Updated July 10, 2023

Definition of Return on Investment Ratio

Return on Investment ratio can be defined as a financial tool that helps in the evaluation of the investment efficiency as it calculates the percentage of earnings of an investment which is calculated using mostly the two elements where the first element is net profit and the other one is the cost of investment.

Formula

There are various methods to calculate the return on investment. Using the most popular formula, return on investment will be calculated as

Where,

Net return is the net profit earned when the investments are sold. These figures can be taken from the Income statement of the company. The acquisition cost is the total amount of money for which the asset was purchased or the cost paid. This figure can be taken from the Balance sheet.

Explanation

The return on investment is a financial measure or a simple ratio that shows the percentage of return earned on the investment made. In a business financial analysis, ROI is an important metric used to rank the different number of available assets based on their earnings percentage. The ROI is always expressed in a percentage form.

The return on investment measure is used for knowing the potential earnings of an investment. ROI helps make the comparison based on the profitability of the available investment opportunities. The investment with the maximum ROI among the available assets is always prioritized. The return on investment considers the elements of earnings and the cost of acquisition which helps in the analysis of how many potential investments have in terms of profitability.

Example of Return on Investment Ratio

Let’s take an example to understand the calculation in a better manner.

Example #1

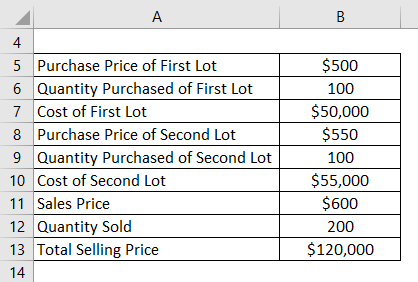

A person wants to invest in the shares of a company. He purchased 100 shares at the price of $500 each and, after some time, bought 100 shares again of the same company at the cost of $550 per share. After a few years, it sold all the 200 shares at $600 per share. Calculate the ROI ratio of the person.

Solution:

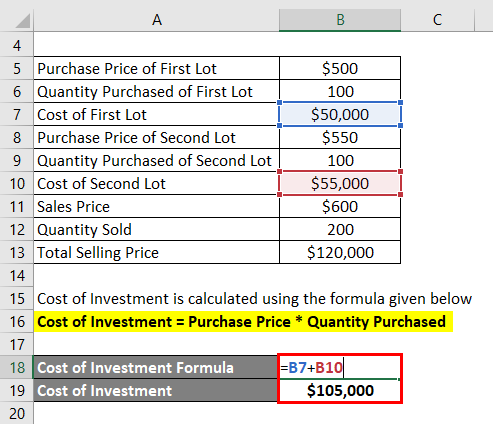

Cost of Investment is calculated using the formula given below.

Cost of Investment = Purchase Price *Quantity Purchased

- Cost of Investment = $500 * 100 + $550 * 100

- Cost of Investment = $50,000 + $55,000

- Cost of Investment = $105,000

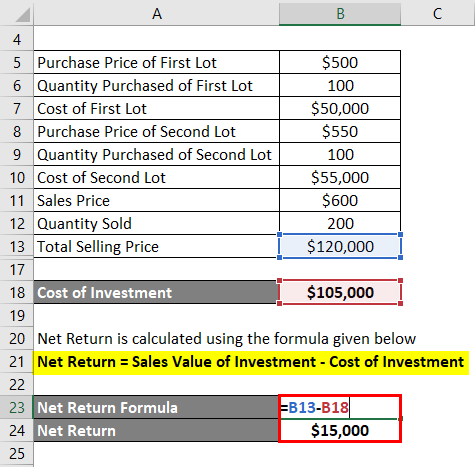

Net Return is calculated using the formula given below.

Net Return = Sales Value of Investment – Cost of Investment

- Net return = (200*600) – $105,000

- Net return = $120,000 – $105,000

- Net return = $15,000

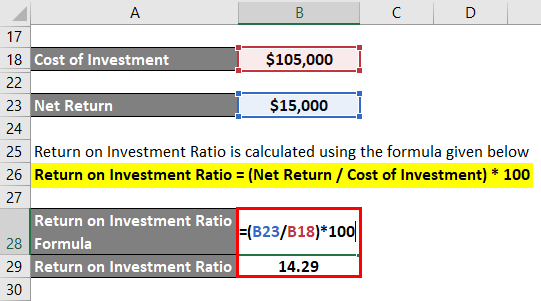

Return on Investment Ratio is calculated using the formula given below.

Return on Investment Ratio = (Net Return /Cost of Investment) * 100

- Return on Investment Ratio = ($15,000 / $105,000) * 100

- Return on Investment Ratio = 14.29 %

Analysis: By investing the money in the shares, the investor earned the 14.29 % return on investment.

Difference Between Return on Investment vs Return on Equity

ROI is a percentage of profit earned on the given investment, which is calculated by dividing net profit earned (sale value of investment – the cost of investment) from the cost of investment and then multiplying the figure by 100, whereas ROE is a measure to calculate the percentage of return earned on the shareholders’ investment in the company and is calculated by dividing net income (Revenue – Expenses) of the company from the total shareholders’ equity (total assets – total debts).

Advantages and Disadvantages of Return on Investment Ratio

The advantages and disadvantages are discussed as follows:

Advantages

The disadvantages are discussed as follows:

- The ROI ensures that the business is investing its funds in the asset that will give the required earnings to the investor. ROI helps finance at its optimum level where the investors can achieve the maximum earnings.

- With the help of ROI, the investor can make the comparison based on the earning potential of the various investment opportunity options available for investing the funds.

- ROI acts as a benchmark for the measurement of the company’s managing efficiency and is significant for measuring the efficiency of the investment decisions taken by the company’s investment division regarding the acquisition and demolition of the company’s assets.

Disadvantages

The disadvantages are discussed as follows:

- Comparing the different companies based on their return on investment ratio might not give good results because there are chances that the companies follow other accounting policies, methods, etc., for their investments’ valuation. Thus the comparison based on ROI should be made only between the companies that follow the same accounting principles, methods, policies, etc.

- Often, the company managers select the investment based on its return on investment ratio. Still, this ratio focuses on short-term profitability and does not focus on long-term profitability. It considers only the cost and returns of the period under consideration. It ignores the effect of such investments in the long term, so managers might avoid the investments whose ROI is low, but in the long term, they might be beneficial for the company and increase the value of the business.

- The ROI does not consider the investment’s risk and only measures the return on such investment.

Conclusion

Return on investment ratio is a ratio that calculates the percentage of return earned by the person out of their investment for the period. Since it is part of an analysis of profitability ratio, it is one of the valuable tools for the person that wants to invest their money in some investment areas. However, if the comparison between the companies and business decision-making is to be done using the return on investment ratio, then along with it, other factors should also be considered to make effective decision making.

Recommended Articles

This is a guide to Return on Investment Ratio. Here we discuss how to calculate return on investment ratio along with a practical example. we also provide a downloadable excel template. You may also look at the following articles to learn more –