Updated July 25, 2023

Net Worth Formula (Table of Contents)

What is the Net Worth Formula?

The term “net worth” refers to the book value of the equity owned by company shareholders. It can also be seen as the net value of a company that can be claimed by its shareholders in case all its assets have been liquidated, and all its debts are repaid.

In other words, it is the dollar amount of assets left after all the liabilities have been paid off. A company’s net worth is also known as stockholder and shareholder equity. The formula for net worth can be derived by subtracting the total liabilities from the total assets of the subject company. The Mathematical representation of the formula is:

Examples of Net Worth Formula (With Excel Template)

Let’s take an example to understand the calculation of the Net Worth Formula in a better manner.

Net Worth Formula– Example #1

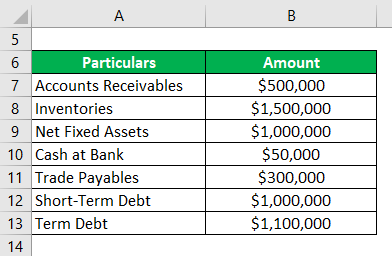

Let us take the example of a company, GHJ Ltd., engaged in synthetic rubber manufacturing. As per the latest balance sheet of the company, the total assets of the company included accounts receivables of $500,000, inventories of $1,500,000, net fixed assets of $1,000,000, and cash at the bank of $50,000, while the total liabilities included trade payables of $300,000 short-term debt of $1,000,000 and term debt of $1,100,000. Calculate the net worth of GHJ Ltd. based on the given information.

Solution:

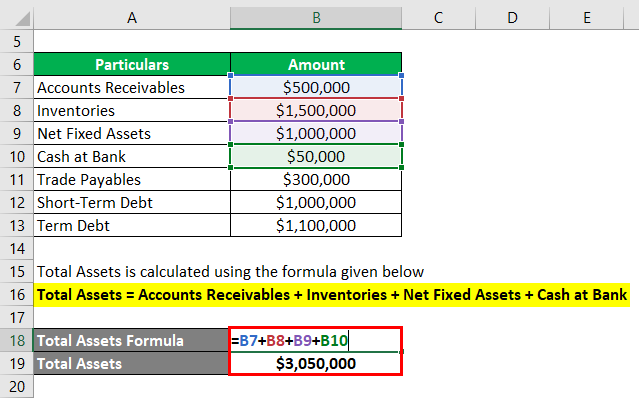

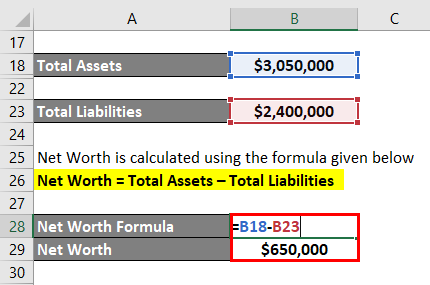

The formula to calculate Total Assets is as below:

Total Assets = Accounts Receivables + Inventories + Net Fixed Assets + Cash at Bank

- Total Assets = $500,000 + $1,500,000 + $1,000,000 + $50,000

- Total Assets = $3,050,000

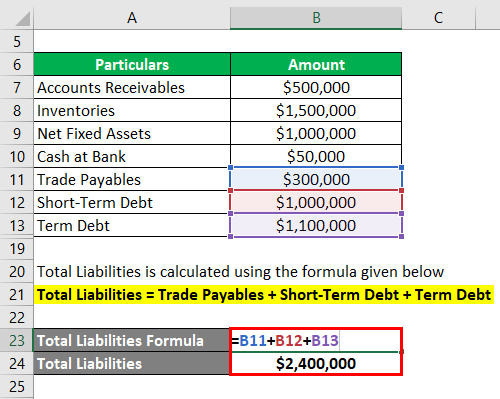

The formula to calculate Total Liabilities is as below:

Total Liabilities = Trade Payables + Short-Term Debt + Term Debt

- Total Liabilities = $300,000 + $1,000,000 + $1,100,000

- Total Liabilities = $2,400,000

The formula to calculate Net Worth is as below:

Net Worth = Total Assets – Total Liabilities

- Net Worth = $3,050,000 – $2,400,000

- Net Worth = $650,000

Therefore, the net worth of GHJ Ltd., as on the balance sheet, stood at $650,000.

Net Worth Formula– Example #2

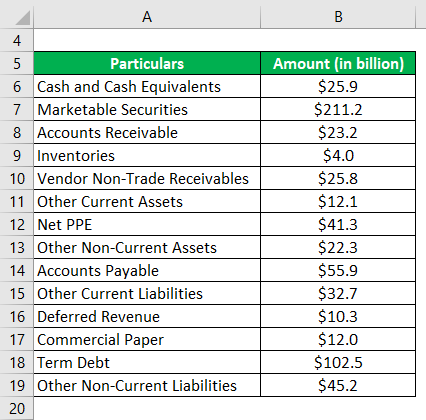

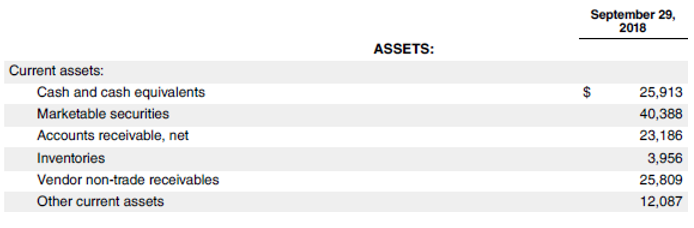

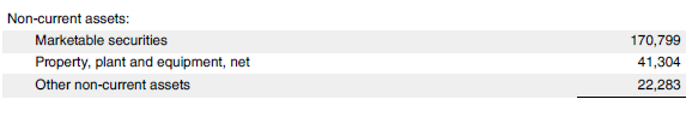

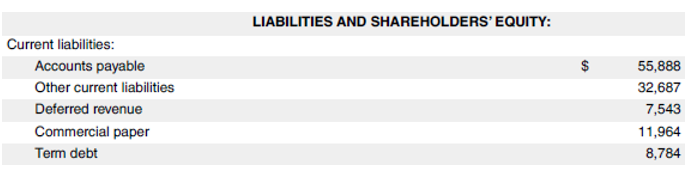

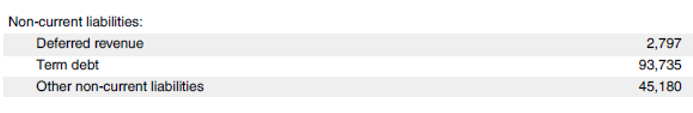

Let us take the example of Apple Inc. to illustrate the computation of net worth. According to the annual report for 2018, the following information is available: Calculate the net worth of Apple Inc. for 2018 based on the information.

Solution:

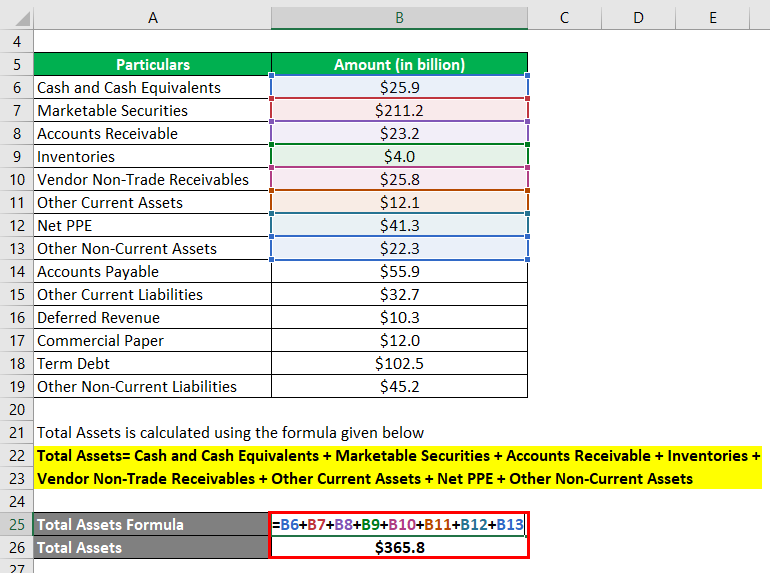

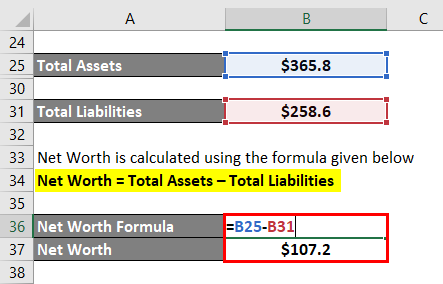

The formula to calculate Total Assets is as below:

Total Assets= Cash and Cash Equivalents + Marketable Securities + Accounts Receivable + Inventories + Vendor Non-Trade Receivables + Other Current Assets + Net PPE + Other Non-Current Assets

- Total Assets = $25.9 Bn + $211.2 Bn + $23.2 Bn + $4.0 Bn + $25.8 Bn + $12.1 Bn + $41.3 Bn + $22.3 Bn

- Total Assets = $365.8 Bn

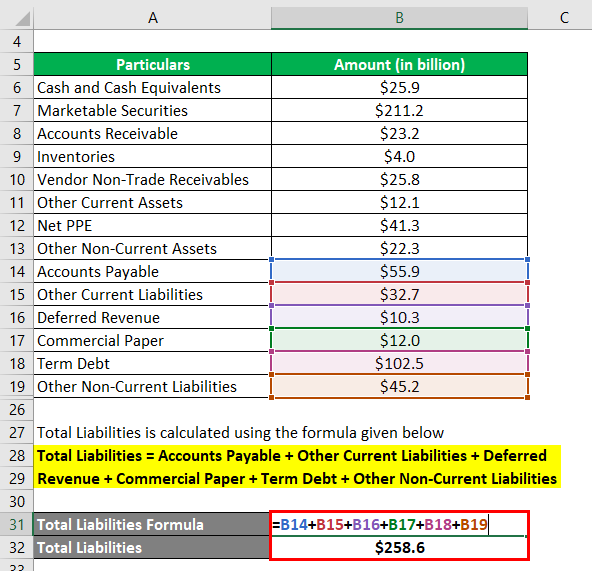

The formula to calculate Total Liabilities is as below:

Total Liabilities = Accounts Payable + Other Current Liabilities + Deferred Revenue + Commercial Paper + Term Debt + Other Non-Current Liabilities

- Total Liabilities = $55.9 Bn + $32.7 Bn + $10.3 Bn + $12.0 Bn + $102.5 Bn + $45.2 Bn

- Total Liabilities = $258.6 Bn

The formula to calculate Net Worth is as below:

Net Worth = Total Assets – Total Liabilities

- Net Worth = $365.8 Bn – $258.6 Bn

- Net Worth = $107.2 Bn

Therefore, the net worth of Apple Inc., as on September 29, 2018, stood at $107.2 Bn.

Source Link: Apple Inc. Balance Sheet

Explanation

The formula for net worth can be derived by using the following steps:

Step 1: First, determine the subject company’s total assets from its balance sheet. Total assets comprise all that can generate future cash inflow, which includes fixed assets, trade receivables, prepaid expenses, etc.

Step 2: Next, determine the total liabilities also available in the balance sheet. Total liabilities include all future payment obligations like term debt, short-term borrowing, trade payables, etc.

Step 3: Finally, the formula for net worth can be derived by subtracting the total liabilities (step 2) from the total assets (step 1) of the company, as shown below.

Net Worth = Total Assets – Total Liabilities

Relevance and Use of Net Worth Formula

Understanding the concept of net worth is very important because it helps assess a company’s financial health. It shows what the company will own if all the liabilities are to be paid off by liquidating the available assets. A positive and increasing net worth indicates good financial health, while a negative or depleting net worth may cause serious concern. As such, lenders scrutinize the business’s net worth before extending any loan.

Net Worth Formula Calculator

You can use the following Net Worth Formula Calculator

| Total Assets | |

| Total Liabilities | |

| Net Worth | |

| Net Worth = | Total Assets – Total Liabilities |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This is a guide to Net Worth Formula. Here we discuss how to calculate Net Worth along with practical examples. We also provide a Net Worth calculator with a downloadable Excel template. You may also look at the following articles to learn more –