Updated July 10, 2023

EBITDA Margin Formula (Table of Contents)

What is the EBITDA Margin Formula?

The term “EBITDA Margin” refers to the measure of profit margin that indicates how efficient the company’s core operation is, i.e., dollar profit generated per dollar of sales from core business.

In other words, the EBITDA margin assesses the ability of a company to generate profit after absorbing all the costs that can be assigned to the production process (namely, the cost of goods sold and operating expenses).

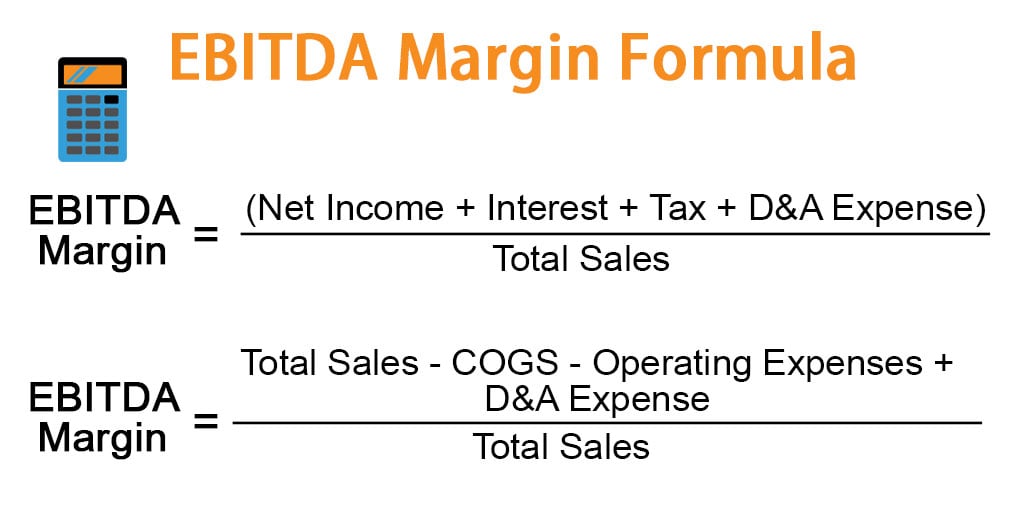

The formula for EBITDA margin is expressed as a summation of net income, interest, tax, and depreciation & amortization (D&A) expense divided by total sales. Mathematically, it represents as,

The formula for EBITDA margin is also expressed as total sales plus D&A expenses minus the cost of goods sold (COGS) and operating expenses, which are then divided by total sales. Mathematically, it represents as,

Example of EBITDA Margin Formula (With Excel Template)

Let’s take an example to understand the EBITDA Margin calculation better.

Example #1

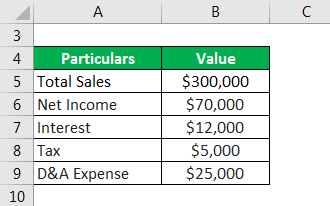

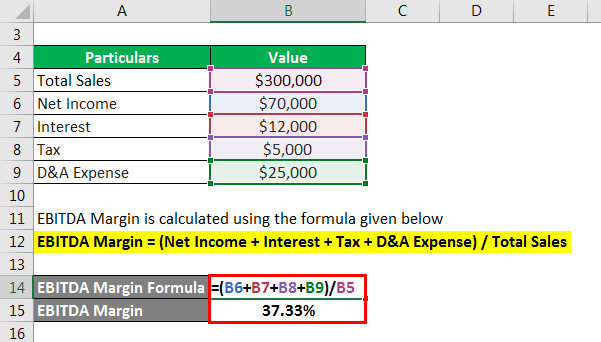

Let us take the example of a company that manufactures soft drinks. The following information is available from its latest annual report. First, calculate the company’s EBITDA margin based on the given information.

Solution:

EBITDA Margin calculate using the formula given below

EBITDA Margin = (Net Income + Interest + Tax + D&A Expense) / Total Sales

- EBITDA Margin = ($70,000 + $12,000 + $5,000 + $25,000) / $300,000

- EBITDA Margin = 37.33%

Therefore, the company’s EBITDA margin stood at 37.33% for the year.

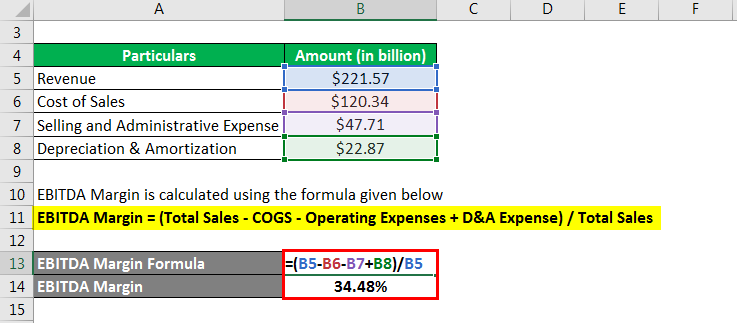

Example #2

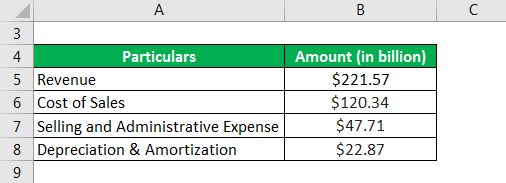

Let us take the example of Samsung Electronics Co. Ltd. to illustrate the computation of the EBITDA margin. According to its annual report for 2018, the following information is available. First, calculate Samsung’s EBITDA margin for the year 2018.

Solution:

EBITDA Margin calculate using the formula given below

EBITDA Margin = (Total Sales – COGS – Operating Expenses + D&A Expense) / Total Sales

- EBITDA Margin = ($221.57 billion – $120.34 billion – $47.71 billion + $22.87 billion) / $221.57 billion

- EBITDA Margin = 34.48%

Therefore, Samsung Electronics Co. Ltd.’s EBITDA margin for the year 2018 was 34.48%.

Source: Samsung’s Consolidated Financial Statements

Example #3

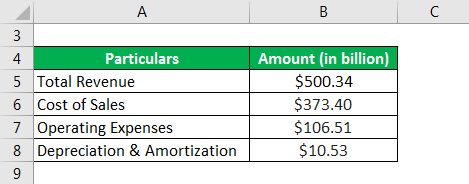

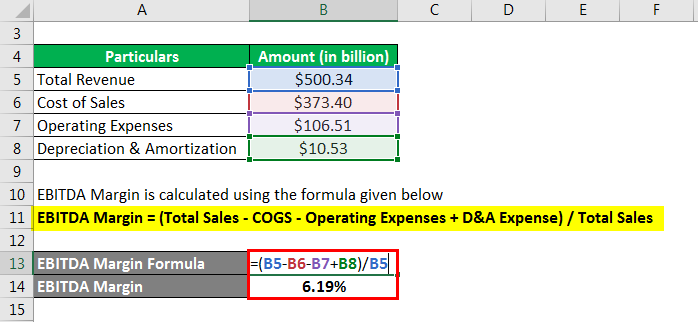

Let us now take the example of Walmart Inc.’s annual report for the year 2018 n order to compute its EBITDA margin. According to the annual report, the following information is available. First, calculate Walmart Inc.’s EBITDA margin for the year 2018.

Solution:

EBITDA Margin calculate using the formula given below

EBITDA Margin = (Total Sales – COGS – Operating Expenses + D&A Expense) / Total Sales

- EBITDA Margin = ($500.34 billion – $373.40 billion – $106.51 billion + $10.53 billion) / $500.34 billion

- EBITDA Margin = 6.19%

Therefore, Walmart Inc.’s EBITDA margin for the year 2018 was 34.47%.

Explanation

Formula, EBITDA Margin can calculate by following these steps:

Step 1: Firstly, note the company’s total sales booked for the year. It may be reported as net sales or revenue.

Step 2: Next, note the net income generated from the business. (Note: Add non-operating expenses and deduct non-operating income to the net income wherever needed)

Step 3: Note the financial or interest expense paid on the outstanding debt.

Step 4: Next, note the income tax paid during the year.

Step 5: Note the D&A expense charged against tangible and intangible assets.

Step 6: Next, compute the EBITDA by adding back interest expense (step 3), income tax (step 4), and D&A expense (step 5) to the net income (step 2).

EBITDA = Net Income + Interest + Tax + D&A Expense

Step 7: Finally, the formula for the EBITDA margin can be derived by dividing the EBITDA (step 6) by the total sales (step 1), as shown below.

EBITDA Margin = (Net Income + Interest + Tax + D&A Expense) / Total Sales

The formula for the EBITDA margin can be calculated using the second method is:

Step 1: Firstly, note the company’s total annual sales.

Step 2: Next, determine the COGS or cost of sales, which is the aggregate of all direct production costs, such as raw material cost, direct labor expense, and manufacturing overhead.

Step 3: Next, note the operating expenses, which aggregate all indirect production costs, such as selling expenses, administrative expenses, etc.

Step 4: Note the D&A expense charged against tangible and intangible assets.

Step 5: Next, compute the EBITDA by deducting COGS (step 2) and operating expenses (step 3) from total sales (step 1) and adding back D&A expenses (step 4).

EBITDA = Total Sales – COGS – Operating Expenses + D&A Expense

Step 6: Finally, the formula for the EBITDA margin can be derived by dividing the EBITDA (step 5) by the total sales (step 1), as shown below.

EBITDA Margin = (Total Sales – COGS – Operating Expenses + D&A Expense) / Total Sales

Relevance and Use of EBITDA Margin Formula

The concept of EBITDA margin is one of the most important because it helps assess the profit generated from the company’s core business. Therefore, analysts often track this metric over some time to see if there is any deviation. Typically, the increase in EBITDA margin indicates improved operational efficiency and, as such, is seen as a positive signal for investors. At the same time, a downtrend can signal operational shortcomings. This metric can also be used for peer comparison among companies operating in the same industry.

EBITDA Margin Formula Calculator

You can use the following EBITDA Margin Formula Calculator

| Net Income | |

| Interest | |

| Tax | |

| D&A Expense | |

| Total Sales | |

| EBITDA Margin | |

| Total Sales = |

| |||||||||

|

Recommended Articles

This is a guide to EBITDA Margin Formula. Here we discuss calculating the EBITDA Margin Formula along with practical examples. We also provide an EBITDA Margin calculator with a downloadable Excel template. You may also look at the following articles to learn more –