Updated November 23, 2023

Difference Between Asset Purchase vs Stock Purchase

When an investor is looking to buy any business or an owner is looking to sell a business, there are two ways of doing it; the transaction can be done as a purchase and sale of the company’s stock or a purchase and sale of the company’s asset.

A buyer of the assets or stock, also known as Acquirer, and the seller of these assets and stock, also known as Target, may have their reason for preferring the type.

When an acquisition is an asset type, the transaction is valued as the total of the sale of all individual assets net of all the liabilities. When a transaction is considered a Stock transaction, the acquisition results in the transfer of ownership, and the entity still owns and holds its assets and liabilities.

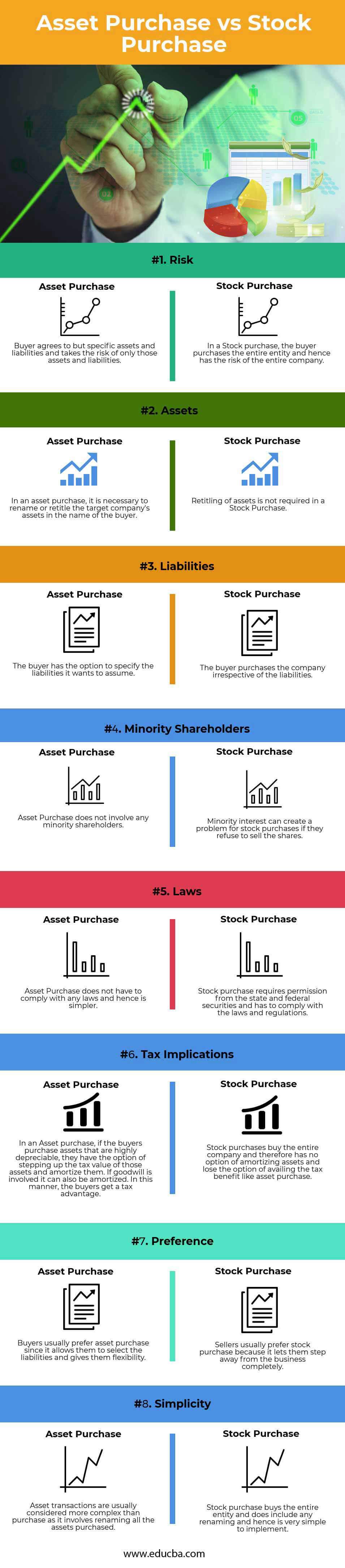

Head To Head Comparison Between Asset Purchase vs Stock Purchase (Infographics)

Below is the top 8 difference between Asset Purchase vs Stock Purchase

Key Differences Between Asset Purchase vs Stock Purchase

Both Asset Purchase vs Stock Purchase are popular choices in the market; let us discuss some of the significant differences between Asset Purchase vs Stock Purchase

- In an Asset, the transaction buyer buys the assets and liabilities. However, the buys have the option to carve out the liabilities which it does want. On the other hand, in the case of a stock purchase, the buyer buys the entire entity and hence accepts all the assets and liabilities.

- An asset transaction limits exposure to the company, thus involving less risk. Conversely, in a stock purchase, the buyer assumes all the risk because they acquire the entire entity.

- In an Asset purchase, if the buyers purchase highly depreciable assets, they can increase their tax value and amortize them. If goodwill is involved, it can also be amortized. In this manner, the buyers get the tax Stock purchases to buy the entire company and therefore have no option of amortizing assets and lose the option of availing the tax benefit like an asset purchase.

- Asset Purchase is considered complex since it involves retitling all the assets, not in the case of stock purchase, and simplifies the process. If a company with 1000 trucks is acquired, an asset purchase would require renaming all these trucks. Therefore, a stock purchase is simpler than an asset purchase in this scenario.

- Asset purchase has no tax implications, while stock purchase requires state and federal securities permission and must comply with the laws and regulations.

- Asset Purchase does not involve any minority shareholders. Minority interests can create a problem for stock purchases if they refuse to sell the shares.

- Buyers usually prefer asset purchase since it allows them to select the liabilities and gives them flexibility. Sellers typically prefer stock purchases because it lets them completely step away from the business.

- Asset Purchase advantages over stock purchase include tax advantage, flexibility in choosing assets and employees, less risk and due diligence, and less role of minority shareholders.

- Disadvantages of asset purchase overstockqa22wz purchase include retitling of assets seller has to liquidate the remaining assets.

- The advantages of stock purchase over asset purchase are that the buyer does not have to bother evaluating assets, buyers can avoid paying taxes, and simplicity.

- Acquiring stocks instead of assets comes with several disadvantages. The Acquirer does not receive the step-up tax benefit, lacks flexibility, and must retain the carrying value of assets and liabilities. Additionally, they must adhere to numerous laws and regulations and can’t deduct goodwill from their taxes.

Asset Purchase vs Stock Purchase Comparison Table

Below are the eight topmost comparisons between Asset Purchase vs Stock Purchase

|

The Basis Of Comparison |

Asset Purchase |

Stock Purchase |

| Risk | Buyer agrees to buy specific assets and liabilities and takes the risk of only those assets and liabilities. | In a Stock purchase, the buyer purchases the entire entity and hence has the risk of the entire company. |

| Assets | In an asset purchase, it is necessary to rename or retitle the target company’s assets in the buyer’s name. | Retitling of assets is not required in a Stock Purchase. |

| Liabilities | The buyer has the option to specify the liabilities it wants to assume. | The buyer purchases the company irrespective of the liabilities. |

| Minority Shareholders | Asset Purchase does not involve any minority shareholders. | Minority interests can create a problem for stock purchases if they refuse to sell the shares. |

| Laws | Asset Purchase does not have to comply with any laws and is simpler. | Stock purchase requires permission from the state and federal securities and has to comply with the laws and regulations. |

| Tax implications | In an Asset purchase, if the buyers purchase highly depreciable assets, they can increase their tax value and amortize them. If goodwill is involved, it can also be amortized. In this manner, the buyers get a tax advantage. | Stock purchases buy the entire company and therefore have no option of amortizing assets and lose the option of availing the tax benefit like an asset purchase. |

| Preference | Buyers usually prefer asset purchase since it allows them to select the liabilities and gives them flexibility. | Sellers usually prefer stock purchases because it lets them completely step away from the business. |

| Simplicity | Asset transactions are usually considered more complex than purchases as they involve renaming all the assets. | Stock purchase buys the entire entity and does include any renaming hence is very simple to implement. |

Conclusion

While deciding on which transaction to choose, weighing the pros and cons regarding the procedure, laws, price, and tax implications is necessary.

Asset purchases can be advantageous for some while dangerous for others. On the one hand, they help the sellers who can quote a higher price for the asset and help the buyer who can limit his exposure to various types of unwanted liabilities.

However, they can disadvantage the sellers as they must plan to liquidate the unused assets.

Selling stocks can help prevent double taxation because it undergoes taxation at a lower capital gain tax rate. If the company’s seller wishes to liquidate the entire entity and all the liabilities and contracts, then stock acquisition is the best option.

Recommended Articles

This has guided the top difference between Asset Purchase and Stock Purchase. Here we also discuss the Asset Purchase vs Stock Purchase differences with infographics and a comparison table. You may also have a look at the following articles to learn more.