Updated July 27, 2023

Holding Period Return Formula (Table of Contents)

What is Holding Period Return Formula?

The term “holding period return” refers to the total return earned by holding an investment or a portfolio of investments over a certain span of time, which is then expressed in term of percentage.

The formula for holding period return can be derived by adding the periodic income generated from the investment to the change in the value of the investment over the period of time (difference of ending value and initial value) and then the result is divided by the initial value of the investment.

Formula For Holding Period Return is represented as,

If you are required to determine the annualized holding period return, then the formula for annualized HPR is as shown below.

where ‘n’ is the tenure of the investment horizon in terms of a number of years.

Example of Holding Period Return Formula (With Excel Template)

Let’s take an example to understand the calculation of Holding Period Return in a better manner.

HPR Formula – Example #1

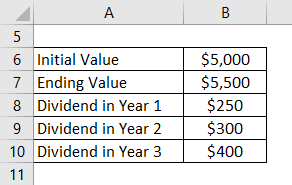

Let us take the example of Stefan who had invested $5,000 three years back in some of the real estate stocks that have generated annual dividends of $250 in Year 1, $300 in Year 2 and $400 in Year 3. Currently, the stocks are valued at $5,500. Calculate the holding period return of the investment for Stefan based on the given information.

Solution:

Total Income generated by the real estate stocks can be calculated as,

Income Generated = Dividend in Year 1 + Dividend in Year 2 + Dividend in Year 3

- Income Generated = $250 + $300 + $400

- Income Generated = $950

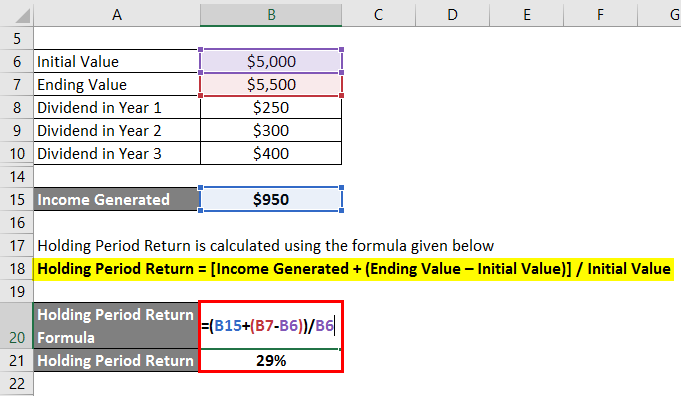

Holding Period Return is calculated using the formula given below

Holding Period Return = [Income Generated + (Ending Value – Initial Value)] / Initial Value

- Holding Period Return = [$950 + ($5,500 – $5,000)] / $5,000

- Holding Period Return = 29%

Therefore, the real estate stocks have generated 29% holding period return for Stefan during the 3 years.

HPR Formula – Example #2

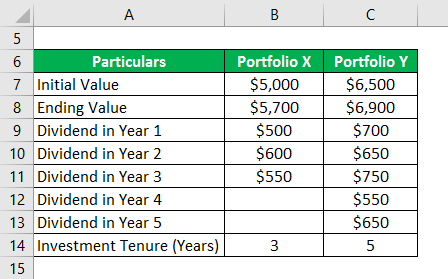

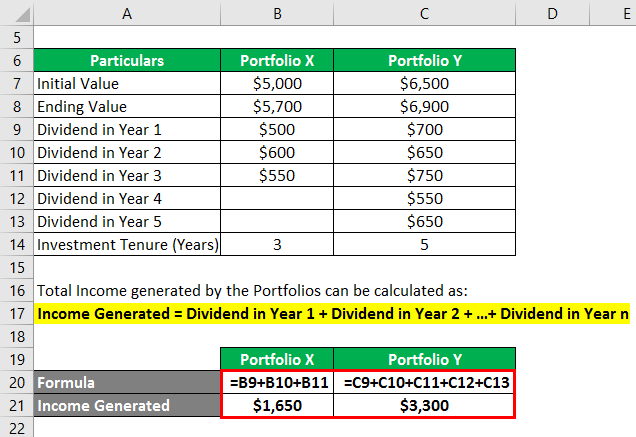

Let us take the example of two investment portfolios. Both the portfolio have similar risk level but differ in terms of income generation, investment value and investment horizon. Determine which portfolio has performed better in terms of overall holding period return and annualized holding period return based on the following information:

Solution:

Total Income generated by the Portfolios can be calculated as:

Income Generated = Dividend in Year 1 + Dividend in Year 2 + …+ Dividend in Year n

For Portfolio X

- Income Generated = $500 + $600 + $550

- Income Generated = $1,650

For Portfolio Y

- Income Generated = $700 + $650 + $750 + $550 + $650

- Income Generated = $3,300

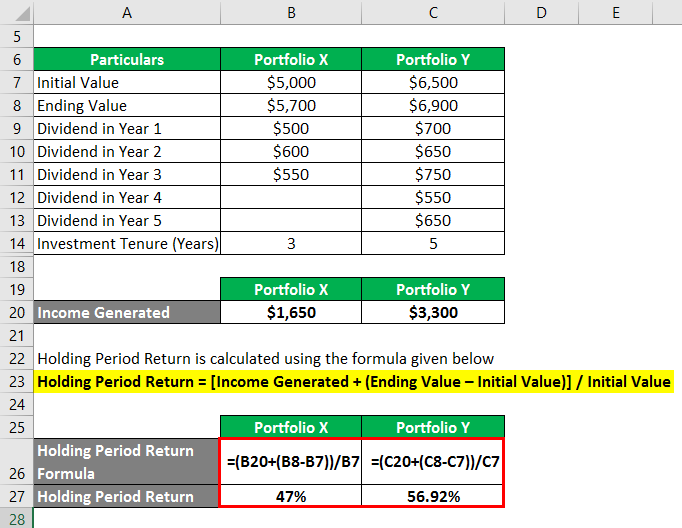

Holding Period Return is calculated using the formula given below

Holding Period Return = [Income Generated + (Ending Value – Initial Value)] / Initial Value

For Portfolio X

- Holding Period Return = [$1,650 + ($5,700 – $5,000)] / $5,000

- Holding Period Return = 47%

For Portfolio Y

- Holding Period Return = [$3,300 + ($6,900 – $6,500)] / $6,500

- Holding Period Return = 56.92%

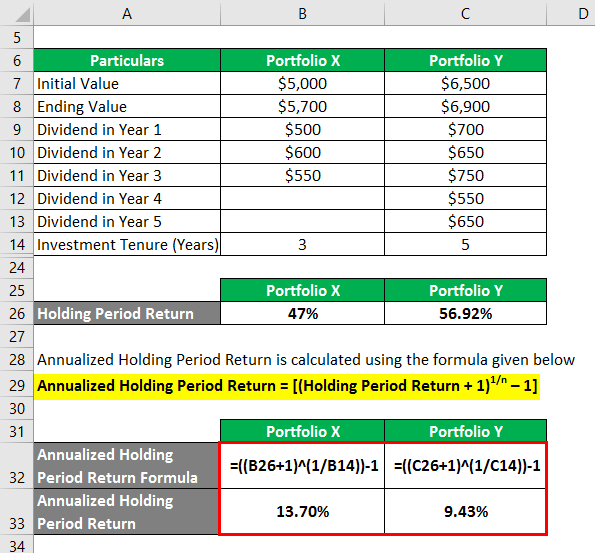

Annualized Holding Period Return is calculated using the formula given below

Annualized Holding Period Return = [(Holding Period Return + 1)1/n – 1]

For Portfolio X

- Annualized Holding Period Return = (47% + 1)1/3 – 1

- Annualized Holding Period Return = 13.70%

For Portfolio Y

- Annualized Holding Period Return = (56.92% + 1)1/5 – 1

- Annualized Holding Period Return = 9.43%

Based on the given information, Portfolio Y offers higher overall holding period return compared to Portfolio X. However, on annualized basis Portfolio X performed better than Portfolio Y because of shorter investment tenure.

Explanation of HPR Formula

The formula for holding period return can be derived by using the following steps:

Step 1: Firstly, determine the value of the investment at the beginning of the investment horizon and it is called the initial value.

Step 2: Next, determine the value of the investment at the end of the investment horizon and it is called the ending value.

Step 3: Next, determine the change in the value of the investment during the investment period and it is calculated by subtracting the initial value (step 1) from the ending value (step 2) of the investment.

Change in Value = Ending Value – Initial Value

Step 4: Next, determine the periodic or interim income generated by the investment, which is usually in the form of dividend distribution.

Step 5: Finally, the formula for holding period return can be derived by adding the periodic income generated (step 4) to the change in the value of the investment over the period of time (step 3) and then the result is divided by the initial value of the investment as shown below.

Holding Period Return = [Income Generated + (Ending Value – Initial Value)] / Initial Value

Relevance and Uses of Holding Period Return Formula

It is important to understand the concept of holding period return because it is usually used in the comparison of performance (returns) among investments held for varying time periods. From the perspective of investment management, it is seen as an important metric as it gives a comprehensive view of the financial performance of an investment by taking into consideration both value appreciation of the investment and its income distributions.

Holding Period Return Formula Calculator

You can use the following Holding Period Return Calculator

| Income Generated | |

| Ending Value | |

| Initial Value | |

| Holding Period Return Formula | |

| Holding Period Return Formula = |

|

|

Recommended Articles

This has been a guide to Holding Period Return Formula. Here we discuss how to calculate Holding Period Return along with practical examples. We also provide a Holding Period Return calculator with downloadable excel template. You may also look at the following articles to learn more –