Updated July 31, 2023

Difference Between Insurance vs Assurance

Insurance and assurance are commonly offered products in the market, but they differ in their offerings despite having similar purposes. This article aims to explore the distinctive features of insurance and assurance, shedding light on their contrasting characteristics and how they are distinct from one another.

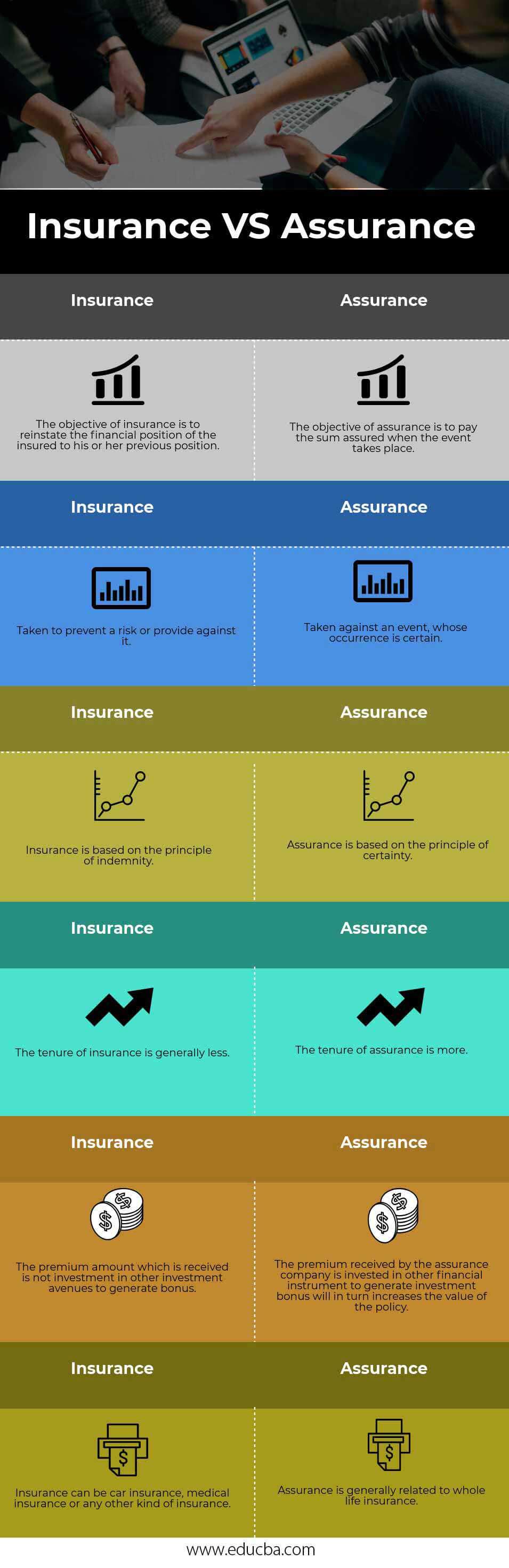

Head To Head Comparison Between Insurance vs Assurance (Infographics)

Below is the top 6 difference between Insurance vs Assurance:

Key Differences Between Insurance vs Assurance

Both Insurance vs Assurance are popular choices in the market; let us discuss some of the major differences:

- Insurance is a contractual arrangement where an insurer agrees to compensate the insured for losses resulting from natural disasters or personal misfortunes. The compensation can be a predetermined percentage of the loss, a fixed sum of money, or a small amount. In contrast, the insurer and the insured agree to assure coverage for an event expected to occur at some point in the insured person’s life.

- Insurance and assurance differ significantly in their approach to covering events. Insurance typically applies to uncertain events, regardless of the likelihood of their occurrence. The probability of such events is often not a significant factor when obtaining insurance coverage. Contrastingly, assurance aims to safeguard against events that are highly likely to occur, expecting them to happen at some point in the insured individual’s life, whether sooner or later.

- The main purpose of insurance is to reduce the financial loss for the insurer in the event of a specific incident. On the contrary, assurance involves making a predetermined payment when a highly probable event occurs in a person’s life. This type of insurance falls under the category of general insurance, while life insurance falls under the category of assurance.

- The tenure of insurance is generally less when compared to the tenure of assurance because the insurance is not a long-term benefit. In contrast, assurance can provide you with long-term benefits.

- Under an assurance policy, the payment is guaranteed since the investment is combined with the sum insured. Additionally, the value of the policy grows over time due to the inclusion of an investment bonus. However, insurance companies can sometimes perplex policyholders by failing to fulfill the expected payment due to undisclosed criteria and clauses that must be satisfied before releasing the final payment, which often goes unmet in many instances.

Insurance vs Assurance Comparison Table

Below are the 6 topmost comparisons between Insurance vs Assurance:

| Insurance | Assurance |

| The objective of insurance is to reinstate the insured’s financial position to his or her previous position. | The objective of assurance is to pay the sum assured when the event takes place. |

| Taken to prevent risk or provide against it | Taken against an event whose occurrence is certain |

| Insurance is based on the principle of indemnity. | Assurance is based on the principle of certainty. |

| The tenure of insurance is generally less. | The tenure of assurance is more. |

| The premium amount which is received is not the investment in other investment avenues to generate the bonus. | The premium received by the assurance company is invested in other financial instruments to generate an investment bonus, which will, in turn, increase the policy’s value. |

| Insurance can be car, medical, or any other kind of insurance. | Assurance is generally related to whole life insurance. |

Conclusion

Insurance companies offer both the products insurance and assurance, which tend to confuse the customer. Many insurance companies offer a wide range of insurance and investment policies and have a sales agent to induce customers to buy them. One should be careful when he or she is purchasing policies like this, which depends on the long-term plan and the customer’s financial status and well-being. An individual should consult a financial planner or an insurance advisor to choose the right insurance policy for him and his family, who must be protected long after he is gone and should remain in a sound financial position.

Recommended Articles

This has been a guide to the top difference between Insurance vs Assurance. Here we also discuss the Insurance vs Assurance key differences with infographics and the comparison table. You may also have a look at the following articles to learn more.