Updated July 27, 2023

Depreciation Expenses Formula (Table of Contents)

What is the Depreciation of Expenses?

This article will discuss the Depreciation Expenses Formula along with the Introduction and various Examples of the Depreciation Expenses Formula.

Depreciation, commonly used in Accounting and Tax, refers to reducing a fixed asset’s cost over its useful period. Each fiscal year, a company records a depreciation expense in its financial statements, such as Income statements, to reflect the decrease in the fixed asset’s value.

On the other hand, some assets may increase in value over time, known as appreciation expenses. Land serves as a prime example of appreciating assets.

Depreciation expenses are associated with tangible assets like buildings, vehicles, mobiles, machines, etc., and are recorded as a reduction in their cost. On the other hand, intangible expenses, such as brands, marketing, logo, and intellectual property, are referred to as amortization. For costs related to fuels, oil prices, and natural resources, the term depletion is used.

Whether it’s a small or large business, understanding depreciation is crucial for tax filings and assessing the performance of specific assets. However, the value of depreciation expense can vary depending on the method employed by a company. There are three common methods used to calculate depreciation expense.

- Straight Line Method.

- Unit of Production Method.

- Double-Declining-Balance Method.

#1 – Straight Line Method

Among 3, this is the simplest formula as we need to plug the values into the formula straight away. This is obtained by dividing the difference amount of the asset’s cost & salvage value by useful life years.

#2 – Unit of Production Method

This method predicts the expense amount based on the output capability, not the number of years. Each product unit of an assembly line is assigned the same expense amount here in this method.

Per Unit Depreciation = (Asset’s Cost – Salvage Value)/ Useful life of each unit

#3 – Double-Declining Balance Method

This method counts the asset’s expense two times the asset’s book value each year. This is an accelerated depreciation method.

Book Value = Cost of the Asset – Accumulated Depreciation

Examples of Depreciation Expenses Formula (With Excel Template)

Let’s take an example to understand the calculation of Depreciation Expenses in a better manner.

Depreciation Expenses Formula – Example #1

#1 – Straight Line Method

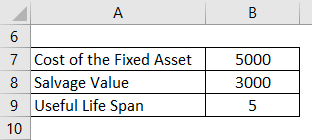

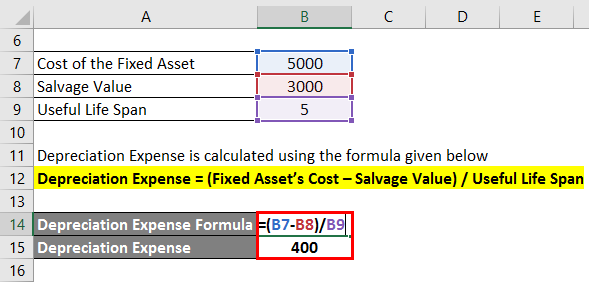

Company A purchases machinery for Rs.5000, the useful life of the machinery is 5 years, and the Salvage value of the machinery is Rs.3000. Now, Let us apply the values in the below formula.

Solution:

The formula to calculate Depreciation Expense is as below:

Depreciation Expense = (Fixed Asset’s Cost – Salvage Value)/ Useful Life Span

- Depreciation Expense = (5000 – 3000) / 5

- Depreciation Expense = 2000 / 5

- Depreciation Expense = Rs. 400

- Depreciation Expense = 4%

#2 -Unit of Production Method

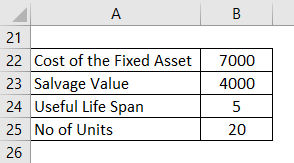

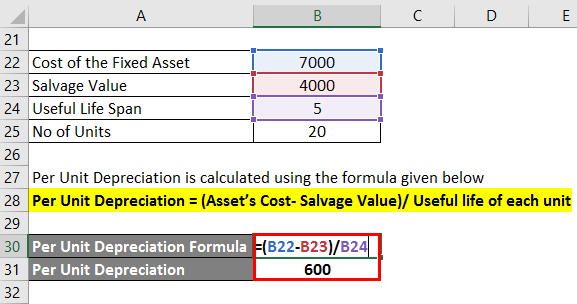

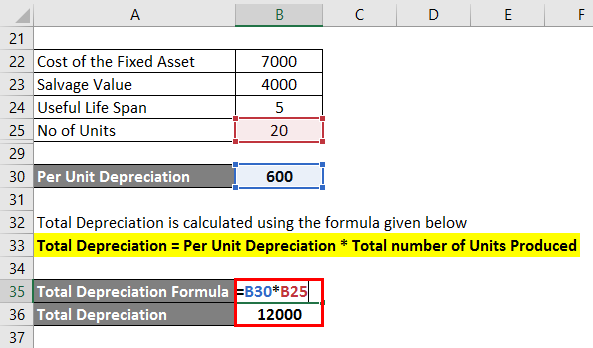

Company X buys equipment for Rs.7000, the useful life of the machinery is 5 years, and the Salvage value of the machinery is Rs.4000. Totally, there are 20 Units of equipment. Now Let us apply the values in the below formula.

Solution:

The formula to calculate Per Unit Depreciation is as below:

Per Unit Depreciation = (Asset’s Cost – Salvage Value)/ Useful life of each unit

- Per Unit Depreciation = (7000 – 4000)/5

- Per Unit Depreciation = 3000/5

- Per Unit Depreciation = Rs. 600

- Per Unit Depreciation = 6%

The formula to calculate Total Depreciation is as below:

Total Depreciation = Per Unit Depreciation * Total number of Units Produced

- Total Depreciation = 600 * 20

- Total Depreciation = Rs.12000

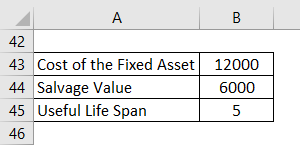

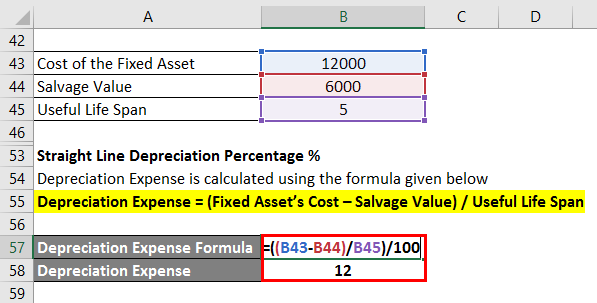

#3 – Double Declining Balance Method

Banyan Company shops stitching units for Rs.12000 in the year 2001 & the useful life of the Units are 5 years, and the Salvage value of the machinery is Rs.6000. Now Let us apply the values in the below formula.

For the Year 2001

The formula to calculate Book Value is as below:

Book Value = Cost of the Asset – Accumulated Depreciation

- Book Value = 12000 – 0

- Book Value = 12000

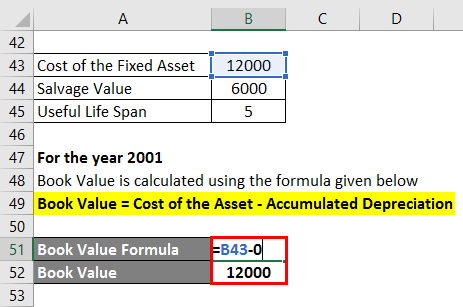

Straight Line Depreciation Percentage

The formula to calculate Depreciation Expense is as below:

Depreciation Expense = (Fixed Asset’s Cost – Salvage Value)/ Useful Life Span

- Depreciation Expense = ((12000 – 6000/5))/100

- Depreciation Expense = 12

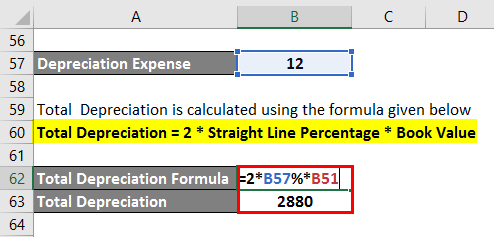

The formula to calculate Total Depreciation is calculated using the formula given below

Total Depreciation= 2 * Straight Line Depreciation Percentage * Book Value

- Total Depreciation = 2 * ((12000 -6000)/5) in % * 12000

- Total Depreciation = 2 * 12% * 12000

- Total Depreciation = 24 % * 12000

- Total Depreciation = 2880

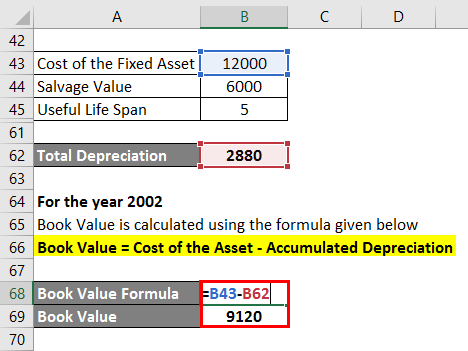

For the Year 2002

The formula to calculate Book Value is as below:

Book value = Cost of the Asset-Accumulated Depreciation

- Book Value = 12000 – 2880

- Book Value= 9120

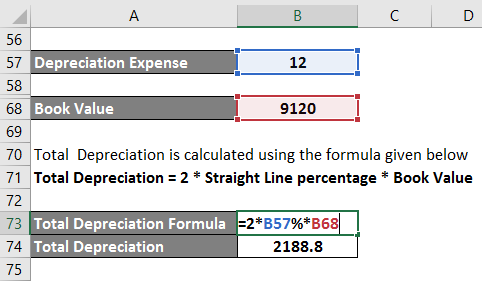

The formula to calculate Total Depreciation is as below:

Total Depreciation = 2 * Straight Line Depreciation Percentage * Book Value

- Total Depreciation = 2 * 12% * 9120

- Total Depreciation = 24% * 9120

- Total Depreciation = 2188.8

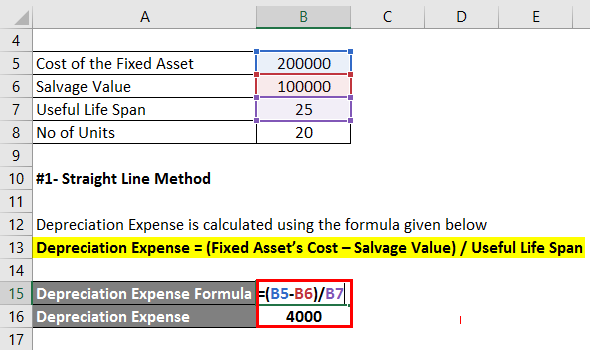

Depreciation Expenses Formula – Example #2

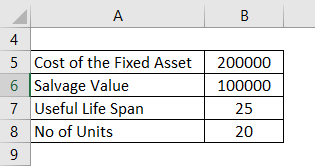

In 2018, Lakshmi Mills Company purchased Machinery for Rs.200000 & the useful life of the machinery is 25 years & the Salvage value of the machinery is Rs.100000. Totally, there are 20 Units of Machinery. Now Let us apply the values below.

- Straight Line Method.

- Unit of Production Method.

- Double-Declining-Balance Method.

#1 – Straight Line Method

The formula to calculate Depreciation Expense is as below:

Depreciation Expense = (Fixed Asset’s Cost – Salvage Value)/ Useful Life Span

- Depreciation Expense = (200000 – 100000) / 25

- Depreciation Expense= 100000 / 25

- Depreciation Expense= Rs. 4000

- Depreciation Expense = 40%

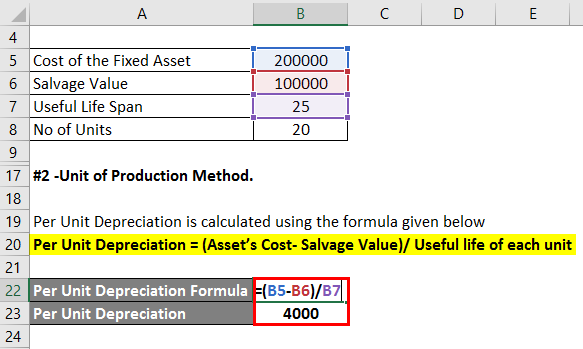

#2 -Unit of Production Method

The formula to calculate Per Unit Depreciation Expense is as below:

Per Unit Depreciation = (Asset’s Cost – Salvage Value) / Useful life of each unit

- Per Unit Depreciation = (200000 – 100000) / 25

- Per Unit Depreciation = Rs. 4000

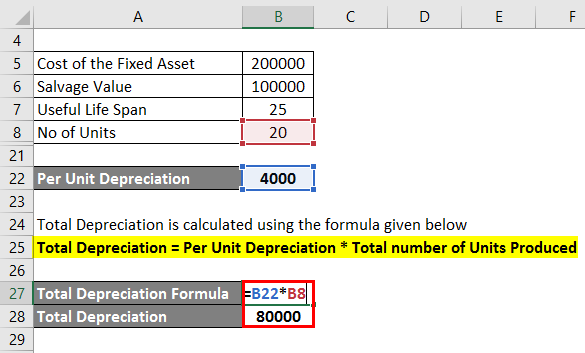

The formula to calculate Total Depreciation is as below:

Total Depreciation = Per Unit Depreciation * Total number of Units Produced

- Total Depreciation = 4000 * 20

- Total Depreciation = Rs. 80000

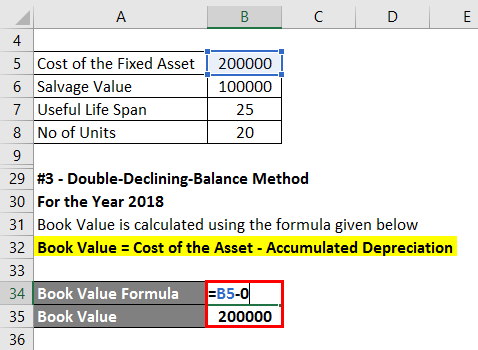

#3 – Double Declining Balance Method

For the Year 2018,

The formula to calculate Book Value is as below:

Book Value = Cost of the Asset – Accumulated Depreciation

- Book Value= 200000 – 0

- Book Value = 200000

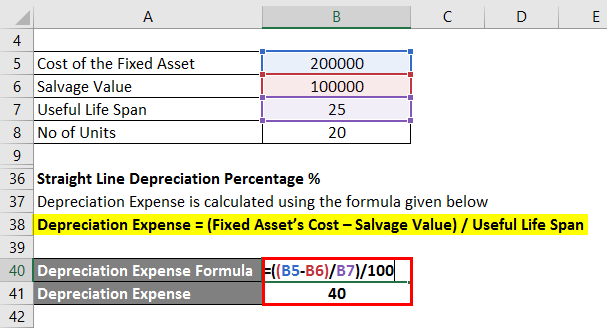

Straight Line Depreciation Percentage %

The formula to calculate Depreciation Expense is as below:

Depreciation Expense = (Fixed Asset’s Cost – Salvage Value) / Useful Life Span

- Depreciation Expense = ((200000 -100000)/ 25) / 100

- Depreciation Expense = 40

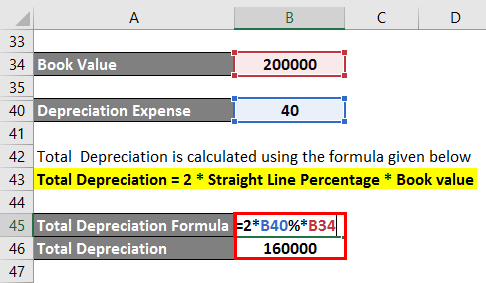

The formula to calculate Total Depreciation is as below:

Total Depreciation = 2 * Straight Line Depreciation Percentage * Book Value

- Total Depreciation = 2* ((200000-100000)/25) in % * 200000

- Total Depreciation= 2* 40% *200000 = 80 % *200000

- Total Depreciation= 160000

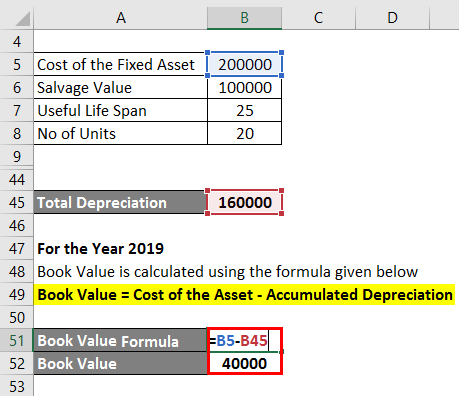

For the Year 2019,

The formula to calculate Book Value is as below:

Book Value = Cost of the Asset – Accumulated Depreciation

- Book Value = 200000 – 160000

- Book Value = 40000

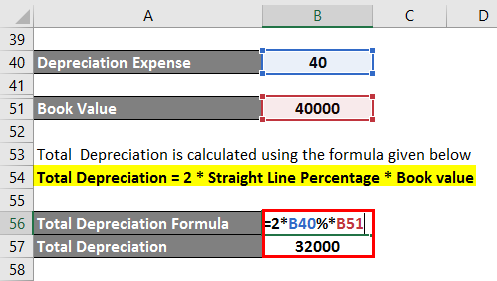

The formula to calculate Total Depreciation is as below:

Total Depreciation Expense = 2 * Straight Line Depreciation Percentage * Book Value

- Total Depreciation = 2* 40% * 40000

- Total Depreciation = 80% * 40000

- Total Depreciation = 32000

Explanation

Straight line Method:

Here is the step-by-step approach for calculating Depreciation expense in the first method.

- Step 1: Asset’s Cost: This is the cost of the fixed asset. This includes actual asset preparation costs, set-up costs, taxes, shipping, etc.

- Step 2: Salvage Value: After the useful lives of an asset, how much reduction has happened in a fixed asset is called salvage value, breakup value, scrap value, or residual value. That is, a company may decide to sell an asset at a reduced price post useful life of it.

- Step 3: Useful Life Span: The duration for which the particular asset is considered productive. Post that, it is considered not cost-effective or operational.

- Step 4: After having all the values in hand, we can apply the values in the below formula to get the depreciation amount.

Depreciation Expense = (Fixed Asset’s Cost – Salvage Value)/ Useful Life Span

Unit of Production Method:

The variables we use are the same as the Straight line method except for the number of units produced.

- Step 1: The variable’s values are found. In addition to the other variables, the number of units produced is also noted.

- Step 2: Finally, the Depreciation expense is calculated by applying the estimated values in the below formula.

Total Depreciation = Per Unit Depreciation * Total number of Units Produced

Double Declining Balance Method:

- Step 1: We must find the straight-line depreciation method using the first method.

- Step 2: Book value is found by deducting the accumulated depreciation from the asset’s cost. Mathematically, we can apply values in the below equation.

Book value = Cost of the Asset – Accumulated Depreciation

- Step 3: After having all the values in hand, we can apply the values in the below formula to get the depreciation amount.

Total Depreciation Expense = 2 * Straight Line Depreciation Percentage * Book Value

Relevance and Uses of Depreciation Expenses Formula

Depreciation Expense is very useful in finding the use of assets each accounting period to stakeholders. Tax benefits also take place in depreciation. On the income statement, it represents a non-cash expense, but it reduces net income too. Lower net income results in lower tax liability too. Though the Straight line method is very straightforward and used in many companies for tax benefits, many companies use the Accelerated Depreciation method too. It gives high depreciation in the early stage, showing lower tax liabilities at the beginning stages.

Recommended Articles

This is a guide to the Depreciation Expenses Formula. Here we discuss calculating the Depreciation Expenses Formula along with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more –