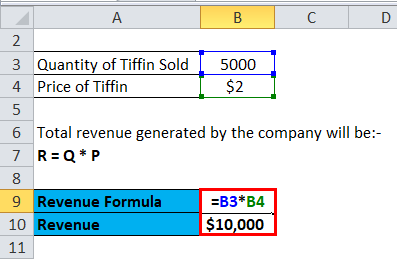

Revenue Formula – Example #1

A company is selling 5000 tiffin boxes daily at a price of $2 each.

Total revenue generated by the company will be:-

R = Q * P

Put the value in the formula.

- Revenue = 5000 * 2

- Revenue = $10,000

The total revenue generated by the company is $10,000.

Revenue on Income Statement

Revenue generated by sales of goods and services allows the company to pay for its expenses, pay salaries of employees, and purchase machinery and inventory. If the company has insufficient revenue, it will not be able to pay for its expense and expand its business. The main source of revenue generation is sales. Another method through which the company will get funds to invest in the business is through borrowing, or the company can raise funds by issuing its equity in the capital market.

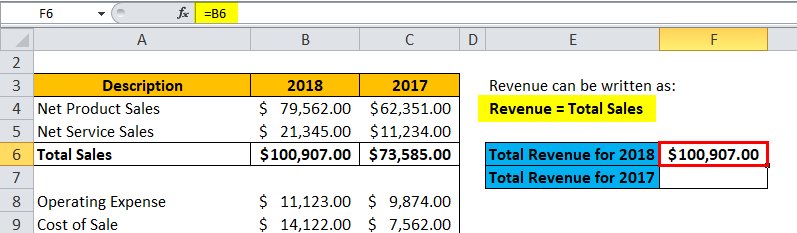

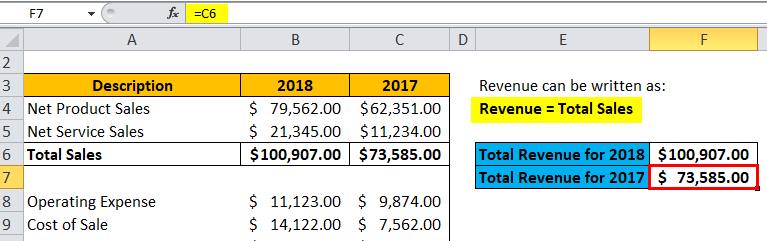

Revenue can be written as:

Revenue = Total Sales

Revenue Formula – Example #2

Below is the income statement for the years 2017 & 2018 of the company Amaze Pvt. Ltd.

| Description | 2018 | 2017 |

| Net Product Sales | $79,562.00 | $62,351.00 |

| Net Service Sales | $21,345.00 | $11,234.00 |

| Total Sales | $100,907.00 | $73,585.00 |

| Operating Expense | $11,123.00 | $9,874.00 |

| Cost of Sale | $14,122.00 | $7,562.00 |

| Fulfillment | $4,211.00 | $2,131.00 |

| Marketing | $6,542.00 | $3,214.00 |

| R&D | $3,523.00 | $2,531.00 |

| Administrative Expense | $574.00 | $233.00 |

| Total Operating Expense | $40,095.00 | $25,545.00 |

| Operating Income | $2,233.00 | $1,124.00 |

| Interest Income | $150.00 | $100.00 |

| Interest Expense | $(789.00) | $(654.00) |

| Other Income | $(852.00) | $(632.00) |

| Total non-operating Income | $742.00 | $(62.00) |

| Provision for Income Taxes | $(1,950.00) | $(1,141.00) |

| Net Income | $59,604.00 | $46,837.00 |

Here, total sales are equal to the total revenue of a company.

Revenue for year 2018 = $100,907

Revenue for year 2017 = $73,585

Revenue Formula – Example #3

A bakery sells 35 cookie packets per day at $20 per pack. To increase the sales of cookies owner did an analysis and found that if he decreased the price of cookies by $5, his sales would increase by 5 packets of cookies, he wants to know how much price he should fix the cookies.

Let x be the multiplying factor.

Price of cookies = 20 – 5x

Quantity of cookies = 35 + 5x

As we know,

Put the above equations in the revenue formula.

(20 – 5x) * (35 + 5x) = 0

20(35 + 5x) – 5x(35 + 5x) =0

700 + 100x – 175x – 25x 2 = 0

25x2 + 75x – 700 = 0

By simplifying the equation.

x 2 + 3x -28 = 0

We get the values of x below by solving the above quadrilateral equation.

(x + 7) (x – 4) = 0

x = -7 or x = 4

Put the value of x in the equation of the price of cookies.

The price of cookies = 20 – 5*4 = 0, which is impossible.

If value x = -7

Price of cookies = 20 – 5 * -7 = 20 + 35 = $ 55

Total revenue is what goes in the company, or it is the financial inflow in the company apart from borrowing or fundraising through issuing equity, as it is not the amount generated by sales of goods and services.

Adding all made by the company results in total revenue generated by the company. From total revenue, the profit of the company can be calculated. In the financial statement, gross sales are equal to total revenue. The company needs to understand the role of sales based on the type of company sales of goods and services that generate revenue. If company sales go down, it will affect the company and its functioning as to run business, money is required, and with a decrease in sales, money with the company also decreases, which leads to cost-cutting, employee cutting, increase in debt and result in the loss to the company.

Explanation of Revenue Formula

Revenue can be calculated by multiplying the quantity of goods or services by price.

Revenue = Quantity * Price

The price of a good or service tells about the revenue generated by the sale of one good or service, and if one wants to know the total revenue generated, one needs to multiply the price by the total number of goods or services sold.

In terms of revenue generated by services formula can be written as:-

Revenue = No. of customer * Average price of services

In terms of revenue generated by goods formula can be written as:-

Revenue = No. of units sold * Average Price

Now, let us see a practical example of a revenue formula.

Significance and Uses of Revenue Formula

There are many uses of revenue and its formula:-

- It helps to calculate the profit of the company.

- Revenue helps in financial analysis.

- It has to find the efficiency of the company.

- It also helps to find the financial position of the company.

- Revenue helps in the company’s forecast based on many drivers like discounts, website traffic, product price, etc.

Revenue is a crucial part of financial analysis and investment banking. Through analyzing the revenue of the company and calculating the profit of the company, the investor makes a decision to invest in the particular company as it helps the investor to find the potential of the company by studying the sales trend of the company and also helps him to calculate return on investment. It also tells about the financial position of the company. Still, we cannot consider revenue as the company’s profit, which has tax and company expenditure costs.

Revenue Calculator

You can use the following Revenue Calculator

| Quantity | |

| Price | |

| Revenue Formula | |

| Revenue Formula = | Quantity x Price |

| = | 0 x 0 = 0 |

Revenue Formula in Excel (With Excel Template)

Here, we will do the same example of the Revenue formula in Excel. It is very easy and simple. You need to provide the two inputs, i.e, Quantity and Price

You can easily calculate the Revenue using the Formula in the template provided.

The revenue of the company is calculated as follows:-

Revenue for the year 2018 is calculated as follows:

Revenue for the year 2017 is calculated as follows:

Recommended Articles

This has been a guide to a Revenue formula. Here, we discuss its uses along with practical examples. We also provide you Revenue Calculator with a downloadable Excel template. You may also look at the following articles to learn more –