Updated July 24, 2023

Discount Rate Formula (Table of Contents)

What is the Discount Rate Formula?

The term “discount rate” refers to the factor used to discount the future cash flows back to the present day. In other words, it is used in the computation of time value of money which is instrumental in NPV (Net Present Value) and IRR (Internal Rate of Return) calculation.

The formula for discount can be expressed as future cash flow divided by present value which is then raised to the reciprocal of the number of years and the minus one. Mathematically, it is represented as,

where,

- n = Number of years

In the case of multiple compounding during a year (t), the formula for the discount rate can be further expanded as shown below.

Examples of Discount Rate Formula (With Excel Template)

Let’s take an example to understand the calculation of Discount Rate in a better manner.

Discount Rate Formula – Example #1

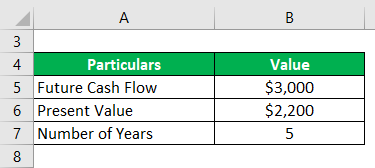

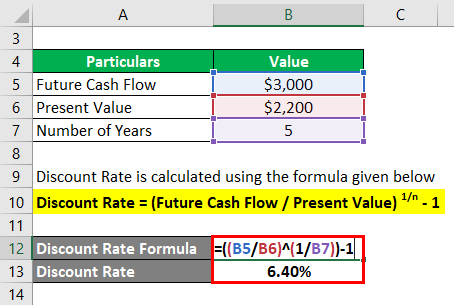

Let us take a simple example where a future cash flow of $3,000 is to be received after 5 years. Calculate the discount rate if the present value of the future cash flow today is assessed to be $2,200.

Solution:

Discount Rate is calculated using the formula given below

Discount Rate = (Future Cash Flow / Present Value) 1/ n – 1

- Discount Rate = ($3,000 / $2,200) 1/5 – 1

- Discount Rate = 6.40%

Therefore, in this case the discount rate used for present value computation is 6.40%.

Discount Rate Formula – Example #2

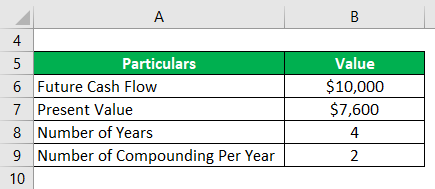

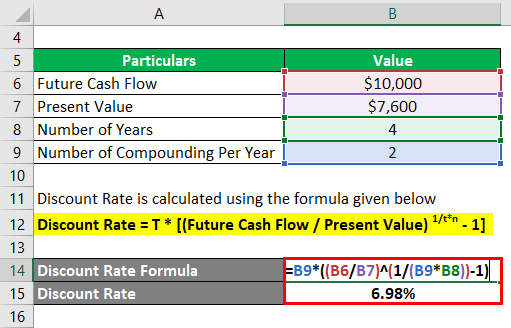

Now, let us take another example to illustrate the impact of compounding on present value computation using the discount rate. In this example, David expects to receive a sum of $10,000 after 4 years and its present value has been assessed to be $7,600. Calculate the discount rate if the compounding is to be done half-yearly.

Discount Rate is calculated using the formula given below

Discount Rate = T * [(Future Cash Flow / Present Value) 1/t*n – 1]

- Discount Rate = 2 * [($10,000 / $7,600) 1/2*4 – 1]

- Discount Rate = 6.98%

Therefore, the effective discount rate for David in this case is 6.98%.

Discount Rate Formula – Example #3

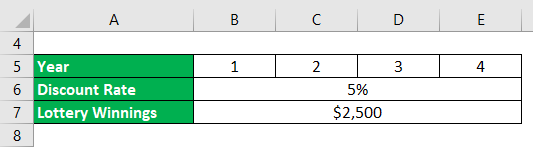

Let us now take an example with multiple future cash flow to illustrate the concept of a discount rate. In this example, Steve has won a lottery worth $10,000 and as per the terms he will be receiving the winnings as yearly pay-out of $2,500 for the next 4 years. Calculate the present value of the lottery winnings if the effective discount rate is 5%.

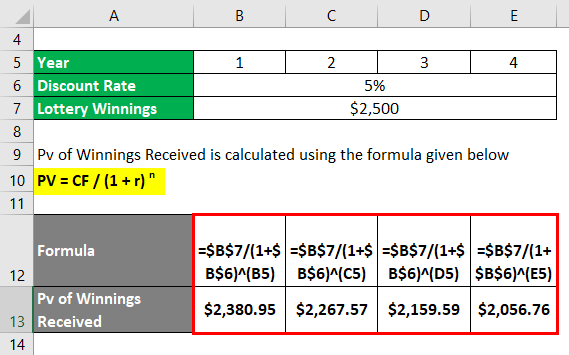

Pv (Present Value) of Winnings Received is calculated using the formula given below

PV = CF / (1 + r) n

For 1st Year

- PV of Winnings Received 1st year, PV1 = CF1 / (1 + r) n1

- PV = $2,500/ (1 + 5%)1

- PV = $2,380.95

For 2nd Year

- PV of winnings received 2nd year, PV2 = CF2 / (1 + r) n2

- PV = $2,500/ (1 + 5%)2

- PV = $2,267.57

For 3nd Year

- PV of Winnings Received 3rd year, PV3 = CF3 / (1 + r) n3

- PV = $2,500/ (1 + 5%)3

- PV = $2,159.59

For 4th Year

- PV of Winnings Received 4th year, PV4 = CF4 / (1 + r) n4

- PV = $2,500 / (1 + 5%)4

- PV = $2,056.76

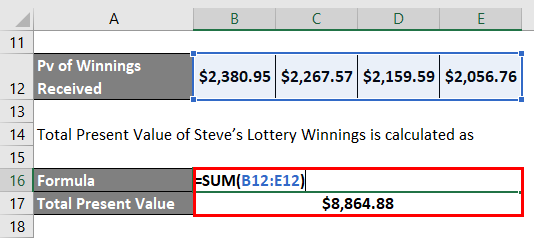

Total Present Value of Steve’s Lottery Winnings is calculated as

- Present Value = $2,380.95 + $2,267.57 + $2,159.59 + $2,056.76

- Present Value = $8,864.88 ~ $8,865

Therefore, the value of Steve’s lottery winnings today is $8,865.

Explanation

The formula for the discount rate can be derived by using the following steps:

Step 1: Firstly, determine the value of the future cash flow under consideration.

Step 2: Next, determine the present value of future cash flows.

Step 3: Next, determine the number of years between the time of the future cash flow and the present day. It is denoted by n.

Step 4: Finally, the formula for discount rate can be derived by dividing the future cash flow (step 1) by its present value (step 2) which is then raised to the reciprocal of the number of years (step 3) and the minus one as shown below.

Discount Rate = (Future Cash Flow / Present Value) 1/n – 1

Relevance and Uses of Discount Rate Formula

The concept discount rate is predominantly used in the computation of NPV and IRR, which are a manifestation of the time value of money that states that a dollar today is worth more than a dollar in the future. As such, the concept of discount rate is very vital in project valuation and so it is important that we choose an appropriate discount rate in order to arrive at the optimum valuation. Some of the discount rates used by the majority of companies are WACC (weighted average cost of capital), cost of equity, cost of debt, risk-free rate of return or company-specific hurdle rate.

Discount Rate Formula Calculator

You can use the following Discount Rate Formula Calculator

| Future Cash Flow | |

| Present Value | |

| n | |

| Discount Rate | |

| Discount Rate = | (Future Cash Flow / Present Value)1 /n - 1 | |

| (0 / 0)1 /0 - 1 = | 0 |

Recommended Articles

This is a guide to Discount Rate Formula. Here we discuss how to calculate Discount Rates along with practical examples. We also provide a Discount Rate calculator with a downloadable Excel template. You may also look at the following articles to learn more –