Updated July 29, 2023

Difference Between Equity vs Shares

The equity of the company refers to capital invested by the owners of the company and profit accumulated by the company during the tenure of business, also called Reserves and Surplus. Equity is also called the net worth of the company. In accounting language, Equity is the value of assets that remain after paying off the Liabilities. When owners of the company do not have sufficient funds, they go to the public to raise the money. The amount of money that is to be invested is divided into portions. This portion is a Share. When we go to the dictionary meaning of share, it is “have a portion of (something)” Likewise, shares of the company are a division of the capital of the company into various portions.

Equity

Equity can be written in the equation:

It is shown on the liability side of the Balance sheet. And it always carries a credit balance. At the same time, the preparation of Financials Statements of Business, capital contribution by owners, and profits are written differently according to the formation of the Business. If the Business is in the form of a Private Limited Company or Public Limited Company, “Equity” is written. In the case of Partnership Firms and Proprietorships, it is written as “Capital”. The Equity of the Company consists of:

- Shareholder’s Equity and

- Reserves and Surplus (For Example, Profit and Loss Reserves, Security Premium Reserve, Capital Reserves, Retained Earnings, etc.)

Every owner of the business invests in his company for the expansion of the business. When a company requires more for expansion, it can bring equity on its own, or it can go to the public to raise the money. People who invest in the company become Shareholders of the company. Shareholders of the company are also the owners of the company as they have invested in companies like owners. And, as owners, they share the Profit and Loss of the company also. In the balance sheet, it is “Shareholder’s Equity”.

“Reserves and Surplus” is the second component of Equity. Reserves and Surplus is profit accumulated by the business for various purposes. All profit is allocated according to specific reserves. This will be useful for business in the future. This is also one of the components of Equity.

If we are talking about the Equity of a Company, we are talking about the shareholders’ equity and Reserves and Surplus it has. The Equity can be Positive Equity, or it can be Negative Equity. Positive Equity means a company has sufficient assets to repay all its Liabilities. Negative Equity means a company has Liabilities more than its Assets. Whenever there is negative equity, it does not give a good sign of the company’s growth.

Shares

Let’s take an example for understanding; there is a Company, ABC Ltd, which needs a capital of Rs. 100 Crores for expansion. It will go to the public to raise the capital. The capital of ABC is divided into 1,000,000 shares of Rs. 1000 each amounting to Rs. 100 Crores. So, if a person wants to invest, he has bought 1,000,000 shares at a rate of Rs. 1000 each. Let us say Mr. X wants to invest Rs. 500,000/- in the company. For this, he has to buy 500 shares of Rs. 1000 each. Let’s say Mr. Y buys 700 shares of Rs. 1000 each, which means that Mr. Y has shares of Rs.700,000. Here, Mr. X & Mr. Y become the company’s shareholders, and they will share the Profit and Loss of the company proportionate to their holdings.

From this example, it is clear that Shares are a division of Capital. There are various types of Shares a Company can issue for raising capital, like Ordinary Shares, Preference Shares, Redeemable shares, non-redeemable shares, Cumulative Preference shares, etc.

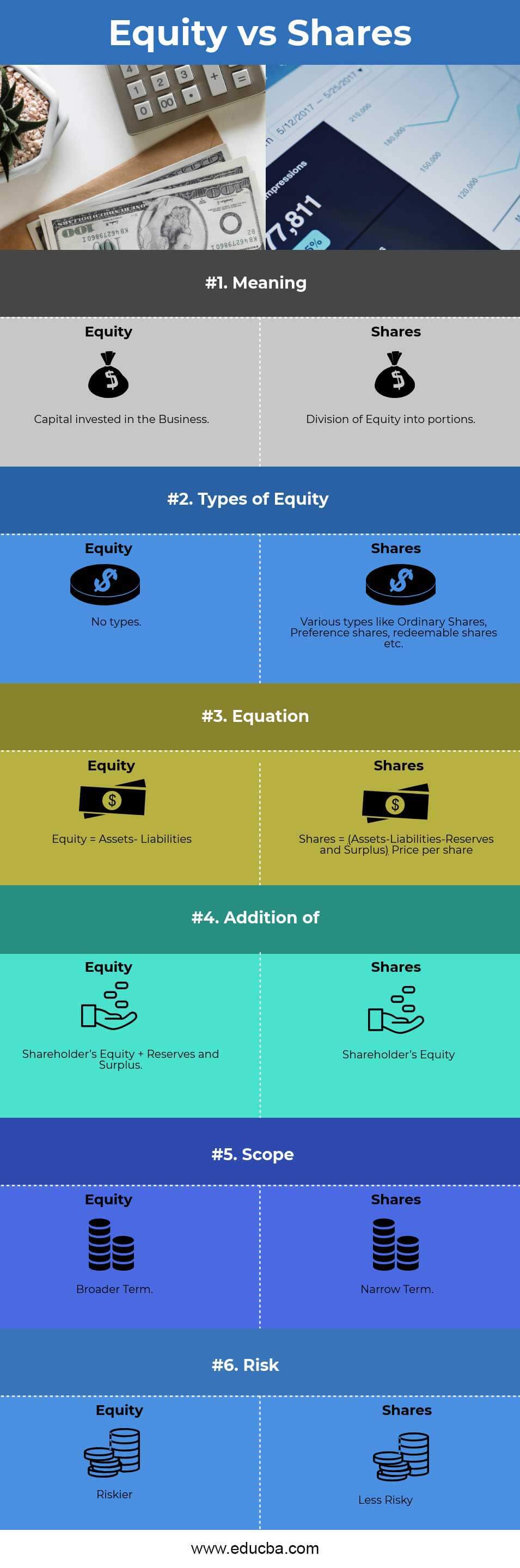

Head To Head Comparison Between Equity vs Shares (Infographics)

Below is the top 6 difference between Equity vs Shares

Key Differences Between Equity vs Shares

Let us discuss some of the major differences between Equity vs Shares.

- Equity is Capital Invested by Owners in the Company, whereas Shares are the division of Capital or Equity.

- It refers to the Value of the Business as a whole, whereas Share refers to the amount of contribution to the Business.

- Equity of a Company consists of Shareholder’s Equity and Reserves and Surplus, whereas Shares consist of only Shareholder’s Equity.

- Equity is riskier as compared to Shares.

- There are various types of Shares like Preference Shares, Redeemable Shares, Ordinary Shares, etc., whereas there is no type of Equity as such.

- Equity covers Shares, whereas there is no vice-versa.

- Equity can be called as Net assets of a Business, whereas Shares are the only capital contribution of a business.

Equity vs Shares Comparison Table

Let’s look at the top 6 Comparisons between Equity vs Shares.

| The Basis Of Comparison | Equity | Shares |

| Meaning | Capital invested in the Business | Division of Equity into portions |

| Types of Equity | No types | Various types like Ordinary Shares, Preference shares, redeemable shares, etc. |

| Equation | Equity = Assets- Liabilities | Shares =(Assets-Liabilities-Reserves and Surplus) Price per share |

| Addition of | Shareholder’s Equity + Reserves and Surplus | Shareholder’s Equity |

| Scope | Broader Term | Narrow Term |

| Risk | Riskier | Less Risky |

Conclusion

From the above, it can be possible that Equity vs Shares has some differences. Equity is a Larger Term, and shares are part of the Equity of the Company. Both Equity vs Shares terms are very common in Finance. It is an essential term in the Stock Market. It helps to decide the size of the business. So, both terms should not be incorrect.

Recommended Articles

This has been a guide to the top difference between Equity vs Shares. Here we also discuss the Equity vs Shares key differences with infographics and comparison table. You may also have a look at the following articles to learn more –