Updated July 24, 2023

What is Yield to Maturity?

Yield to Maturity(YTM) can be described as the total anticipated return which an investor will earn on his/her investments starting from the date of investment till the ultimate due date of maturity (generally calculated for bonds, debentures, etc.); YTM is generally confused with an annual rate of return which is different from YTM, or else YTM can be described as the discount rate at which sum of all future cash flows from the bond will be equal to bond price.

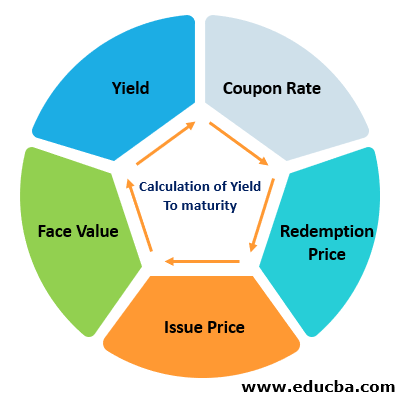

Components of Yield to Maturity

For the purpose of calculating Yield to Maturity, we need to have a proper understanding of various terms used in the calculation of YTM as follows:

- Coupon Rate: Rate of Interest that a bond offers during its period of investment.

- Redemption Price: Price or value which will accrue to the investor on the final settlement of bond/ investment.

- Issue Price: Initial price at which bond/ Investment is sold by Government/Corporates.

- Face Value: Par Value of Bond, which neither includes any premium nor offers any discount.

- Yield: Yield can be said as the total amount of return an investor earns or can be said as the return earned on his/her Investment.

Formula #1:

Where,

- YTM: Yield to maturity.

- n: Number of years to maturity.

- Current Price: Bond’s today’s market price.

- Face Value: Bond’s par value.

Formula #2:

Where,

- C: Coupon Rate.

- F: Face Value (Issue Price).

- P: Market Price of Bond.

Formula #3:

Examples of Yield to Maturity Formula

Let’s take an example to understand the calculation in a better manner.

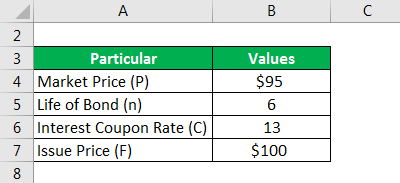

Example #1

Calculate the yield to maturity of a bond with the help of the following given information:

Solution:

Yield to Maturity is calculated using the formula given below:

YTM = [C + ((F – P) / n)] / [(F + P)/2]

- YTM = [13 + ($100 – $95 / 6)] / [($100 + $95 )/2]

- YTM = 14.19%

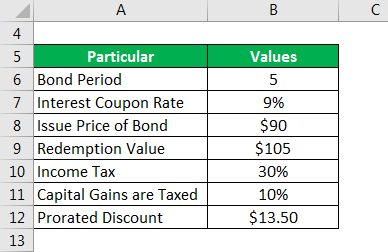

Example #2

Consider a market bond issued in the market having a bond period of 5 years and an interest coupon rate of 9%. Consider the issue price of Bond at $ 90, and redemption value be $ 105. Calculate the post-tax Yield to Maturity for the investor where the rate of normal Income tax can be assumed at 30% and capital gains are taxed at 10%. You are required to calculate post-tax yield to maturity.

Solution:

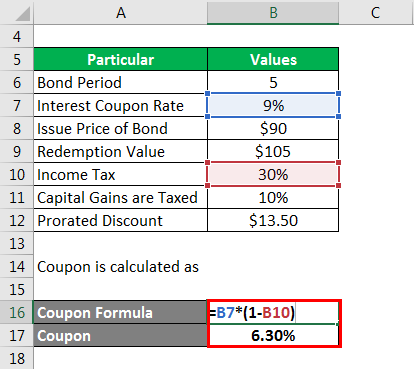

Coupon is calculated as

- Coupon = 0.09 * (1 – 0.30)

- Coupon = 6.30%

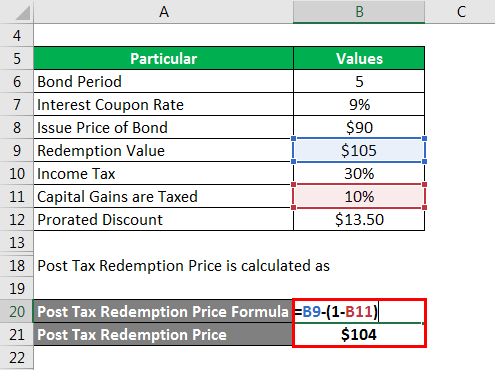

Post Tax Redemption Price is calculated as

- Post Tax Redemption Price = $105 – (1 – 0.10)

- Post Tax Redemption Price = $104

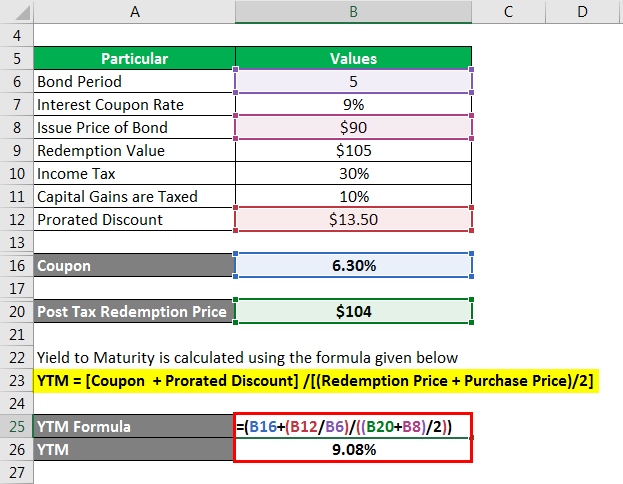

Yield to Maturity is calculated using the formula given below

YTM =[Coupon + Prorated Discount] /[(Redemption Price + Purchase Price)/2]

- YTM = [6.30 + ($13.50 / 5) / [($104 + $90) / 2]

- YTM = 9.08%

Advantages and Disadvantages

Following are the advantages and disadvantages mentioned below:

Advantages

- Calculates total return which an investor will earn during the entire life of the bond.

- It not only considers revenue gains but also takes into consideration capital gains which present a complete earing picture.

- It does not include any forecast in its calculation and therefore gives more accurate information.

Disadvantages

- It assumes that the bond/investment will be held until maturity, which is impractical since there is a wide variety of bonds that allow an investor to square up his/ her investment before maturity also and an expert investor may exercise that option.

- Another major limitation of yield to maturity is the rate of investment. Yield to maturity assumes that all earnings of investment will be reinvested at the same rate. There are multiple investment options in today’s investment market, and a wise investor will never invest at the same rate if a better option is available.

Conclusion

Yield to maturity can be said as the discount rate at which the sum of all future cash flows accruing from investment in the bond will be equal to par value. It is one of the useful measures to evaluate a bond investment proposal. The major advantage of YTM is that it takes into account all future cash flows, not only of revenue nature but also of capital nature. YTM’s major disadvantage is that it assumes investment will be held up to maturity, which is practically not much correct. Also, the rate of return on investment will be the same throughout the investment period is also practically incorrect.

Recommended Articles

This is a guide to Yield to Maturity. Here we discussed the calculation for yield to maturity along with advantages and disadvantages. We also provide a downloadable excel template. You may also look at the following articles to learn more –